Top 17 Toronto Venture Capital Firms for Tech Startups [2024]

Are you seeking venture capital in Toronto for your early-stage tech venture? Take a look at these 17 promising options we’ve created.

Ready to start your tech business in Toronto but need some cash? Toronto is a hotspot for new companies, kind of like a mini Silicon Valley. Big names like Shopify and Slack got their start here.

But it’s not just about big names – there’s a whole community of small companies helping each other out.

Getting money for your business in Toronto is easier than you might think. In 2023 alone, over $1.4 billion was given to new companies. And a good chunk of that went to tech startups.

So, if you’ve got a great idea, Toronto is the place to be. Check out these 17 companies ready to help your early-stage tech startup take off.

17 Early-Stage Venture Capital Firms in Toronto, Canada

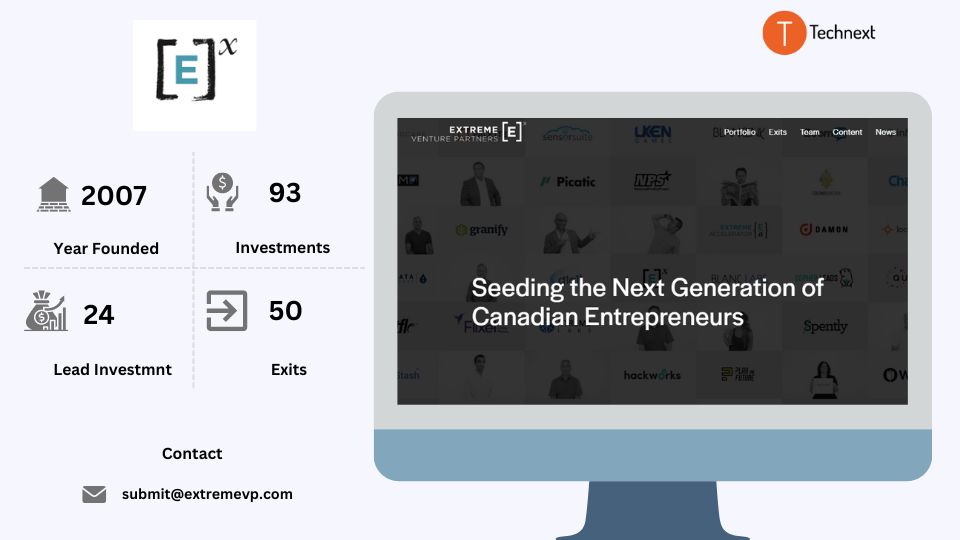

1. Extreme Venture Partners

Extreme Venture Partners (EVP) has been one of Canada’s most successful venture capital funds over the past decade. They are putting a substantial amount of money into developing its internal opportunities by investing in Extreme Innovations. As a technology accelerator, they team up with skilled entrepreneurs and tech experts to build companies. Also, they test business models first before bringing in more partners.

Details of Extreme Venture Partners

Foundation Year: 2007

Countries of Operation:

- Canada

Number of Investments: 93

Lead Investments: 24

Number of Exits: 50

Focus of Extreme Venture Partners

Stage

- Crowdfunding

- Early Stage Startup

- Seed

Industries

- B2B

- Commercial services

- Big data

- Mobile

- Internet

Investment size

Minimum check size: $250,000

Maximum check size: $1,000,000

Notable Investments

1. wagepoint

URL: wagepoint.com

Funding Rounds: 4

Total Funding: $14.8M

2. Foxquilt

URL: www.foxquilt.com

Funding Rounds: 4

Total Funding: $23.5M

3. FIxel Photos

URL: www.flixel.com

Funding Rounds: 5

Total Funding: $3.7M

Contact

Website: https://www.evp.vc/

Email: submit@extremevp.com

Phone: +1 416 907 9470

2. Antler

Antler is the investor who backs ambitious founders from day one to glory. It was established on the principle that human innovation is essential to constructing a better future. Since 2018, they have proudly invested in 600 + companies. They are ready to collaborate with people worldwide to develop and scale up their businesses

