15 Top Berlin Venture Capital Firms for Early-Stage Startups [2024]

If you’re looking for Berlin venture capital firms to help fund your early-stage startup, here are 15 options to explore.

Berlin has become one of three Europe’s startup hotspots in recent years. With a buzzing tech scene, a young and innovative workforce, and a government actively promoting entrepreneurship, Berlin offers fertile ground for ambitious founders to launch and scale their businesses.

Stats show that 20.8 percent of German startups were located in Berlin. The reason behind this is Berlin companies raised $4.8 billion in capital in 2022. And the venture capital is increasing day by day. If you are a startup founder in Berlin, here is our list of the top 15 Berlin venture capital firms.

15 Early-Stage Berlin Venture Capital Firms

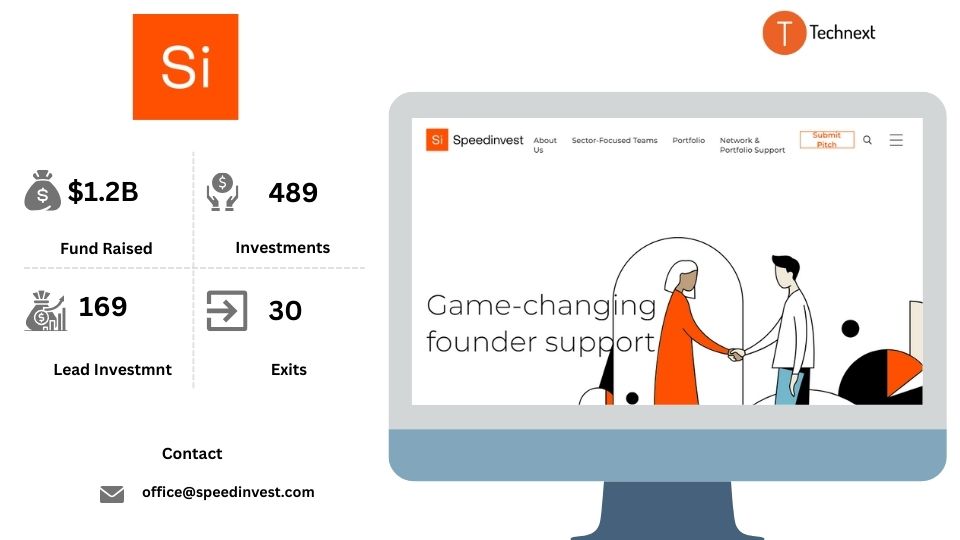

1. Speedinvest

Speedinvest is one of Europe’s most prominent early-stage investors. They prefer to partner with the most innovative tech startups. Their mission is to empower entrepreneurs with game-changing support through every stage of the journey. This is why they are one of the best Berlin venture capital.

Besides that, they provide access to an experienced team of investors and operational experts to their portfolio companies. Also, portfolio companies have access to a network of business partners who provide the startups with whatever they need to build successful businesses.

.

Details of Speedinvest

Foundation Year: 2011

Countries of Operation:

- Germany

- Austria

- France

- United Kingdom

Number of Investments: 489

Lead Investments: 169

Number of Exits: 30

Funds raised: $1.2B

Focus of Speedinvest

Stage

- Early Stage Startup

- Seed

- Pre-Seed

Industries

- Fintech

- Health & Wellness

- Deep Tech & Hard Science

- Industrial

- Marketplace

- Consumer

- SaaS

- Climate & Sustainability

- Crypto & Blockchain

- Infrastructure

Notable Investments

1. Planetly

URL: planetly.com

Funding Rounds: 2

Total Funding: €5.2M

2. FinCompare – Smarter Business Finance

URL: fincompare.de

Funding Rounds: 3

Total Funding: €24.5M

3. iyzico

URL: iyzico.com

Funding Rounds: 6

Total Funding: $27M

Contact

Website: https://www.speedinvest.com/

Email: office@speedinvest.com

Phone: +43 69911898616

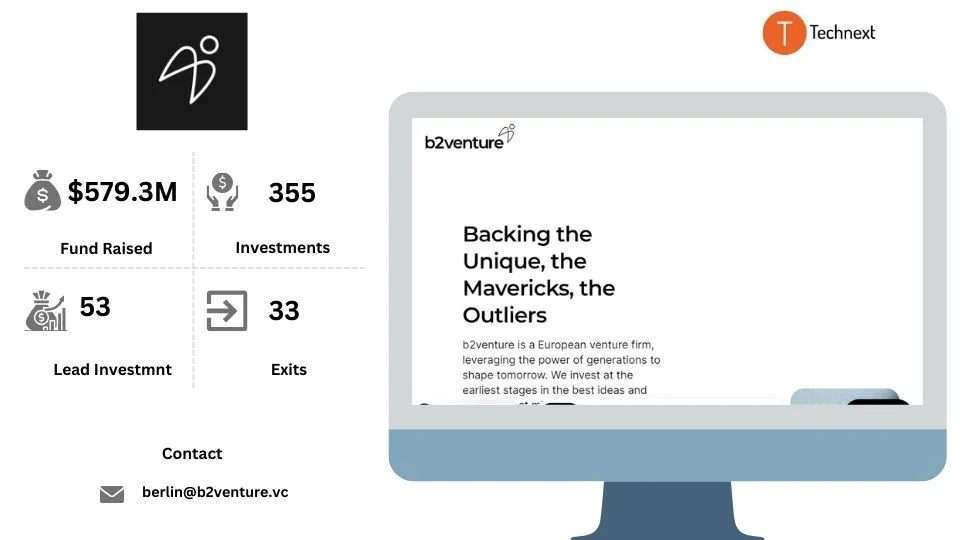

2. b2venture

b2venture (formerly btov Partners) is a European venture firm. They specialize in making early-stage investments in digital and industrial technology companies. They are leveraging the power of generations to shape tomorrow.

They also support the most ambitious business entrepreneurs and give them the wings to grow. They invest EUR 100m+ per year in high-growth companies with ticket sizes from EUR 0.25m to 3.5m. Besides that, they provide funding and support to startups at various stages of their growth, making them a valuable player in venture capital firms in Berlin.

Details of b2venture

Foundation Year: 2000

Countries of Operation:

- Germany

Number of Investments: 355

Lead Investments: 53

Number of Exits: 33

Funds raised: $579.3M

Minimum cheque size: €250,000

Maximum Cheque Size: €5,000,000

Focus of b2venture

Stage

- Early Stage Startup

- Seed

- Series A

Industries

- Consumer

- Enterprise

- SaaS

- AI & ML

- Marketplace

- Internet & Mobile

- Healthcare

- Industrial

- IoT

- Cybersecurity

Notable Investments

1. Predium

URL: predium.de

Funding Rounds: 2

Total Funding: €6.1M

2. Nelly

URL: getnelly.de

Funding Rounds: 4

Total Funding: €19M

3. Text Cortex AI

URL: textcortex.com

Funding Rounds: 2

Total Funding: $1.2M

Contact

Website: https://www.b2venture.vc/

Email: berlin@b2venture.vc

Phone: +49 30 346 55 84 00

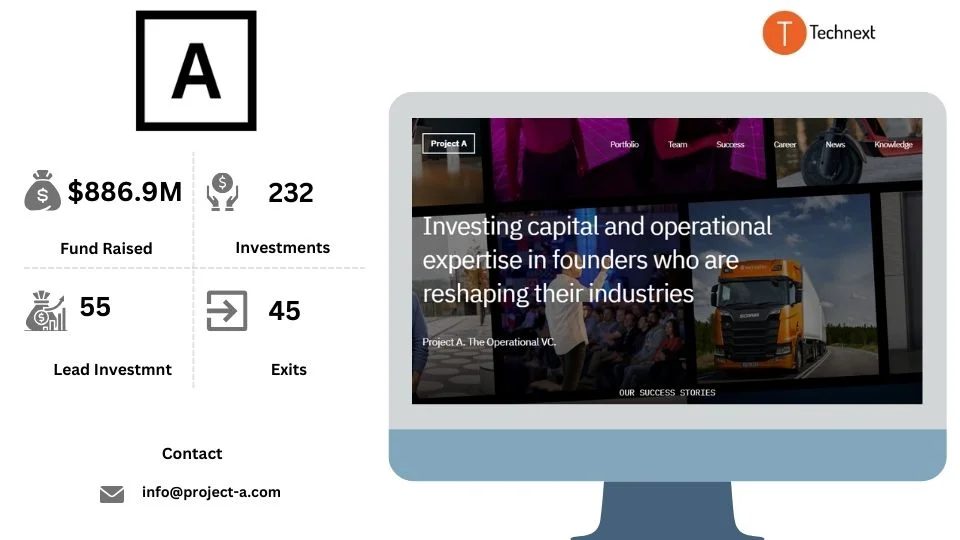

3. Project A

Project A is a renowned Berlin venture capital firm. They have been providing capital and operational support to startups since 2012. They always helped their portfolio companies to take the next step from startup to scale-up. So far, they have backed 100+ digital companies across 15 industries and 12 countries.

Also, they support their portfolio companies with a team of over 110 in-house professionals in areas such as software and product development, design, business intelligence, brand, marketing, CRM, sales, venture development, and recruiting. Besides that, if you face any problem scaling up your organization, you can consider Project A to have the right people to help you solve it.

