11 Top VCs in London for Early-Stage Tech Startups

We’ve put together a list of 11 VCs in London who are willing to take the risk and invest in your early-stage tech startup and offer unique funding options.

In the world of tech startups, securing funding is one of the biggest challenges for the founders, especially if you are in the early stage or have an innovative idea. Well, in more established startup ecosystems like the USA, securing funding for innovative early-stage startup ideas is relatively less challenging than in the UK.

If you are a startup founder in the UK, you can reach out to any of the 191 venture capitalist firms currently operating in the UK. But you probably already know how hard it is to get financial backing from traditional VCs in London. Their strict requirements and focus on proven business models can make it difficult for early-stage startups to secure the funding they need to get off the ground.

Fortunately, there are some London venture capitalists who are willing to take risks believing in new, disruptive and even unproven ideas. We have put together 11 such VCs in London that are breaking the mold and standing out from the crowd by offering unique funding opportunities and a willingness to invest in the early stage of a tech startup. We hope this list will provide you with some valuable insights.

11 VCs in London, UK, that are Investing in the Future of Tech Startups

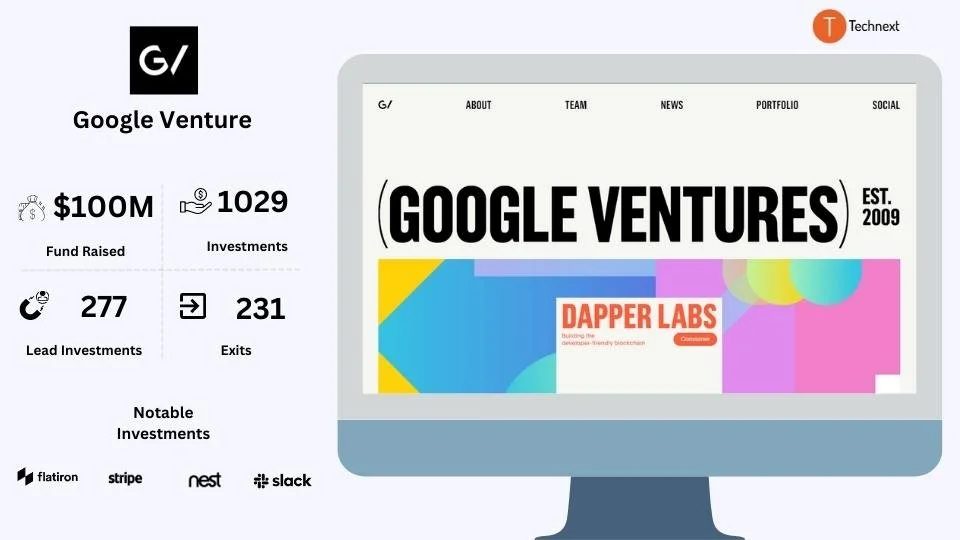

1. Google Ventures

Google Ventures (now known as GV) is one of such unique VCs in London, that aim to assist innovative founders. With $8 billion dollar under management, they not only provide founders with capital but also help them build the right team, pick the right co-founders, develop the best product, and ultimately market the product and grow. If you are aiming to build a product that would bring equitable change, GV would be the right fit for you.

Details of Google Venture

Year of Foundation: GV was founded in 2009 as an independent venture capital firm.

Countries of Operation: USA and United Kingdom

Number of Investments: 1022

Number of Exits: 230

Funds raised: $100,000,000

Focus of Google Venture

Stages: Google venture mainly focuses on early-stage startups, including pre-seed, seed, and series A. But has the ability and track record of investing in the late stages.

Industries: Consumer, Engineering, Enterprise, Design, Life Sciences, Marketplace, Diversity & Inclusion, Transportation, Talent Productivity

Investment size of GV

Forward partner investment size ranges from $1 million to $10 million.

Minimum cheque size: $2,000,000.