Details of Antler

Foundation Year: 2018

Countries of Operation

- Canada

- Australia

- India

- Indonesia

- Japan

- Korea

- Malaysia

- Singapore

- Vietnam

- Denmark

- Finland

- France

- Germany

- Iberia

- Netherlands

- Norway

- Sweden

- UK

- Brazil

- US

- Kenya

- Middle East

Number of Investments: 1240

Lead investments: 637

Number of Exits: 106

Funds raised: $82.2M

Focus of Antler

Stage

- Early Stage

- Seed

Industries

- AI & ML

- Consumer

- Crypto & Blockchain

- Cybersecurity

- E-Commerce

- Fintech

- SaaS

- Gaming

- Proptech

- Real Estate

- Internet & Mobile

- Food & Beverage

- Supply Chai & Logistics

- Healthcare

- Media

Notable Investments

- Treyd

URL: www.treyd.io

Funding Rounds: 2

Total Funding: $25M

2. Volopay

URL: www.volopay.com

Funding Rounds: 5

Total Funding: $31.2M

3. Airalo

URL: https://www.airalo.com/

Funding Rounds: 5

Total Funding: $67.3M

Contact

Website: https://www.antler.co/

Email:hello@antler.co

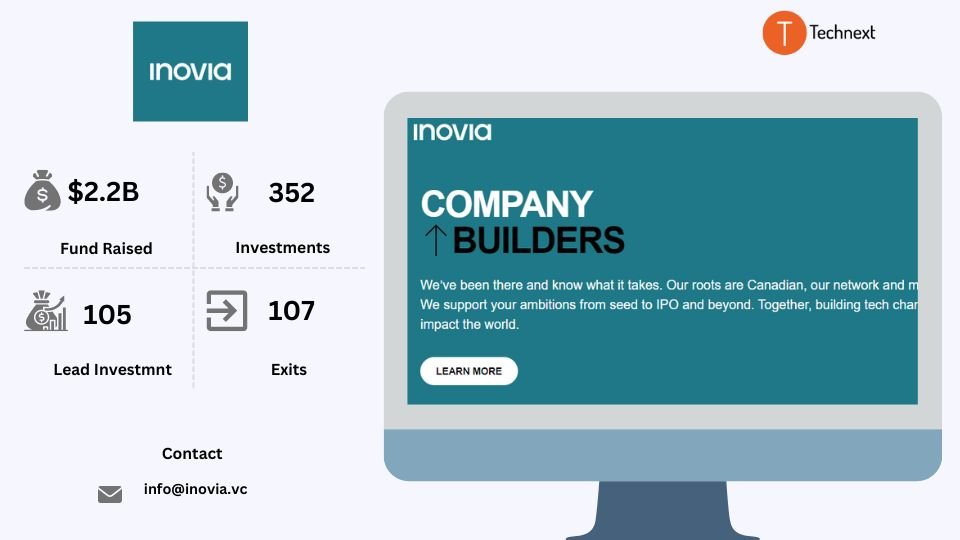

3. Inovia Capital

Inovia Capital is a renowned venture capital firm that collaborates with entrepreneurs to build long-lasting and meaningful enterprises. They are always ready to support founders like you with capital, mentorship, and insights throughout the journey. Most importantly, they are not about providing capital to companies; they are about creating economic, intellectual, and financial wealth. Also, they strongly support their ecosystem and communities at every step

Details of Inovia Capital

Foundation Year: 2007

Countries of Operation:

- Canada

- United States

- United Kingdom

Number of Investments: 352

Lead Investment: 105

Number of Exits: 107

Funds raised: $2.2B

Focus of Inovia Capital

Stage

- Early Stage Startup

- Late Stage Startup

Industries

- Internet & Mobile

- SaaS

- Robotics

- Crypto & Blockchain

- Cybersecurity

- Healthcare

Notable Investments

- Clearco

URL: clear.co

Funding Rounds: 8

Total Funding: $858.6M

2. Lakera AI

URL: lakera.ai

Rounds: 1

Total Funding: $10M

3. Bench

URL: www.bench.co

Rounds: 9

Total Funding: $115M

Contact:

Website: https://www.inovia.vc/

Email: info@inovia.vc

Phone: +1 514-982-2251

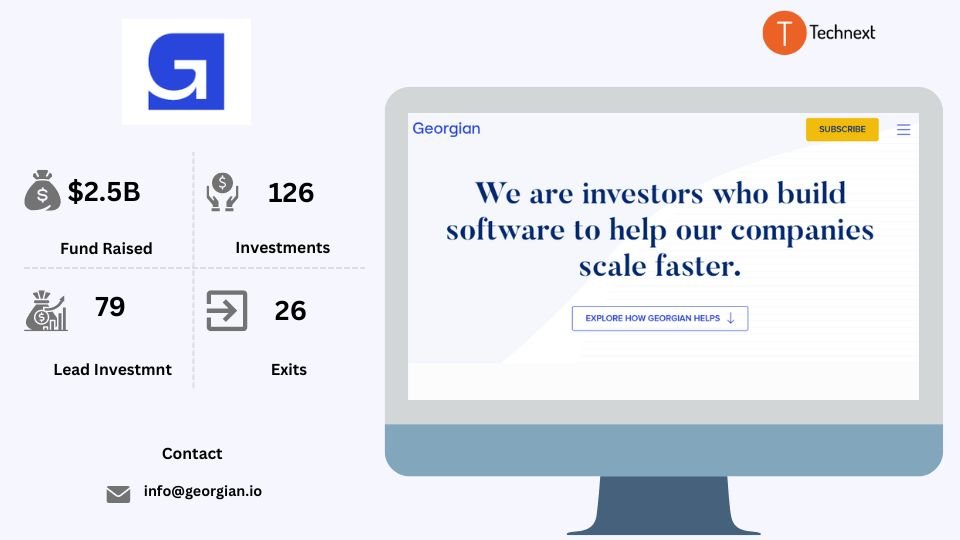

4. Georgian

Georgian is a renowned fintech company that invests in high-growth technology companies. Its platform is designed to accelerate and identify the best growth-stage software companies. Their purpose is to maximize participation in the digital economy.

They build software to help their companies to scale faster. Also, they are building a platform to provide a better growth capital experience to software company CEOs and their teams. At Georgian, they have constantly innovated to add more value to other companies.

Details of Georgian

Foundation Year: 2008

Countries of Operation:

- Canada

Number of Investments: 126

Lead Investments: 79

Number of Exits: 26

Funds raised: $2.5B

Focus of Georgian

Stage

- Late Stage Startup

Industries

- Fintech

- AI & ML

- Artificial intelligence

- Information technology sectors

Notable Investments

1. Shopify

URL: georgian.io

Funding Rounds: 4

Total Funding: $122.3M

2. Armis Security

URL: www.armis.com

Funding Rounds: 6

Total Funding: $537M

3. Aera Technology

URL: www.aeratechnology.com

Funding Rounds: 9

Total Funding: $173.7M

Contact

Website: https://georgian.io/

Email: info@georgian.io

Phone: 416-868-1514

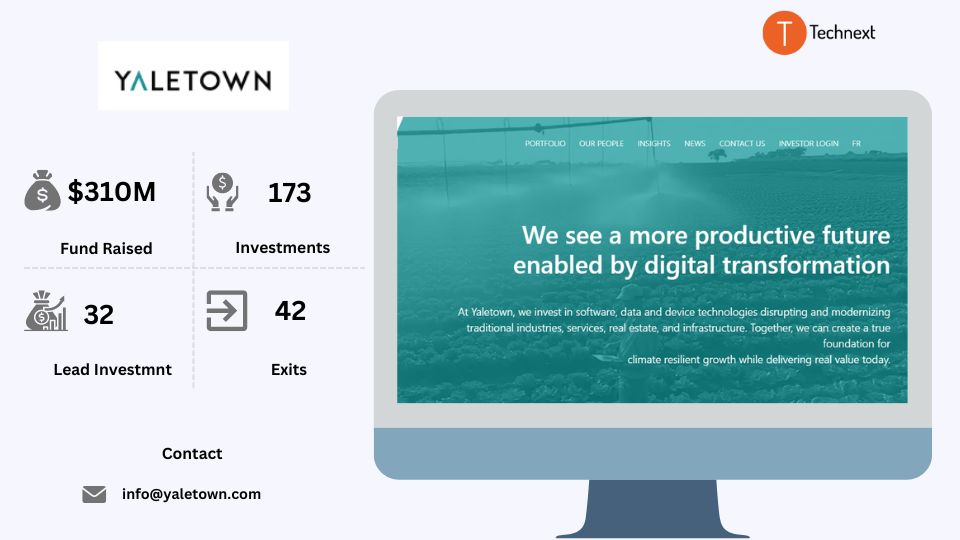

5. Yaletown Partners

Yaletown Partners is a leading Canadian IoT and Cleantech investor. They focus on Intelligent Industry companies. They are interested in investing in tech companies that make industries and businesses more efficient. As a strategic partner, they back the company’s vision to help build an enduring business. If you once connected with Yaletown Partners, they link your business with an extensive network of successful CEOs, industry leaders, and entrepreneurs from around the world

Details of Yaletown Partners

Foundation Year: 2001

Countries of Operation:

- Canada

Number of Investments: 173

Lead Investments: 32

Number of Exits: 42

Funds raised: $310M

Focus of Yaletown Partner

Stage

- Early Stage Startup

- Late Stage Startup

- Private Equity

- Seed

Industries

- AI & ML

- IoT

- SaaS

Investment size

Minimum check size: $2,000,000

Maximum check size: $5,000,000

Notable Investments

1. Glia

URL: www.glia.com

Funding Rounds: 6

Total Funding: $152M

2. Foodee

URL: www.food.ee

Funding Rounds: 7

Total Funding: $25.5M

3. Innerspace

URL: www.innerspace.io

Funding Rounds: 6

Total Funding: $11.3M

Contact

Website: https://yaletown.com/

Email: info@yaletown.com

Phone: 604.688.7807

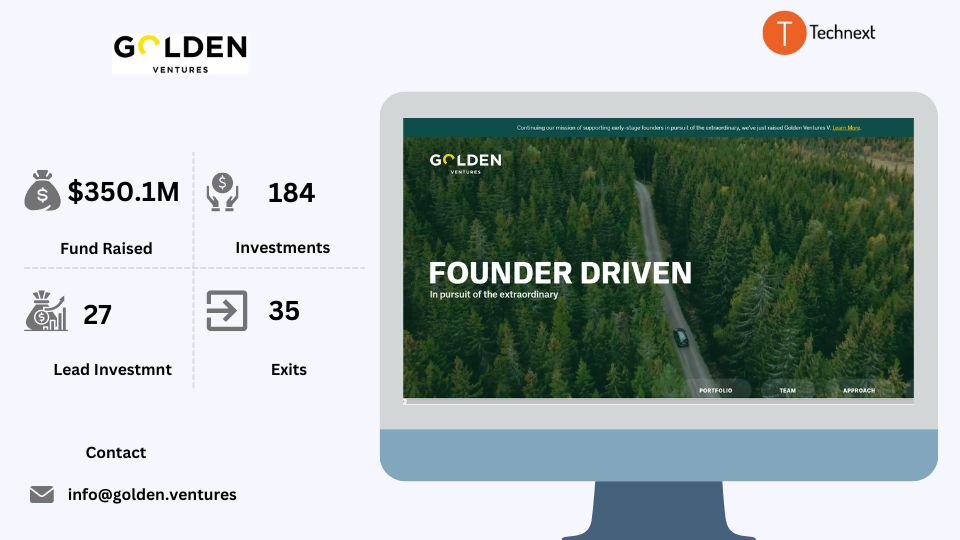

6. Golden Ventures

Golden Ventures is a venture capital fund based in Toronto, with investments spanning across North America. They are one of the top Toronto venture capitals. Their primary mission is to support visionary founders who are shaping the future through innovation. They believe that technology is not confined to a specific industry but in all aspects of life.

