13 Top Dubai Venture Capital Firms for Early-Stage Startups [2024]

Find out which 15 Dubai venture capital firms are prepared to help your early-stage startup both financially and technically.

Dubai, the largest city in the UAE, has become a hotspot for innovation and entrepreneurship in resent years. It is a place for growth and investment due to its strategic location, forward-thinking government and world-class infrastructure.

By 2024, the United Arab Emirates’ total capital raised in the venture capital industry is expected to be US$1.1 billion. This growth is helped by the presence of a dynamic venture capital (VC) ecosystem. They helps startups to scale operations, disrupt sectors, and gain worldwide reputation.

In this article we have listed the top Dubai venture capital for your early stage startups.

15 Early-Stage Dubai Venture Capital Firms

1. Morningstar Ventures

Morningstar Ventures is an investment firm. This firm is led by Chief Investment Officer Danilo S. Carlucci, who brings a wealth of expertise. They are dedicated to supporting ambitious early-stage founders. Their primary focus is the MultiversX ecosystem. They are one of the best Dubai venture capital.

They actively engage in both equity investments and token investments, with a particular emphasis on the Elrond ecosystem. Aside from investments, they also launched products such as Bistox, a currency exchange platform and the first gaming guild dedicated to the Elrond ecosystem, and some more are in development.

Additionally, they operate MSV STUDIO, an in-house development, design, strategy, and marketing arm that plays a vital role in supporting their portfolio companies. Basically, their teams are always ready to provide comprehensive support to founders throughout their journey.

Details of Morningstar Ventures

Foundation Year: 2020

Countries of Operation:

- United Arab Emirates

Number of Investments: 74

Lead Investments: 6

Number of Exits: 6

Funds raised: $4.2M

Focus of Morningstar Ventures

Stage

- Early Stage Startup

Industries

- Crypto & Blockchain

- Gaming

- Fintech

Notable Investments

1. XLD Finance

URL: xld.finance

Total Funding: $13M

2. Biconomy

URL: biconomy.io

Funding Rounds: 3

Total Funding: $22M

3. Holoride

URL: holoride.com

Funding Rounds: 2

Total Funding: €10M

Contact

Website: https://morningstar.ventures/

Email: info@holoride.com

2. BECO Capital

BECO Capital is the largest non-government early-stage Dubai venture capital firm. It was founded by Dany Farha and Amir Farha, and it is headquartered in Dubai. They are investing in MENA (Middle East and North Africa) entrepreneurs. And their vision is to reinvent MENA through innovation and tech.

Also, they provide growth capital and hands-on operational support for early-stage technology companies. Overall, they support startups with strategy, fundraising, business development, mentorship and ongoing data analytics, and insights, which makes them one of the best venture capital firms in Dubai.

Details of BECO Capital

Foundation Year: 2012

Countries of Operation:

- United Arab Emirates

Number of Investments: 98

Lead Investments: 33

Number of Exits: 8

Funds raised: $150M

Minimum cheque size: $250,000

Maximum Cheque Size: $2,000,000

Focus of BECO Capital

Stage

- Early Stage Startup

- Seed

Industries

- Consumer

- Enterprise

- Fintech

- Healthcare

- Crypto & Blockchain

Notable Investments

1. Dukkantek

URL: dukkantek.com

Funding Rounds: 3

Total Funding: $15.2M

2. Hubpay

URL: wearehubpay.com

Funding Rounds: 5

Total Funding: $22M

3. Mango SciencesI

URL: mangosciences.com

Funding Rounds: 4

Total Funding: $3.5M

Contact

Website: https://becocapital.com/

Email: hello@becocapital.com

Phone: +971 4 368 7811

3. Global Ventures

Global Ventures is an international VC firm in Dubai. They focus on growth-stage tech companies in emerging markets. Their team has a mix of diverse, collaborative, talented professionals with loads of experience and expertise in building and scaling companies. They back global-minded founders who are running growth-stage businesses and using technology to change the world and emerging markets.

Besides that, their outstanding portfolio includes a few products such as Proximie, a cloud-based health software platform, Valeo Wellbeing, a personalized mobile health tracker; and TeamApt, digital financial services for underserved individuals and businesses in Africa.