Maximum cheque size: $30,000,000.

Notable Investments:

Uber, Nest, Slack, Duo Security, GitLab, Flatiron Health, Verve Therapeutics, and One Medical.

Contact

Website: https://www.gv.com/

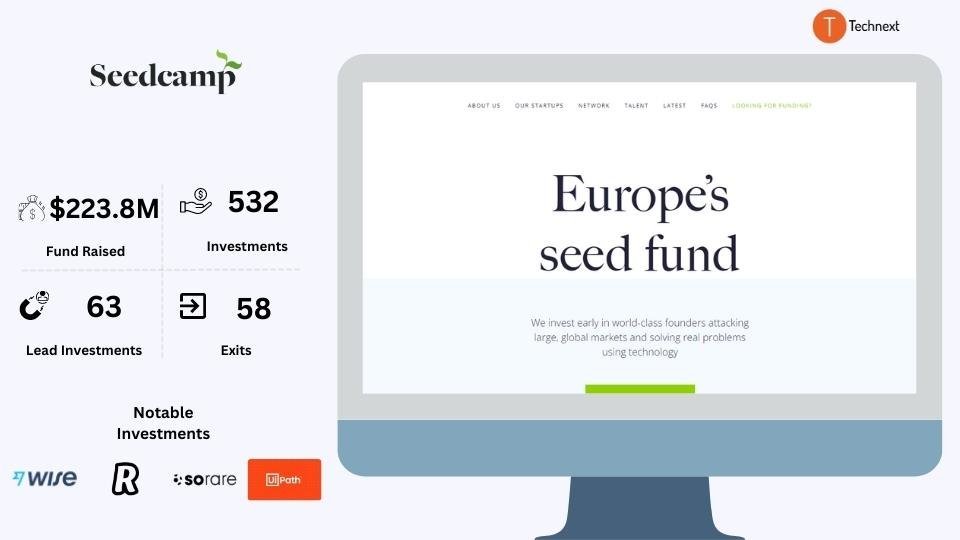

2. Seedcamp

Seedcamp is a European seed fund that identifies and invests early in founders attacking global markets. They don’t focus on one sector and look for founders and networks to help identify Europe’s next big talent. They believe investing at the earliest stage is the biggest advantage the Seedcamp team can bring to any company. Also, they provide a carefully curated core team and community of exceptional people across the world to help you supercharge your vision.

Details of Seedcamp

Year of Foundation: Seedcamp venture capital firm Founded in 2007.

Countries of Operation: United Kingdom

Number of Investments: 532

Number of Exits: 58

Funds raised: $223.8M

Focus of Seedcamp

Stages: Seed Camp mainly focuses on early-stage entrepreneurs, mainly interested in investing in the seed round.

Industries: SaaS, Robotics, AI & ML, Crypto & Blockchain, Cloud, Infrastructure, Big Data & Analytics, Developer Tools, E-Commerce, Education, Future of Work, Fintech, Productivity, Gaming, Human Resources, InsurTech, IoT, Marketing, Advertising, Marketplace, Media, Creator Economy, Proptech & Real Estate, Cybersecurity, Social, Travel & Hospitality.

Investment size of Seeccamp:

Seedcamp is funded by 12 investors like Accomplice and Samosa Digital. They have raised a total of $223.8M across 5 funds.

Minimum cheque size: £300,000

Maximum cheque size: £500,000

Notable Investments:

Hopin, Wise, Revolut, Sorare, wefox, Pleo, UiPath, viz.ai, and Grover.

