15 United States Saas Venture Capital Firms for Startups[2024]

Discover the top 15 United States SaaS Venture Capital firms ready to support your early-stage startup not only financially but also technically.

The United States stands as a global powerhouse of venture capital. It’s dynamic economy, supportive regulatory environment, and culture that celebrates risk-taking attracts top-tier investors.

It also fosters the growth of pioneering startups across diverse sectors, including Software as a Service (SaaS). Forecasts show that the SaaS industry will grow from $130 billion in 2021 to $716 billion in 2028.

If you are a Saas startup founder in the US and looking for funding, we have prepared a list of the top 15 Saas venture capital in the US.

15 Early-Stage United States Saas Venture Capital Firms

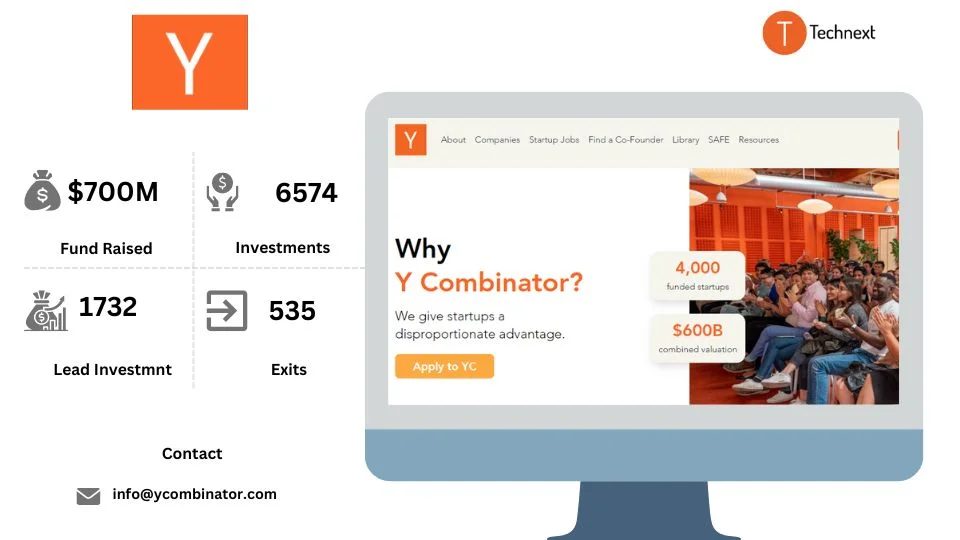

1. Y Combinator

Y Combinator is one of the best startup SAAS venture capital firms in the world. They help entrepreneurs to create connections with other investors. They are providing mentorship and funding to companies across all sectors. They also have programs and resources that support founders throughout the life of their company.

Twice a year, they invest $500k in each startup they take on. They focus on those struggling with the seed stage, working intensively with those startups for three months to help them get on their feet. So far, they have invested in more than 3,000 companies and partnered with over 6,000 founders since 2005.

.

Details of Y Combinator

Foundation Year: 2005

Countries of Operation:

- USA

Number of Investments: 6574

Lead Investments: 1732

Number of Exits: 535

Funds raised: $700M

Minimum cheque size: $500,000

Focus of Y Combinator

Stage

- Debt

- Early Stage Startup

- Seed

Industries

- Enterprise

- SaaS

- Big Data & Analytics

- Productivity

- DTC

- Cybersecurity

- Supply Chain & Logistics

- Education

- Consumer

- Food & Beverage

- Gaming

- Future of Work

- Social

- Transportation

- Travel & Hospitality

- AR & VR

- Healthcare

- Health & Wellness

- Biotech

- Fintech

- InsurTech

- Industrial

- Aerospace & Space

- Climate & Sustainability

- Robotics

- Government Technology

- Manufacturing

- Infrastructure

- Legal

- Marketing

- Agriculture

- Automotive

- Energy

Notable Investments

1. Reddit

URL: redditinc.com

Funding Rounds: 10

Total Funding: $1.3B

2. Coinbase

URL: coinbase.com

Funding Rounds: 19

Total Funding: $678.7M

3. Airbnb

URL: airbnb.com

Funding Rounds: 30

Total Funding: $6.4B

Contact

Website: https://www.ycombinator.com/

Email: info@ycombinator.com

Phone: (415) 598-7720

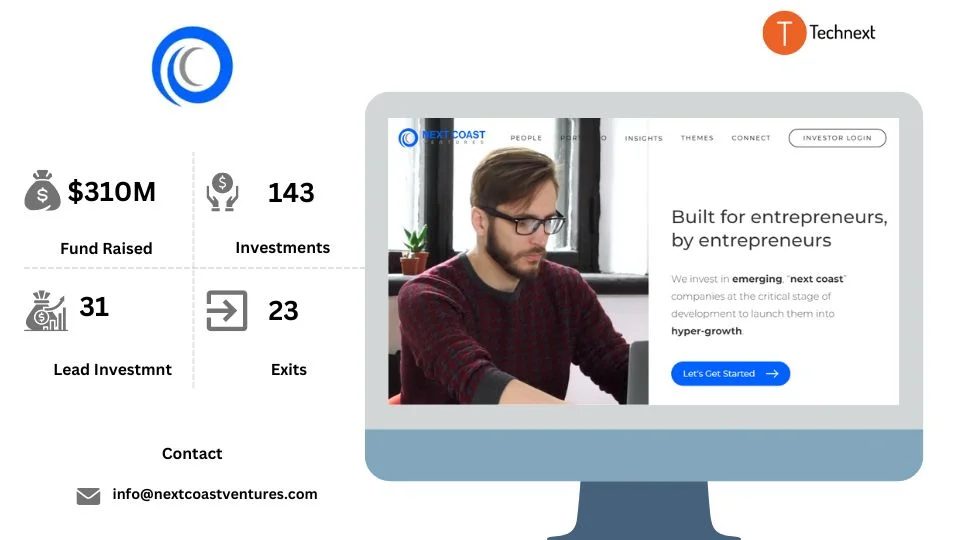

2. Next Coast Ventures

Next Coast Ventures is a renowned SAAS venture capital firm based in Austin, Texas. Their investment strategy is centered on macro trends and themes. They enjoy working with entrepreneurs who are prepared to take chances and create new enterprises. They also work very closely with their portfolio companies throughout their journey. Most importantly, they not only provide funds but also provide mentorship and access to their network.

Details of Next Coast Ventures

Foundation Year: 2015

Countries of Operation:

- United States

- Australia

Number of Investments: 143

Lead Investments: 31

Number of Exits: 23

Funds raised: $310M

Focus of Next Coast Ventures

Stage

- Early Stage Startup

- Late Stage Startup

Industries

- Health & Wellness

- Marketplace

- Future of Work

- Consumer,

- Enterprise

- DTC

- SaaS

Notable Investments

1. CoreChain Technologies

URL: corechain.tech

Rounds: 2

Total Funding: $5.5M

2. Diligent Robotics

URL: diligentrobots.com

Rounds: 8

Total Funding: $71.6M

3. Osano

URL: osano.com

Rounds: 4

Total Funding: $44.4M

Contact

Website: nextcoastventures.com/

Email: info@nextcoastventures.com

3. S3 Ventures

S3 Ventures is a prominent software venture capital firm situated in Austin, Texas. Members of their team are proven business people with extensive expertise. They help entrepreneurs in building high-impact companies. Also, they have invested in startups with patient funding, resources, and industry knowledge. Interestingly, they have been supported from the beginning by a single philanthropic family with a multibillion-dollar foundation.

Details of S3 Ventures

Foundation Year: 2006

Countries of Operation:

- United States

- Canada

Number of Investments: 110

Lead Investments: 56

Number of Exits: 29

Funds raised: $2.1B

Investment size: $500K to $10M

Focus of S3 Ventures

Stage

- Early Stage Startup

- Late Stage Startup

Industries

- Business Technology

- Digital experiences

- Healthcare technology sectors

Notable Investments

1. Atmosphere

URL: atmosphere.tv

Rounds: 5

Total Funding: $184M

2. Pivot3

URL: pivot3.com

Rounds: 16

Total Funding: $273.4M

3. Levelset

URL: levelset.com

Rounds: 6

Total Funding: $46.8M

Contact:

Website: s3vc.com/

Email: s3ventures@treblepr.com

Address:

6300 Bridge Point Pkwy

Building 1, Suite 405

Austin, TX 78730, United States

Phone number: +1 (512) 258-1759

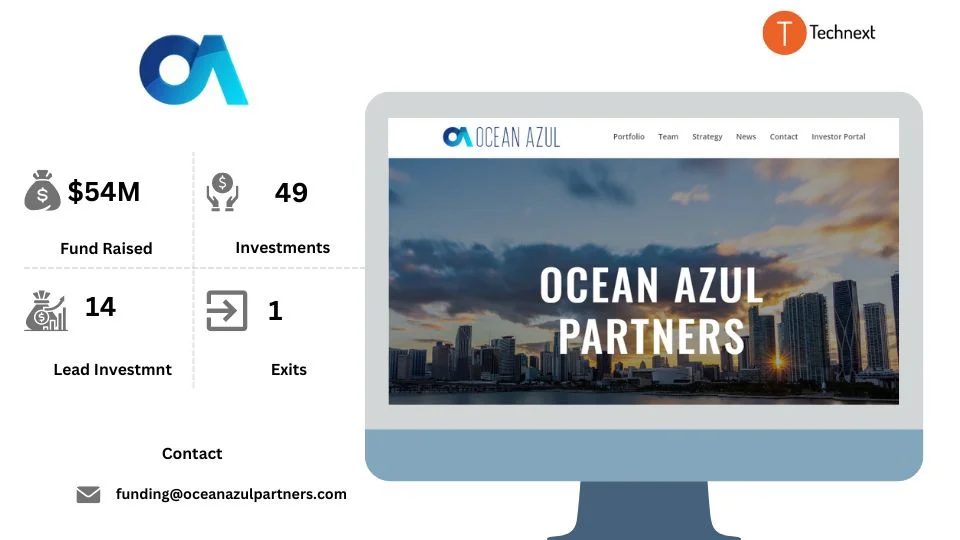

4. Ocean Azul Partners

Ocean Azul Partners is an early-stage renowned SAAS VC firm. They are passionate about helping entrepreneurs bring innovative technology solutions to market. They value the team’s quality as much as the product and market opportunity. When they invest in founders, they commit to a long-term partnership.

