11 Venture Capital Firms in Austin for Early-Stage Startups

If you are seeking venture capital firms in Austin to secure funding for your early-stage startup, we have compiled a list of 11 options worth exploring.

Austin, the live music capital of the world, has earned a new identity in recent years: the city of unicorns and tech giants. This is due to the massive influx of startup founders and venture capital firms in 2020 and 2021.

The capital city of Texas attracted over $5.5 billion in investments in 2021 alone. Tax advantages and the presence of giants like Google, Apple, and Tesla helped Austin to create the perfect ecosystem for startups to grow.

If you’re a startup founder in Austin, you can contact any of the 416 venture capital firms currently operating in the city. Unfortunately, not everyone is willing to invest in early-stage startups.

So, we’ve put together a list of 11 venture capital firms in Austin, Texas, that are willing to take the risk and invest in your early-stage company.

11 Early-Stage Venture Capital Firms in Austin

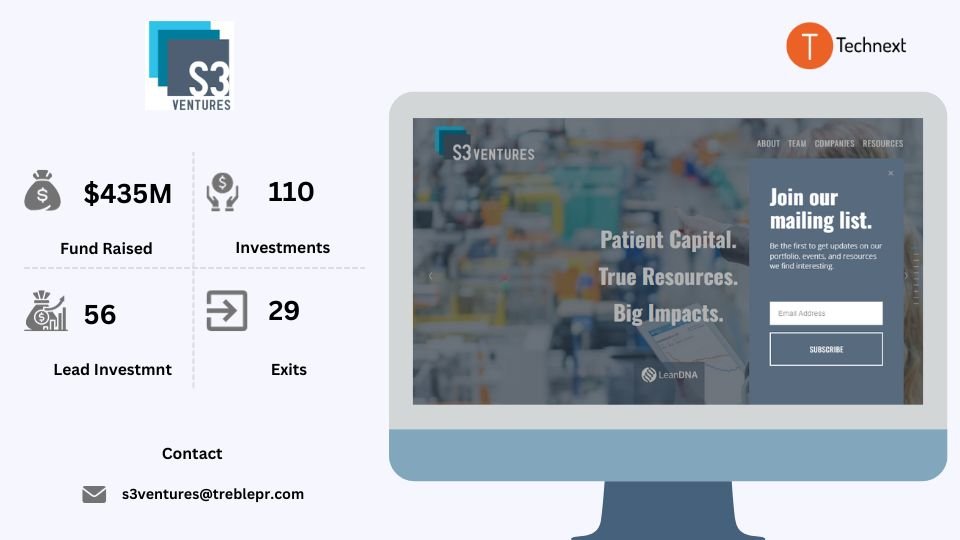

1. S3 Ventures

S3 Ventures is one of the largest venture capital firms in Austin, Texas. They have experienced and successful entrepreneurs in their team. Their investors and top management have diverse experiences that might add value from different perspectives in your startups.

They have invested in patient capital, resources, and industry insight into the startups. From the beginning, they are backed by a single philanthropic family with a multi-billion dollar foundation.

Details of S3 Ventures

Foundation Year: 2006

Countries of Operation:

- United States

- Canada

Number of Investments: 110

Number of Exits: 29

Funds raised: $435M

Focuses of S3 Ventures

Stage

- Early Stage

- Pre-Seed

- Seed

Industries

- Business Technology

- Digital experiences

- Healthcare technology sectors

Investment size

S3 Venture’s investment size is $500K to $10M.

Notable Investments

1. Atmosphere

URL: atmosphere.tv

Funding Rounds: 5

Total Funding: $184M

2. BrainCheck

URL: braincheck.com

Rounds: 8

Total Funding: $21.5M

3. Arpio

URL: arpio.io

Rounds: 3

Total Funding: $10.4M

Contact:

