18 San Francisco Venture Capital Firms for Early-Stage Startups[2024]

We’ve gathered a list of 18 San Francisco venture capital willing to invest in your early-stage firm while also providing innovative funding possibilities.

Venture capital firms in San Francisco are like rocket fuel for startups. This city’s connection to Silicon Valley makes it a popular destination for entrepreneurs with big ideas.

Every year, a lot of money is put into these firms, making San Francisco one of the best places for investment. Startups received over 35% of all U.S. venture capital funding in 2022. This funding injection promotes the growth of new technology and keeps San Francisco at the forefront of innovation.

Whether you are a seasoned veterans or newcomers, these venture capitalists are the driving force behind the city’s startup industry, defining the future of exciting new products and motivating others to dream big.

Here we have prepared a list of San Francisco venture capital for you.

18 Early-Stage San Francisco Venture Capital Firms

1. Andreessen Horowitz

Andreessen Horowitz was founded by Silicon Valley veterans Marc Andreessen and Ben Horowitz. This San Francisco venture capital has a significant presence. Also, they are known for their bold investments in transformative technologies and disruptive startups across a wide range of industries.

They are likely to invest in fearless entrepreneurs who are using technology to build the future. Their goal is to connect with entrepreneurs, engineers, investors, academics, executives, industry experts, and others in the technology ecosystem. One thing that makes Andreessen Horowitz different from other firms is that they have a dedicated team that works with their portfolio companies on everything from products to recruiting.

.

Details of Andreessen Horowitz

Foundation Year: 2009

Countries of Operation:

- USA

- China

Number of Investments: 1689

Lead Investments: 645

Number of Exits: 210

Funds raised: $32.4B

Minimum cheque size: $500,000

Maximum Cheque Size: $1,000,000

Focus of Andreessen Horowitz

Stage

- Early Stage Startup

- Late Stage Startup

Industries

- Biotech

- Healthcare

- Crypto & Blockchain

- Consumer

- Enterprise

- Fintech

- Gaming

Notable Investments

URL: pinterest.com

Funding Rounds: 26

Total Funding: $1.5B

2. GitHub

URL: github.com

Funding Rounds: 5

Total Funding: $350M

3. Airbnb

URL: www.airbnb.com

Funding Rounds: 30

Total Funding: $6.4B

Contact

Website: https://a16z.com/

Email: businessplans@a16z.com

Phone: (650) 798-5800

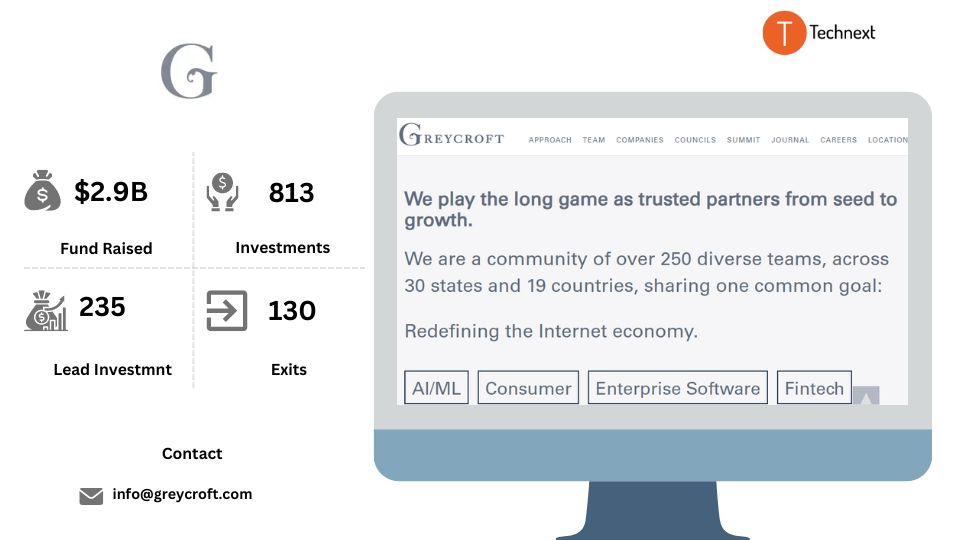

2. Greycroft Partners

Greycroft Partners is a prominent venture capital firm that actively invests in San Francisco’s flourishing startup scene. They love to build partners with exceptional entrepreneurs. They focus on technology startups and investments in the Internet and mobile markets. They have the ability to solve problems uniquely. Which makes them one of the best San Francisco venture capital.

Also, they guide and motivate entrepreneurs to achieve their goals. Leveraging their extensive connections in media and tech, they help entrepreneurs gain visibility, launch products, and build thriving businesses.

They have a diverse portfolio and experienced team, making them a sought-after partner for entrepreneurs aiming to disrupt industries. So, if you’re looking to shake things up in an industry, they’re the go-to partners

Details of Greycroft Partners

Foundation Year: 2006

Countries of Operation:

- United States

- United Kingdom

Number of Investments: 813

Lead Investments: 235

Number of Exits: 130

Funds raised: $2.9B

Minimum cheque size: $1,000,000

Maximum Cheque Size: $10,000,000

Focus of Greycroft Partners

Stage

- Early Stage Startup

- Late Stage Startup

- Private Equity

- Seed

Industries

- Consumer

- Enterprise

- Fintech

- SaaS

- Internet & Mobile

- Healthcare

- AI & ML

- Automation

- Cloud

Notable Investments

1. Flashpoint

URL: www.flashpoint.io

Funding Rounds: 5

Total Funding: $49M

2. Rocket.Chat

URL: rocket.chat

Funding Rounds: 4

Total Funding: $36.9M

3. Shipt

URL: www.findoctave.com

Funding Rounds: 3

Total Funding: $65.2M

Contact

Website: https://www.greycroft.com/

Email: info@greycroft.com

Phone: 212-756-3508

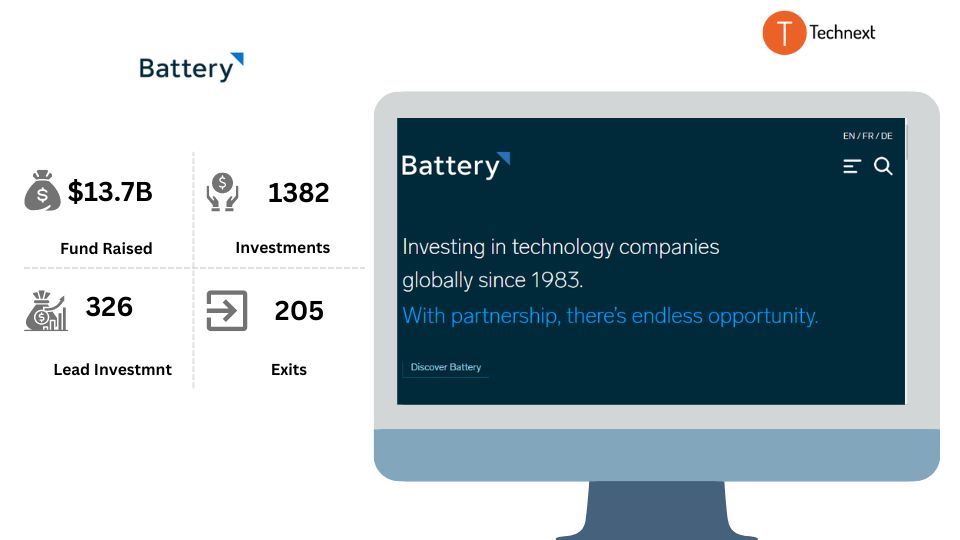

3. Battery Ventures

Battery Ventures is one of the global investment firms that focuses on technology among San Francisco venture capitals. They are decisive, hard-working, and thesis-driven investors. They are hard-working and focused investors with a solid strategy. They always look forward to extraordinary business leaders. Also, they support exceptionally skilled teams, from startups to becoming established market leaders. To help companies, they specialize in areas like recruiting, branding, business development, IT infrastructure scaling, and growth leadership

Details of Battery Ventures

Foundation Year: 1983

Countries of Operation:

- USA

- United Kingdom

- Israel

Number of Investments: 1382

Lead Investments: 326

Number of Exits: 205

Funds raised: $13.7B

Minimum cheque size: $15,000,000

Maximum Cheque Size: $20,000,000

Focus of Greycroft Partners

Stage

- Debt

- Early Stage Startup

- Late Stage Startup

- Private Equity

- Seed

Industries

- Life Sciences

- Industrial

- Consumer

- Cybersecurity

- Cloud

- DevOps

- AI & ML

- Fintech

- Healthcare

- Infrastructure

Notable Investments

- Wayfair

URL: www.wayfair.com

Funding Rounds: 5

Total Funding: $2.3B

2. Coinbase

URL: www.coinbase.com

Funding Rounds: 19

Total Funding: $678.7M

3. Earnest

URL: www.earnest.com

Funding Rounds: 6

Total Funding: $316.3M

Contact:

Website: https://www.battery.com/

Phone: (415) 426-5900

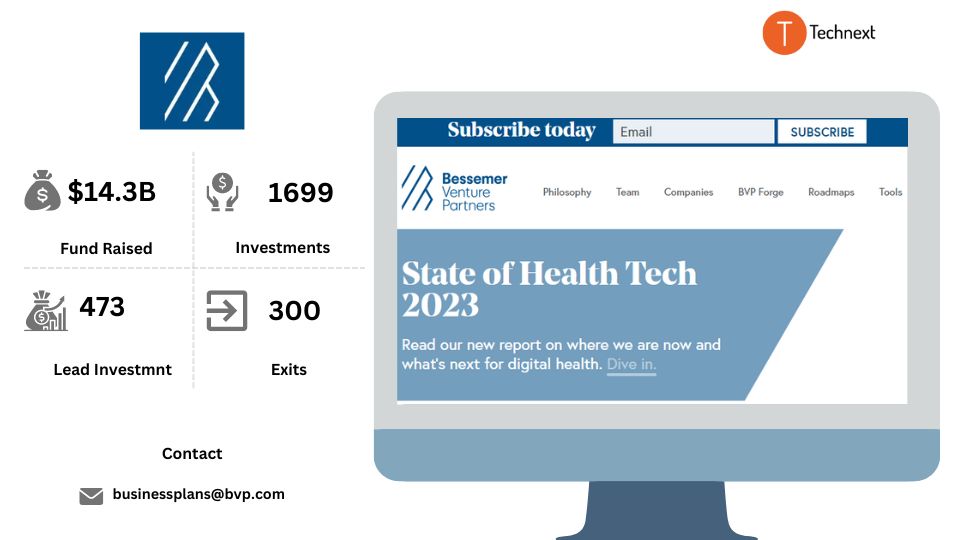

4. Bessemer Venture Partners

Bessemer Venture Partners is one of the most renowned and experienced venture capital firms in San Francisco. They have good partnerships with founders all around the world. They love to team up with innovative companies that have big ideas to change the way we live, work, and do business.

They help visionary entrepreneurs lay strong foundations to create companies that matter and support them through every stage of their growth. Also, they always try to find out hidden problems and try to understand things that others might miss.

Details of Bessemer Venture Partners

Foundation Year: 1911

Countries of Operation:

- USA

- India

- Israel

- United Kingdom

Number of Investments: 1699

Lead Investments: 473

Number of Exits: 300

Funds raised: $14.3B

Investment size:

Minimum cheque size: $2,000,000

Maximum Cheque Size: $8,000,000

Focus of Bessemer Venture Partners

Stage

- Early Stage Startup

- Late Stage Startup

Industries

- Consumer

- Enterprise

- Healthcare

- Cloud

Notable Investments

1. Shopify

URL: www.shopify.com

Funding Rounds: 4

Total Funding: $122.3M

2. Pinterest

URL: pinterest.com

Funding Rounds: 26

Total Funding: $1.5B

3. Twitch

URL: www.twitch.tv

Funding Rounds: 3

Total Funding: $35M

Contact

Website: https://www.bvp.com/

Email: businessplans@bvp.com

Phone: +1 415 800 8982

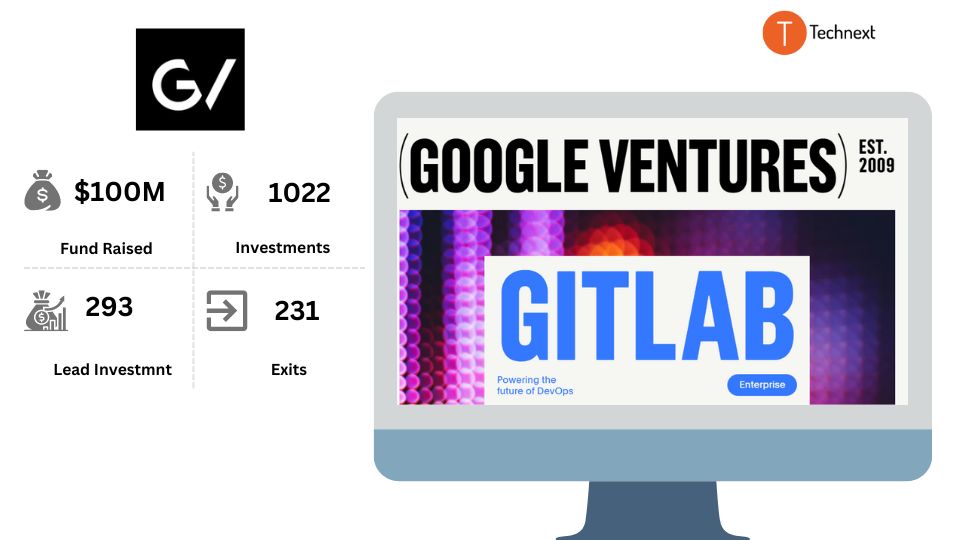

5. Google Ventures

General Catalyst is working to transform companies, industries, and the world around us. The important side of Google Ventures (GV) is a globally renowned venture capital firm. They back forward-thinking entrepreneurs who are changing the world. They not only provide funding to founders but also assist them in building the ideal team. Additionally, they help them to choose the ideal co-founders, create the best product, market the product, and grow. If you want to create a product that will bring equitable change, GV is the appropriate San Francisco venture capital choice for you.

