15 Saas Venture Capital Firms in Canada Invest in SaaS Products

Are you looking for SaaS VC firms in Canada for your early-stage startup? Check out the 15 promising options we’ve generated.

Canada’s startup ecosystem is flourishing, attracting ambitious founders and savvy investors alike. Fueled by a highly educated workforce, government support programs, and a culture of innovation, Canada boasts a unique environment for SaaS businesses to thrive.

In 2022 alone, the venture capital landscape saw a staggering $9.42 billion in disbursements, solidifying Canada’s position as a major player in the global tech scene.

This guide dives into the top 15 VC firms in Canada specifically focused on SaaS ventures. Whether you’re a budding entrepreneur seeking seed funding or a seasoned leader ready for Series A and beyond, this list will connect you with the investment partners best equipped to propel your SaaS startup toward success.

15 Early-Stage Canada Saas Venture Capital Firms

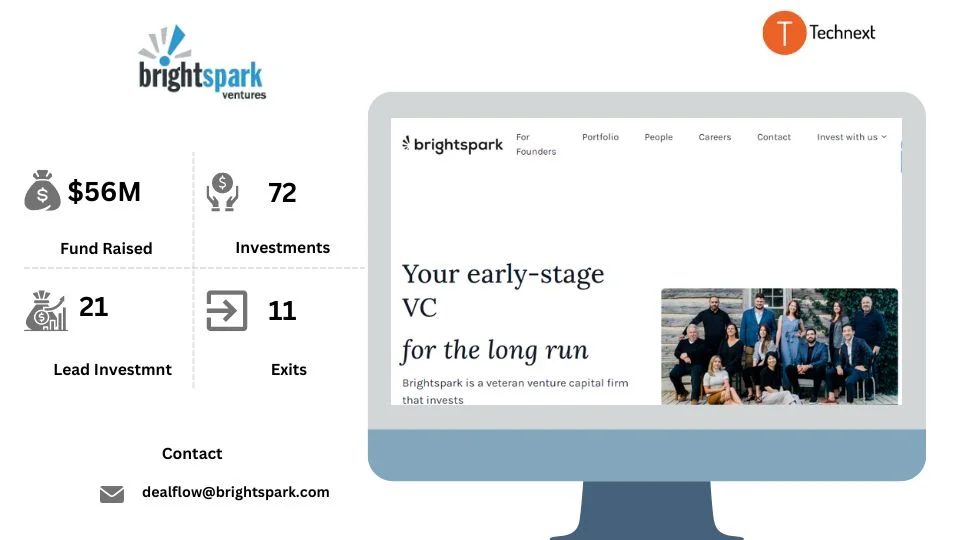

1. BrightSpark Ventures

Brightspark Ventures invests in early-stage Canadian software companies. They have been investing in the Canadian VC industry since 1999. As one of the top saas venture capitals in Canada, their goal is to find great startups and work closely with these companies. By actively working as the company’s gatekeepers, they ensure that the company can grow to its full potential without getting sidetracked or losing its focus. Also, they have built a world-class investor relations team. Besides that, they provide ongoing education for tech investors to keep up to date with the latest trends.

.

Details of BrightSpark Ventures

Foundation Year: 1999

Countries of Operation:

- Canada

Number of Investments: 72

Lead Investments: 21

Number of Exits: 11

Funds raised: $56M

Minimum check size: $500,000

Maximum check size: $1,500,000

Focus of BrightSpark Ventures

Stage

- Early Stage Startup

- Late Stage Startup

- Seed

Industries

- Internet & Mobile

- Consumer

- Hardware

- SaaS

Notable Investments

1. Nudge

URL: nudge.co

Funding Rounds: 5

Total Funding: $15.9M

2. Borderfree

URL: borderfree.com

Funding Rounds: 12

Total Funding: $729.7M

3. nGUVU

URL: genesys.com

Funding Rounds: 1

Total Funding: CA$3M

Contact

Website: https://www.ycombinator.com/

Email: info@ycombinator.com

Phone: (415) 598-7720

2. ScaleUp

ScaleUP Ventures is a popular Canada’s early-stage venture fund. Their focus is on early-stage venture capital with a preference for Business-to-Business opportunities. They support creative entrepreneurs and assist them with investments, which make them one of the best saas venture capitals in Canada. They not only help entrepreneurs with capital but also spend their knowledge and expertise to help their investors get into the market sooner and scale up faster.

