15 Best Miami Venture Capital Firms for Early-Stage Startups [2024]

Explore 15 Miami Venture Capitals (VCs) Ready to Invest in Your Early-Stage Startup, Offering a Range of Funding Opportunities.

Miami has become a hub for new ideas and investment opportunities in many fields nowadays. According to recent statistics, Miami ranked among the top 30 cities for startup activity in the United States, with $5.8 billion in venture capital investment in 2022.

With its strategic location as a gateway to Latin America and the Caribbean, Miami has become a magnet for entrepreneurs, investors, and innovators.

Whether you’re an aspiring business owner looking for funding to start or level up your early-stage startup, Miami can be your place.

We are here to help you find the right investment partner. This article lists 15 Miami Venture Capital that can invest in your early-stage startup.

15 Early-Stage Miami Venture Capital Firms

1. Ocean Azul Partners

Ocean Azul Partners is one of the famous venture capital firms in Miami. They invest in early-stage companies that have the ability to become a leader in their respective industry.

Also, all their team members have a wide network that will help you in becoming successful. Basically, they are the ones who will be with you even in your toughest journey. However, they love maintaining a long-term partnership with every company they invest in.

.

Details of Ocean Azul Partners

Foundation Year: 2017

Countries of Operation:

- United States

- Australia

- Israel

Number of Investments: 51

Lead Investments: 13

Number of Exits: 3

Funds raised: $54M

Focus of Ocean Azul Partners

Stage

- Early-Stage Venture

- Seed

- Convertible Note

Industries

- FinTech

- Life Sciences

- Healthcare

- Real Estate and Construction Tech

- Business Services

- Environment Tech

- Travel and Hospitality Tech

- Enterprise Infrastructure

- Media & Entertainment

- Blockchain Technology

- Food and Agriculture Tech

Notable Investments

- BabySparks

URL: babysparks.com

Funding Rounds: 3

Total Funding: $3.8M

2. Taxfyle

URL: www.taxfyle.com

Funding Rounds: 7

Total Funding: $27.3M

3. Fortify

URL: 3dfortify.com

Funding Rounds: 11

Total Funding: $46.3M

Contact

Website: https://oceanazulpartners.com/

Email: funding@oceanazulpartners.com

Address:

255 Alhambra Cir, Suite 340

Coral Gables, FL 33134

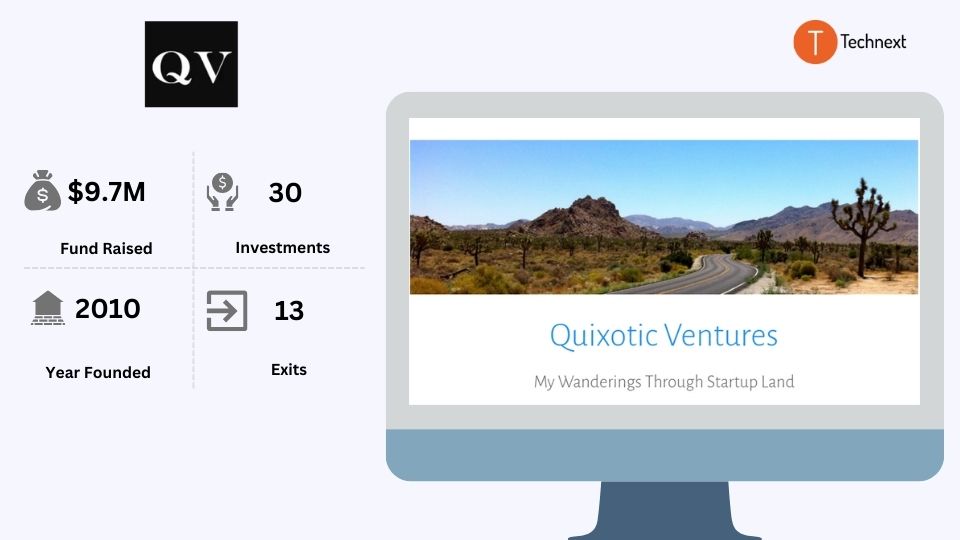

2. Quixotic Ventures

The founder of Quixotic Ventures, Mark Kingdom, has been investing in startups since 2005. Quixotic Ventures offers seed funding to startups.

Till now, they have invested in 30 startups with some big names. If you want funding from Quixotic Ventures, you must have a concise pitch deck with clear insight.