Details of Google Venture:

Foundation Year: 2009

Countries of Operation:

- USA

- United Kingdom

Number of Investments: 1022

Lead Investments: 293

Number of Exits: 231

Funds raised: $100M

Minimum check size: $2,000,000.

Maximum check size: $30,000,000

Focus of Google Venture:

Stage

- Early Stage Startup

- Late Stage Startup

- Private Equity

- Seed

Industries

- Consumer

- Engineering

- Enterprise

- Design

- Life Sciences

- Marketplace

- Diversity & Inclusion

- Transportation

- Talent Productivity

Notable Investments

1. Uber

URL: www.uber.com

Funding Rounds: 32

Total Funding: $25.2B

2. Slack

URL: www.slack.com

Funding Rounds: 13

Total Funding: $1.4B

3. Nextdoor

URL: nextdoor.com

Funding Rounds: 13

Total Funding: $736.5M

Contact

Website: https://www.gv.com/

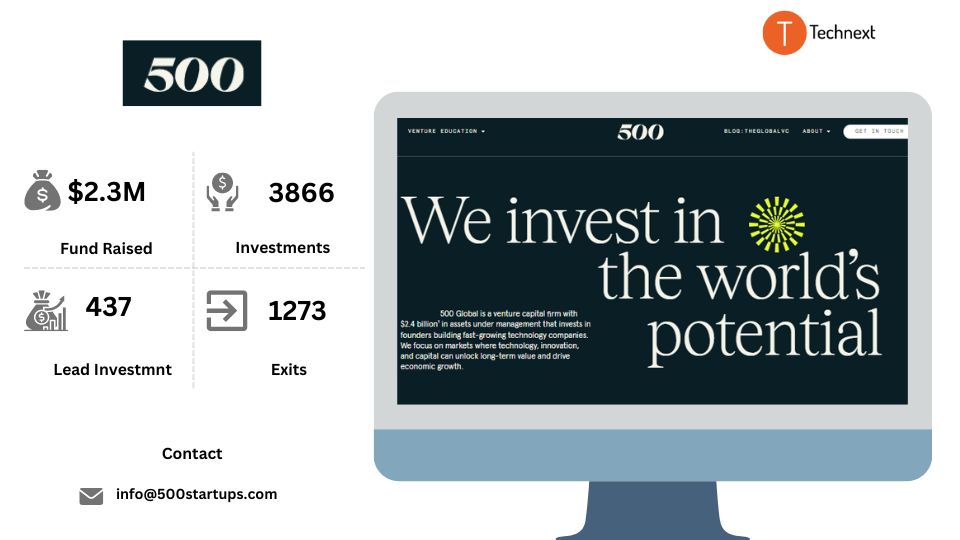

6. 500 Startups

500 Startups is one of the most active venture capital firms in San Francisco as well as the world. It’s on a quest to find the most brilliant entrepreneurs. If you are an aspiring founder, 500 Startups will help you build a successful firm. They also help develop innovation ecosystems by assisting companies and investors through educational programs, events, conferences, and partnerships

Details of 500 Startups

Foundation Year: 2010

Countries of Operation:

- USA

- India

- United Kingdom

- Hong Kong

- Singapore

- China

Number of Investments: 3866

Lead Investments: 437

Number of Exits: 1273

Funds raised: $2.3M

Minimum cheque size: $50,000

Maximum cheque size: $250,000

Focus of 500 Startups

Stage

- Early Stage Startup

- Seed

Industries

- SaaS

- Media

- E-Commerce

- Consumer

- Healthcare

- Fintech

- Crypto

- Blockchain

Notable Investments

1. Canva

URL: canva.com

Rounds: 17

Total Funding: $581M

2. Reddit

URL: reddit.com

Rounds: 7

Total Funding: $1.62B

3. GitLab

URL: gitlab.com

Rounds: 6

Total Funding: $413.5M

Contact:

Website: 500. co/

Email: info@500startups.com

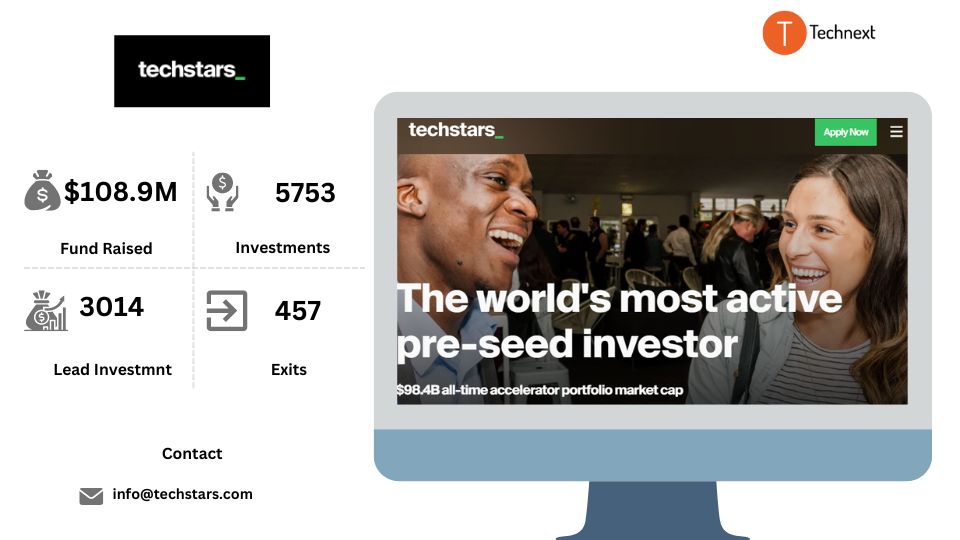

7. Techstars

Techstars is a global innovation and investment platform. They’re trying to create a worldwide network that helps entrepreneurs succeed. They also offer mentorship, talent, and infrastructure. Besides that, they can stimulate innovation and tackle the world’s biggest challenges by connecting entrepreneurs with organizations and corporations worldwide. Which makes them one of the best VC firms in San Francisco.