Details of Global Ventures

Foundation Year: 2018

Countries of Operation:

- Egypt

- United Arab Emirates

Number of Investments: 81

Lead Investments: 44

Number of Exits: 2

Funds raised: $1.5M

Focus of Global Ventures

Stage

- Early Stage Startup

- Growth

Industries

- Fintech

- Healthcare

- Education

- InsurTech

- Cybersecurity

- Crypto & Blockchain

- Supply Chain & Logistics

- Future of Work

- E-Commerce

- Agriculture

Notable Investments

1. Remedial Health

URL: remedial.health

Funding Rounds: 5

Total Funding: $17.4M

2. Klasha

URL: www.klasha.com

Funding Rounds: 6

Total Funding: $4.8M

3. Mumzworld

URL: mumzworld.com

Funding Rounds: 4

Total Funding: $20M

Contact:

Website: https://www.global.vc/team

Email: info@global.vc

Phone: +971 4 580-7254

4. Arzan

Arzan Venture Capital is the corporate venture arm of Arzan Financial Group. They invest in a young, fast-growing, innovative tech startup. Their business lines lie in wealth management, credit and assets management, debt collections, and venture capital investments. And they are committed to building long-lasting relationships with the region’s most talented entrepreneurs at an early stage.

Additionally, they are a member of the International Financial Advisors Group (IFA), a leading consortium of 10 Kuwaiti companies listed on the stock market. The market value of the consortium is 3.1% of the total market capitalization of the Kuwait Stock Exchange. The main activities of the consortium cover real estate development, insurance, and financial services, which are all administered through Arzan Financial Group.

Details of Arzan

Foundation Year: 2013

Countries of Operation:

- Kuwait

- United Arab Emirates

Number of Investments: 69

Lead Investments: 9

Number of Exits: 8

Focus of Arzan

Stage

- Early Stage Startup

- Seed

- Pre-Seed

- Series A

Industries

- E-Commerce

- Internet & Mobile

- SaaS

Notable Investments

1. Careem

URL: careem.com

Funding Rounds: 7

Total Funding: $771.7M

2. Onfleet

URL: onfleet.com

Funding Rounds: 7

Total Funding: $41.9M

3. Fatura

URL: faturab2b.com

Funding Rounds: 2

Total Funding: $4M

Contact

Website: https://arzan.com.kw/

Email: info@arzan.com.kw

Phone: 965 22203000

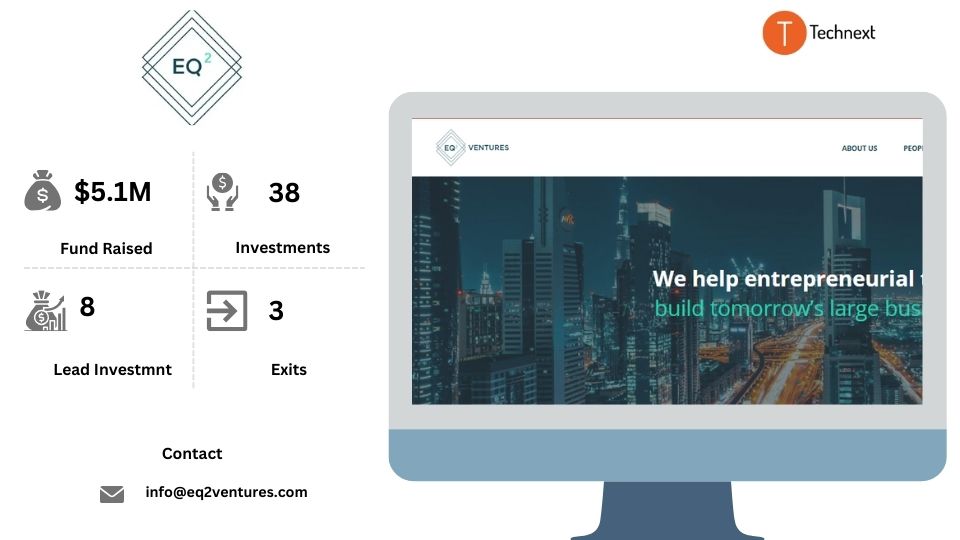

5. EQ2 Ventures

EQ2 Ventures is a Dubai-based evergreen investment company. They invest in Seed to Series B-stage startup companies. They have a focus on driving innovation and fostering growth in the market. Also, they help talented entrepreneurs solve significant business problems and consumer issues, build sustainable companies, and create long-term value. Besides that, they are the investment arm of Choueiri Group, a media representation group that manages advertising space across various channels.