They are also helpful to entrepreneurs at every level, from introductions to potential clients to strategic guidance. Besides that, all of their team members have an extensive network that will assist you in becoming successful.

Details of Ocean Azul Partners

Foundation Year: 2017

Countries of Operation:

- United States

- Australia

- Israel

Number of Investments: 49

Lead Investments: 14

Number of Exits: 1

Funds raised: $54M

Investment size: $200,000–$3M

Focus of Ocean Azul Partners

Stage

- Early-Stage Startup

- Seed

- Convertible Note

Industries

- FinTech

- Life Sciences

- Healthcare

- Real Estate and Construction Tech

- Business Services

- Environment Tech

- Travel and Hospitality Tech

- Enterprise Infrastructure

- Media & Entertainment

- Blockchain Technology

- Food and Agriculture Tech

Notable Investments

1. Fohlio

Website: babysparks.com

Funding Rounds: 3

Total Funding: $3.4M

2. Bandwango

Website: bandwango.com

Funding Rounds: 5

Total Funding: $8.2M

3. Fortify

Website: 3dfortify.com

Funding Rounds: 8

Total Funding: $45M

Contact

Website: https://oceanazulpartners.com/

Email: funding@oceanazulpartners.com

Address:

255 Alhambra Cir, Suite 340

Coral Gables, FL 33134

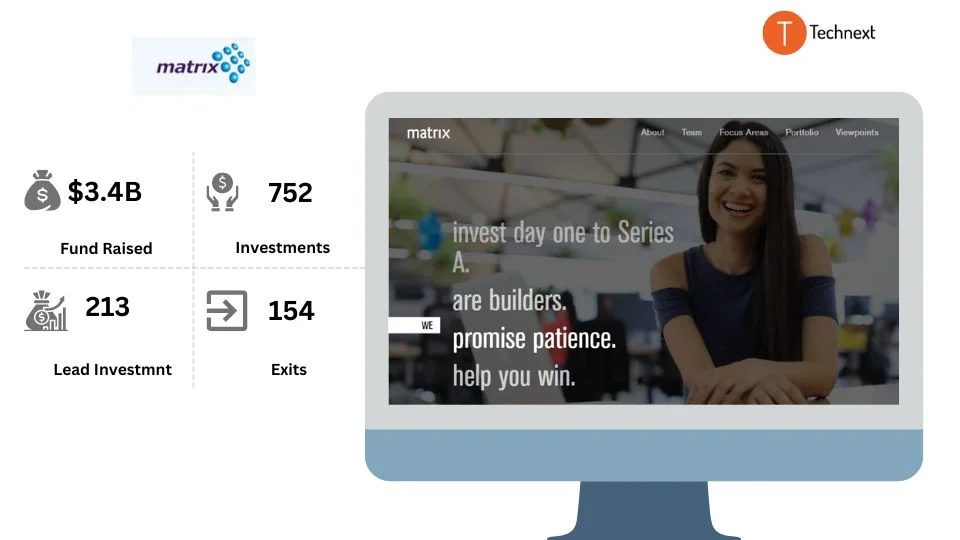

5. Matrix

Matrix is a significant player in SaaS investment. Over 40 years of the journey, they have gathered different knowledge and experiences making the one of the top saas investors. And they are always ready to help tech entrepreneurs with their knowledge and experiences to turn their ideas into reality. As entrepreneurs themselves, the Matrix team has faced all of the challenges that come with launching a new business.

Overall, they have invested over $4 billion and helped hundreds of companies from pre-seed to Series A rounds. Besides that, they focus on company building and forming long-term relationships with founders because, at the end of the day, founders’ success ultimately matters to them.

Details of Matrix:

Foundation Year: 1977

Number of Investments: 752

Lead Investments: 213

Number of Exits: 154

Funds raised: $3.4B

Focus of Matrix:

Stage

- Early Stage Startup

- Seed

Industries

- Computer Vision

- Consumer

- Enterprise

- FinTech

- Internet

Notable Investments

1. Canva

URL: canva.com

Funding Rounds: 15

Total Funding: $572.6M

2. HubSpot

URL: hubspot.com

Funding Rounds: 6

Total Funding: $100.5M

3. Zendesk

URL: zendesk.com

Funding Rounds: 8

Total Funding: $85.5M

Contact

Website: https://matrix.vc/

Phone Number: (650) 798-1600

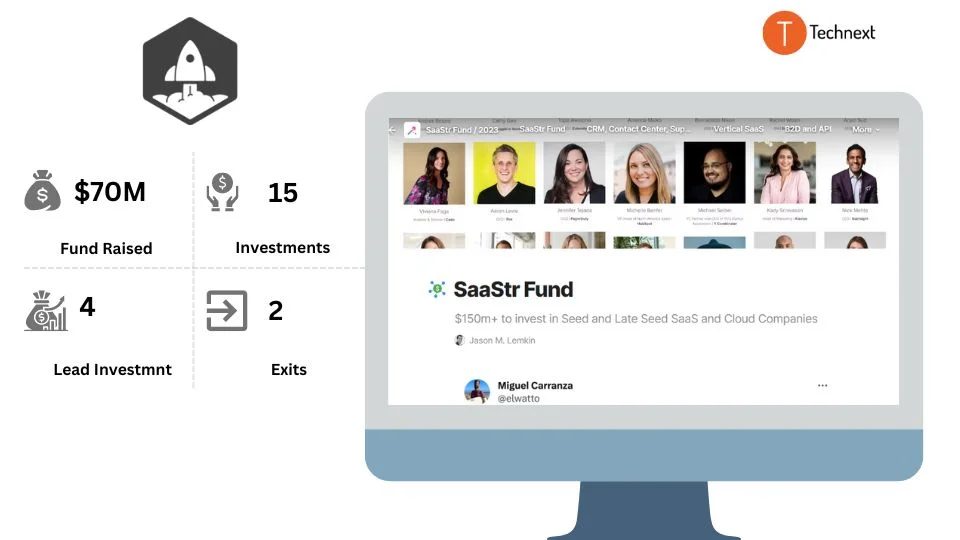

6. SaaStr Fund

SaaStr Fund is a renowned SAAS venture capital firm. They strongly prefer to invest in more diverse and inclusive teams. Also, they invest in 4-5 awesome SaaS startups annually, generally in the $0.1m to $2m ARR range. Besides that, they use their resources and experience to help entrepreneurs launch and scale their SaaS startups.

In addition to the $500,000 and $6 million the SaaStf Fund invests per startup, the fund’s participants also offer their support and expertise through every stage of development.

SaaS startups that SaaStr Fund has been involved with include RevenueCat, which offers in-app subscription support; Algolia, an AI-powered search engine platform; and Talkdesk, a leading call center software solution.

Details of SaaStr Fund

Foundation Year: 2016

Countries of Operation:

- United States

- Estonia

Number of Investments: 15

Lead Investments: 4

Number of Exits: 2

Funds raised: $70M

Focus of SaaStr Fund

Stage

- Early Stage Startup

- Seed

Industries

- Enterprise Applications

- Auto Tech

Notable Investments

1. Owner

URL: owner.com

Funding Rounds: 6

Total Funding: $29.2M

2. Mapistry

URL: mapistry.com

Funding Rounds: 5

Total Funding: $4

3. Algolia

URL: algolia.com

Funding Rounds: 8

Total Funding: $334.2M

Contact:

Website: https://coda.io/@jasonmlemkin/saastrfund/

Phone: (510) 409-4863

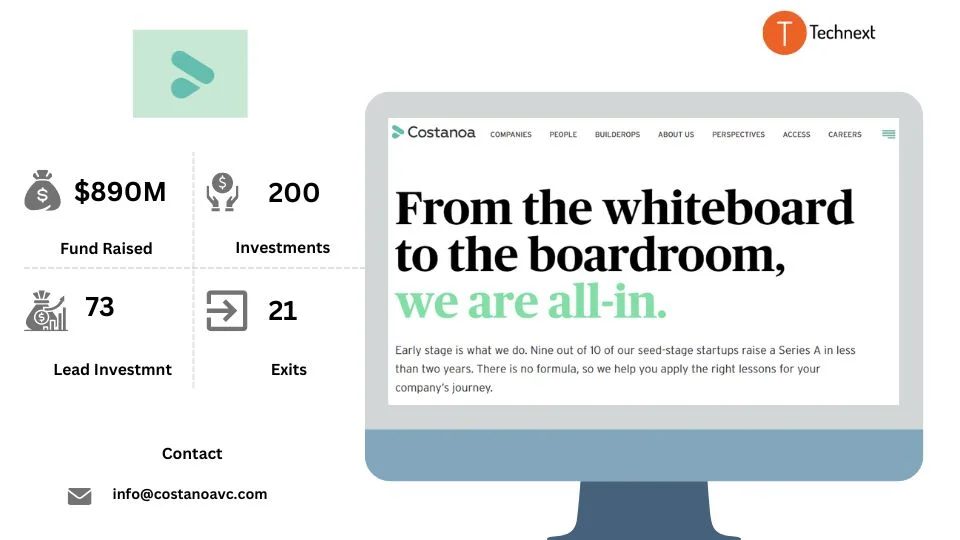

7. Costanoa Ventures

Costanoa Ventures is a California-based SAAS VC company founded in 2012. They provide early-stage funding predominantly to SaaS entrepreneurs with disruptive ideas. Their team of experts offers its expertise to help guide you through every stage of development. Their primary goal is to help you accelerate your goals and get to market faster. 90% of Costanoa Ventures’ seed-stage startups are investing predominantly in cloud-based startups, raising a Series A within two years.

.