Details of Global Founders Capital

Foundation Year: 2011

Countries of Operation:

- Canada

Number of Investments: 184

Lead Investments: 27

Number of Exits: 35

Funds raised: $350.1M

Focus of Golden Ventures

Stage

- Early Stage Startup

- Seed

- Venture

Industries

- Manufacturing

- Business services

- Consumer products & services

- Education

- Energy

- Esports & gaming

- Fintech

- Food

- Logistics

- Media

- E-commerce

Notable Investments

1. Applyboard

URL: www.applyboard.com

Funding Rounds: 10

Total Funding: $491.2M

2. Arteria AI

URL: www.arteria.ai

Funding Rounds: 3

Total Funding: $40.9M

3. Avidbots

URL: avidbots.com

Funding Rounds: 10

Total Funding: $106.5M

Contact:

Website: https://www.golden.ventures/

Email: info@golden.ventures

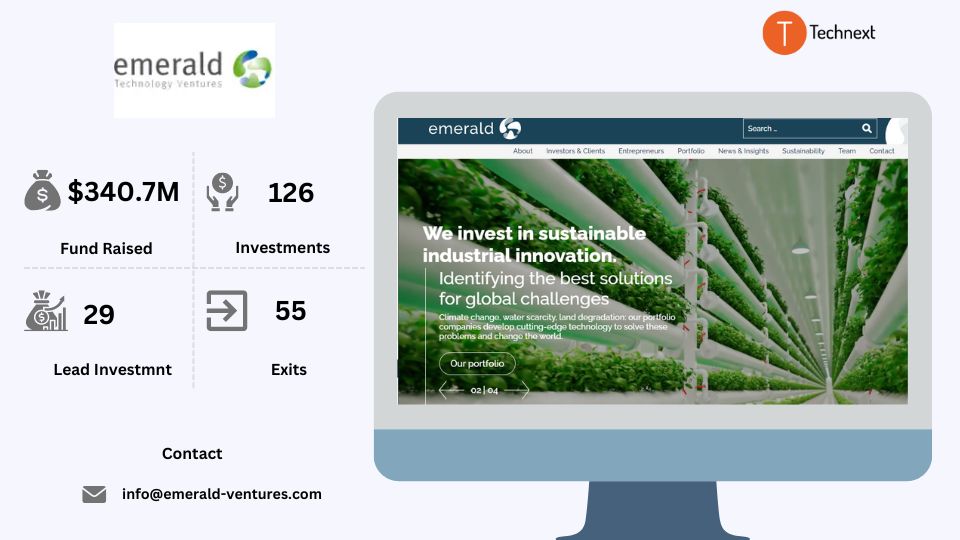

7. Emerald Technology Ventures

Emerald is one of the first venture capital companies to focus on sustainable industrial innovation. They have over 50 large corporations as investors and partners in open innovation. They’ve been at the forefront of sustainability for many years, from intelligent water efficiency to intelligent packaging to high-tech improvements in transportation and industry. They are dedicated to tackling big challenges in climate change and sustainability.

If you connect with Emerald Technology Venture, they will link businesses with top opportunities to drive the necessary changes for a more sustainable world

Details of Emerald Technology Ventures

Foundation Year: 2000

Countries of Operation:

- Canada

- Switzerland

- Singapore

Number of Investments: 126

Lead Investments: 29

Number of Exits: 55

Funds raised: $340.7M

Focus of Emerald Technology Ventures

Stage

- Early Stage Venture

- Late Stage Venture

Industries

- Energy

- Water & Wastewater

- Food

- Agriculture

- Mobility & Urbanization

- Materials & Packaging

- Industrial IT

Investment size

Minimum check size: $10,000,000

Maximum check size: $20,000,000

Notable Investments

1. Spear Power Systems

URL:

www.spearpowersystems.com

Funding Rounds: 1

Total Funding: $14.6M

2. Powerhouse Dynamics

URL: powerhousedynamics.com

Funding Rounds: 15

Total Funding: $24.1M

3. Fido Tech

URL: fido.tech

Funding Rounds: 3

Total Funding:$9.5M

Contact

Website: https://emerald.vc/

Email: info@emerald-ventures.com

Phone Number: +41 44 269 61 00

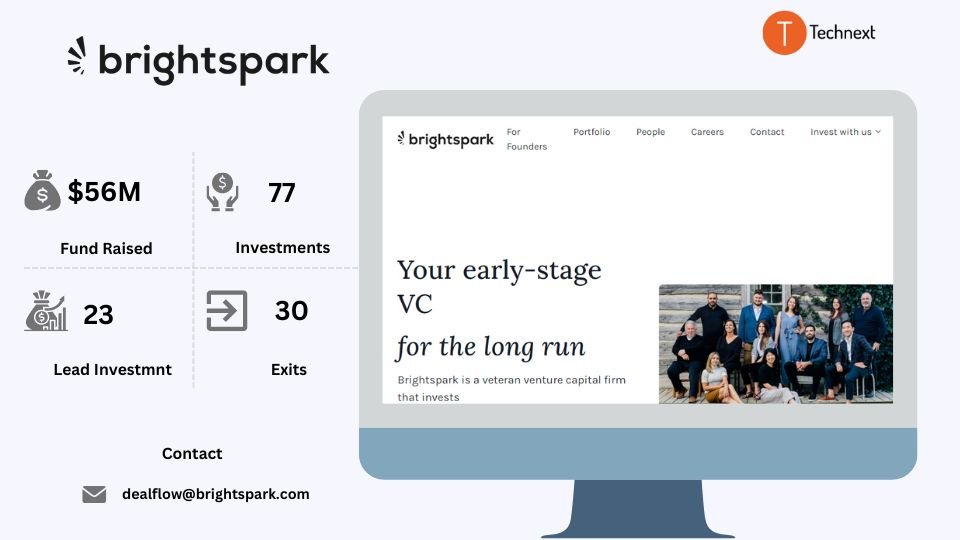

8. BrightSpark Ventures

Brightspark is an experienced venture capital firm that backs outstanding early-stage Canadian tech companies. They have been fuelling Canadian tech success stories since the beginning of the internet. Also, they have a fully automated tech platform that they built in-house. Besides that, Brightspark Financial is the Exempt Market Dealer that provides entrusted investors access to VC investments

Details of BrightSpark Ventures

Foundation Year: 1999

Countries of Operation:

- Canada

Number of Investments: 77

Lead Investments: 23

Number of Exits: 30

Funds raised: $56M

Focus of BrightSpark Ventures

Stage

- Early Stage Startup

- Late Stage Startup

- Seed

Industries

- Internet & Mobile

- Consumer

- Hardware

- SaaS

Investment size

Minimum check size: $500,000

Maximum check size: $1,500,000

Notable Investments:

1. POTLOC

URL: potloc.com

Rounds: 5

Total Funding: CA$58.4M

2. Hopper

URL: www.hopper.com

Rounds: 12

Total Funding: $729.7M

3. Classcraft

URL: www.classcraft.com

Rounds: 4

Total Funding: $15.4M

Contact

Website: https://brightspark.com/en

Email: dealflow@brightspark.com

Phone: 416-488-1999

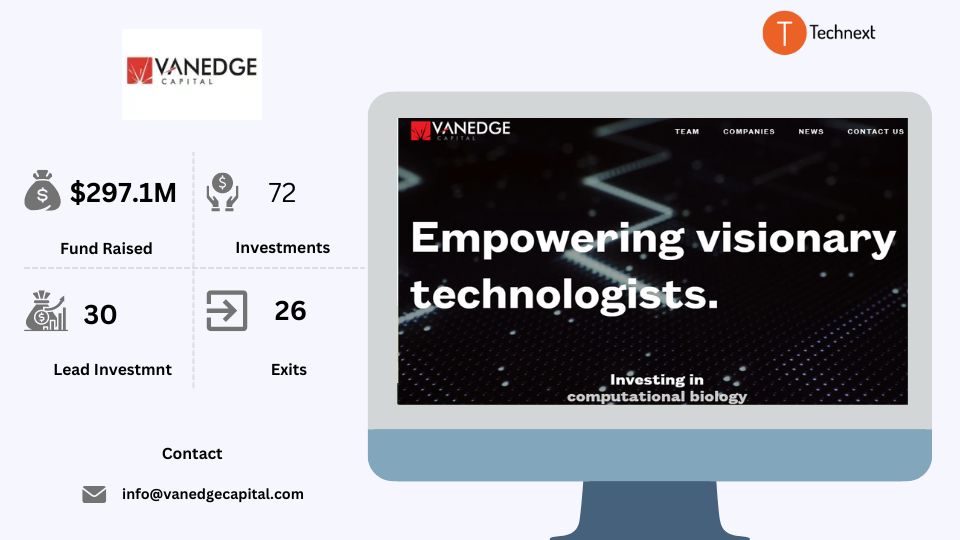

9. Vanedge Capital

Vanedge Capital is an early-stage venture capital firm based in Vancouver and Silicon Valley. So far, they have developed a reliable investment method ensuring top-notch returns for their investors. As operators, they have built and led world-class companies. And as investors, they utilize their skills and network to assist great entrepreneurs in expanding their businesses. Besides that, their strong team’s deep technology background helps them to find diamonds in the rough and identify technology trends early.

Details of Vanedge Capital

Foundation Year: 2010

Countries of Operation:

- USA

- Canada

Number of Investments: 72

Lead Investments: 30

Number of Exits: 26

Funds raised: CA $297.1M

Focus of Google Venture

Stage

- Early Stage Startup

- Late Stage Startup

- Seed

Industries

- Cloud Computing

- Cloud Infrastructure

- Cyber Security

- Digital Media

- Geospatial

- Internet of things

- Marketing Automation

- Saas

Investment size

Minimum check size: $2,000,000

Maximum check size: $5,000,000

Notable Investments

1. Ploty

URL: plotly.com

Rounds: 7

Total Funding: $18.4M

2. Cogniac

URL: www.cogniac.ai

Rounds: 6

Total Funding: $40.1M

3. HEAVY.AI

URL: www.heavy.ai

Rounds: 5

Total Funding: $92.1M

Contact

Website: https://www.vanedgecapital.com/

Email: info@vanedgecapital.com

Phone: +1 604 569 3813

10. ScaleUp

ScaleUP Ventures is Canada’s early-stage venture fund designed to assist the nation’s most promising startups. It’s one of the capital firms that support creative entrepreneurs with more than just capital. Their goal is to create case studies to help great Canadian tech companies go big worldwide. They spend time with entrepreneurs and living with their technology to see things from a user’s perspective. They also spend their time and expertise to help their investors get into the market sooner and scale up faster

Details of ScaleUp

Foundation Year: 2016

Countries of Operation:

- Canada

Number of Investments: 63

Lead Investments: 11

Number of Exits: 11

Funds raised: $100M

Focus of ScaleUp

Stage

- Early Stage Startup

- Seed

Industries

- Fintech

- Enterprise

- SaaS

- Creator Economy

Investment size

Minimum check size: $2,000,000

Maximum check size: $10,000,000

Notable Investments

1. Sonder

URL: www.sonder.com

Rounds: 11

Total Funding: $839.6M

2. Mojix

URL: www.mojix.com

Rounds: 8

Total Funding: $95.5

3. Splash

URL: splashthat.com

Rounds: 7

Total Funding: $39.5M

Contact

Website: https://suv.vc/

Email: christian@suv.vc.