Details of ScaleUp

Foundation year: 2016

Countries of Operation:

- Canada

Number of Investments: 61

Lead Investments: 11

Number of Exits: 5

Funds raised: $100M

Minimum check size: $2,000,000

Maximum check size: $10,000,000

Focus of ScaleUp

Stage

- Early Stage Startup

- Seed

Industries

- Fintech

- Enterprise

- SaaS

- Creator Economy

Notable Investments

1. Naborly

URL: naborly.com

Funding Rounds: 4

Total Funding: $13.5M

2. Canalyst

URL: canalyst.com

Funding Rounds: 4

Total Funding: $90M

3. Rewind

URL: rewind.com

Funding Rounds: 4

Total Funding: $80.1M

Contact

Website: https://suv.vc/

Email: christian@suv.vc

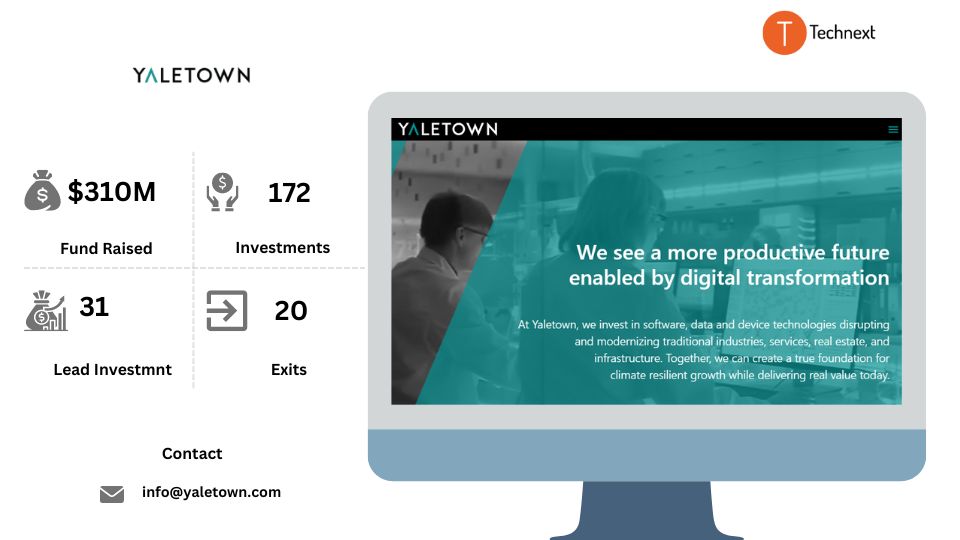

3. Yaletown Partners

Yaletown Partners is known for investing in software, data, and service technologies affecting various businesses. Whether your sector focuses on real estate or commerce, Yaletown wants to help clean tech businesses scale and achieve their maximum growth potential.

They have a broad network of past successful CEOs, industry leaders, and entrepreneurs worldwide. Also, they have experienced team members who will help you expand your company’s growth as the best Saas venture capital in Canada in 2024. Also, they have offices in Vancouver, Calgary, Montreal, and Toronto.

Details of Yaletown Partners

Foundation Year: 2001

Countries of Operation:

- Canada

Number of Investments: 172

Lead Investments: 31

Number of Exits: 20

Funds raised: $310M

Minimum cheque size: $2,000,000

Maximum Cheque Size: $5,000,000

Focus of Yaletown Partners

Stage

- Early Stage Startup

- Late Stage Startup

- Private Equity

- Seed

Industries

- AI & ML

- IoT

- SaaS

Notable Investments

1. Finn AI

URL: finn.ai

Funding Rounds: 4

Total Funding: $13.9M

2. Tasktop

URL: tasktop.com

Funding Rounds: 4

Total Funding: $129.5M

3. Shadow Networks

URL: shadownetworks.com

Funding Rounds: 3

Total Funding: $21.5M

Contact:

Website: https://yaletown.com/

Email: info@yaletown.com

Phone: +1-604-688-7807

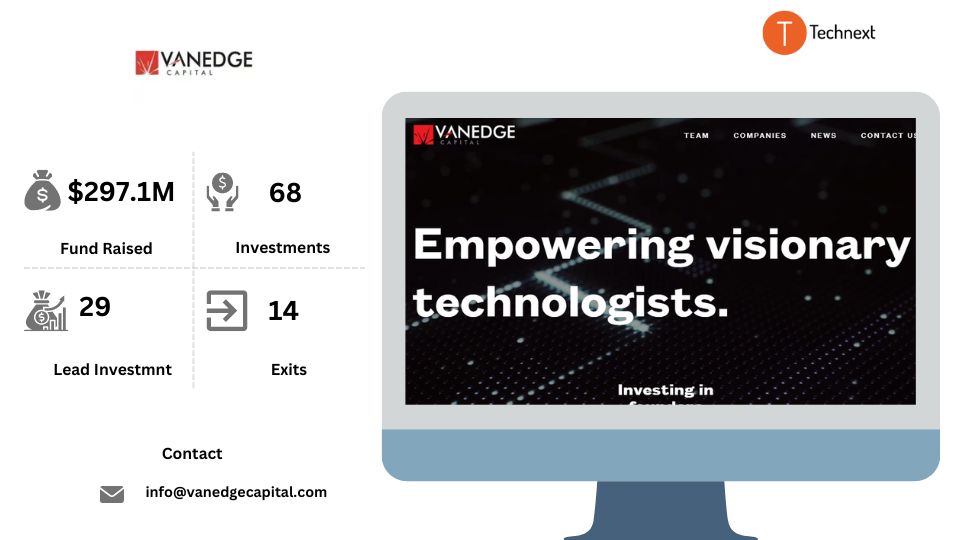

4. Vanedge Capital

Vanedge Capital is a venture capital firm based in Vancouver, Canada. They have built a great investing strategy that ensures top-notch returns for their investors. Their team members are experienced in technology and utilize their expertise to help companies grow and find potential investors. Besides that, the extensive technological experience of their talented team enables them to spot technological trends early on and uncover hidden gems.

Details of Vanedge Capital

Foundation Year: 2010

Countries of Operation:

- Canada

- USA

Number of Investments: 68

Lead Investments: 29

Number of Exits: 14

Funds raised: $297.1M

Minimum check size: $2,000,000

Maximum check size: $5,000,000

Focus of Ocean Azul Partners

Stage

- Early Stage Startup

- Late Stage Startup

- Seed

Industries

- Cloud Computing

- Cloud Infrastructure

- Cyber Security

- Digital Media

- Geospatial

- Internet of things

- Marketing Automation

- Saas

Notable Investments

1. HyTrust

URL: hytrust.com

Funding Rounds: 8

Total Funding: $108.5M

2. Boundless Spatial

URL: boundlessgeo.com

Funding Rounds: 3

Total Funding: $10.3M

3. Bitfusion.io

URL: vmware.com

Funding Rounds: 5

Total Funding: $9.4M

Contact

Website: https://www.vanedgecapital.com/

Email: info@vanedgecapital.com

Phone: +1 604 569 3813

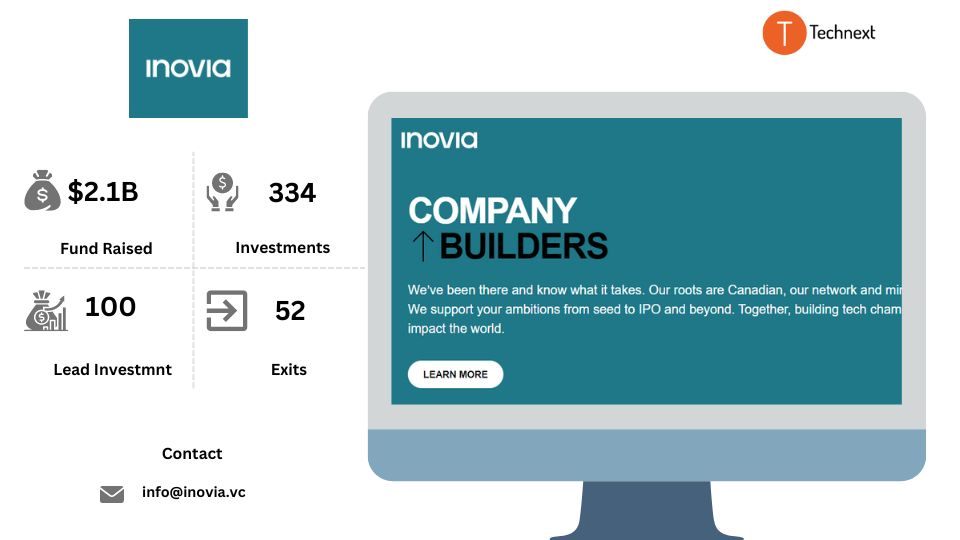

5. Inovia Capital

Inovia Capital is one of the best SAAS venture capitals in Canada adventure capital firm working with entrepreneurs to build influential, long-term businesses. They are willing to invest in different stages of a business’s lifecycle. They build partnerships with founders to build impactful and enduring global companies. They have four active venture funds, two growth funds, and a continuation fund. Also, they have an expanding team of investors, operators, and advisors. They are fully equipped to support founders with capital, insights, and mentorship throughout their journey.