Contact

Website: https://seedcamp.com/

Email: info@seedcamp.com

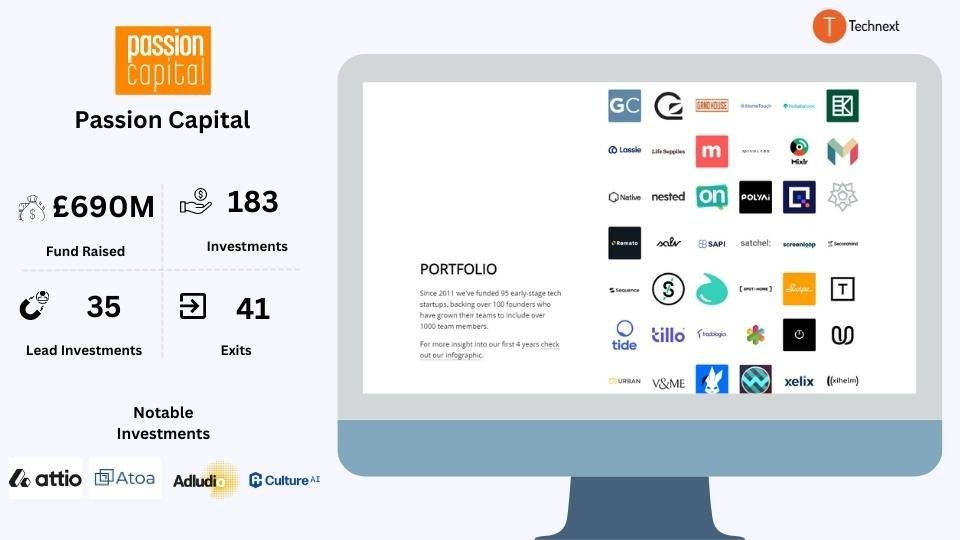

3. Passion Capital

Passion Capital is a partnership of entrepreneurs and operators who are applying their experiences to helping founders and early-stage teams build great digital media/technology companies. They are committed to fostering an ecosystem of technology, collaboration, and execution excellence in Europe, and the critical differentiator and key asset of a successful business is the passion and ability of its founders.

Details of Passion Capital

Year of Foundation: Passion Capital was founded in 2011.

Countries of Operation: United Kingdom

Number of Investments: 183

Number of Exits: 41

Funds raised: £69,000,000

Focus of Passion Capital

Stages: Passion Capital is an early-stage venture capital firm. And it focuses on pre-seed and seed-stage companies.

Industries: Information technology, TMT, internet, mobile, infrastructure, and SaaS sectors.

Investment size of Passion Capital:

Passion Capital plans to make around 50 investments, on average, in the range of $170K-227,000 per deal.

Notable Investments:

Xelix, Native, FERTIFA, Daybridge, Coinfloor, Attio, and Sequence.

Contact:

Website: passioncapital.com

Email: info@passioncapital.com

4. Frontline Ventures

Frontline provides funds for early-stage B2B companies with global aspirations. It’s a fund for challengers looking for other strong minds, whether you’re a first-time creator producing something meaningful or a seasoned entrepreneur who understands how difficult it is to “make it.”

Also, with their own profound expertise in technology, they are eager to invest in European tech, computer science, and engineering pioneers. And they assist founders in getting started — and go global.

Details of Frontline Ventures

Year of Foundation: Frontline Ventures was founded in 2012.

Countries of Operation: United Kingdom and Ireland

Number of Investments: 178

Number of Exits: 15

Funds raised: $83,800,000

Focus of Frontline Ventures

Stages: Frontline Venture is an early-stage venture capital in uk. And it prefers to invest in seed-stage, although they fund some late Stage startups.

Industries:

AI & ML, SaaS, Automation, Creator Economy, Crypto & Blockchain, Cybersecurity, Legal, Marketing

Investment size of Frontline Ventures

Frontline Ventures expects to invest in up to 45 companies over the next four years with an investment size of € 250,000 to € 2.5 million.

Minimum cheque size: $250,000

Maximum cheque size: $2,500,000

Notable Investments:

Lattice, Qualio, Evervault, Lob, Lattice, Evervault, and Qualio.