Details of Project A

Foundation Year: 2012

Countries of Operation:

- Germany

- United Kingdom

Number of Investments: 232

Lead Investments: 55

Number of Exits: 45

Funds raised: $886.9M

Minimum cheque size: €1,000,000

Maximum Cheque Size: €10,000,000

Focus of Project A

Stage

- Early Stage Startup

- Seed

Industries

- E-Commerce

- Fintech

- Cybersecurity

- Supply Chain & Logistics

- Marketplace

- Proptech & Real Estate

- Internet & Mobile

- InsurTech

- SaaS

- Climate & Sustainability

- DTC

- Developer Tools

- Health & Wellness

- Education

- Food & Beverage

- Gaming, Media

- Transportation

- Travel & Hospitality

- Manufacturing

- Marketing

Notable Investments

1. Root Global

URL: rootglobal.io

Funding Rounds: 1

Total Funding: €2.5M

2. re:cap

URL: re-cap.com

Funding Rounds: 3

Total Funding: $128M

3. Knowunity

URL: knowunity.de

Funding Rounds: 3

Total Funding: €21M

Contact:

Website: http://www.project-a.com/

Email: info@project-a.com

Phone: +49 30 340606300

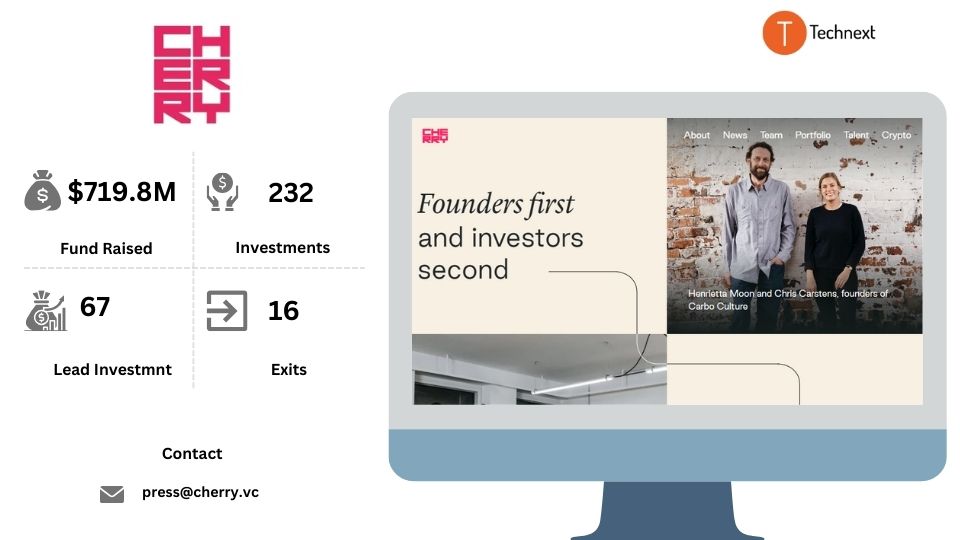

4. Cherry Ventures

Cherry Ventures is a renowned early-stage venture capital firm. It is led by a team of entrepreneurs with experience building fast-scaling companies such as Zalando and Spotify. They are sector agnostic. They prefer to back Europe’s boldest founders. They also look for passionate founders who are resourceful and strong.

Apart from initial financial investments, they focus on long-term working with their portfolio companies. In addition, they analyze the market to make sure there is potential for success. Also, they make sure to deliver on their promises throughout the investment phase.

Details of Cherry Ventures

Foundation Year: 2012

Countries of Operation:

- Germany

- United Kingdom

- Sweden

Number of Investments: 232

Lead Investments: 67

Number of Exits: 16

Funds raised: $719.8M

Minimum cheque size: €300,000

Maximum Cheque Size: €3,000,000

Focus of Cherry Ventures

Stage

- Early Stage Startup

- Seed

Industries

- Climate & Sustainability

- Consumer

- Fintech

- Healthcare

- Industrial

- Mobility

- SaaS

Notable Investments

1. AUTO1 Group

URL: auto1-group.com

Funding Rounds: 12

Total Funding: $1.4B

2. flaschenpost

URL: flaschenpost.de

Funding Rounds: 4

Total Funding: €70M

3. Drover

URL: joindrover.com

Funding Rounds: 5

Total Funding: £30.3M

Contact

Website: https://www.cherry.vc/

Email: press@cherry.vc

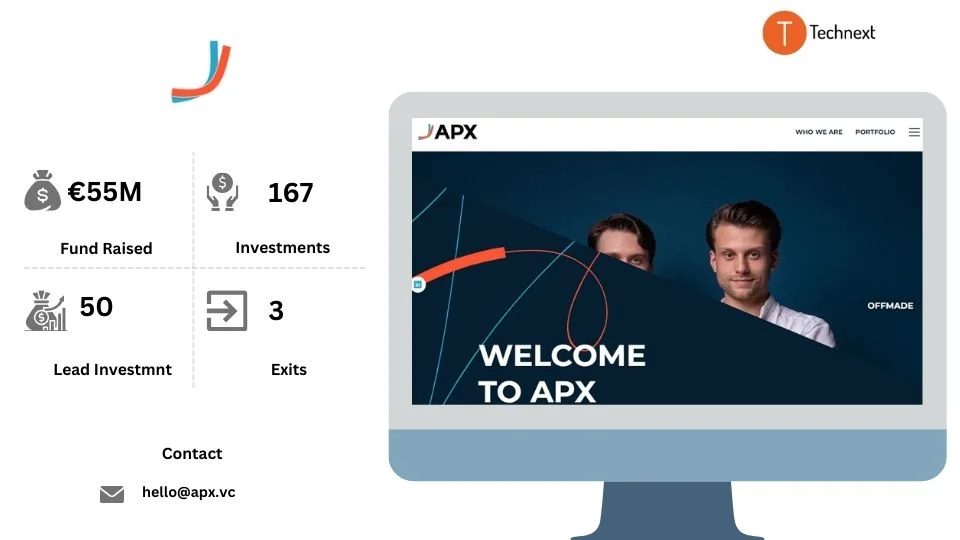

5. APX

APX IS one of the most active Berlin venture capital. They prefer investing in the earliest stages and target startups with digital business models. Also, they search for companies with high growth potential and valid hypothesis that can make a meaningful difference in people’s lives. They are sector-agnostic VC firms. They only invest in companies with more than one founder or single founders looking to bring co-founders on board.