Details of Quixotic Ventures

Foundation Year: 2010

Number of Investments: 30

Number of Exits: 13

Focus of Quixotic Ventures

Stage

- Early Stage Startup

- Seed

Industries

- E-Commerce

- Consumer

- Marketplace

- Mobile

- Interne

Notable Investments

1. Refinery29

Website: www.refinery29.com

Funding Rounds: 7

Total Funding: $133.4M

2. Sellbrite

Website: www.sellbrite.com

Funding Rounds: 6

Total Funding: $2.8M

3. Mathison

Website: www.mathison.io

Funding Rounds: 5

Total Funding: $31.2M

Contact

Website: https://quixotic.ventures/

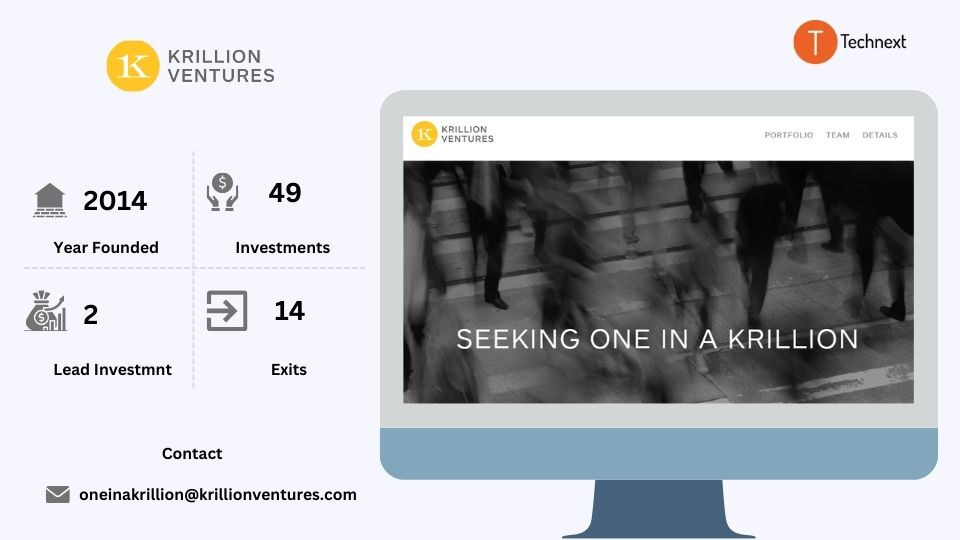

3. Krillion Ventures

Krillion Ventures is a renowned Miami venture capital. They are willing to take a few risks to find the next great entrepreneur. They love to provide funds to the fearless teams that turn big ideas into winning companies.

They accept both pre-revenue and revenue-generating startups. The pre-revenue startups must have a demonstrated proof of concept. They also back companies with support in strategy, marketing, and additional capital raising.

Details of Krillion Ventures

Foundation Year: 2014

Countries of Operation:

- United States

- Israel

Number of Investments: 49

Lead Investments: 2

Number of Exits: 14

Focus of Krillion Ventures

Stage

- Early Stage Startup

- Seed

Industries

- Consumer

- Retail

- Health Tech

- High Tech

- Life Sciences

- Real Estate

- Construction Tech

- FinTech

- Food

- Agriculture Tech

- Environment Tech

- EdTech

- Travel and Hospitality Tech

- Transportation and Logistics Tech

Notable Investments

- Inner Cosmos

URL: innercosmos.io

Funding Rounds: 2

Total Funding: $10M

2. Breezeway

URL: www.breezeway.io

Funding Rounds: 6

Total Funding: $36.2M

3. Wheels Up

URL: wheelsup.com

Funding Rounds: 9

Total Funding: $1.6B

Contact:

Website: https://krillionventures.com/

Email:

4. Miami Angels

Miami Angels is comprised of over 150 angel investors. This Miami venture capital firm has successful entrepreneurs who know how to guide young startups to become successful.