Contact

Website: www.frontline.vc

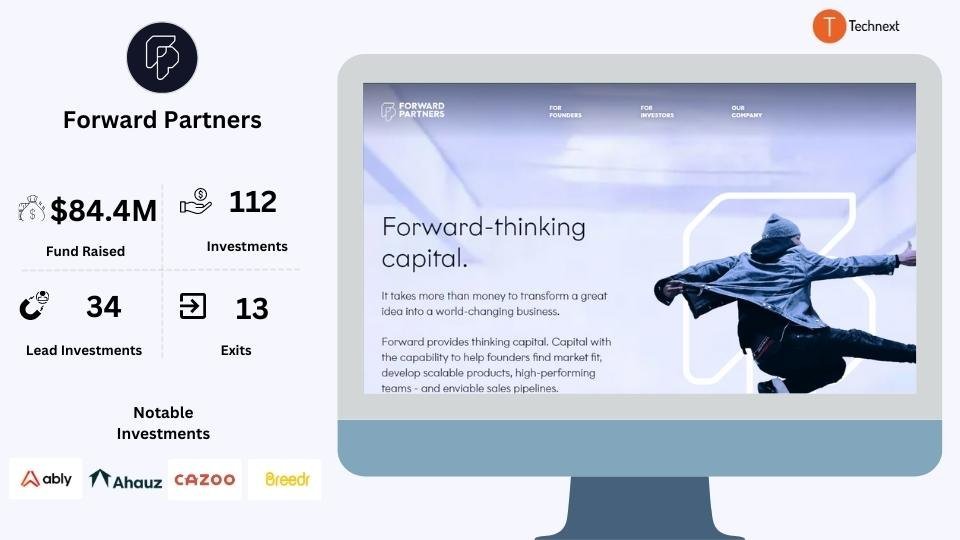

5. Forward Partners

Forward Partners is a London-based venture capital firm that focuses on early-stage technology enterprises in the marketplace applying AI and Web3. They usually work with the most ambitious teams. They also provide flexible and equitable funding and collaborate from the start to provide hands-on support with strategy and execution, allowing teams to reach their full potential sooner.

Details of Forward Partners

Year of Foundation: Forward partners was founded in 2013.

Countries of Operation: United Kingdom

Number of Investments: 112

Number of Exits: 13

Funds raised: £60,000,000

Focus of Seedcamp

Stages: Forward Partners mainly focuses on early-stage startups, including seed and series A.

Industries: E-Commerce, Marketplace, AI & ML, Crypto & Blockchain

Investment size of Forward partner

Forward partner investment size ranges from £250,000 to £750,000.

Minimum cheque size: £200,000

Maximum cheque size: £2,000,000

Notable Investments

Baselime, Sourcery, Koyo, LEXOO, ably, and PATCH.