If you want to create a local startup community, connect with the world’s top startups, or invest in businesses that are making a difference in your sector. Then Techstars could be the ideal option for you. Because they provide a range of ways to interact with your startup ecosystem that are aligned with your business objectives.

.

Details of Techstars

Foundation Year: 2006

Countries of Operation:

- United States

- United Kingdom

- India

- China

- Africa

- Oceania

Number of Investments: 5753

Lead Investments: 3014

Number of Exits: 457

Funds raised: $108.9M

Minimum cheque size: $20,000

Maximum Cheque Size: $100,000

Focus of Techstars

Stage

- Debt

- Early Stage Startup

- Seed

Industries

- Advertising

- Aerospace & Space

- Agriculture

- AI & ML

- Biotech

- Crypto & Blockchain

- Climate & Sustainability

- Cloud

- Consumer

- Cybersecurity

- SaaS

- Big Data & Analytics

- Developer Tools

- E-Commerce

- Education

- Energy

- Enterprise

- Entertainment

- Fintech

- Sports

- Food & Beverage

- Future of Work

- Gaming

- Life Sciences

- Manufacturing

- Marketplace

- Media

- Mobility

Notable Investments

1. Leucine

URL: www.leucinetech.com

Funding Rounds: 4

Total Funding: $8.1M

2. Roadie

URL: dollarize.me

Funding Rounds: 3

Total Funding: $2.6M

3. Uber

URL: www.uber.com

Funding Rounds: 32

Total Funding: $25.2B

Contact

Website: https://www.techstars.com/

Email: info@techstars.com

Phone: +1 303-720-6559

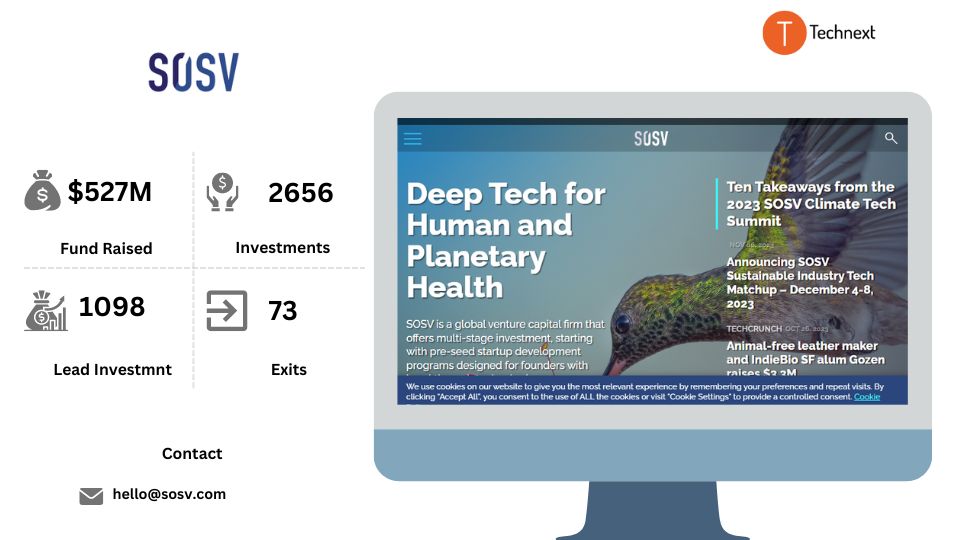

8. SOSV

SOSV is a global venture funding business with early-stage startup development programs. Their curricula are mostly focused on two large categories. The first is breakthrough deep technology that promises to improve people and the world. The second category is startups in emerging markets that are poised for rapid expansion.

They aim to invest in a small number of high-potential businesses and leverage their extensive resources to speed product development, client acquisition, and overall scalability. Furthermore, SOSV firms frequently raise investment rounds led by top-tier investors.

Details of SOSV

Foundation Year: 1994

Countries of Operation:

- USA

- China

- Taiwan

- Ireland

Number of Investments: 2656

Lead Investments: 1098

Number of Exits: 73

Funds raised: $527M

Minimum cheque size: $100,000

Maximum Cheque Size: $250,000

Focus of SOSV

Stage

- Early Stage Startup

- Seed

Industries

- Health & Wellness

- Deep Tech & Hard Science

- E-Commerce

- Consumer

- IoT

- SaaS

- Robotics

- AI & ML

- Fintech

- Healthcare

- Media

- Crypto & Blockchain

- Climate & Sustainability

- Advertising

Notable Investments:

1. Leap Motion

URL: www.leapmotion.com

Funding Rounds: 7

Total Funding: $94.1M

2. Roadie

URL: www.roadie.com

Funding Rounds: 4

Total Funding: $62M

3. Shaper

URL: shapertools.com

Funding Rounds: 3

Total Funding: $16.3M

Contact

Website: https://sosv.com/

Email: hello@sosv.com

9. New Enterprise Associates

New Enterprise Associates (NEA) is an internationally recognized venture capital firm. They invest capital into technology and healthcare. They are improving the world by assisting founders. They work with visionary creators to turn great ideas and huge dreams into services, products, and solutions that impact the future. They are investors, but they are also inventors, technologists, business owners, physicians, researchers, marketers, and, yes, entrepreneurs.

.

Details of New Enterprise Associates

Foundation Year: 1997

Countries of Operation:

- United States

- India

Number of Investments: 2616

Lead Investments: 752

Number of Exits: 585

Funds raised: $26.1B

Minimum cheque size: $1,000,000

Maximum Cheque Size: $10,000,000

Focus of New Enterprise Associates

Stage

- Early Stage Startup

- Late Stage Startup

Industries

- Enterprise

- Consumer

- Life Sciences

- AI & ML

- Education

- Fintech

Notable Investments

1. Duolingo

URL: www.duolingo.com

Funding Rounds: 8

Total Funding: $183.3M

2. Juniper Networks

URL: www.juniper.net

Funding Rounds: 5

Total Funding: $38.7M

3. Cloudflare

URL: www.cloudflare.com

Funding Rounds: 8

Total Funding: $332.2M

Contact

Website: https://www.nea.com/

Email: kbarrett@nea.com

Phone: 650-854-9499

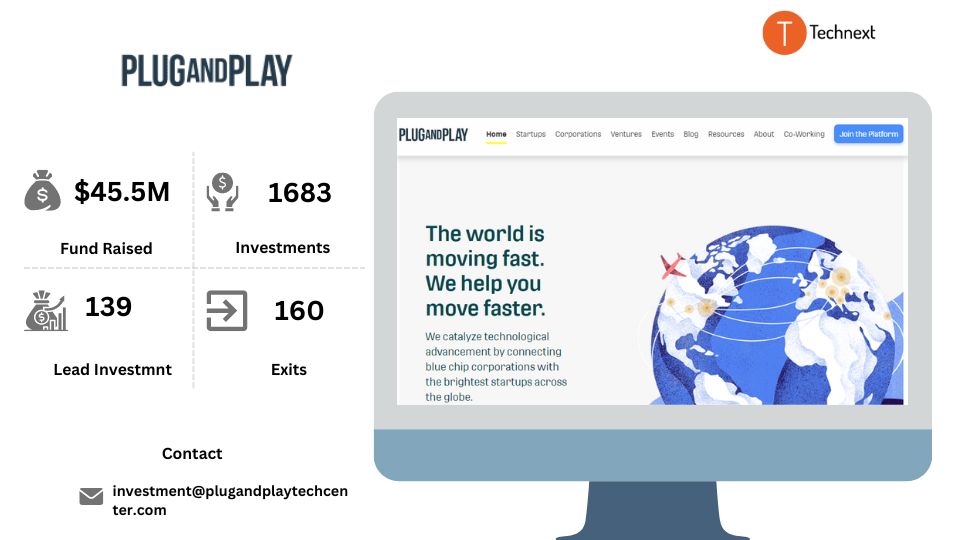

10. Plug and Play Tech Center

Plug and Play San Francisco venture capital firm is the ultimate innovation platform. Their goal is to create the world’s leading innovation platform and make it available for everyone. They accomplish this by bringing together entrepreneurs, corporations, and investors from all over the world. In addition, they are collaborating with partners to create a system that connects people, invests in companies, and brings key stakeholders together.

Details of Plug and Play Tech Center

Foundation Year: 2006

Countries of Operation:

- USA

- Canada

- Brazil

- United Arab Emirates

- Netherlands

- Belgium

- Spain

- Switzerland

- Morocco

- Germany

- Turkey

- South Africa

- Italy

- France

- China

- Japan

- South Korea

Number of Investments: 1683

Lead Investments: 139

Number of Exits: 160

Funds raised: $45.5M

Minimum cheque size: $50,000

Maximum Cheque Size: $250,000

Focus of Bessemer Venture Partners

Stage

- Early Stage Startup

- Late Stage Startup

Industries

- Consumer

- Enterprise

- Healthcare

- Cloud

Notable Investments

1. PayPal

URL: www.paypal.com

Funding Rounds: 6

Total Funding: $5.2B

2. Life360

URL: www.life360.com

Funding Rounds: 15

Total Funding: $140.2M

3. Shippo

URL: goshippo.com

Funding Rounds: 8

Total Funding: $153.3M

Contact

Website: https://www.plugandplaytechcenter.com/

Email: investment@plugandplaytechcenter.com

Phone: +1 408-524-1400

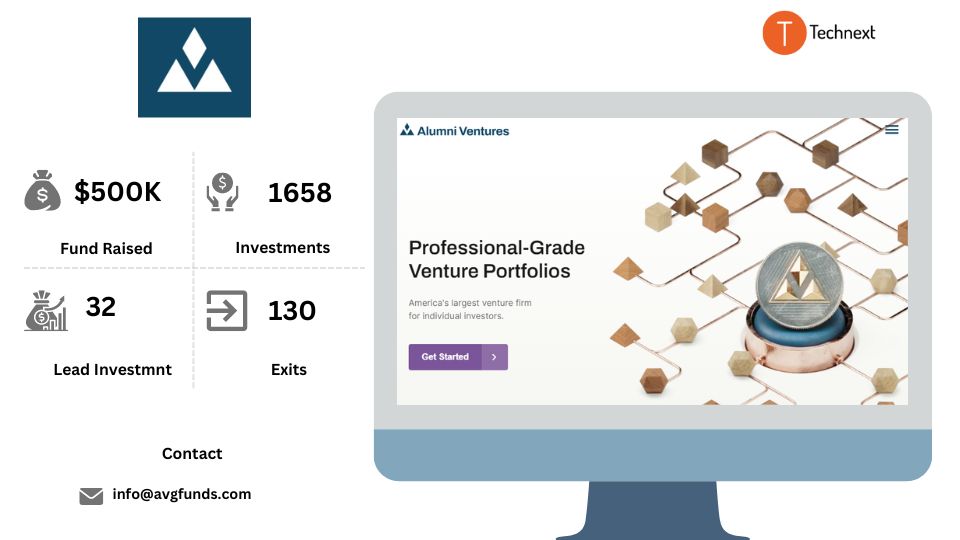

11. Alumni Ventures Group

Alumni Ventures is America’s Largest Individual Investor Venture Capital Firm. They have one of the world’s largest and fastest-growing venture portfolios. They also have a large group of venture investors from all over the world, representing all venture communities.

They believe in diversity. Which makes them one of the best of San Francisco venture capital. They enjoy investing in experienced lead investors and run a disciplined and rigorous process. If you link with Alumni Ventures, you will have access to new partners and customers through their network.

Details of Alumni Ventures Group

Foundation Year: 2014

Countries of Operation:

- United States

- United Kingdom

Number of Investments: 1658

Lead Investments: 32

Number of Exits: 130

Funds raised: $500K

Focus of Alumni Ventures Group

Stage

- Early Stage Startup

- Late Stage Startup

- Seed

Industries

- AI & ML

- AR & VR

- Consumer

- Cybersecurity

- Fintech

- Food & Beverage

- Healthcare

- Industrial

- IoT

- Life Sciences

- Proptech & Real Estate

- SaaS

- Climate & Sustainability

- Transportation

- Media

- Manufacturing

Notable Investments

1. GitHub

URL: github.com

Funding Rounds: 5

Total Funding: $350M

2. Shift

URL: shift.com

Funding Rounds: 11

Total Funding: $504M

3. Casper

URL: casper.com

Funding Rounds: 5

Total Funding: $339.7M

Contact

Website: https://www.av.vc/

Email: info@avgfunds.com

Phone: 603-518-8112

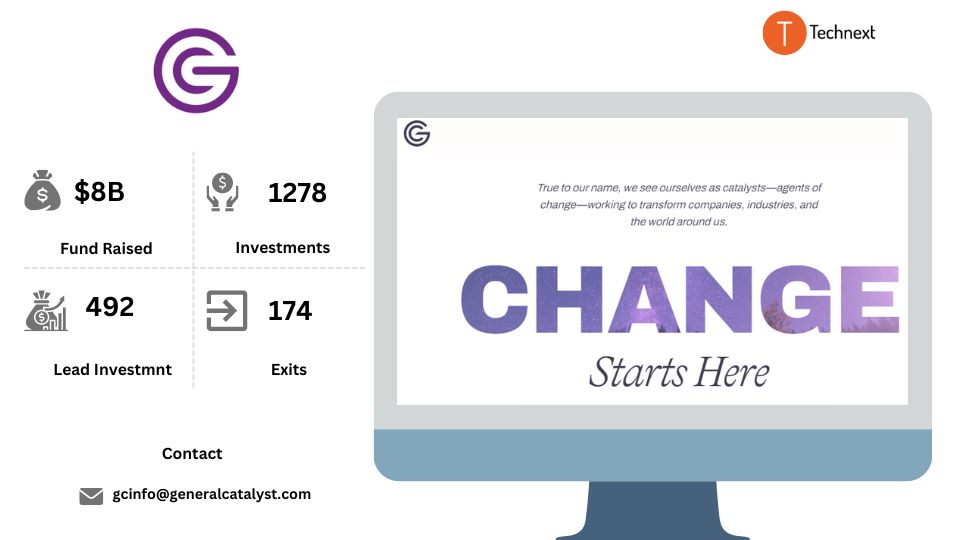

12. General Catalyst

General Catalyst is transforming businesses, industries, and the world around us as the best San Francisco venture capital firm. Their significant aspect is that they deal with businesses throughout their whole lifecycle—from the beginning stages to growth and beyond. They are remarkable entrepreneurs who are developing cutting-edge technology and market-leading firms. Their objective is to invest in long-lasting, constructive reforms. Furthermore, General Catalyst team members use their significant skills to guide founders in establishing excellent firms

.

Details of General Catalyst

Foundation Year: 2000

Countries of Operation:

- USA

- United Kingdom

Number of Investments: 1278

Lead Investments: 492

Number of Exits: 174

Funds raised: $8B

Minimum check size: $500,000

Maximum check size: $2,000,000

Focus of General Catalyst

Stage

- Early Stage Startup

- Late Stage Startup

- Seed

Industries

- Consumer

- Enterprise

- AI & ML

- Cloud

- Marketplace

- SaaS

- Developer Tools

Notable Investments

- HubSpot

URL: www.hubspot.com

Funding Rounds: 6

Total Funding: $100.5M

2. Airbnb

URL: www.airbnb.com

Funding Rounds: 30

Total Funding: $6.4B

3. Loom

URL: www.loom.com

Funding Rounds: 7

Total Funding: $203.6M

Contact

Website: https://www.generalcatalyst.com/

Email: gcinfo@generalcatalyst.com

Phone Number: 212-775-4000

13. Index Ventures

Index Ventures helps the most ambitious entrepreneurs who can turn bold ideas into global businesses. They are a multinational team with a global attitude. They are ready to assist founders from anywhere in the world. They form alliances with exceptional entrepreneurs with amazing ideas and a strong willingness to make those ideas a reality. They also create solid relationships with entrepreneurs and their teams throughout the scaling-up process. Other companies may invest in transactions, but Index Venture investing in people makes them one of the best venture capital firms San Francisco.

Details of Index Ventures

Foundation Year: 1996

Countries of Operation:

- USA

- United Kingdom

Number of Investments: 1232

Lead Investments: 433

Number of Exits: 242

Funds raised: $12.7B

Minimum cheque size: $1,000,000

Maximum Cheque Size: $1,000,000

Focus of Index Ventures

Stage

- Early Stage Startup

- Late Stage Startup

- Seed

Industries

- AI & ML

- Entertainment

- Fintech

- Healthcare

- Media

- SaaS

Notable Investments

1. Funding Circle

URL: www.fundingcircle.com

Funding Rounds: 10

Total Funding: $746.4M

2. Datadog

URL: www.datadoghq.com

Funding Rounds: 8

Total Funding: $147.9M

3. Dropbox

URL: www.dropbox.com

Funding Rounds: 11

Total Funding: $1.7B

Contact

Website: https://www.indexventures.com/

Email: press@indexventures.com

Phone: 415-471-1700

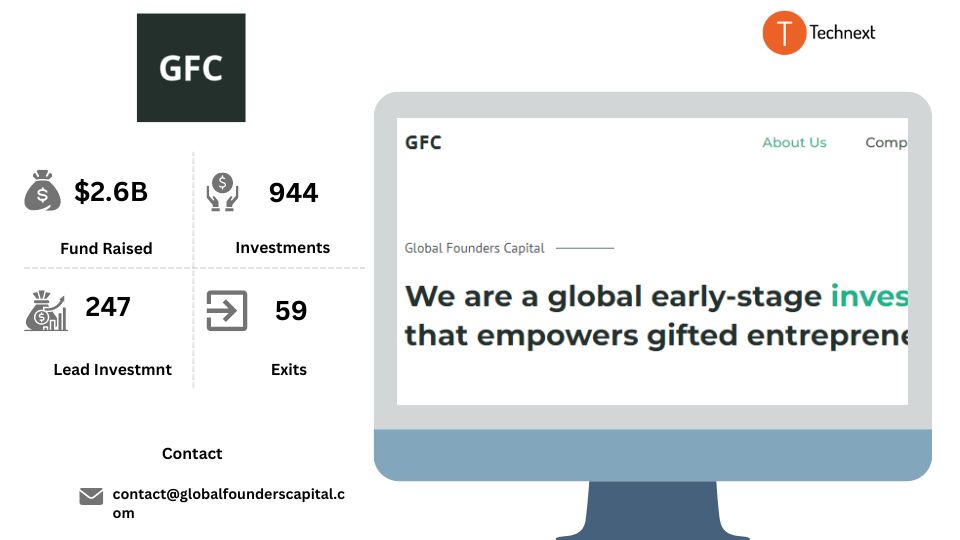

14. Global Founders Capital

Global Founders Capital is a renowned globally oriented venture capital firm headquartered in Berlin, Germany. Their San Francisco operation leads them to this list of VC firms in San Francisco. They assist founders from day one to the IPO. Aside from that, they also provide necessary support to founders for scaling up their journey.