Website: https://www.s3vc.com/

Email: s3ventures@treblepr.com

Phone number: +1 (512) 258-1759

Address: 6300 Bridge Point Pkwy

Building 1, Suite 405

Austin, TX 78730, United States

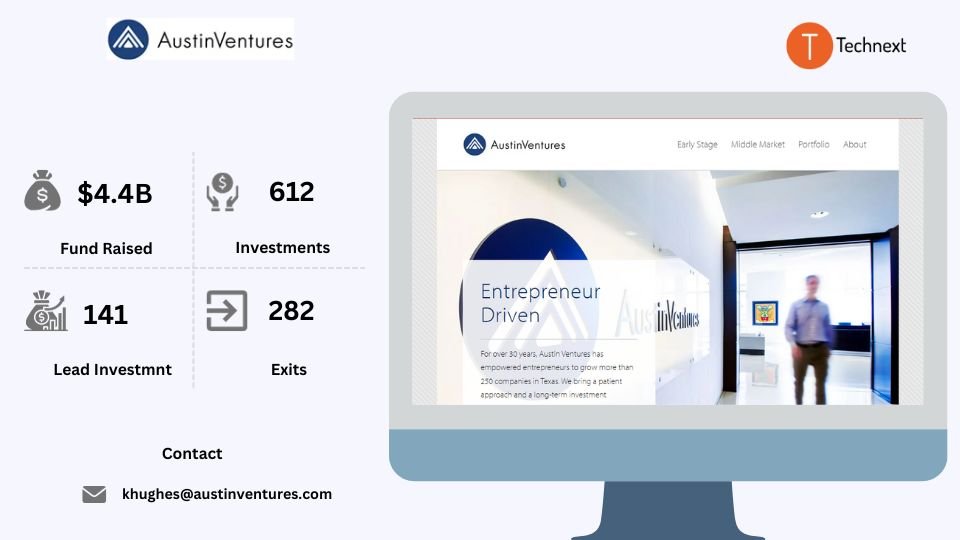

2. Austin Ventures

Austin Venture is one of the most established venture capital firms in Texas. If you are a talented executive and entrepreneur, they would like to build a partnership with you.

Their main target is to build top-notch companies in Texas. Austin Ventures is one of the few VCs who are always ready to use their experience and expertise to help your startup grow.

Details of Austin Ventures

Foundation Year: 1984

Countries of Operation

- United States

- China

- Canada

- Germany

- Australia

- United Kingdom

Number of Investments: 612

Number of Exits: 282

Funds raised: $4.4B

Focus of Austin Ventures

Stage

- Early Stage

- Late Stage

- Seed

Industries

- Fintech

- Healthcare

- Industrial

- Enterprise

- Hardware

- Internet

- Mobile

- SaaS

Investment

Investment size: $500k – $10M (Early Stage) and $1M – $40M (Growth Stage)

Minimum cheque size: $500,000

Notable Investments

1. Bazaarvoice

URL: bazaarvoice.com

Rounds: 6

Total Funding: $20.4M

Contact

Website: https://austinventures.com/

Email: khughes@austinventures.com

Address: 100 Congress Avenue, Suite 1600, Austin, Texas 78701-2746

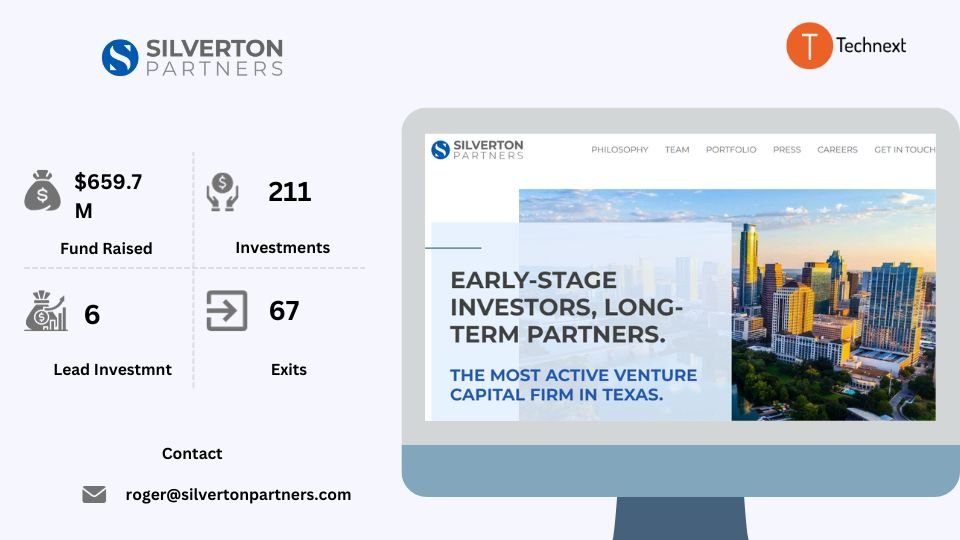

3. Silverton Partners

Silverton Partners is one of the most active venture capital firms in Texas. They’re all about partnering with entrepreneurs like you who have bold aspirations to break the mold. They focused on funding and mentoring early-stage businesses that disrupt the markets and build enduring companies.