Contact

Website: https://forwardpartners.com

Email: nic@forwardpartners.com

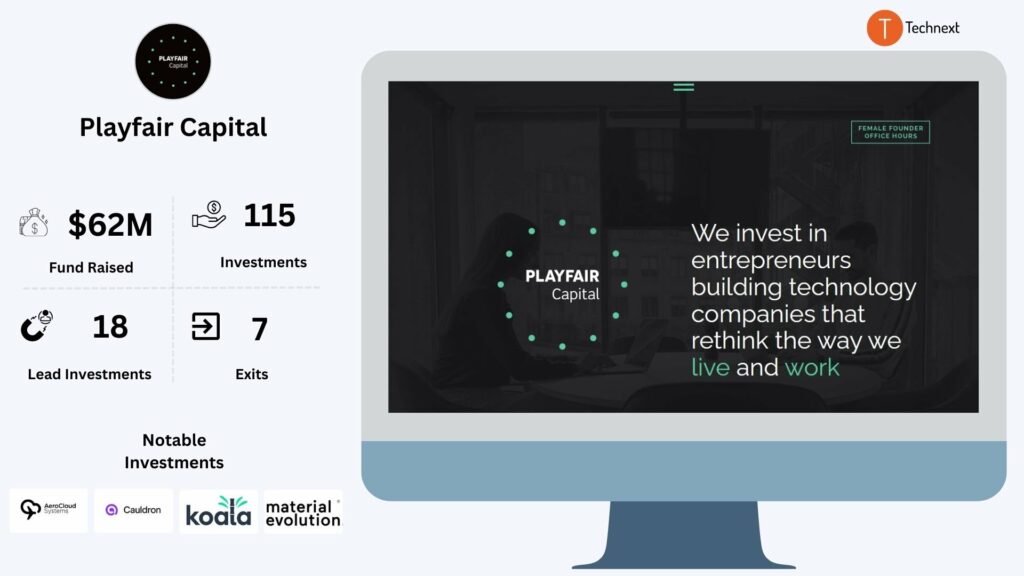

6. Playfair Capital

Playfair Capital is an early-stage fund that invests in companies with conviction. Since 2013, they have been assisting ambitious and extraordinary entrepreneurs in the development of brilliant technology businesses. Also, they tend to invest early and enthusiastically in founding teams worldwide, with a particular emphasis on the United Kingdom.

Details of Playfair Capital

Year of Foundation: Playfair Capital was founded in 2013.

Countries of Operation: United Kingdom

Number of Investments: 115

Number of Exits: 7

Funds raised: $62M

Focus of Playfair Capital

Stages:

Playfair Capital is one of London’s leading early stage investors. And they mainly focus on pre-seed and seed rounds.

Industries:

Advertising, Big Data & Analytics, AI & ML, Automation, E-Commerce, Energy, Fintech, Gaming, Healthcare, IoT, Supply Chain & Logistics, Marketplace, Internet & Mobile, Proptech & Real Estate, SaaS, Social, Travel & Hospitality.

Investment size of Playfair

Playfair Capital investment size is £100k-£500k into pre-seed and seed stage companies raising rounds of up to £2m.

Minimum cheque size: £100,000

Maximum cheque size: £500,000

Notable Investments:

Mapillary (acq. by Facebook), CryptoFacilities (acq. by Kraken), Omnipresent, Orca AI, Ravelin, sprout.ai, Thought Machine, Trouva and Vinehealth.

Contact

Website: https://playfaircapital.com/

Email: hello@playfaircapital.com

7. Episode 1 Ventures

Episode 1 Ventures is one of the top venture capital firms in UK that focuses on seed-stage funds. They are passionate about the technologies, the ideas, and the business models that are reshaping the world. They are always ready to share their knowledge and unique ideas and always roll their sleeves up to support founders. Also, they have deep connections with Silicon Valley.

Details of Episode 1 Ventures

Year of Foundation: Episode 1 Ventures was founded in 2013.

Countries of Operation: United Kingdom

Number of Investments: 135

Number of Exits: 8

Funds raised: £97.5M

Focus of Episode 1 Ventures

Stages: Episode 1 Ventures focuses on early-stage ventures, including seed rounds.

Industries: B2B software sector.

Investment size of Episode 1 Ventures

£500k – £2m in early-stage software companies in the UK.

Notable Investments

Adludio, Docker, Adsum, Carwow, and CloudNC.

Contact

Website: episode1.com

Email: info@episode1.com

8. LocalGlobe

LocalGlobe is an early-stage seed round focused micro VC for ambitious founders. They remain active investors, averaging 10-20 investments per year, and are comfortable investing across multiple sectors. They invest in startups selling to consumers, small businesses, and enterprises. Also, they offer highly structured, collaborative support to our investee companies and have an excellent track record in getting our startups to a Series A raising (almost 90% vs. less than 40% EU average).

Details of LocalGlobe

Year of Foundation: LocalGlobe was founded in 1999

Countries of Operation: USA, United Kingdom

Number of Investments: 358

Number of Exits: 56

Funds raised: $1.4B

Focus of LocalGlobe

Stages: Pre-Seed, Seed (with main focus on seed stage).