They focus on early-stage SaaS-enabled startups. Their primary investment requirement is that the startups must be in the post-launch stage with some commercially viable product. Apart from funding, they provide mentoring and hands-on collaboration to support startups

Details of Miami Angels

Foundation Year: 2013

Countries of Operation:

- United States

Number of Investments: 85

Lead Investments: 5

Number of Exits: 19

Fund Raised: $109.5K

Investment size:

Typically invest $1 Million–$5 Million

Focus of Miami Angels

Stage

- Early-Stage Venture

- Seed

Industries

- Financial Services

- Retail

- Blockchain Technology

- Enterprise Infrastructure

- Life Sciences

- Business Services

- Gaming

- Ed Tech

- FinTech

- HealthTech

- Enterprise Applications

- Consume

Notable Investments

1. ApexEdge

URL: apexedge.com

Funding Rounds: 1

Total Funding: $4M

2. Smart Barrel

URL: smartbarrel.io

Funding Rounds: 5

Total Funding: $2.8M

3. BabySparks

URL: babysparks.com

Funding Rounds: 3

Total Funding: $3.8M

Contact

Website: https://www.miamiangels.vc/

Email:hello@miamiangels.vc

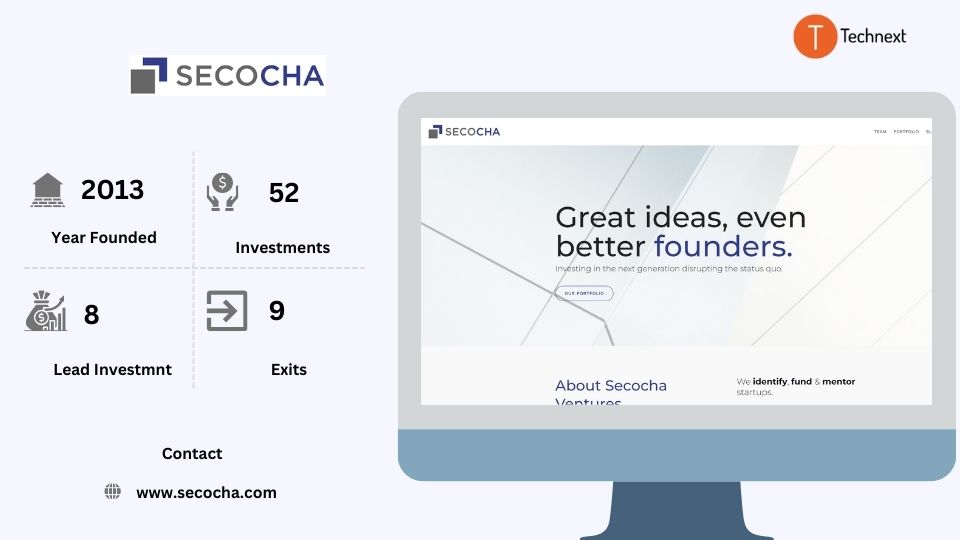

5. Secocha Ventures

Secocha Ventures is a forward-thinking investment firm committed to fostering innovation and driving growth in emerging markets. Secocha Ventures provides strategic guidance and financial support to entrepreneurs with bold visions.

They primarily invest in B2C business, which makes them a perfect fit for venture capital firms Miami. By using its large network and deep industry expertise, Secocha Ventures empowers founders to realize their potential and make a meaningful impact on the world

Details of Secocha Ventures:

Foundation Year: 2013

Countries of Operation:

- United States

- India

- Israel

- France

Number of Investments: 52

Lead Investments: 8

Number of Exits: 9

Focus of Secocha Ventures:

Stage

- Pre- Seed

- Seed

- Series A

Industries

- FinTech

- HealthTech

- Consumer Products & Services.