Details of APX

Foundation Year: 2018

Countries of Operation:

- Germany

- United Kingdom

Number of Investments: 167

Lead Investments: 50

Number of Exits: 3

Funds raised: €55M

Minimum cheque size: €50,000

Maximum Cheque Size: €500,000

Focus of APX

Stage

- Early Stage Startup

- Seed

Industries

- AR & VR

- Fintech

- Education

- Consumer

- Big Data & Analytics

- Media

- Gaming

- Transportation

- Proptech & Real Estate

- Manufacturing

- Sports

- Marketing

- Human Resources

- SaaS

- Healthcare

Notable Investments

1. Dogo GmbH

URL: dogo.app

Funding Rounds: 7

Total Funding: $4.8M

2. Bluedot

URL: thebluedot.co

Funding Rounds: 6

Total Funding: $7M

3. askui

URL: askui.com

Funding Rounds: 3

Total Funding: €6.1M

Contact

Website: https://apx.vc/

Email: hello@apx.vc

Phone: + 49 30 2591 78001

6. Lunar Ventures

Lunar Ventures is a venture capital firm based in Berlin, Germany. They have a team of 3 deep-tech expert partners in Berlin. Their mission is to turn sci-fi ideas into working products. They prefer to partner with technical founders.

They mainly invest in promising European startups specializing in artificial intelligence, machine learning, and blockchain technologies. Also, they support outstanding DeepTech business teams, building global startups.

Besides that, they also bring a fresh perspective into tech investments, leveraging their backgrounds in software architecture, computer science, business strategy, and early-stage investments.

Details of Lunar Ventures

Foundation Year: 2017

Countries of Operation:

- United Kingdom

- United States

Number of Investments: 30

Lead Investments: 10

Number of Exits: 1

Funds raised: $40M

Minimum cheque size: €300,000

Maximum Cheque Size: €1,000,000

Focus of Lunar Ventures

Stage

- Early Stage Startup

- Seed

Industries

- AI & ML

- Cybersecurity

- Crypto & Blockchain

- Big Data & Analytics

- Health & Wellness

Notable Investments

1. Hathora

URL: hathora.dev

Funding Rounds: 1

Total Funding: $7.6M

2. Mutable

URL: mutable.io

Funding Rounds: 4

Total Funding: $1.7M

3. Kyso

URL: kyso.io

Funding Rounds: 4

Total Funding: $255K

Contact:

Website: http://lunarventures.eu/

Email: hello@lunarventures.eu

7. Fly Ventures

Fly Ventures is a Berlin venture capital for technical founders solving hard problems. Also, they support European technical founders from day zero to their seed stage. They firmly believe in transparency. Regarding investment criteria, they prefer to meet with founders before investing in their startup. Additionally, to have a better understanding of the portfolio company’s performance, the investment firm regularly conducts checks. Besides that, they follow the anti-thesis investment approach to help the startups.

Details of Fly Ventures

Foundation Year: 2017

Countries of Operation:

- Germany

- United Kingdom

Number of Investments: 76

Lead Investments: 34

Number of Exits: 5

Funds raised: €88M

Minimum cheque size: €1,000,000

Maximum Cheque Size: €5,000,000

Focus of Fly Ventures

Stage

- Seed

- Early Stage startup

- Pre-Seed

Industries

- Big Data & Analytics

- Cybersecurity

- Developer Tools

- Fintech

- InsurTech

- Supply Chain & Logistics

- Climate & Sustainability

- Healthcare

Notable Investments

1. Pyka

URL: flypyka.com

Funding Rounds: 3

Total Funding: $48.1M

2. Chatterbug

URL: chatterbug.com

Funding Rounds: 3

Total Funding: $9.8M

3. Mutable

URL: mutable.io

Funding Rounds: 4

Total Funding: $1.7M

Contact

Website: http://www.fly.vc/

Email: hello@fly.vc

Phone: (253) 720-8601

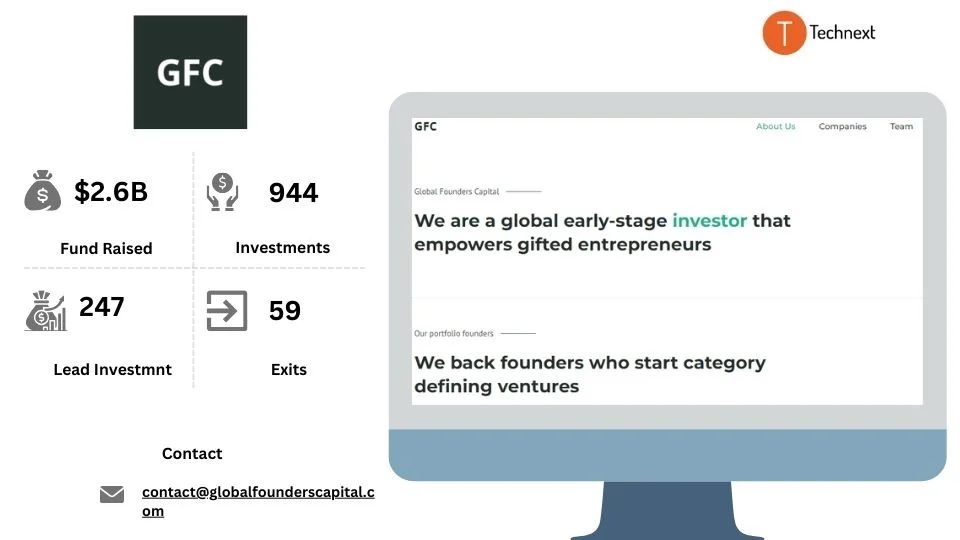

8. Global Founders Capital

Global Founders Capital is a global early-stage investor. They have backed entrepreneurs from series seed to IPO on all continents. They are stage agnostic and empower gifted entrepreneurs. They have deep operational experience in building technology companies.

They prefer to invest in companies that operate within the Internet, retail, financial software, media, communication, and information technology sectors. Also, they support founders from day zero through all the stages of growth.

Details of Global Founders Capital

Foundation Year: 2013

Countries of Operation:

- USA

- Canada

- United Kingdom

- Germany

- France

- Sweden

- Italy

- Turkey

- Singapore

- China

- Israel

- United Arab Emirates

- Indonesia

- Brazil

- Mexico

Number of Investments: 944

Lead Investments: 247

Number of Exits: 59

Funds raised: $2.6B

Focus of Global Founders Capital

Stage

- Early Stage Startup

- Late Stage Startup

- Seed

Industries

- Consumer

- SaaS

- Enterprise

- Internet & Mobile

- E-Commerce

- Productivity

- Supply Chain

- Logistics

- InsurTech

Notable Investments:

1. Rocket Internet

URL: rocket-internet.com

Funding Rounds: 7

Total Funding: $2.2B

2. LinkedIn

URL: linkedin.com

Funding Rounds: 7

Total Funding: $154.8M

3. Revolut

URL: revolut.com

Funding Rounds: 12

Total Funding: $2.14B

Contact

9. Antler

Antler is a renowned venter capital firm in Berlin. They prefer to invest in the world’s most driven founders, from day zero to greatness. They were founded on the belief that people with innovative ideas are the key to building a better future. They have offices in 27 cities across six continents, including Austin, New York, London, Berlin, Stockholm, Bangalore, Jakarta, Singapore, Seoul, Tokyo, and Sydney.

They have helped, created, and invested in more than 900+ startups across various industries and technologies. Also, they represent 145+ nationalities, and 32% of companies have at least one female founder.

Details of Antler

Foundation Year: 2017

Countries of Operation:

- Singapore

- Germany

- Netherlands

- Denmark

- Portugal

- United Kingdom

- Spain

- Norway

- France

- Sweden

- Australia

- India

- Vietnam

- Indonesia

- South Korea

- Japan

- USA

- Canada

- Kenya

Number of Investments: 1034

Lead investments: 604

Number of Exits: 6

Funds raised: $82.2M

Focus of Antler

Stage

- Early Stage Startup

- Seed

Industries

- AI & ML

- Consumer

- Crypto & Blockchain

- Cybersecurity

- E-Commerce

- Fintech

- SaaS

- Gaming

- Proptech

- Real Estate

- Internet & Mobile

- Food & Beverage

- Supply Chain & Logistics

- Healthcare

- Media

Notable Investments:

1. Genuine Taste

URL: genuinetaste.co

Funding Rounds: 3

Total Funding: $188.7K

2. ChatFood

URL: chatfood.io

Funding Rounds: 2

Total Funding: $8M

3. Airalo

URL: airalo.com

Funding Rounds: 4

Total Funding: $67.3M

Contact

Website: https://www.antler.co/

Email: hello@antler.co

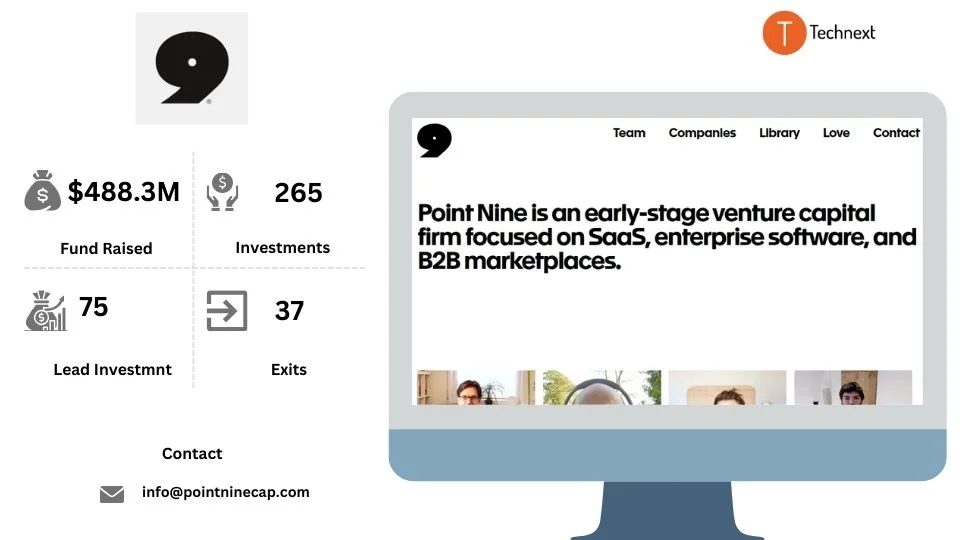

10. Point Nine Capital

Point Nine Capital is a popular Berlin-based venture capital firm. They specialize in early-stage investments in SaaS and digital marketplaces. They are geography agonistic. They provide funding and support to startups at various stages. Since 2008, they have been amongst the first investors in companies like Algolia, Contentful, Chainalysis, Delivery Hero, Docplanner, Loom, and Zendesk.

They are obsessed with helping their portfolio companies throughout their journey. More than 65% of the companies that they back at the seed stage raise a Series A, and more than ten are already at $100 million + annual revenue (and counting)

Details of Point Nine Capital

Foundation Year: 2008

Countries of OperationGermany:

- Germany

Number of Investments: 265

Lead Investments: 75

Number of Exits: 37

Funds raised: $488.3M

Minimum cheque size: €500,000

Maximum Cheque Size: €5,000,000

Focus of Point Nine Capital

Stage

- Early Stage Startup

- Seed

- Series A

Industries

- Marketplace

- SaaS

- Consumer

Notable Investments

1. Loom

URL: loom.com

Funding Rounds: 7

Total Funding: $203.6M

2. Typeform

URL: typeform.com

Funding Rounds: 5

Total Funding: $187.3M

3. Fyber – A Digital Turbine Company

URL: fyber.com

Funding Rounds: 7

Total Funding: $129.5M

Contact

Website: http://www.pointnine.com/

Email: info@pointninecap.com

Phone: +44 2079369198

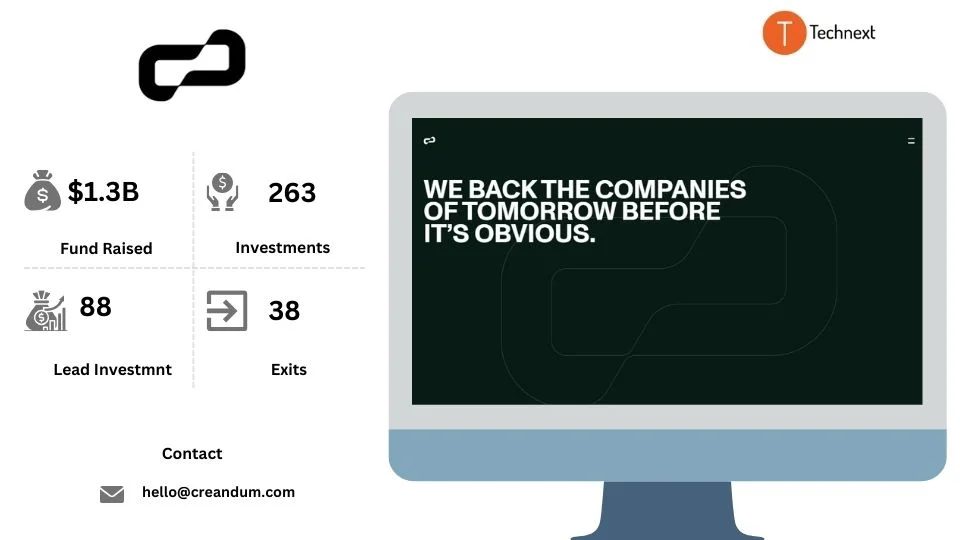

11. Creandum

Creandum is one of the leading Berlin venture capital firms. They have offices in Stockholm, Berlin, London, and San Fran. They support early-stage entrepreneurs in building global, category-defining companies across the most relevant industries. Also, they are backing some of Europe’s most successful tech companies, including iZettle, Spotify, Depop, Klarna, KRY, Epidemic Sound, and Small Giant Games.