Industries: Energy, creative industries, property, fashion, finance, food, education, insurance, security, health, travel, and transport

Investment size of LocalGlobe

We couldn’t find the exact funding range for LocalGlobe. From their lead investment, we can estimate that they invest between 1.5 and 4.5 million in the seed stage. and 5M to 14M in the A series.

Notable Investments:

TransferWise (Now wise), Zoopla, LOVEFiLM, Improbable, Wonga, VIO Technology, Eastnine, Betaworks Studios, Asteroid, and FloodFlash Insurance.

Contact

Website: https://localglobe.vc/

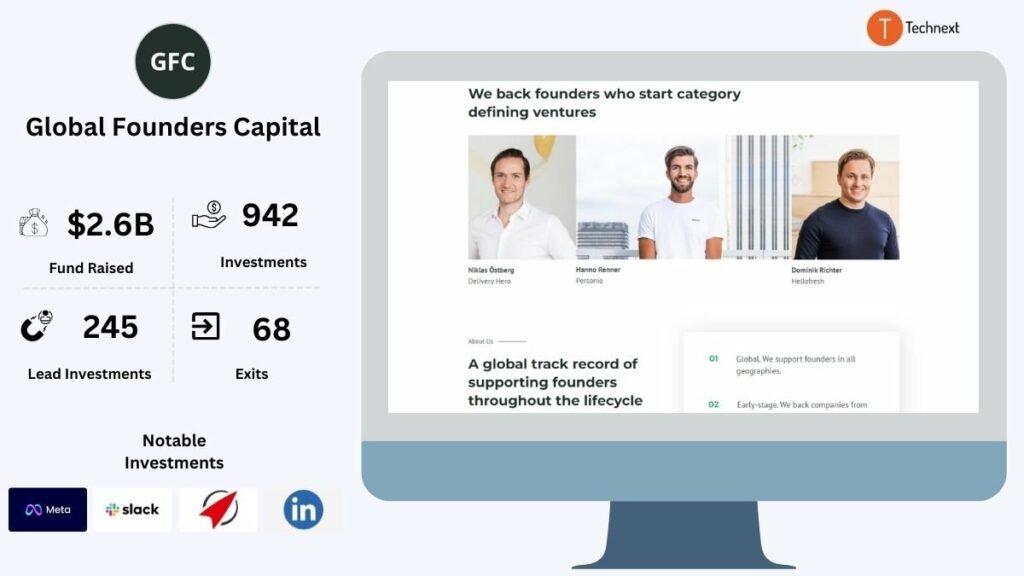

9. Global Founders Capital

Global Founders Capital is an early-stage investor that empowers gifted entrepreneurs. They try to support their founders through their platform from day zero. Armed with deep operational experience building technology companies, the Global Founders have a track record of supporting entrepreneurs from seed to IPO on every continent.

Details of Global Founders Capital

Year of Foundation: Global Founders Capital was founded in 2013

Countries of Operation: USA, UK, France, Israel, Sweden, Germany, Italy, Turkey, Singapore, United Arab Emirates, Indonesia, China, Brazil, Mexico

Number of Investments: 942

Number of Exits: 68

Funds raised: $2.6B

Focus of Global Founders Capital

Stages: Global Founder Capital is an early-stage venture with a main focus on pre-seed and seed stages.

Industries: Consumer, SaaS, Enterprise, Internet & Mobile, IoT, E-Commerce, Productivity, Supply Chain & Logistics, InsurTech.

Investment size of Global Founders Capital

As core investors, Global Founders Capital’s average fund size ranges from $300,000 to $4 million. In Series A, they have a track record of being lead investors in a $29 million fundraiser.

Minimum cheque size: $1,000,000

Notable Investments

Meta, Slack, Rocket Internet, LinkedIn, Zalando, Delivery Hero, Revolut, JUMIA, deel, and Canva.