Details of Costanoa Ventures

Foundation Year: 2012

Countries of Operation:

- USA

Number of Investments: 200

Lead Investments: 73

Number of Exits: 21

Funds raised: $890M

Minimum cheque size: $2,000,000

Maximum Cheque Size: $5,000,000

Focus of Costanoa Ventures

Stage

- Early Stage Startup

- Seed

Industries

- Fintech

- AI & ML

- SaaS

- Future of Work

- DevOps

Notable Investments

1. StackHawk

URL: stackhawk.com

Funding Rounds:

Total Funding: $35.3M

1. Return Path

URL: returnpath.com

Funding Rounds: 14

Total Funding: $126.4M

3. Kenna Security

URL: kennasecurity.com

Funding Rounds: 6

Total Funding: $98.3M

Contact

Website: https://costanoa.vc/

Email: info@costanoavc.com

Phone: (650) 388-9310

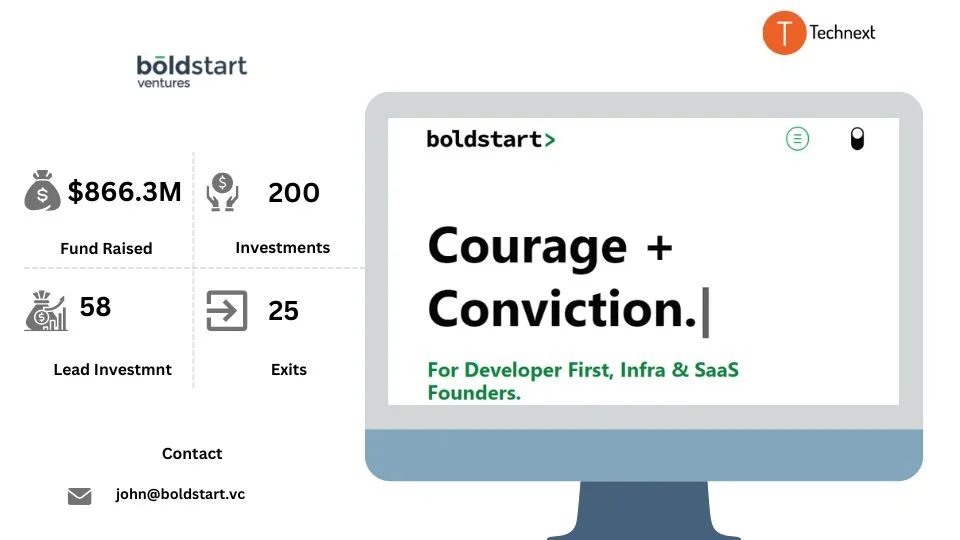

8. BoldStart Ventures

BoldStart Ventures is a New York-based VC company that provides seed funding in the tech marketplace. They prefer to work with tech founders who are passionate about solving challenges. Which makes them one of the best saas venture capital. Their advisory board helps entrepreneurs identify pain points and offer targeted advice based on their findings. Besides that, they collaborate closely with technical founders before a company is formally established.

Details of BoldStart Ventures

Foundation Year: 2010

Countries of Operation:

- United States

- Canada

- United Kingdom

- Austria

- Belgium

- Germany

- Sweden

Number of Investments: 200

Lead Investments: 58

Number of Exits: 25

Funds raised: $866.3M

Minimum check size: $500,000

Maximum check size: $5,000,000

Focus of BoldStart Ventures

Stage

- Seed

- Early Stage Startup

- Late Stage Startup

Industries

- SaaS

- Cybersecurity

- Crypto

- Blockchain

- API

- Developer Tools

Notable Investments:

1. Spectro Cloud

URL: spectrocloud.com

Funding Rounds: 4

Total Funding: $67.5M

2. Robin

URL: robinpowered.com

Funding Rounds: 1

Total Funding: $59.1M

3. Kustomer

URL: kustomer.com

Funding Rounds: 7

Total Funding: $233.5M

Contact

Website: https://boldstart.vc/

Email: john@boldstart.vc

Phone Number: 877-342-7222

9. OpenView

OpenView is a growth-stage Saas venture capital firm. They are speeding up the growth of SaaS companies. They target seven to nine new investments each year. By limiting their efforts, their team can provide concentrated support, ensuring each investment results in success. Also, they provide their extensive knowledge and experiences to their entrepreneurs.

But the support doesn’t stop there. They also provide access to their expansion platforms, helping companies hire top talent and grow their customer base and network.

.

Details of OpenView

Foundation Year: 2006

Countries of Operation:

- USA

Number of Investments: 154

Lead Investments: 69

Number of Exits: 35

Funds raised: $2B

Focus of OpenViewates

Stage

- Debt

- Early Stage Startup

- Late Stage Startup

Industries

- SAAS

Notable Investments

1. Tebra

URL: tebra.com

Funding Rounds: 3

Total Funding: $137M

2. JumpCloud

URL: jumpcloud.com

Funding Rounds: 12

Total Funding: $416.8M

3. Expensify

URL: we.are.expensify.com

Funding Rounds: 9

Total Funding: $138.2M

Contact

Website: https://openviewpartners.com/

Email: info@openviewpartners.com

Phone: (617) 478 7500

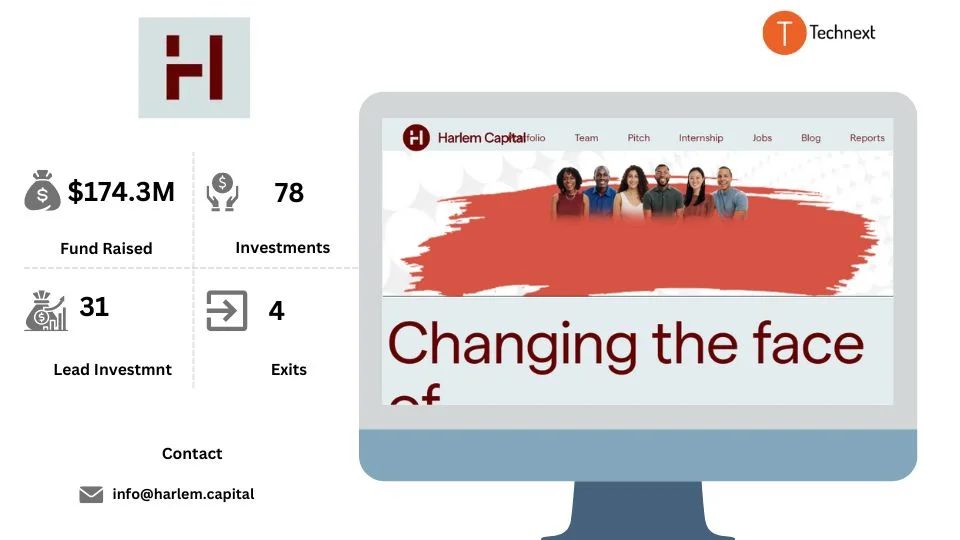

10. Harlem Capital Partners

Harlem Capital Partners is a micro-venture capital firm based in Harlem. They are a dedicated group of diverse investors. They focus on minority and women founders. Their unique approach makes them one of the best saas venture capital firms They are on a mission to diversify the business ecosystem, with a goal to invest in 1,000 minority entrepreneurs over the next twenty years. By addressing the disparities in business, the company has given a voice to innovative founders who would otherwise have remained silent. Furthermore, they assist entrepreneurs through their knowledge and experience in business, finance, media, and networking.

Details of Harlem Capital Partners Center

Foundation Year: 2015

Countries of Operation:

- USA

Number of Investments: 78

Lead Investments: 31

Number of Exits: 4Funds raised: $174.3M

Focus of Harlem Capital Partners

Stage

- Early Stage Startup

- Seed

Industries

- Finance

- Financial Services

- Venture Capital

Notable Investments

1. Lami

URL: lami.world

Funding Rounds: 4

Total Funding: $5.6M

2. Portabl

URL: getportabl.com

Funding Rounds: 1

Total Funding: $3.2M

3. Drip

URL: dripshop.live

Funding Rounds: 2

Total Funding: $28.5M

Contact

Website: https://harlem.capital/

Email: info@harlem.capital

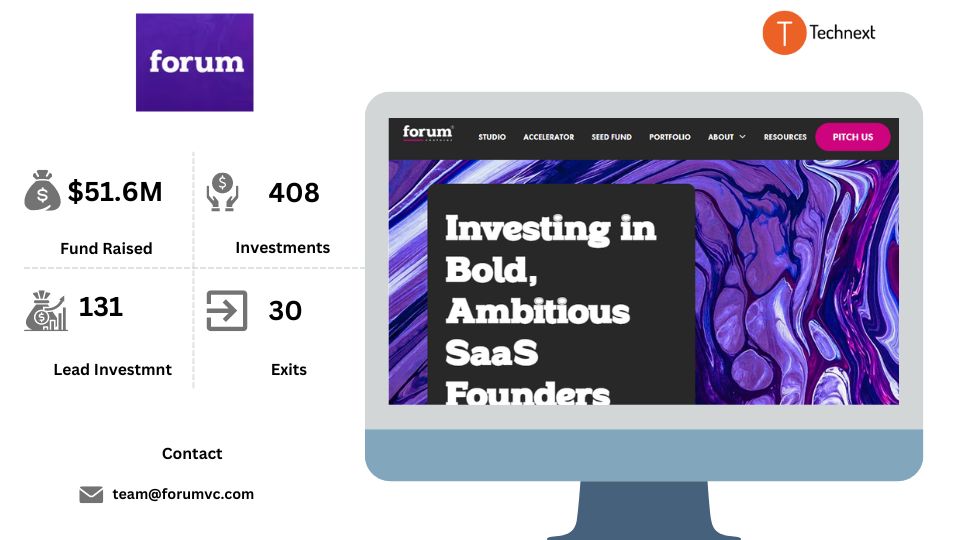

11. Forum Ventures

Forum Ventures (formerly Acceleprise) is a renowned SaaS venture capital firm. They invest in early-stage B2B companies that offer disruptive SaaS solutions. This firm is led by a team of entrepreneurs who have built their own successful SaaS startups. Forum Ventures has built an international community of experts who are there to lend support and guidance through every stage of your journey. Besides that, to ensure every SaaS startup’s success, they offer investment options and an accelerator program.