Details of EQ2 Ventures

Foundation Year: 2015

Countries of Operation:

- United Arab Emirates

Number of Investments: 38

Lead Investments: 8

Number of Exits: 3

Funds raised: $5.1M

Focus of EQ2 Ventures

Stage

- Seed

- Series A

- Series B

Industries

- Advertising

- E-Commerce

- Fintech

- Healthcare

- Education

- Marketplace

Notable Investments

1. Abwaab

URL: abwaab.me

Funding Rounds: 4

Total Funding: $27.5M

2. invygo

URL: invygo.com

Funding Rounds: 5

Total Funding: $14.3M

3. Eyewa

URL: eyewa.com

Funding Rounds: 8

Total Funding: $29.8M

Contact

Website: https://www.eq2ventures.com/

Email: info@eq2ventures.com

Phone: +971 4 454 55 66

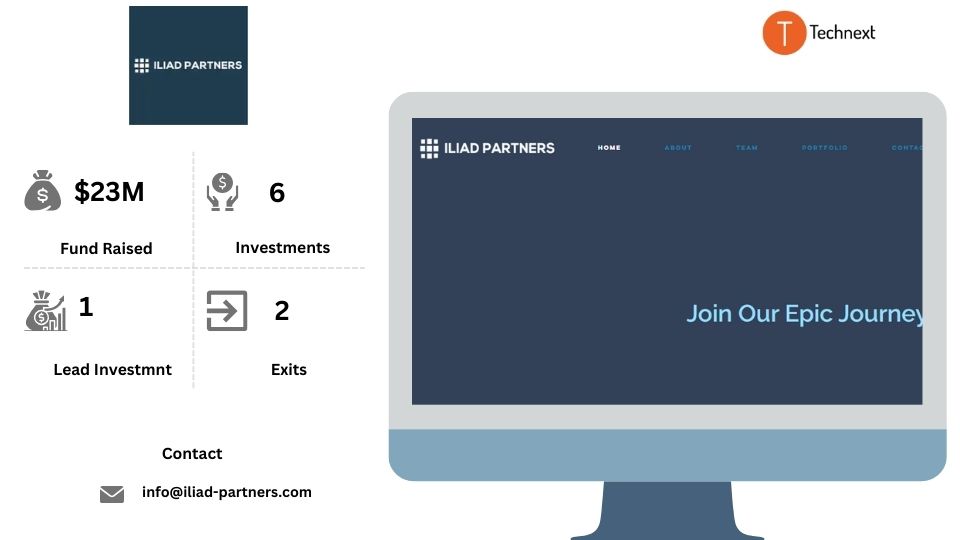

6. Iliad Partners

Iliad Partners is a top venture Capital firm based in Dubai. They invest in early-stage tech companies with a focus on the MENA region. They love to build partnerships with founders to help them develop their startups into high-growth ventures that will become the disruptive companies of tomorrow.

With operating experience and a regional network, they take a hands-on approach to supporting their startup business development. Besides that, they will actively help you throughout your journey by helping you grow your business in new areas, hire better employees, improve your finance function, and further fundraising.