Notable Investments

1. Brigit

URL: hellobrigit.com

Funding Rounds: 4

Total Funding: $115M

2. Bling

URL: www.bling.eu

Funding Rounds: 4

Total Funding: €6.7M

3. Allocate

URL: allocate.co

Funding Rounds: 3

Total Funding: $30.3M

Contact

Website: https://www.secocha.com/index

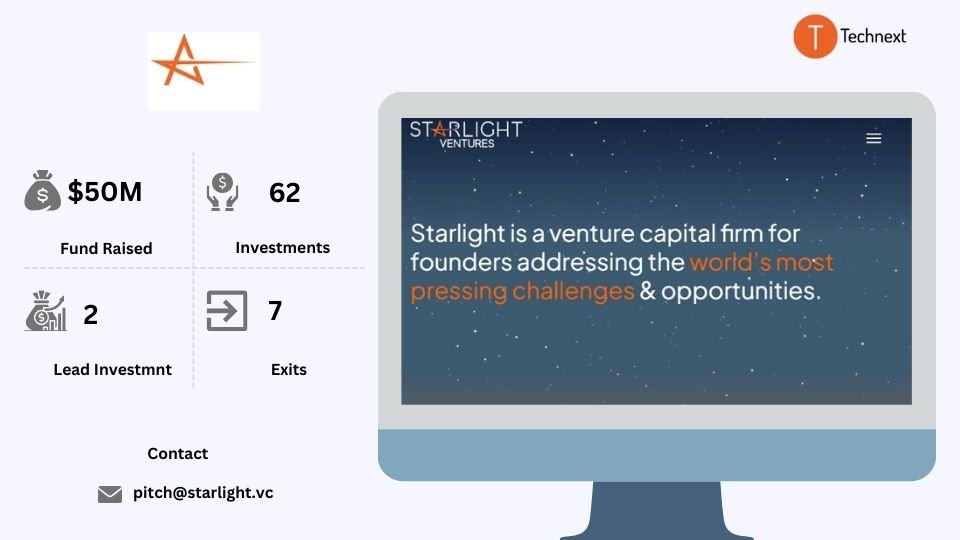

6. Starlight Ventures

Starlight Ventures is another of Miami’s famous venture capital firms. They have a great team of entrepreneurs, operators, and scientists. They love to stand in the founders’ shoes and understand the journey. They never limit themselves to any particular field. They look for teams that are uniquely suited. They love to invest in startups that solve large-scale problems. Also, they believe in assisting entrepreneurs by providing helpful feedback.

Details of Starlight Ventures

Foundation Year: 2017

Countries of Operation:

- United States

- Canada

- United Kingdom

- Argentina

Number of Investments: 62

Lead Investments: 2

Number of Exits: 7

Funds raised: $50M

Focus of Starlight Ventures

Stage

- Early Stage Startup

- Seed

Industries

- Energy Transition

- Industrial Biology

- Space Technology

- Next-gen Platforms

Notable Investments

1. Carbo Culture

URL: carboculture.com

Funding Rounds: 6

Total Funding: $27.5M

2. 3T Biosciences

URL: 3tbiosciences.com

Funding Rounds: 3

Total Funding: $52M

3. ICEYE

URL: https://www.iceye.com/

Funding Rounds: 10

Total Funding: $313.3M

Contact:

Website: https://starlight.vc/

Email:

pitch@starlight.vc

7. TheVentureCity

TheVentureCity is a Miami-based female-founded venture capital. They understand startup culture well because many of their partners are former operators and founders of successful companies. They don’t believe innovation has a zip code. And they are looking for entrepreneurs like you from any part of the world. If you’re someone who can think creatively to tackle significant challenges, TheVentureCity is eager to collaborate with you.

Details of TheVentureCity

Foundation Year: 2017

Countries of Operation:

- United States

- EMEA

- Latin America

Number of Investments: 150

Lead Investments: 15

Number of Exits: 40

Fund raised: $124M

Focus of TheVentureCity

Stage

- Early Stage Venture

- Seed

Industries

- FinTech

- HealthTech

- Healthcare

- Artificial intelligence

- Machine learning

- EdTech

- Blockchain Technology

Notable Investments

1. Belo

URL: https://www.belo.app/

Funding Rounds: 1

Total Funding: $3M

2. BrandLovrs

URL: www.brandlovrs.com

Funding Rounds: 1

Total Funding: $2M

3. Devengo

URL: devengo.com

Funding Rounds: 2

Total Funding: $2.9M

Contact

Website: https://www.theventure.city/

Email: hello@theventure.city

8. Fuel Venture Capital

Fuel Venture Capital firm was founded in 2017 and focuses on technology-enabled companies. It’s a team of visionaries who have already faced the challenges of building and scaling a startup. Fuel Venture wants to invest in companies that have the potential to change how people interact with the world. Apart from funding, they provide support and guidance that portfolio companies need to succeed.

Details of Fuel Venture Capital

Foundation Year: 2017

Countries of Operation:

- United States

- United Kingdom

- Guatemala

- UAE

- Spain

- Colombia

Number of Investments: 49

Lead Investments: 12

Number of Exits: 8

Funds raised: $689M

Focus of Fuel Venture Capital

Stage

- Early Stage Startup

- Late Stage Startup

Industries

- Finance

- Fintech

- Saas

- Software

- Market place

Notable Investments:

1. Tradeshift

URL: tradeshift.com

Funding Rounds: 14

Total Funding: $1.1B

2. Eyrus

URL: www.eyrus.com

Funding Rounds: 6

Total Funding: $14.5M

3. Ubicquia

URL: www.ubicquia.com

Funding Rounds: 4

Total Funding: $61.3M

Contact

Website: https://fuelventurecapital.com/

9. LAB Miami Ventures

LAB Miami Ventures works as both a VC fund and a startup studio. It’s helping technology companies take the next step in business to create huge results. They invest in early-stage real estate and construction technology companies.