The best thing about Silverton Partners is they passionately share their decades of knowledge and extensive network with every one of their investments. It’s a partnership that could take your venture to new heights.

Details of Silverton Partners

Foundation Year: 2006

Countries of Operation:

- Canada

- United States

Number of Investments: 211

Number of Exits: 67

Funds raised: $659.7M

Focus of Silverton Partners

Stage

- Early Stage

- Seed

Industries

- Business Software

- Consumer internet

- Cloud service

- Enterprise software

Investment size

Silverton Partners’ investment size is more than $950 million.

Notable Investments

Contact

Contact:

Website: silvertonpartners.com/

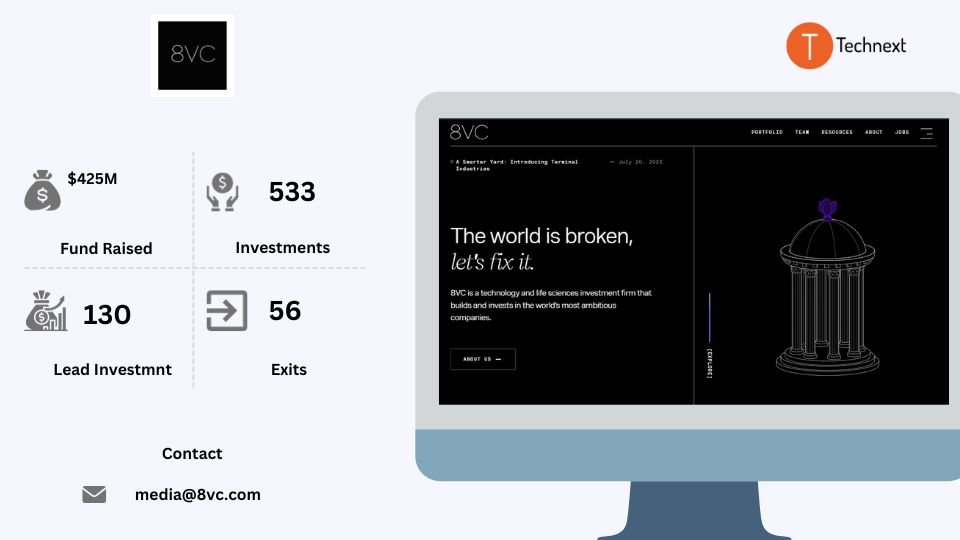

4. 8VC

8VC is a venture capital firm that focuses on investing and supporting technology startups across various industries. If you are one of those companies that can create long-term economic and societal value, there are huge possibilities that they will start aligning with you.

Also, 8VC is known for backing companies that have the potential to make a significant impact on their industries. And they are the investors who never stopped being engineers, operators, policymakers, philosophers, and entrepreneurs for your betterment.

Details of 8VC

Foundation Year: 2012

Countries of Operation:

- USA

- Canada

- Colombia

Number of Investments: 533

Number of Exits: 56

Funds raised: $425,000,000

Focus of 8VC

Stage

- Early Stage

- Seed

- Late Stage

Industries

- Healthcare

- Biotech

- Consumer

- Enterprise

- Supply Chain Logistics

- Government Technology

- Life Sciences

- Manufacturing

- Fintech

Notable Investments

1. Blend

URL: blend.com

Rounds: 8

Total Funding: $685M

2. Sonoma Bio

URL: sonomabio.com

Rounds: 3Total Funding: $335M

3. Socotra

URL: socotra.com

Rounds: 7Total Funding: $98M

Contact

URL: 8vc.com/

Email: media@8vc.com

5. LiveOak Venture Partners

LiveOak Venture Partners is one of the venture capital companies that focuses on providing the first institutional capital for tech and tech-enabled services companies.

They want to team up with intelligent and creative entrepreneurs, just like you, to create world-class, industry-leading businesses.