Details of Creandum

Foundation Year: 2003

Countries of Operation:

- United Kingdom

- USA

- Germany

- Sweden

Number of Investments: 263

Lead Investments: 88

Number of Exits: 38

Funds raised: $1.3B

Focus of Creandum

Stage

- Early Stage Startup

- Late Stage Startup

- Seed

Industries

- Creator Economy

- Crypto & Blockchain

- Climate & Sustainability

Notable Investments

1. Distribusion Technologies

URL: distribusion.com

Funding Rounds: 3

Total Funding: €37.3M

2. Laka

URL: laka.co

Funding Rounds: 10

Total Funding: $31M

3.Shopify

URL: shopify.com

Funding Rounds: 4

Total Funding: $122.3M

Contact

Website: https://creandum.com/

Email: hello@creandum.com

Phone: +46 852463630

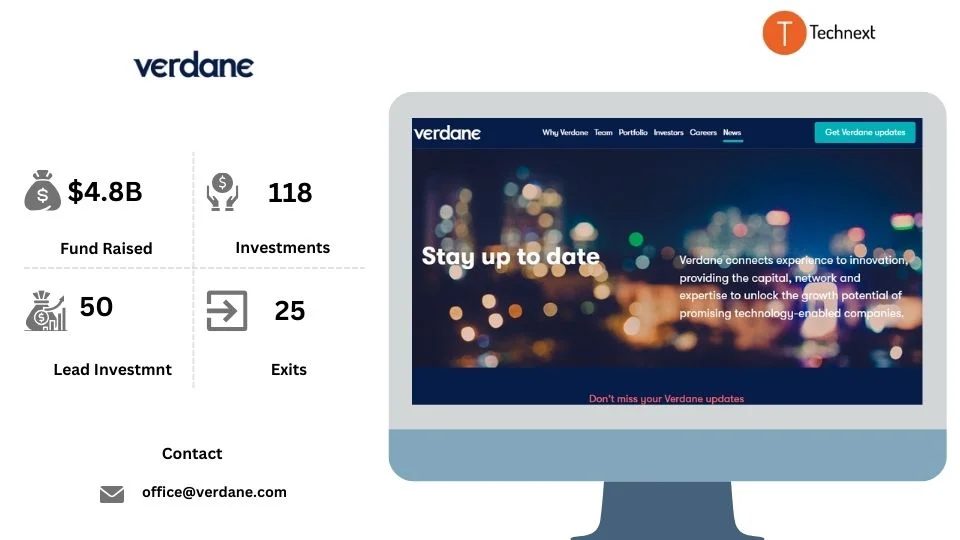

12. Verdane

Verdane is a famous specialist growth equity investment firm. They prefer to partner with sustainable, tech-enabled Northern European businesses to step up to the next level of international growth. They have a team of over 80 operational experts and investment professionals based in Berlin, Copenhagen, Helsinki, Oslo, London, and Stockholm.

Besides that, they also provide funding, expertise, and networks to help promising technology-enabled businesses reach their full potential. They can invest as a minority or majority investor, either in individual firms or in portfolios of companies.

Details of Verdane

Foundation Year: 2003

Countries of Operation:

- Germany

- Finland

- Norway

- United Kingdom

- Denmark

- Sweden

Number of Investments: 118

Lead Investments: 50

Number of Exits: 25

Funds raised: $4.8B

Minimum cheque size: €8,000,000

Maximum Cheque Size: €150,000,000

Focus of Verdane

Stage

- Late Stage Startup

Industries

- Consumer

- E-Commerce

- Marketplace

- Climate & Sustainability

- Enterprise

- SaaS

Notable Investments

1. Boozt

URL: boozt.com

Funding Rounds: 3

Total Funding: $56M

2. inRiver

URL: inriver.com

Funding Rounds: 4

Total Funding: $49.9M

3. Brightpearl

URL: brightpearl.com

Funding Rounds: 8

Total Funding: $88.3M

Contact

Website: https://verdane.com/updates/

Email: office@verdane.com

Phone: +46 8 407 4200

13. HV Capital

HV Capital is a venture capital firm based in Munich, Germany. They are one of Europe’s most successful and financially strongest early-stage and growth venture capitalists. They support exceptional founders in building market-leading digital companies. Also, they back them from the earliest days to all growth phases. Besides that, they are creating an ecosystem for companies to connect and thrive together across Europe and beyond.

Details of HV Capital

Foundation Year: 2000

Countries of Operation:

- Germany

Number of Investments: 451

Lead Investments: 120

Number of Exits: 87

Funds raised: €2.6B

Minimum cheque size: €500,000

Maximum Cheque Size: €5,000,000

Focus of HV Capital

Stage

- Early Stage Startup

- Late Stage Startup

- Private Equity

- Seed

Industries

- Consumer

- Enterprise

- Fintech

- Education

- Internet & Mobile

- Healthcare

- DTC

- Transportation

Notable Investments

1. Informed

URL: informed.so

Funding Rounds: 1

Total Funding: €5M

2. Hadrian

URL: hadrian.io

Funding Rounds: 3

Total Funding: €13M

3. Storyblok

URL: storyblok.com

Funding Rounds: 4

Total Funding: $58M

Contact

Website: https://www.hvcapital.com/

Email: info@hvcapital.com

Phone: +49 89 20 60 7-751

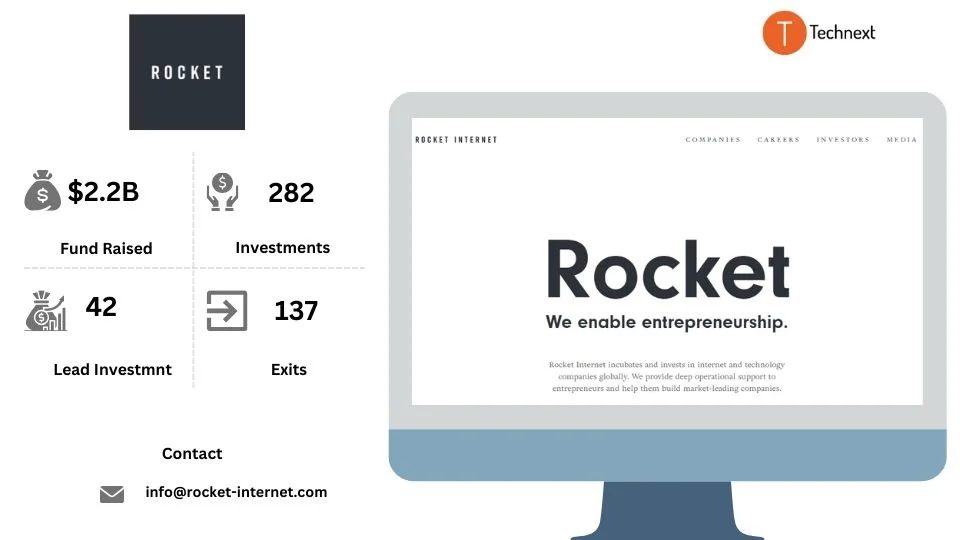

14. Rocket Internet SE

Rocket Internet is a venture builder based in Berlin, Germany. They are active in a large number of countries around the world. They focus on creating transparent, long-term, sustainable value for their investors. They incubate and invest in internet and technology companies globally.

Also, they provide deep operational support to entrepreneurs and help them build market-leading companies. Besides, they strategically invest in complementary internet and technology companies globally to build out their network.

Details of Rocket Internet SE

Foundation Year: 2007

Countries of Operation:

- Germany

Number of Investments: 282

Lead Investments: 42

Number of Exits: 137

Funds raised: $2.2B

Focus of Rocket Internet SE

Stage

- Early Stage Startup

Industries

- Internet & Mobile

- SaaS

Notable Investments

1. Expertlead

URL: expertlead.com

Funding Rounds: 3

Total Funding: €16.5M

2. Global Savings Group

URL: global-savings-group.com

Funding Rounds: 10

Total Funding: €74.5M

3. everstox

URL: everstox.com

Funding Rounds: 3

Contact

Website: https://www.rocket-internet.com/

Email: info@rocket-internet.com

Phone: +49 30 300131800

15. Heartcore Capital

Heartcore Capital is a venture capital firm based in Copenhagen, Denmark. They invest in companies that use technology to improve people’s lives. Since 2007, they have backed some of Europe’s biggest category-defining companies, such as Tink, Neo4j, Boozt, Peakon, Seriously and TravelPerk. They help their portfolio companies refine their purpose, build their vision, and achieve their mission.

Details of Heartcore Capital

Foundation Year: 2007

Countries of Operation:

- Denmark

- Germany

- France

- USA

- Austria

- Sweden

- Spain

- Hungary

- Poland

- United Arab Emirates

Number of Investments: 231

Lead Investments: 49

Number of Exits: 21

Funds raised: $681.4M

Minimum cheque size: €300,000

Maximum Cheque Size: €6,000,000

Focus of Heartcore Capital

Stage

- Early Stage Startup

- Seed

Industries

- Travel & Hospitality

- Education

- Entertainment

- Food & Beverage

- Health & Wellness

- Productivity

- Consumer

- Gaming

- InsurTech

- Energy

Notable Investments

1. Reddit

URL: redditinc.com

Funding Rounds: 10

Total Funding: $1.3B

2. Insight

URL: insightbrowser.com

Funding Rounds: 1

Total Funding: $1.5M

3. Werlabs

URL: werlabs.se

Funding Rounds: 3

Total Funding: SEK128.6M

Contact

Website: https://www.heartcore.com/

Email: contact@heartcore.com

This was our list of Berlin venture capital firms looking to invest in your early-stage startup. However, keep in mind that this procedure demands considerable thinking and strategic planning.

Researching the market is a good place to start, then establish your equity and team, If needed, seek the advice of an expert.

![13 Top Japan Venture Capital Firms for Early-Stage Startups [2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/05/Japan-Venture-Capital-Firms-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)

![13 Top Amsterdam Venture Capital Firms for Early-Stage Startups [2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/05/Amsterdam-venture-capital-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)

![15 Houston Venture Capital Firms for Early-Stage Startups[2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/03/Best-Venture-Capital-Firms-in-Miami-for-Early-Stage-Startups-1-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)

![13 Top Dubai Venture Capital Firms for Early-Stage Startups [2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/05/Dubai-Venture-Capital-Firms-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)