They not only provide the financial resources required for scaling, but they can also provide in-house services for developing new technology. Also, they provide highly motivated entrepreneurs funding, ongoing mentorships, and ideas for expanding the company

.

Details of LAB Miami Ventures

Foundation Year: 2017

Countries of Operation:

- United States

- United Kingdom

- Colombia

Number of Investments: 30

Funding Rounds: 1

Number of Exits: 4

Total Funding Amount: $500K

Investment Size

Minimum cheque size: $100K to $250K

Maximum cheque Size: $1M

Focus of LAB Miami Ventures

Stage

- Early Stage Startup

- Seed

Industries

- Real Estate

- Construction technology

Notable Investments

1. Parcl

URL: www.parcl.co

Funding Rounds: 2

Total Funding: $11.5M

2. Knowify

URL: www.knowify.com

Funding Rounds: 6

Total Funding: $12.1M

Contact

Website: https://www.labventures.co/

Email: info@thelabmiami.com

Phone Number: +1 305-507-3660

10. Knight Enterprise Fund

”Knight Enterprise Fund” venture capital firm is a social investor and one of the unique Miami venture capital firms. They fund journalism, culture, and the arts to create more effective democracy in culture. The purpose of this firm is to boost high-quality journalism and the communities. They not only invest but also collect and share information with communities. Also, they support companies to create a more democratic world.

Details of Knight Enterprise Fund

Foundation Year: 2011

Countries of Operation:

- United States

Number of Investments: 101

Lead Investments: 4

Number of Exits: 28

Funds raised: $25k–$500,000

Focus of Knight Enterprise Fund

Stage

- Early Stage Startup

- Seed

Industries

- Journalism

- Arts and culture in community

- Media and democracy

Notable Investments

1. WhereBy.Us

URL: www.whereby.us

Funding Rounds: 9

Total Funding: $3M

3. Catchafire

URL: www.catchafire.org

Funding Rounds: 6

Total Funding: $8.7M

Contact

Website: https://knightfoundation.org/

Email: web@knightfoundation.org

Telephone: (305) 908-2600

11. Electric Feel Ventures

Electric Feel venture is home to rising superstar artists, producers, songwriters, brands, and partners. They elevate and empower their clients to achieve their dreams. They focus on technology and consumer trends, emphasizing digital health, fintech, and e-commerce. Their goal is to identify and invest in companies like yours, which will play a big role in shaping the future.

Details of Electric Feel Ventures

Foundation Year: 2013

Number of Investments: 51

Lead Investments: 3

Number of Exits: 1

Focus of Electric Feel Ventures

Stage

- Early Stage Startup

Industries

- Consumer

- Consumer Electronics

- Beauty

- Crypto Currency

- Foood and Bebarage

- Music Streaming

- Gaming

Notable Investments

1. Goodles

URL: www.goodles.com

Funding Rounds: 2

Total Funding: $19.4M

2. Chamberlain Coffee

URL:

chamberlaincoffee.com

Funding Rounds: 2

Total Funding: $15M

3. Creative Intell

URL:

www.creativeintell.com/

Funding Rounds: 1

Total Funding: $3M

Contact

Website: https://www.electricfeelent.com/

Email: info@efent.com

12. Dragon Global

Dragon Global is a private investment firm. They focus on venture capital and real estate investments. They want to be the best partner for entrepreneurs and bring a big impact in the consumer and enterprise markets. They also want to partner with real estate developers to help shape communities. Their mission is to empower people to build communities and bring the world closer together. Also, all of their partners have a lot of experience working in successful companies. Some of them even run their own companies.