Details of Iliad Partners

Foundation Year: 2016

Countries of Operation:

- United Arab Emirates

Number of Investments: 6

Lead Investments: 1

Number of Exits: 2

Funds raised: $23M

Minimum cheque size: $300,000

Maximum Cheque Size: $1,000,000

Focus of Iliad Partners

Stage

- Early Stage Startup

Industries

- Fintech

- Proptech & Real Estate

- Supply Chain & Logistics

- Mobility

- Education

- Enterprise

Notable Investments

1. Fetchr

URL: fetchr.us

Funding Rounds: 6

Total Funding: $77M

2. TruKKer

URL: trukker.com

Funding Rounds: 16

Total Funding: $320.4M

3. Qashio

URL: qashio.com

Funding Rounds: 2

Total Funding: $12.5M

Contact:

Website: https://www.iliad-partners.com/

Email: info@iliad-partners.com

Phone: +971 508459487

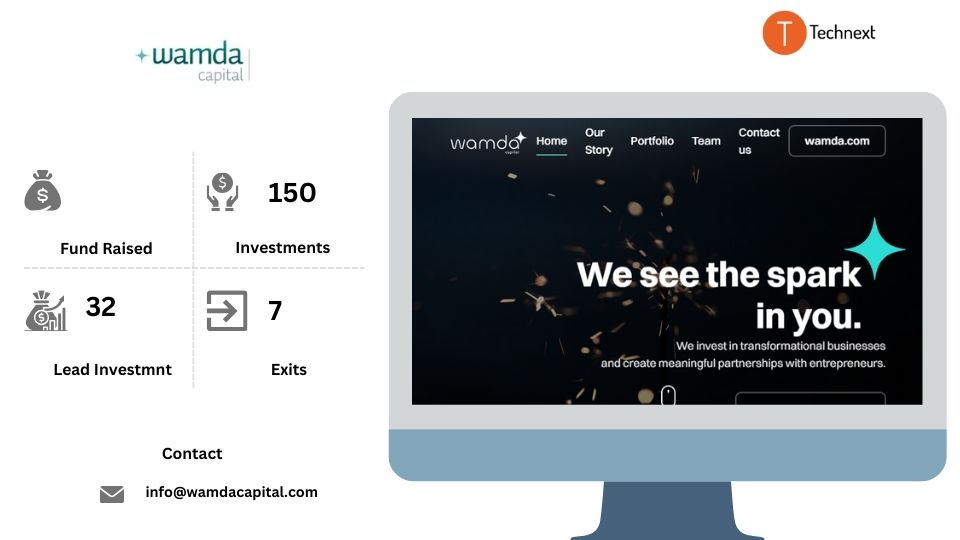

7. Wamda

Wamda Capital is recognized as one of the most prominent venture capital firms in the MENA region. They invest in exceptional entrepreneurs. Also, they are known for their commitment to supporting exceptional entrepreneurs in this dynamic market.

Besides that, they are not just a financial resource provider but also a strategic partner for high-potential startups. They have successfully backed several companies that have gone on to achieve significant success. They continue to pave the way for technology and innovation in the MENA region by supporting visionary entrepreneurs and fostering the growth of transformative businesses.

Details of Wamda

Foundation Year: 2014

Countries of Operation:

- United Arab Emirates

- United State

Number of Investments: 150

Lead Investments: 32

Number of Exits: 7

Focus of Wamda

Stage

- Early Stage Startup

- Seed

Industries

- Banking

- Financial Services

- Mobile

- Cryptocurrency

Notable Investments

1. Insider

URL: useinsider.com

Funding Rounds: 8

Total Funding: $272.1M

2. Tabby

URL: tabby.ai

Funding Rounds: 11

Total Funding: $944M

3. Believe

URL: believe.sg

Funding Rounds: 1

Total Funding: $55M

Contact

Website: https://wamdacapital.com/

Email: info@wamdacapital.com

Phone: 971 43388823

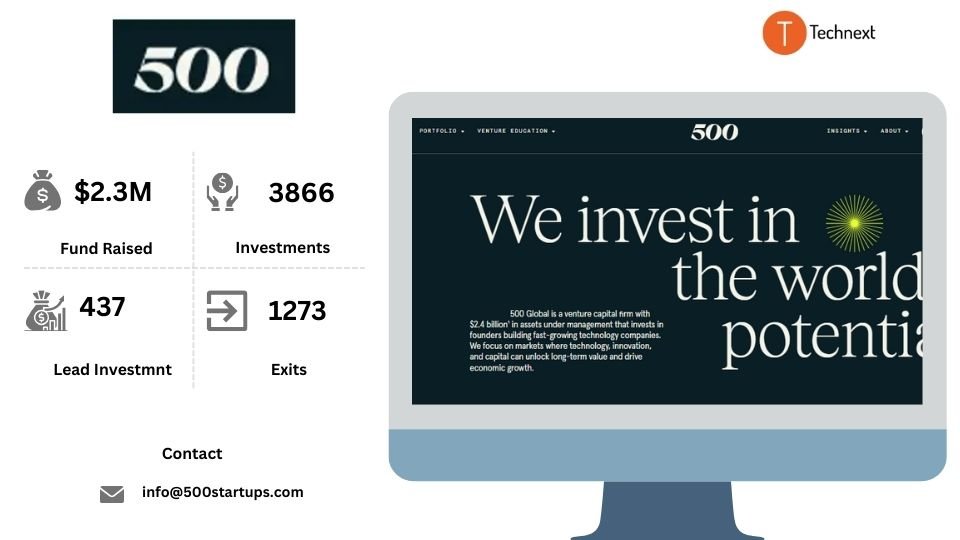

8. 500 Startups

500 Startup is a globally renowned venture capital firm investing in early-stage tech companies. They always try to uplift people and the economy worldwide through their outstanding entrepreneurship. They focus on markets where technology, innovation, and capital can create long-term value and promote economic growth.

Besides that, they have invested in over 2,300 companies through their 5 global funds and 15 thematic funds. Also, their 100+ team members are located in 20 countries worldwide to support the 500 Startups global portfolio of investments spanning more than 75 countries.

Details of 500 Startups

Foundation Year: 2010

Countries of Operation:

- USA

- India

- United Kingdom

- Brazil

- France

- Hong Kong

- Singapore

- United Arab Emirates

- Azerbaijan

- Egypt

- Bahrain

- Saudi Arabia

- Thailand

- China

- Malaysia

- Cambodia

- South Korea

- Taiwan

Number of Investments: 3866

Lead Investments: 437

Number of Exits: 1273

Funds raised: $2.3M

Minimum cheque size: $50,000

Maximum cheque size: $250,000

Focus on 500 Startups

Stage

- Early Stage Startup

- Seed

Industries

- SaaS

- Media

- E-Commerce

- Consumer

- Healthcare

- Fintech

- Crypto

- Blockchain

Notable Investments:

1. Canva

URL: canva.com

Rounds: 17

Total Funding: $581M

2. Reddit

URL: reddit.com

Rounds: 7

Total Funding: $1.62B

3. Twilio

URL: twilio.com

Rounds: 12

Total Funding: $614.4M

Contact

Website: https://500.co/

Email: info@500startups.com

9. Performous

Performous is an Intercontinental VC Firm with over 25 years of experience. They are all about helping early-stage digital entrepreneurs. But they are not a typical investment company. Their purpose is to work with founders to help them get their ideas off the ground, build products, grow and inspire teams, and access further funding. They love to support potential successful entrepreneurs and small companies with interests in marketing, technology, and e-commerce.

Besides that, they have more than 20 years of hands-on experience developing and growing successful digital businesses across a wide range of B2B and B2C sectors. Also, they have driven numerous beginner commerce and SAAS brands to what they are nowadays

Details of Performous

Foundation Year: 2014

Number of Investments: 3

Investment size: $500K-$3M

Focus of Performous

Stage

- Seed

Industries

- E-Commerce

- SaaS

- Marketing

- Technology

Notable Investments:

1. iBooking.com

URL: ibooking.com

2. Cyclists.com

URL: cyclists.com

3. YALLA PROTEIN

URL: yallaprotein.com

Contact

Website: https://www.performous.com/

Email: m@rcus.co.uk

10. Jabbar Internet Group

Jabbar Internet Group is one of the market-leading investors in the MENA region. They love to embrace any entrepreneur who is ready to try new things and take risks to create something great. Their main mission is to increase the internet quality of the region. Also, their goal is to become the largest Arabic Internet company.

Besides that, they have lots of success stories. The exit of their portfolio company, Souq to Amazon in 2017, was one of the largest transactions in the region. Another success story is Instashop, acquired by Delivery Hero in 2020, which also became one of the biggest tech deals in the region.