Contact

Website: https://www.globalfounderscapital.com/

Email: contact@globalfounderscapital.com

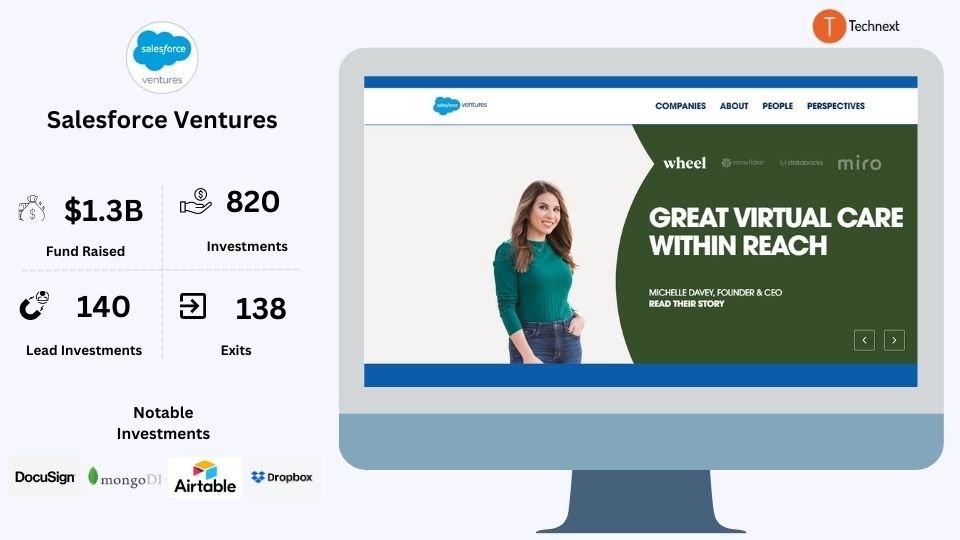

10. Salesforce Ventures

Salesforce Ventures is a corporate venture capital firm focusing exclusively on investing in enterprise software. Their mission is to help ambitious entrepreneurs build innovative companies that transform the way the world works. At Salesforce Ventures, there is great enthusiasm for the long-term positive effects of business technology.

Details of Salesforce Ventures

Year of Foundation: Salesforce Ventures was founded in 2009.

Countries of Operation: USA, United Kingdom, Australia, Japan

Number of Investments: 820

Number of Exits: 138

Funds raised: $1.3B

Focus of Salesforce Ventures

Stages: Salesforce Ventures focuses on the early stage, Late stage, and seed.

Industries: Cloud, SaaS, Enterprise, Healthcare, Productivity, Fintech, Cybersecurity, Automation

Investment size of Salesforce Ventures

A large number of Salesforce fundings remains undisclosed, but from the analysis, they usually fund in millions.

Minimum cheque size: $1,000,000

Maximum cheque size: $2,000,000

Notable Investments:

DocuSign, MongoDB, Infor, Airtable, Algolis, Dropbox, and Stripe.