Details of LiveOak Venture Partners

Foundation Year: 2013

Countries of Operation:

- United States

- United Kingdom

Number of Investments: 123

Number of Exits: 36

Funds raised: $424M

Focus of LiveOak Venture Partners

Stage

- Early Stage

- Seed

Industries

- SaaS

- Information technology

- Health tech

- Mobile

Investment size

LiveOak Venture Partner’s Investment size is between $1 million and $5 million.

Notable Investments

1. Osano

URL: osano.com

Rounds: 4

Total Funding: $44.4M

2. Homeward

URL: homeward.com

Rounds: 7

Total Funding: $210M

3. ConverseNow

URL: conversenow.ai

Rounds: 3

Total Funding: $28.8M

Contact

URL: liveoakvp.com/

Email: info@liveoakvp.com

6. Trust Ventures

Trust ventures like pioneering new companies to break down public policy barriers, accelerate business innovation, and improve consumers’ lives. Their strategies are built and executed in this way, which has the potential to break barriers in different industries.

Trust Ventures wants to build partnerships with companies that drive the next generation of great ideas. Also, their motto is to add value for founders and create tremendous value for society.

Foundation Year: 2018

Countries of Operation:

- United States

Number of Investments: 39

Number of Exits: 4

Funds raised: $168M

Focus of Trust Ventures

Stage

- Early Stage

Industries

- Health Care

- Information Technology

- Manufacturing

- Insurance

- Employee benefits

Investment size

Trust Ventures Investment size is $200 million.

Notable Investments

1. ICON

URL: iconbuild.com

Rounds: 7

Total Funding: $415M

2. Oklo

URL: oklo.com

Rounds: 4

Total Funding: $120k

3. Visibly

URL: govisibly.com

Rounds: 7

Total Funding: $50.2M

Contact

Email: info@trustventures.com

URL: trustventures.com/

7. Next Coast Ventures

Next Coast Ventures likes to work with entrepreneurs who are willing to take risks and build new businesses. Their investment approach is based on macro trends and themes.

They take a hands-on approach to working with their portfolio companies, providing not only capital but also mentorship and access to their network.

Details of Next Coast Ventures

Foundation Year: 2015

Countries of Operation:

- United States

- Australia

Number of Investments: 143

Number of Exits: 23

Funds raised: $310M

Focus of Next Coast Ventures

Stage

- Early Stage Venture

- Late Stage Venture

Industries

- Health & Wellness

- Marketplace

- Future of Work

- Consumer,

- Enterprise

- DTC

- SaaS

Notable Investments

1. BrainCheck

URL: braincheck.com

Rounds: 8

Total Funding: $21.5M

2. First Dollar

URL: firstdollar.com

Rounds: 2

Total Funding: $19M

3. Osano

URL: osano.com

Rounds: 4

Total Funding: $44.4M

Contact

Email: info@nextcoastventures.com

8. Antler

Antler was founded on the belief that innovation is the key to making the future better. They offer global residency programs to help founders like you from all over the world.

They’ve made their company grow quickly by connecting with co-founders from around the globe. Antler gives founders access to talent, expert advisors, support, opportunities to expand, and capital right from the start.

Details of Antler

Foundation Year: 2017

Countries of Operation:

- Singapore

- Germany

- United Kingdom

- Australia

- South Korea

- Japan

- USA,

- Canada

Number of Investments: 1052

Number of Exits: 61

Funds raised: $82.M

Stage

- Pre-Seed

- Seed

Industries

- AI & ML

- Consumer

- Crypto & Blockchain

- Cybersecurity

- E-Commerce

- Fintech

- SaaS

Contact

Email: hello@antler.co

Website: www.antler.co

9. QED Investors

QED is the leading venture capital firm in the fintech area. It was founded on the principles of bringing transparency, fairness, and access to financial services.

They are focused on investing in disruptive financial services. They are also dedicated to building great businesses and use a unique, hands-on approach that leverages their partners’ expertise. Overall, they are known for their knowledge, engagement, and empathy.