Details of Jabbar Internet Group

Foundation Year: 2009

Number of Investments: 57

Number of Exits: 2

Investment size: $2M-$5M

Focus of Jabbar Internet Group

Stage

- Early Stage Startup

Industries

- E-Commerce

- FinTech

- Internet Development

- Software

Notable Investments

1. Yahoo

URL: yahoo.com

Funding Rounds: 2

Total Funding: $6.8M

2. Delivery Hero

URL: deliveryhero.com

Funding Rounds: 21

Total Funding: $9.9B

3. Ziina

URL: ziina.com

Funding Rounds: 5

Total Funding: $8.5M

Contact

Website: https://jabbar.com/

Email: info@jabbar.com

Phone: +971 44462767

11. Dtec Ventures

Dtec Venture is one of the Middle East’s largest tech startup coworking campuses. They prefer to invest in early-stage technology businesses in the MENA region. They are dedicated to supporting and creating partnerships with grown ventures and early-stage. Also, they provide access to startup funding for talented and promising technology founders and companies. Which makes them one of the best venture capital firms in Dubai.

Besides that, they offer a community featuring 1000+ startup founders, a range of tailored events, training, mentorship, networking opportunities, and an in-house venture capital division and incubation programs.

.

Details of Dtec Ventures

Foundation Year: 2012

Countries of Operation:

- United Arab Emirates

- United States

Number of Investments: 26

Lead Investments: 1

Number of Exits: 3

Investment size: $100K-$500K

Focus of Creandum

Stage

- Early Stage Startup

- Seed

Industries

- Software

- Internet

- EdTech

- E-Commerce

Notable Investments

1. ShortPoint

URL: shortpoint.com

Funding Rounds: 4

Total Funding: $2M

2. souKare

URL: soukare.com

Funding Rounds: 3

Total Funding: $2.8M

3. Geeks

URL: geeks.ae

Funding Rounds: 3

Total Funding: $3M

Contact

Website: https://dtec.ae/

Email: ventures@dtec.ae

Phone: 600 595 5557

12. GrowValley

GrowValley is a hybrid Venture Studio. They build startups at scale with a team led by experienced entrepreneurs and industry experts. Also, they are dedicated to supporting startups in diverse technology areas.

Besides that, they offer unique partnerships and exclusive ideas to grow the companies they invest in. Also, make significant decisions to take those entrepreneurs to the next level by providing plenty of opportunities.

Details of GrowValley

Foundation Year: 2018

Countries of Operation:

- United Arab Emirates

- United Kingdom

Funds raised: $1.7M

Investment size $500K-$2M

Focus of GrowValley

Stage

- Early Stage Startup

- Seed

Industries

- Internet

- Technology

- Investigation

- Financial Services

Contact

Website: https://www.growvalley.co/

Email: mail@growvalley.co

Phone: +971 45187217

13. Food Fund

Food Fund is a family-owned business. They have several restaurants across the globe. They aim to reduce the total cost of food throughout the value chain. They actively support the industry and food brands to increase their reach, market value, and popularity. They also support Agriculture and some Tech industries. Besides that, they have a group of talented team members who always bring their unique and valuable skills and experience to the table.

Details of Food Fund

Foundation Year: 2000

Countries of Operation:

- UAE

Focus of Food Fund

Stage

- Series B

Industries

- Agriculture

- BioTech

- Food and Beverage

Contact

Website: https://www.foodfundint.com/

This was our list for Dubai venture capitals who provides startups with a supportive environment to flourish. From giving necessary funding to supplying priceless advice and knowledge, this VCS helps a great many entrepreneurs

So make sure you arew well prepeared. If needed, seek the advice of an expert.

![15 United States Saas Venture Capital Firms for Startups[2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/04/Saas-Venture-Capital-Firms-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)

![18 San Francisco Venture Capital Firms for Early-Stage Startups[2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/04/Best-San-Francisco-Venture-Capital-Firms-1-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)

![13 Top Amsterdam Venture Capital Firms for Early-Stage Startups [2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/05/Amsterdam-venture-capital-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)

![15 Best Miami Venture Capital Firms for Early-Stage Startups [2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/03/Best-Venture-Capital-Firms-in-Miami-for-Early-Stage-Startups-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)