Contact

Website: https://salesforceventures.com/

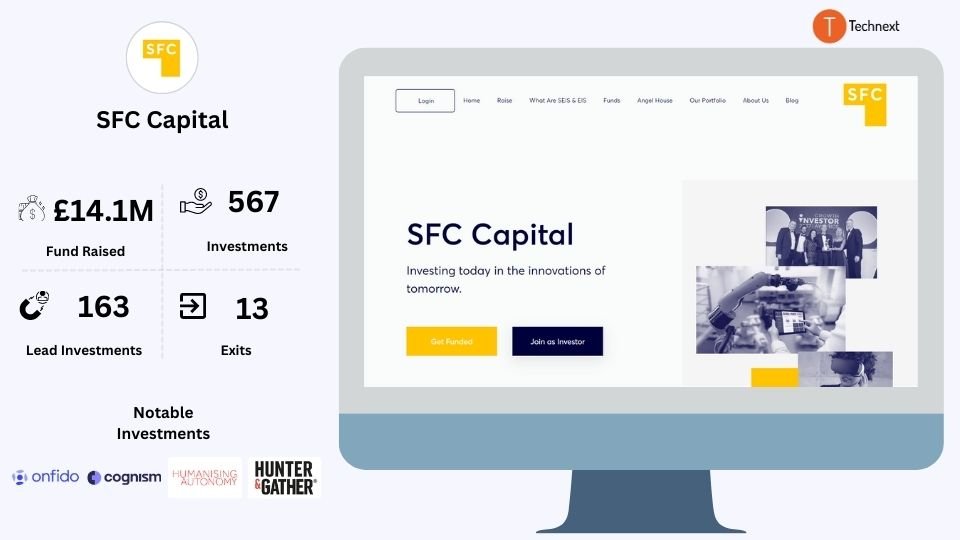

11. SFC Capital

SFC is a pioneer in the early-stage investment market in the United Kingdom, providing seed capital and support to potential British entrepreneurs. They have built a unique strategy by merging their Angel Network and Seed Funds, allowing investors to gain exposure to SEIS- and EIS-qualifying enterprises directly or through a diversified portfolio chosen and managed by their specialist staff. SFC is the ideal partner for entrepreneurs who will accompany you from your first SEIS funding round to a successful exit.

Details of SFC Capital

Year of Foundation: SFC Capita was founded in 2012

Countries of Operation: United Kingdom

Number of Investments: 567

Number of Exits: 13

Funds raised: £14.1M

Focus of SFC Capital

Stages: SFC Capital focuses on an early-stage investment firm, including pre-seed and seed rounds.

Industries: AI & ML, Entertainment, Fintech, Healthcare, Media, SaaS, Productivity, Cybersecurity, Developer Tools

Investment size of SFC Capital

SFC Capital’s investment size is £30 million

Minimum cheque size: £100,000

Maximum cheque size: £300,000

Notable Investments:

Grandnanny, Bot-Hive, Mayku, Onfido, Cognism, Humanising Autonomy, and Vertical Future.

Contact

Website: https://sfccapital.com/

Email: info@sfccapital.com

Well, that was our list of venture capital firms in UK that are willing to invest in your early-stage startup. Remember, venture capital firms don’t just invest in ideas; They invest in people, and that is why you need to pitch a local investor before going to international vcs. For the same reason, you need to make sure you are prepared enough before pitching an investor.

Formulate your startup team structure, figure out the equity, do market research for the startup, and find out the potential. Those are the things that investors would want to see at this stage.

Last but not least, figure out the way you want to develop your product, you may consider outsourcing your development efforts or setting up an in-house development team. In that case, finalize how you will hire developers.

Figure all those factors out, and discuss with an expert if you have to. Remember, funding is hard to come by, but with solid preparation, it is possible to get people to believe in your vision.

Best of Luck!

![15 United States Saas Venture Capital Firms for Startups[2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/04/Saas-Venture-Capital-Firms-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)

![13 Top Amsterdam Venture Capital Firms for Early-Stage Startups [2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/05/Amsterdam-venture-capital-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)

![18 San Francisco Venture Capital Firms for Early-Stage Startups[2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/04/Best-San-Francisco-Venture-Capital-Firms-1-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)

![15 Top Berlin Venture Capital Firms for Early-Stage Startups [2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/04/Berlin-Venture-Capital-Firms-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)

![9 Top Saudi Arabia Venture Capital Firms for Early-Stage Startups [2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/05/Saudi-Arabia-Venture-Capital-Firms-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)

![15 Houston Venture Capital Firms for Early-Stage Startups[2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/03/Best-Venture-Capital-Firms-in-Miami-for-Early-Stage-Startups-1-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)