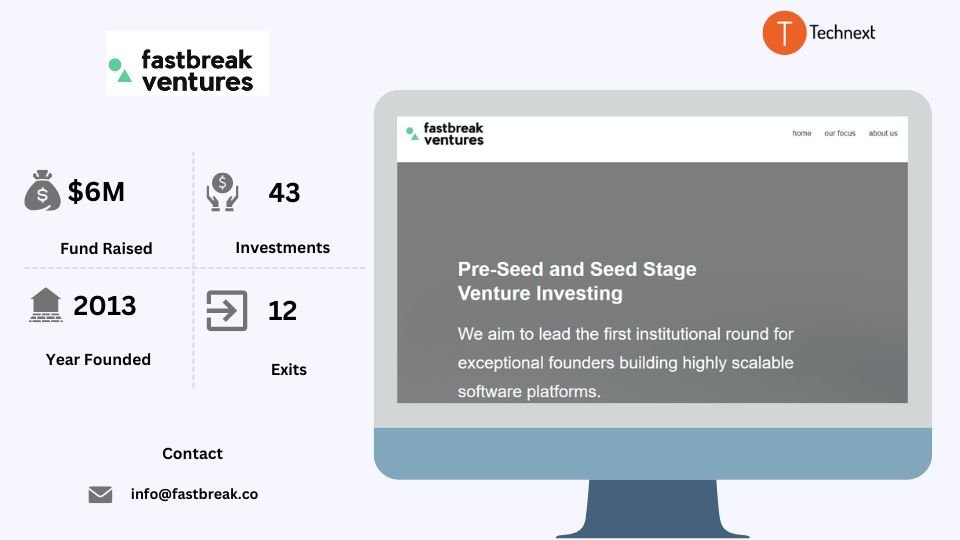

11. Fastbreak Ventures

Fastbreak Ventures is a venture capital firm based in Toronto, Canada. They focused on the key areas in the early growth stages that have proven successful across their portfolio. They use their experience, connections, and customer relationships to speed the growth of their portfolio companies. Also, they work closely with founders to build the team, boost technology, and increase traction

Details of Fastbreak Ventures

Foundation Year: 2013

Countries of Operation:

- Canada

Number of Investments: 43

Number of Exits: 12

Funds raised: $6,000,000

Focus of Fastbreak Ventures

Stage

- Pre-Seed Startup

- Seed Startup

Industries

- FinTech

- PropTech

- Digital Health

Notable Investments

1. Flybits

URL: flybits.com

Funding Rounds: 4

Total Funding: $44.1M

2. Sensibill

URL: getsensibill.com

Rounds: 6

Total Funding: $57.4M

3. Flyshot

URL: www.flyshot.io

Rounds: 3

Total Funding: $1.2M

Contact

Website: https://www.fastbreak.co/

Email: info@fastbreak.co

12. iGan Partners

iGan Partners is one of the largest venture capital firms investing in Canada. They are a dedicated team of entrepreneurs, operators, company builders, and investors. They bring unique expertise and domain-specific knowledge to their investment.

Also, they provide capital and expertise to help scale leading healthcare innovations globally. Besides that, they tend to invest in dynamic management teams, empowering them to build impactful businesses. They build a strong support system with capital, talent, and management experience to help startups to the next level.

Details of iGan Partners

Foundation Year: 2011

Countries of Operation:

- Canada

Number of Investments: 49

Lead Investments: 15

Number of Exits: 8

Funds raised: $350M

Focus of iGan Partners

Stage

- Early Stage Startup

- Seed

Industries

- Healthcare

- AI & M

Investment size

Minimum check size: $1,000,000

Maximum check size: $5,000,000

Notable Investments

1. Segmed

URL: www.segmed.ai

Funding Rounds: 5

Total Funding: $10M

2. Curv Health

URL: www.curvhealth.com

Funding Rounds: 4

Total Funding: $5.2M

3. MolecuLight

URL: www.moleculight.com

Funding Rounds: 6

Total Funding: $29.2M

Contact

Website: https://iganpartners.com/

Email:info@iganpartners.com

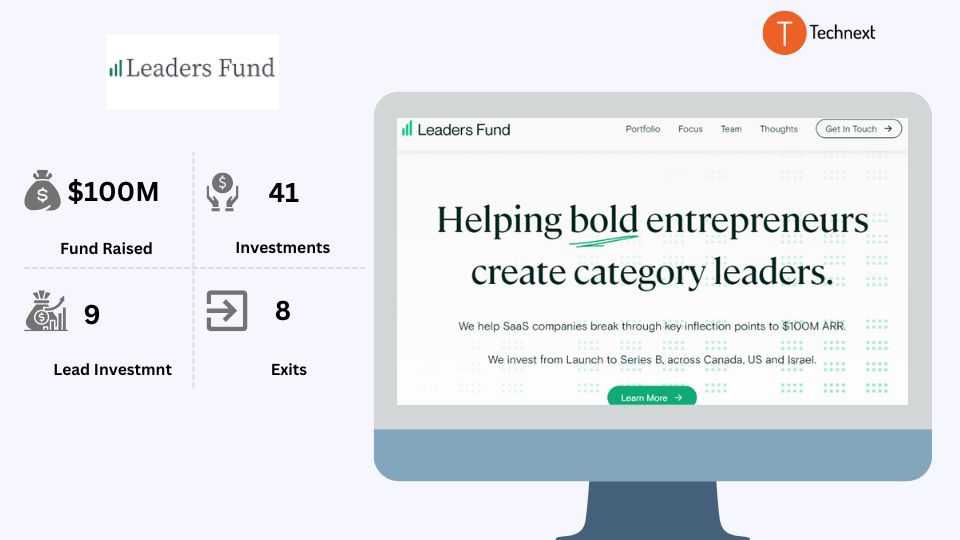

13. Leaders Fund

Leaders Fund invests in fast-growing software companies and is led by tenacious entrepreneurs. They are a team of operators that have founded, grown, and exited multiple technology businesses. They are focused on compounding value, not pushing entrepreneurs towards a binary outcome.

Also, they target three new investments each year, ensuring close collaboration with each portfolio company. Their flexible fund structure enables creative partnerships with other investors while ensuring deep alignment with their portfolio companies.