Details of Dragon Global

Foundation Year: 2010

Countries of Operation:

- United States

Number of Investments: 15

Number of Exits: 5

Focus of Dragon Global

Stage

- Seed

- Early Stage Startup

- Late Stage Startup

- Private Equity

- Post-IPO

Industries

- Artificial intelligence (AI)

- Cloud

- Cybersecurity

- Software / SaaS

- IoT

- Climate tech

- Robotics

- Space

- Social networking

- Mobility

Notable Investments

- Uber

URL: www.uber.com/bd/

Funding Rounds: 32

Total Funding: $25.2B

2. Zynga

URL: www.zynga.com

Funding Rounds: 13

Total Funding: $526M

3. H2PRO

URL: www.h2pro.co

Funding Rounds: 5

Total Funding: $180M

Contact

Website:https://www.dragonglobal.com/

13. Volta Global

Volta Global is a private equity firm based in Miami, Florida. They are not like most real estate developers or private equity firms. They don’t manage their fund with outside investors. Even they don’t use any fund management model. So they can patiently let their investments grow over time.

They invest in properties and markets with deep knowledge and a long-term commitment, which makes them one of the best Miami venture capitalists. They value integrity and trust and aim to build strong, lasting relationships with in-house resources. Apart from funding, they also support founders at every step.

Details of Volta Global

Foundation Year: 2015

Countries of Operation:

- United States

- United Kingdom

- France

Number of Investments: 7

Lead Investments: 2

Number of Exits: 1

Focus of Tidal Ventures

Stage

- Seed

- Early Stage Startup

- Late Stage Startup

- Private Equity

- Post-IPO

Industries

- FinTech

- Life Sciences

- Enterprise Infrastructure

- Enterprise Applications

- Food and Agriculture Tech

- Gaming

- Retail

- Consumer

Notable Investments

1. Fnatic

URL: fnatic.com

Funding Rounds: 10

Total Funding: $54.9M

2. Ubiq Security

URL:www.ubiqsecurity.com

Funding Rounds: 1

Total Funding: $6.4M

3. SponsorUnited

URL: www.sponsorunited.com

Funding Rounds: 4

Total Funding: $39.2M

Contact

Website: https://www.voltaglobal.com/

Email: contact@voltaglobal.com

Phone Number: 305-428-6500

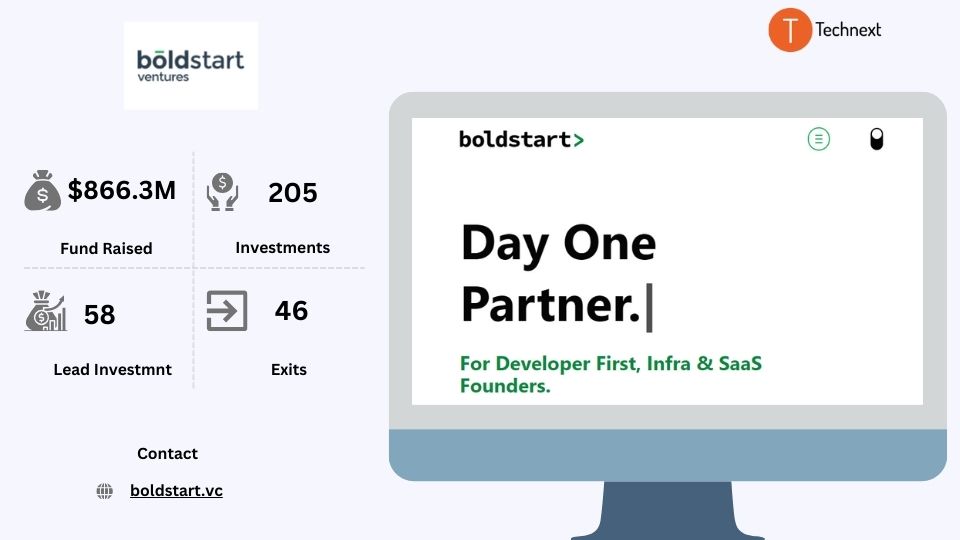

14. BoldStart Ventures

BoldStart Ventures is an American-renowned venture capital firm. They aim to partner with tech founders who are passionate about solving problems they’ve personally faced. They prefer to invest in software and blockchain technology. They help firms from the beginning of their startup journey. Also, they work closely with technical founders even before a company is formally established.