Details of QED Investors

Foundation Year: 2007

Countries of Operation:

- United Kingdom

- USA

- Austria

- Canada

- Sweden

- China

Number of Investments: 353

Number of Exits: 72

Funds raised: $2.3B

Focus of Google Venture

Stage

- Early Stage

- Seed

Industries

- Creator Economy

- Crypto & Blockchain

- Fintech, Education, Healthcare

- InsurTech

- Marketplace

- E-Commerce

Notable Investments

1. Klarna

URL: klarna.com

Rounds: 23

Total Funding: $4.09B

2. Remitly

URL: remitly.com

Rounds: 13

Total Funding: $436M

3.

SoFi

URL: sofi.com

Rounds: 15

Total Funding: $2.67B

Contact

URL: qedinvestors.com/

Email: ashley@qedinvestors.com

10. Sevin Rosen Funds

Sevin Rosen Funds is a well-known early-stage venture capital firm with a 28-year track record. They’ve built outstanding partnerships with entrepreneurs to establish world-class technology firms.

Their active funds are completely invested, which means any future investments will be limited to Sevin Rosen portfolio firms only.

Details of Sevin Rosen Funds

Foundation Year: 1981

Countries of Operation:

- USA

- United Kingdom

Number of Investments: 363

Number of Exits: 154

Funds raised: $1.7B

Focus of Sevin Rosen Funds

Stage

- Early Stage

Industries

- Internet & Mobile

- Media

- Life Sciences

- Healthcare

- Industrial

- Energy

- SaaS

Notable Investments

1. Hightail

URL: hightail.com

Rounds: 5

Total Funding: $77.7M

2. vidyo.ai

URL: vidyo.ai

Rounds: 1

Total Funding: $1.1M

3. Splunk

URL: splunk.com

Rounds: 8

Total Funding: $40M

Contact

Email: info@srfunds.com

11. Moonshots Capital

Moonshots Capital is a seed-stage venture capital firm that invests in extraordinary leadership.

They believe that military-trained entrepreneurs possess the best qualities.

If they see that you are one of those firms that can motivate others, inspire trust, and plan heuristically, they will invest in you with full conviction. Also, they are always ready to deploy their entrepreneurial experience and network to help you succeed.

Details of Moonshots Capital

Foundation Year: 2017

Countries of Operation:

- USA

Number of Investments: 143

Number of Exits: 42

Funds raised: $56M

Focus of Moonshots Capital

Stage

- Seed

- Early Stage

Industries

- Internet & Mobile,

- Fintech

- Cybersecurity

- Gaming

- Transportation Media

Investment size

Moonshot capita investment size ranges from $0.75-2.5M

Minimum cheque size: $750,000

Maximum cheque size: $3,000,000

Notable Investments

1. Slack

URL: slack.com

Rounds:11

Total Funding: $1.22B

2. LinkedIn

URL: linkedin.com

Rounds: 9

Total Funding: $123M

3. Pandora

URL: pandora.com

Rounds: 11

Total Funding: $56.1M

Contact

URL: moonshotscapital.com

Email: kelly@moonshotscapital.com

Well, that was our list of early-stage venture capital firms in Austin, Texas. Remember, venture capital firms don’t just invest in ideas; They invest in people, and that is why you need to pitch a local investor before going to international VCs. For the same reason, you need to make sure you are prepared enough before pitching an investor.

Formulate your startup team structure, figure out the equity, do market research for the startup, and find out the potential. Those are the things that investors would want to see at this stage.

Last but not least, figure out the way you want to develop your product, you may consider outsourcing your development efforts or setting up an in-house development team. In that case, finalize how you will hire developers.

Figure all those factors out, and discuss with an expert if you have to. Remember, funding is hard to come by, but with solid preparation, it is possible to get people to believe in your vision.

Best of Luck!

![9 Top Saudi Arabia Venture Capital Firms for Early-Stage Startups [2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/05/Saudi-Arabia-Venture-Capital-Firms-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)

![18 San Francisco Venture Capital Firms for Early-Stage Startups[2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/04/Best-San-Francisco-Venture-Capital-Firms-1-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)

![Top 17 Toronto Venture Capital Firms for Tech Startups [2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/03/Toronto-Venture-Capital-Firms-for-Tech-Startups-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)

![13 Top Amsterdam Venture Capital Firms for Early-Stage Startups [2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/05/Amsterdam-venture-capital-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)

![17 New York Venture Capital Firms for Early-Stage Startups[2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/04/New-York-Venture-Capital-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)