Details of Leaders Fund

Foundation Year: 2016

Countries of Operation:

- Canada

Number of Investments: 41

Lead investments: 9

Number of Exits: 8

Funds raised: $100M

Focus of Leaders Fund

Stage

- Early Stage Startup

- Late Stage Startup

Industries

- SaaS

- Cloud

- Cybersecurity

- Enterprise

- Supply Chain & Logistics

- AI & ML

Investment size

The investment size of Leaders Fund is Up to $20M

Notable Investments

1. Ada

URL: www.ada.cx

Funding Rounds: 7

Total Funding: $190.6M

2. 360insights

URL: 360insights.com

Funding Rounds: 3

Total Funding: $47.7M

3. Drata

URL: drata.com

Funding Rounds: 4

Total Funding: $328.2M

Contact

Website: https://www.leaders.vc/

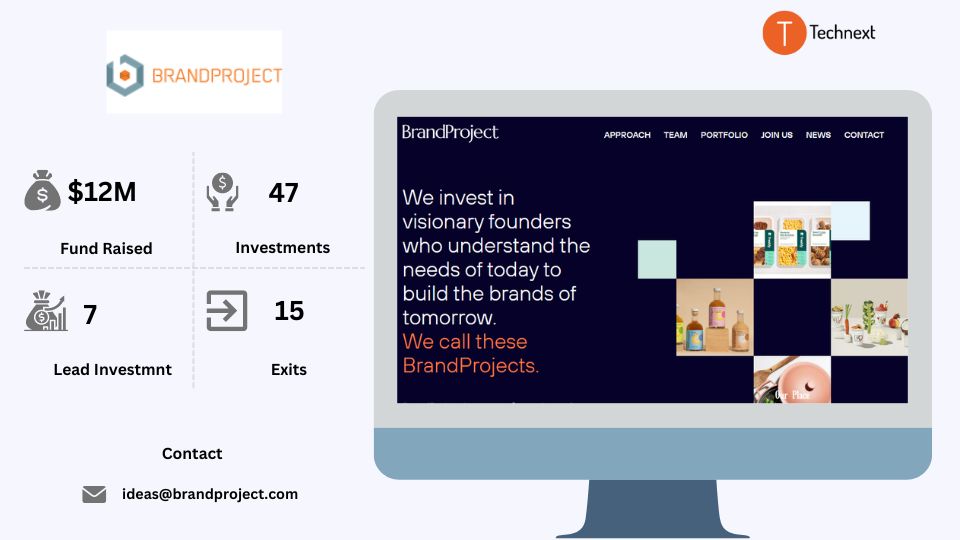

14. Brand Project

Brand Project is a multi-stage venture capital organization that invests in consumer brands. They have a team of experienced entrepreneurs and operators. They are passionate about partnering with visionary founders. Besides that, they are typically the first venture money and often the sole investor in a round. They are always dedicated to helping founders reach their dreams. Also, they are actively looking to back passionate founders who are creating differentiated products for large markets.

Details of Brand Project

Foundation Year: 2013

Countries of Operation:

- Canada

- USA

Number of Investments: 47

Lead investments: 7

Number of Exits: 15

Funds raised: $12M

Focus of Brand Project

Stage

- Pre-Seed

- Seed

- Series A

Industries

- Consumer

- DTC

- Health & Wellness

- Food & Beverage

- Marketplace

- Supply Chain & Logistics

Investment size

Minimum check size: $500,000

Maximum check size: $5,000,000

Notable Investments

1. Freshly

URL: www.freshly.com

Funding Rounds: 5

Total Funding: $107M

2. Porta

URL: eatporta.com

Funding Rounds: 1

Total Funding: CA $10.5M

3. Owlet

URL: www.owletcare.com

Funding Rounds: 8

Total Funding: $217.2M

Contact

Website: https://brandproject.com/

Email:

15. Arctern

ArcTern Ventures is a venture capital firm that is obsessed with rethinking sustainability and helping solve the climate crisis. They began with the idea that speeding up the shift to a carbon-neutral economy would create a huge chance for significant financial gains.

They invest worldwide in tech startups that can drastically cut down greenhouse gas emissions. Also, they love working with visionary entrepreneurs who can deliver positive environmental impact.

Details of Arctern

Foundation Year: 2012

Countries of Operation:

- Canada

Number of Investments: 58

Lead Investments: 18

Number of Exits: 3

Funds raised: $485.4M

Focus of Arctern

Stage

- Series A

- Early Stage Startup

Industries

- Climate & Sustainability

- AI & ML

- Biotech

- Robotics

- Transportation

- Industrial

- Manufacturing

- Energy

Investment size

Minimum check size: $5,000,000

Maximum check size: $15,000,000

Notable Investments

1. Emitwise

URL: www.emitwise.com

Funding Rounds: 4

Total Funding: $16.6M

2. Palmetto

URL: palmetto.com

Funding Rounds: 9

Total Funding: 628.3M

3. Carbon America

URL: www.carbonamerica.com

Funding Rounds: 5

Total Funding: $39.5M

Contact

Website: https://www.arcternventures.com/

Email: info@arcternventures.com

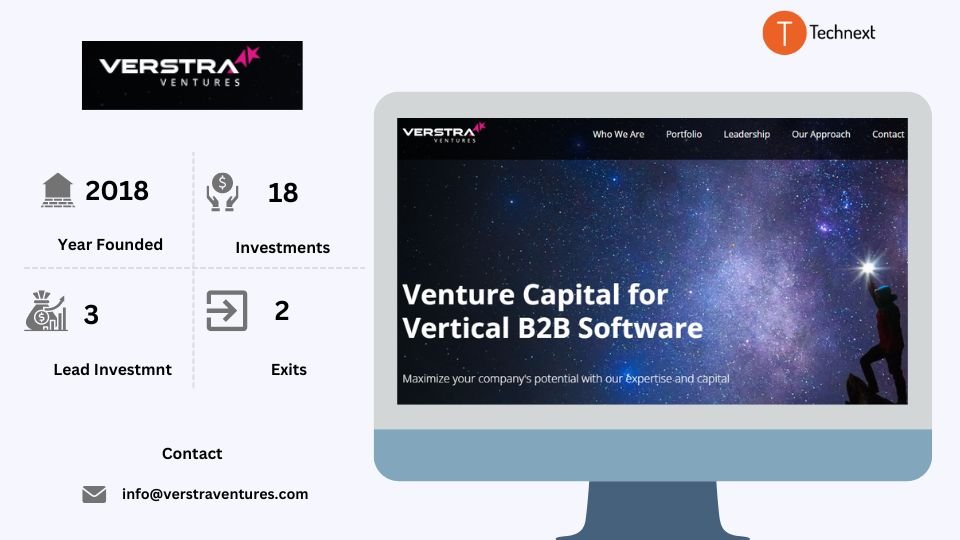

16. Verstra Ventures

Verstra Ventures is a venture capital firm based in Mississauga, Canada. They invest in outstanding founders who are building enduring software companies. Through their capital, network, and extensive knowledge, they are vertically focused software businesses. Also, they help their portfolio companies scale up quickly and sustainably. Besides that, they go beyond traditional venture capital and consider long-term, unique, and unorthodox investments.

Details of Verstra Ventures

Foundation Year: 2018

Countries of Operation:

- Canada

Number of Investments: 18

Lead Investments: 3

Number of Exits: 2

Focus of Verstra Ventures

Stage

- Early Stage Startup

- Late Stage Startup

Industries

- Enterprise

- SaaS

Investment size

Minimum check size: $500,000

Maximum check size: $2,000,000

Notable Investments

1. Renovai

URL: renovai.com

Funding Rounds: 2

Total Funding: $5.8M

2. Dream Payments

URL: www.dreampayments.ca

Funding Rounds: 5

Total Funding: $15.8M

3. MiCharity

URL: micharity.com

Funding Rounds: 6

Total Funding: $6.1M

Contact

Website: https://verstraventures.com/

Email: info@verstraventures.com

17. Plug and Play Tech Center

Plug and Play venture capital firm is the ultimate innovation platform. Their mission is to build the world’s leading innovation platform and open it to anyone, anywhere. They do this by connecting entrepreneurs, corporations, and investors worldwide. Also, they’re working with partners to build a system that connects people, invests in startups, and brings together key stakeholders.

Details of Plug and Play Tech Center

Foundation Year: 2006

Countries of Operation:

- Canada

- USA

- Brazil

- United Arab Emirates

- Netherlands

- Belgium

- Spain

- Switzerland

- Morocco

- Germany

- Turkey

- South Africa

- Italy

- France

- China

- Japan

- South Korea

Number of Investments: 6092

Lead Investments: 144

Number of Exits: 1364

Funds raised: $45.5M

Focus of Plug and Play Tech Center

Stage

- Early Stage Startup

- Series A

- Series B

- Series C

Industries

- DTC

- Enterprise

- Fintech

- Food & Beverage

- Healthcare

- InsurTech

- IoT

- Media

- Transportation

- Hardware

- Proptech & Real Estate

- Supply Chain & Logistics

- Climate & Sustainability

- Travel & Hospitality

- Agriculture

- Energy

Investment size

Minimum cheque size: $50,000

Maximum Cheque Size: $250,000

Notable Investments

1. PayPal

URL: www.paypal.com

Funding Rounds: 6

Total Funding: $5.2B

2. Honey

URL: www.joinhoney.com

Funding Rounds: 6

Total Funding: $31.8M

3. Shippo

URL: goshippo.com

Funding Rounds: 8

Total Funding: $154.3M

Contact

Website: https://www.plugandplaytechcenter.com/

Email: investment@plugandplaytechcenter.com

Phone: +1 408-524-1400

This was our list of venture capital firms in Toronto willing to invest in your early-stage startup. Getting funds in the early stage will take a lot of work. Remember venture capital firms in Toronto are now more selective than they ever were, so you have to be prepared with your idea. Develop your MVP well, Prepare a winning pitch deck, and then approach VCs. This increases your investment opportunities.

With your idea, you also have to formulate your startup team structure, figure out the equity, do market research for the startup, and find out the potential.

Remember, venture capital firms don’t just invest in ideas; They invest in people. If investors could see you are already prepared enough, the chances of you getting funded increase a lot. You can also discuss everything with an expert if you want.

And one more thing, you also have to decide the way you want to develop your product. You can consider setting up an in-house development team or outsourcing your development efforts. Once you are set on the type of team, finalize how you will hire your developers.

Finally, always remember it can be hard to get the funding, but if you have solid preparation and vision, you can get one.

Best of Luck!

![15 Top Berlin Venture Capital Firms for Early-Stage Startups [2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/04/Berlin-Venture-Capital-Firms-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)

![18 San Francisco Venture Capital Firms for Early-Stage Startups[2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/04/Best-San-Francisco-Venture-Capital-Firms-1-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)

![15 Best Miami Venture Capital Firms for Early-Stage Startups [2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/03/Best-Venture-Capital-Firms-in-Miami-for-Early-Stage-Startups-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)

![13 Top Dubai Venture Capital Firms for Early-Stage Startups [2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/05/Dubai-Venture-Capital-Firms-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)