Details of BoldStart Ventures

Foundation Year: 2010

Countries of Operation:

- United States

- Canada

- United Kingdom

- Austria

- Belgium

- Germany

- Sweden

Number of Investments: 205

Lead Investments: 58

Number of Exits: 46

Funds raised: $866.3M

Focus of BoldStart Ventures

Stage

- Seed

- Early Stage Startup

- Late Stage Startup

Industries

- SaaS

- Cybersecurity

- Crypto

- Blockchain

- API

- Developer Tools

- Security sectors

Notable Investments

1. Spectro Cloud

URL: www.spectrocloud.com

Funding Rounds: 4

Total Funding: $67.5M

2. Robin

URL: robinpowered.com

Funding Rounds: 1

Total Funding: $59.1M

3. Blockdaemon

URL:

www.blockdaemon.com

Funding Rounds: 10

Total Funding: $431.3M

Contact

Website: https://boldstart.vc/

Phone Number: 877-342-7222

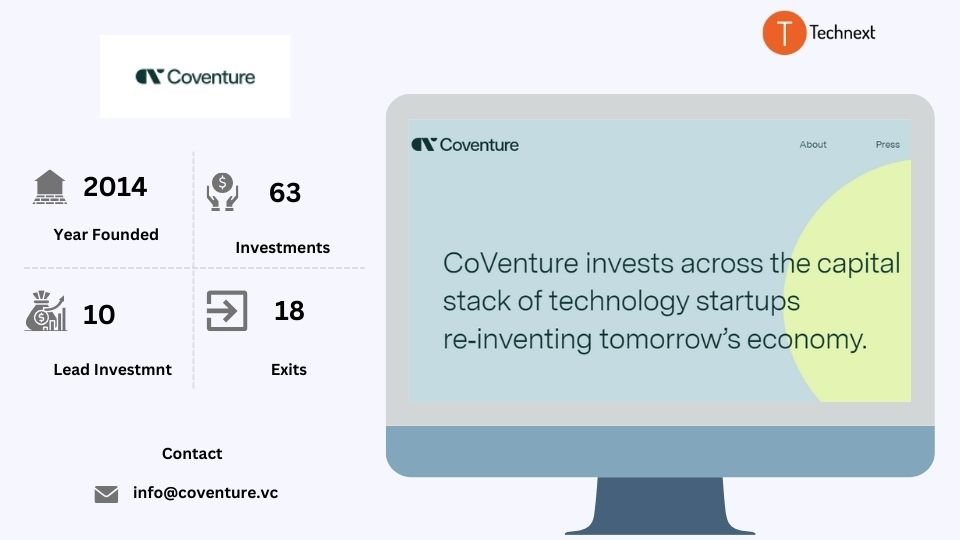

15. CoVenture

CoVenture is a group of dedicated investors supporting entrepreneurs who have a vision for the future. They provide venture and debt funding to tech companies. They love to partner with founders who are creating new things, finding new markets, or need different types of funding to grow. They support those firms with venture capital and debt financing. This is how they have made their name on this list of Miami venture capitalists.

Details of CoVenture

Foundation Year: 2014

Countries of Operation:

- United States

- United Kingdom

- Mexico

- France

- India

Number of Investments: 63

Lead Investments: 10

Number of Exits: 18

Focus of CoVenture

Stage

- Early Stage Startup

Industries

- E-Commerce

- Media

- Entertainment

- SaaS

Notable Investments

1. Constrafor

URL: www.constrafor.com

Funding Rounds: 5

Total Funding: $113.8M

2. Captain

URL: www.captainhq.com

Funding Rounds: 2

Total Funding: $104M

3. Embrace Software

URL: www.embracesoftwareinc.com

Funding Rounds: 1

Total Funding: $100M

Contact

Website: https://coventure.vc/

Email:

info@coventure.vc

press@coventure.vc

This is our list of 15 VCs in Miami. As you can see, the Miami VC landscape offers a diverse range for your startup. From established firms to exciting newcomers, there’s a VC out there with the potential to be the perfect fit for your early-stage startup goals and industry.

Also, consider researching their investment preferences, team expertise, and track record to identify the VCs that best align with your vision. If you need advice, discuss it with an expert.

![18 San Francisco Venture Capital Firms for Early-Stage Startups[2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/04/Best-San-Francisco-Venture-Capital-Firms-1-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)

![9 Top Saudi Arabia Venture Capital Firms for Early-Stage Startups [2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/05/Saudi-Arabia-Venture-Capital-Firms-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)

![13 Top Japan Venture Capital Firms for Early-Stage Startups [2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/05/Japan-Venture-Capital-Firms-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)

![13 Top Amsterdam Venture Capital Firms for Early-Stage Startups [2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/05/Amsterdam-venture-capital-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)