Details of Global Founders Capital

Foundation Year: 2013

Countries of Operation:

- USA

- Canada

- United Kingdom

- Germany

- France

- Sweden

- Italy

- Turkey

- Singapore

- China

- Israel

- United Arab Emirates

- Indonesia

- Brazil

- Mexico

Number of Investments: 944

Lead Investments: 247

Number of Exits: 59

Funds raised: $2.6B

Focus of Global Founders Capital

Stage

- Early Stage Startup

- Late Stage Startup

- Seed

Industries

- Consumer

- SaaS

- Enterprise

- Internet & Mobile

- E-Commerce

- Productivity

- Supply Chain

- Logistics

- InsurTech

Notable Investments

1. Slack

URL: http://www.slack.com/

Funding Rounds: 11

Total Funding: $1.22B

2. Canva

URL: https://www.canva.com/

Funding Rounds: 17

Total Funding: $581M

3. Meta

URL: https://meta.com/

Funding Rounds: 15

Total Funding: $24.6B

Contact

Website: https://www.globalfounderscapital.com/

Email:contact@globalfounderscapital.com

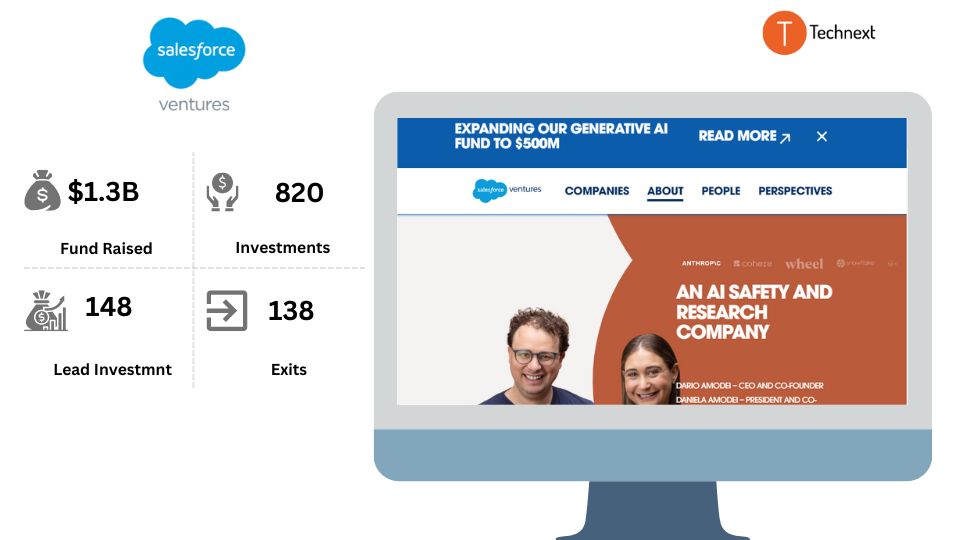

15. Salesforce Ventures

Battery Ventures is one of the global investment firms that focuses on technology. They are hard-working and foSalesforce Ventures is a corporate venture capital firm focusing exclusively on investing in enterprise software. Their mission is to help ambitious entrepreneurs build innovative companies that transform the way the world works. At Salesforce Ventures, there is great enthusiasm for the long-term positive effects of business technology..

Details of Salesforce Ventures

Foundation Year: 2009

Countries of Operation:

- USA

- United Kingdom

- Australia

- Japan

Number of Investments: 820

Lead Investments: 148

Number of Exits: 138

Funds raised: $1.3B

Minimum check size: $1,000,000

Maximum check size: $2,000,000

Focus of Salesforce Ventures

Stage

- Early Stage Startup

- Late Stage Venture

- Seed

Industries

- Cloud

- SaaS

- Enterprise

- Healthcare

- Productivity

- Fintech

- Cybersecurity

- Automation

Notable Investments

1. Zoom

URL: zoom.us

Funding Rounds: 9

Total Funding: $276M

2. Dropbox

URL: www.coinbase.com

Rounds: 19

Total Funding: $678.7M

3. Ironclad

URL: www.ironcladapp.com

Funding Rounds: 8

Total Funding: $334M

Contact

Website: https://salesforceventures.com/

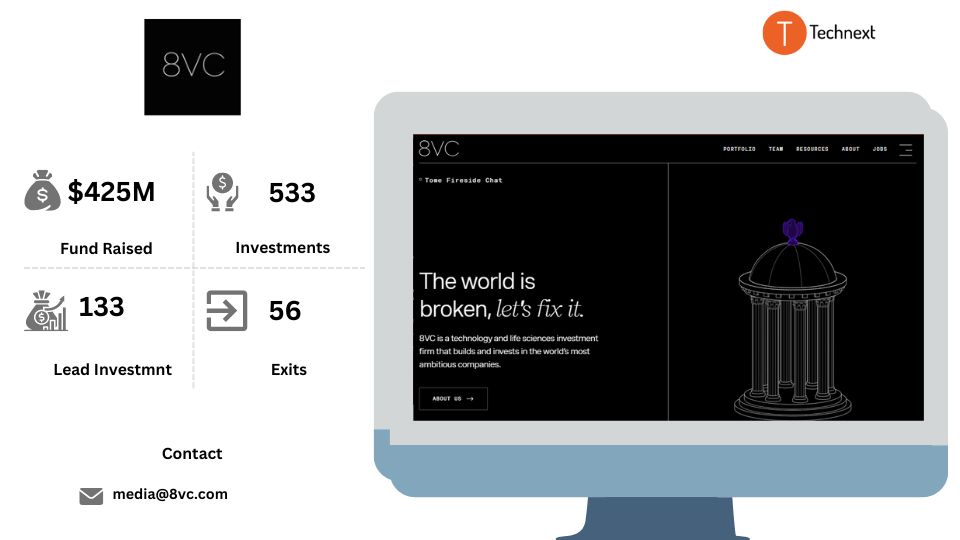

16. 8VC

8VC is a renowned San Francisco venture capital firm that invests and supports technology entrepreneurs in various industries. If you are one of those organizations that can generate long-term economic and societal benefits, there is a huge possibility that they will begin to align with you.

In addition, 8VC is known for investing in firms with the potential to have a substantial influence on their sectors. And they are the investors who have never stopped being engineers, operators, policymakers, philosophers, and business owners for your benefit

Details of 8VC

Foundation Year: 2012

Countries of Operation:

- USA

- Canada

- Colombia

Number of Investments: 533

Lead Investments: 133

Number of Exits: 56

Funds raised: $425M

Focus of 8VC

Stage

- Early Stage Startup

- Seed

- Late Stage Startup

Industries

- Healthcare

- Biotech

- Consumer

- Enterprise

- Supply Chain Logistics

- Government Technology

- Life Sciences

- Manufacturing

- Fintech

Notable Investments

1. Blend

URL: blend.com/

Rounds: 8

Total Funding: $685M

2. Sonoma Bio

URL: sonomabio.com

Rounds: 3

Total Funding: $335M

3. Oscar Health

URL: http://www.hioscar.com/

Rounds: 11

Total Funding: $1.6B

Contact

Website: 8vc.com/

Email:

Phone Number: (415) 366-8422

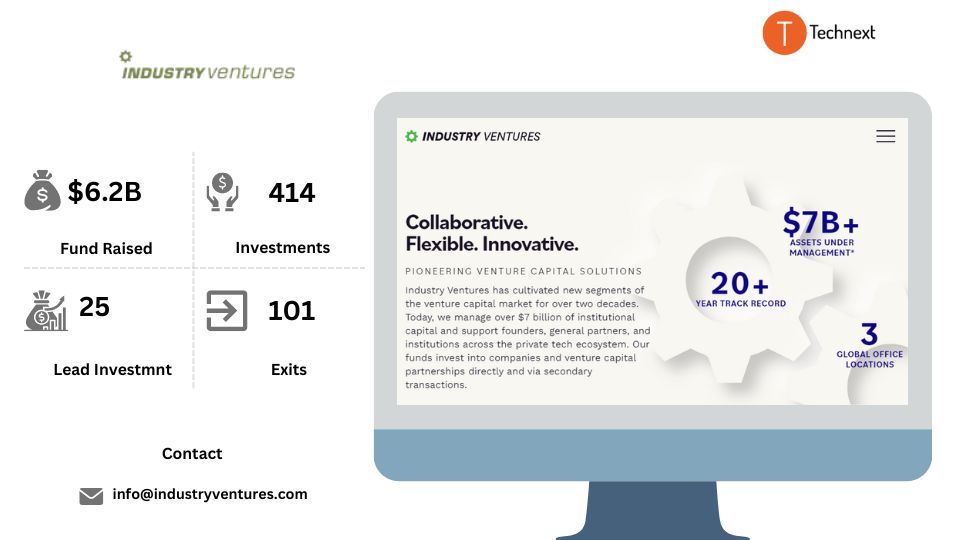

17. Industry Ventures

Industry Ventures is a renowned venture capital firm in San Francisco, California. They have cultivated new segments of the venture capital market for over two decades. As a primary and secondary investor with direct investment capabilities, they offer unique support to fund managers over the life cycle of a fund. They believe that unicorn shareholders deserve fast and easy access to liquidity. Besides that, they also have three investing strategies: secondary investments, primary fund of fund investments, and direct co-investments

Details of Industry Ventures

Foundation Year: 2000

Countries of Operation:

- USA

- United Kingdom

Number of Investments: 414

Lead investments: 25

Number of Exits: 101

Funds raised: $6.2B

Focus of Industry Ventures

Stage

- Early Stage Startup

- Late Stage Startup

- Private Equity

Industries

- SaaS

- Enterprise

- Big data.

Notable Investments

1. Planet

URL: www.planet.com

Funding Rounds: 10

Total Funding: $573.9M

2. Turvo

URL: www.turvo.com

Funding Rounds: 3

Total Funding: $91.6M

3. Airbnb

URL: www.airbnb.com

Funding Rounds: 30

Total Funding: $6.4B

Contact

Website: https://www.industryventures.com/

Email: info@industryventures.com

Phone: (415) 273 4201

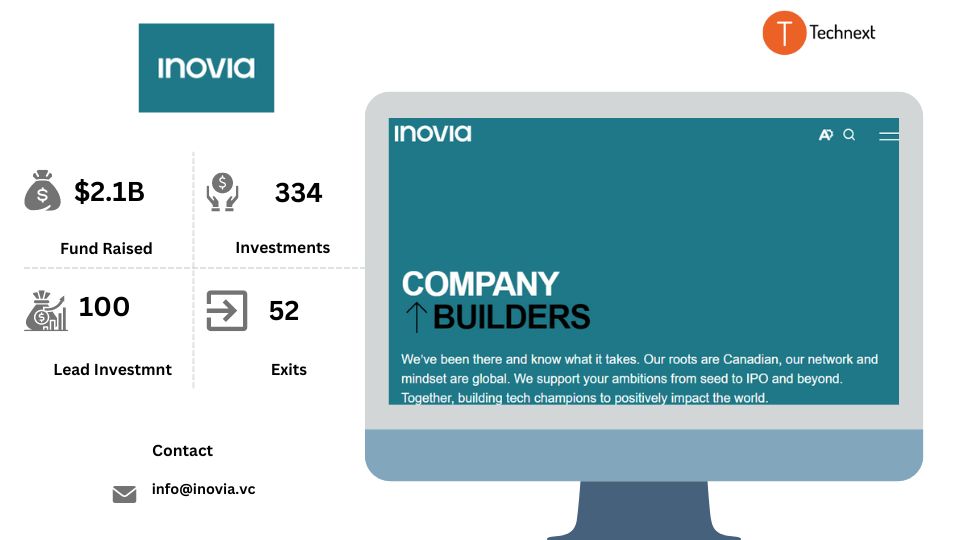

18. Inovia Capital

Inovia Capital is a well-known San Francisco venture capital firm that works with entrepreneurs to create long-lasting and meaningful businesses. They are always ready to provide founders with capital guidance and insights throughout the process. They also vigorously support their ecosystem and communities at every step. Most notably, they are not about providing capital to firms; instead, they are about creating economic, intellectual, and financial wealth.

Details of Inovia Capital

Foundation Year: 2007

Countries of Operation:

- Canada

- USA

- United Kingdom

Number of Investments: 334

Lead Investment: 100

Number of Exits: 52

Funds raised: $2.1B

Focus of Inovia Capital

Stage

- Early Stage Startup

- Late Stage Startup

Industries

- Internet & Mobile

- SaaS

- Robotics

- Crypto & Blockchain

- Cybersecurity

- Healthcare

Notable Investments

1. BenchSci

URL: www.benchsci.com

Funding Rounds: 10

Total Funding: $164.2M

2. Cohere

URL: cohere.com

Funding Rounds: 4

Total Funding: $434.9M

3. OTTO Motors

URL: ottomotors.com

Funding Rounds: 4

Total Funding: $70.1M

Contact

Website: https://www.inovia.vc/

Email: info@inovia.vc

Phone: +1 514-982-2251

This was our list of San Francisco venture capital firms. They stand as pillars of innovation, driving the city’s dynamic startup ecosystem forward.

This VCS supports countless startups from providing crucial funding to offering invaluable guidance and expertise. So make sure you are fully prepared. Consult an expert if necessary.

Keep in mind that, funding can be challenging to secure, but with thorough planning, you may convince others to support your goal.

Establish your startup’s team structure, calculate the equity, analyze the startup’s target market, and assess the company’s potential. These are the kinds of things that might attract your investors.

![13 Top Amsterdam Venture Capital Firms for Early-Stage Startups [2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/05/Amsterdam-venture-capital-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)

![15 United States Saas Venture Capital Firms for Startups[2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/04/Saas-Venture-Capital-Firms-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)

![15 Best Miami Venture Capital Firms for Early-Stage Startups [2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/03/Best-Venture-Capital-Firms-in-Miami-for-Early-Stage-Startups-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)

![17 New York Venture Capital Firms for Early-Stage Startups[2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/04/New-York-Venture-Capital-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)