Details of Forum Ventures

Foundation Year: 2012

Countries of Operation:

- United States

- Canada

Number of Investments: 408

Lead Investments: 131

Number of Exits: 30

Funds raised: $51.6M

Focus of Forum Ventures

Stage

- Early Stage Startup

- Seed

Industries

- B2B

- E-Commerce

- Finance

- Financial Services

- Health Care

- Manufacturing

- Marketing

- Retail

- SaaS

- Software

Notable Investments

1. Bbot

URL: bbot.menu

Funding Rounds: 7

Total Funding: $22.2M

2. StayNTouch

URL: stayntouch.com

Funding Rounds: 7

Total Funding: $36.4M

3. Aquicore

URL: aquicore.com

Funding Rounds: 7

Total Funding: $36.4M

Contact

Website: https://www.forumvc.com/

Email: team@forumvc.com

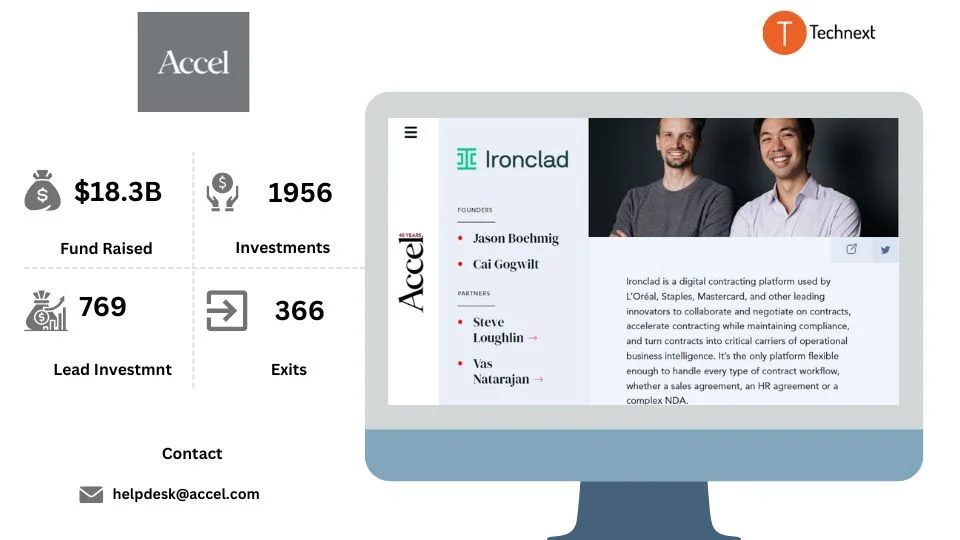

12. Accel

Accel is a seed and growth-stage SAAS venture capital firm. They help ambitious entrepreneurs build iconic global businesses. They prefer to invest in early-stage companies. They have additional offices in San Francisco, California, London, the United Kingdom, Bangalore and India. Since the beginning, over 40 years ago, the Accel team has worked with some of today’s most recognized names in the tech industry. Their seed and early-stage investments include Facebook, Slack, and Dropbox. In March of 2022, Accel made news with its $650 million investment fund for Southeast Asian and Indian start-ups.

Details of Accel

Foundation Year: 1983

Countries of Operation:

- United States

- India

Number of Investments: 1956

Lead Investments: 769

Number of Exits: 366

Funds raised: $18.3B

Focus of Accel

Stage

- Early Stage Startup

- Late Stage Startup

- Seed

Industries

- Finance

- Financial Services

- Venture Capital

Notable Investments

1. Spotify

URL: hubspot.com

Funding Rounds: 6

Total Funding: $100.5M

2. Slack

URL: slack.com

Funding Rounds: 13

Total Funding: $1.4B

3. Deliveroo

URL: deliveroo.co.uk

Funding Rounds: 13

Total Funding: $1.7B

Contact

Website: https://www.accel.com/relationships/ironclad

Email: helpdesk@accel.com

Phone Number: 650-614-480

13. Bessemer Venture Partners

Bessemer Venture Partners is a famous SAAS venture capital firm based in Redwood City, California. They have good partnerships with founders all around the world. They prefer to team up with creative companies that have big ideas to change the way we live, work, and do business.

They always support founders with unique ideas, unique thinking, and different perspectives. They have invested in and helped grow superior SaaS products like Shopify, Twilio, and PagerDuty. Also, they have taken part in 130 IPOs over the past five decades. Consider Bessemer Venture Partners if you want a SaaS investor who understands the intricacies of developing your company.

Details of Bessemer Venture Partners

Foundation Year: 1911

Countries of Operation:

- USA

- India

- Israel

- United Kingdom

Number of Investments: 1699

Lead Investments: 473

Number of Exits: 300

Funds raised: $14.3B

Minimum cheque size: $2,000,000

Maximum Cheque Size: $8,000,000

Focus of Bessemer Venture Partners

Stage

- Early Stage Startup

- Late Stage Startup

Industries

- Consumer

- Enterprise

- Healthcare

- Cloud

Notable Investments

1. PagerDuty

URL: pagerduty.com

Funding Rounds:8

Total Funding: $523.6M

2. Procore

URL: procore.com

Funding Rounds: 17

Total Funding: $654M

3. Rocket Lab

URL: rocketlabusa.com

Funding Rounds: 7

Total Funding: $712.4M

Contact

Website: https://www.bvp.com/

Email: businessplans@bvp.com

Phone: +1 415 800 8982

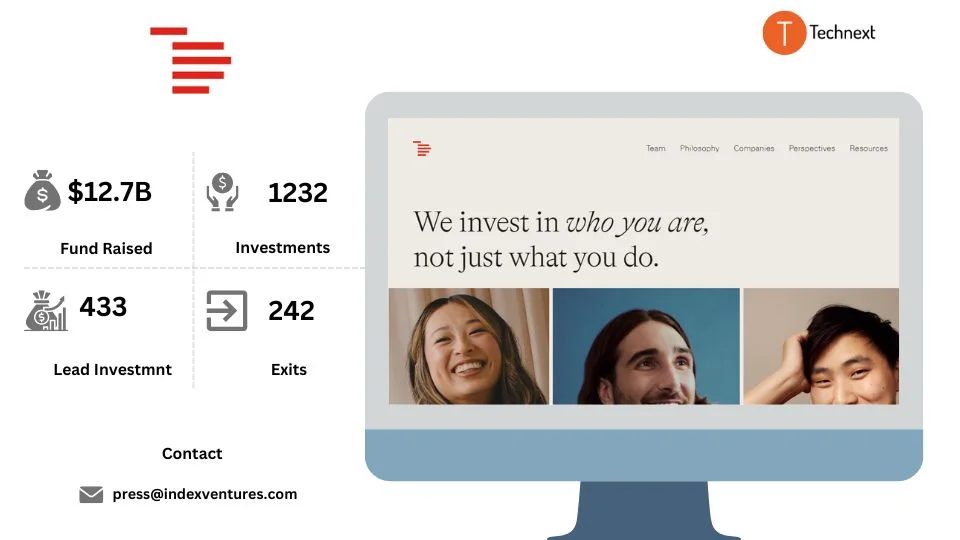

14. Index Ventures

Index Venture was established in 1996 by Neil Rimer, David Rimer, and Giuseppe Zocco. They are helping entrepreneurs to turn innovative ideas into global business which makes them one of the top saas investors. They just don’t invest in ideas; they invest in the innovators behind the ideas. They take a more personal approach, forging powerful relationships with the people they back. Through collaboration, they’ve taken companies from seed to IPO and turned entrepreneurs into global industry leaders.

Details of Index Ventures

Foundation Year: 1996

Countries of Operation:

- USA

- United Kingdom

Number of Investments: 1232

Lead Investments: 433

Number of Exits: 242

Funds raised: $12.7B

Minimum cheque size: $1,000,000

Maximum Cheque Size: $1,000,000

Focus of Index Ventures

Stage

- Early Stage Startup

- Late Stage Startup

- Seed

Industries

- AI & ML

- Entertainment

- Fintech

- Healthcare

- Media

- SaaS

Notable Investments

1. Etsy

URL: etsy.com

Funding Rounds: 9

Total Funding: $97.3M

2. Dropbox

URL: dropbox.com

Funding Rounds: 11

Total Funding: $1.7B

3. Deliveroo

URL: deliveroo.co.uk

Funding Rounds: 13

Total Funding: $1.7B

Contact

Webs

Website: https://www.indexventures.com/

Email: press@indexventures.com

Phone: 415-471-1700

15. FJ Labs

FJ Labs is a renowned saas venture capital with over 30 of their investments have turned into unicorns. They are looking for motivated founders who want to solve critical problems. They look for founders who are passionate, determined and have the ability to make their ideas into reality. Also, they believe in human integrity and support entrepreneurs with all their resources and knowledge.

Besides that, they want to invest in all stages of development in any sector or geography. They currently have the world’s largest portfolio of marketplace businesses.

Details of FJ Labs

Foundation Year: 2015

Countries of Operation:

- United States

- France

Number of Investments:1573

Lead Investments: 55

Number of Exits: 88

Funds raised: $5.5M

Minimum cheque size: $400,000

Maximum Cheque Size: $400,000

Focus of FJ Labs

Stage

- Early Stage Startup

- Seed

Industries

- Internet & Mobile

- Gaming

- Crypto & Blockchain

- Fintech

- SaaS

Notable Investments

1. Bodily

URL: itsbodily.com

Funding Rounds: 2

Total Funding: $7.8M

2. Passionfruit

URL: usepassionfruit.com

Funding Rounds: 2

Total Funding: $5M

3. Neol

URL: neol.co

Funding Rounds: 1

Total Funding: $5.2M

Contact

Website: https://www.fjlabs.com/

Email: team@fjlabs.com

Phone: (415) 769-9219

This is our list of venture capital firms that can get your startup running. As we all know Inflation in the United States peaked at 9.1% in 2022, and during the second quarters of 2021 and 2022, the number of unicorns dropped by 43%.

Funding can be challenging to secure, so, prepare yourself. Start by determining the equity, structuring the startup’s team, conducting market research, and assessing the venture’s potential.

Remember to determine whether you want an in-house team or outsourcing. In that case, finalize how you will hire developers. Make sure to consult with an expert while figuring out all of these components.

Hopefully, you will be successful in finding your SaaS venture capital.

![13 Top Australia Venture Capital Firms for Early-Stage Tech Startups [2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/03/Top-Software-Companies-in-Bangladesh--768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)

![15 Top Berlin Venture Capital Firms for Early-Stage Startups [2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/04/Berlin-Venture-Capital-Firms-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)

![18 San Francisco Venture Capital Firms for Early-Stage Startups[2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/04/Best-San-Francisco-Venture-Capital-Firms-1-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)

![13 Top Dubai Venture Capital Firms for Early-Stage Startups [2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/05/Dubai-Venture-Capital-Firms-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)