Details of Inovia Capital:

Foundation Year: 2007

Countries of Operation:

- Canada

- USA

- United Kingdom

Number of Investments: 334

Lead Investment: 100

Number of Exits: 52

Funds raised: $2.1B

Focus of Inovia Capital:

Stage

- Early Stage Startup

- Late Stage Startup

Industries

- Internet & Mobile

- SaaS

- Robotics

- Crypto & Blockchain

- Cybersecurity

- Healthcare

Notable Investments

1. BenchSci

URL: benchsci.com

Funding Rounds: 10

Total Funding: $164.2M

2. Cohere

URL: cohere.com

Funding Rounds: 4

Total Funding: $434.9M

3. Bench

URL: bench.co

Funding Rounds: 8

Total Funding: $115M

Contact

Website: https://www.inovia.vc/

Email: info@inovia.vc

Phone: +1 514-982-2251

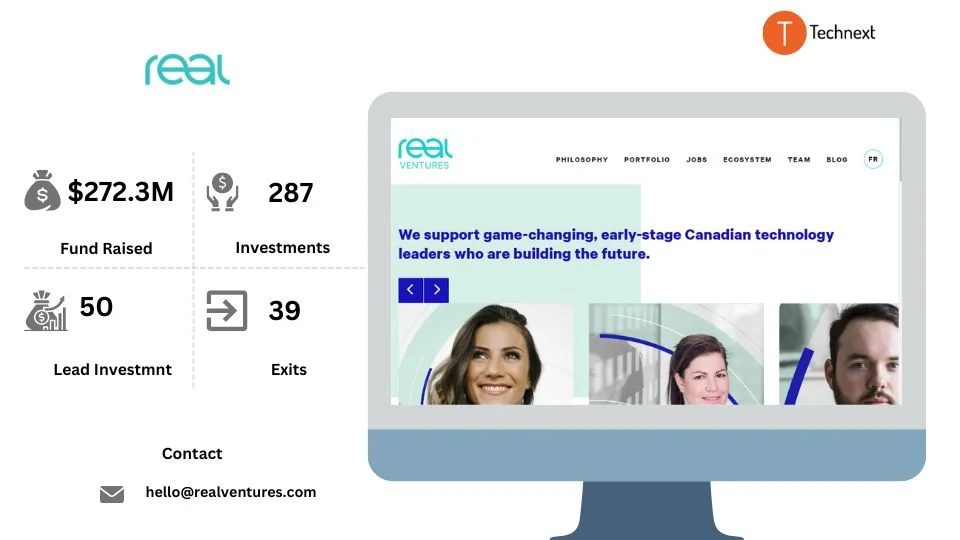

6. Real Ventures

Real Ventures is Canada’s leading early-stage VC firm. They focused on serving daring entrepreneurs with the ambition to create successful, global companies. They’re committed to helping entrepreneurs and nurturing the communities in which they thrive.

Since 2007, Real Ventures has dedicated itself to building the Canadian startup ecosystem, believing that people, not money, can build game-changing companies. They also provide guidance, mentorship, and access to networks and resources to founders to take their companies to the next level which makes them one of the top saas venture capitals in canada.

Details of Real Ventures

Foundation Year: 2007

Countries of Operation:

- Canada

- United States

Number of Investments: 287

Lead Investments: 50

Number of Exits: 39

Funds raised: $272.3M

Focus of Real Ventures

Stage

- Early Stage Startup

- Seed

Industries

- Angel Investment

- Finance

- Financial Services

- Incubators

- Venture Capital

Notable Investments

1. dcbel

URL: dcbel.energy

Funding Rounds: 3

Total Funding: $90M

2. HumanFirst

URL: humanfirst.ai

Funding Rounds: 1

Total Funding: CA$5M

3. BIOS

URL: bios.health

Funding Rounds: 9

Total Funding: $46.7M

Contact:

Website: https://realventures.com/

Email: hello@realventures.com

7. BDC Venture Capital

BDC Venture Capital is Canada’s largest and most active venture capital investor. They focus on technology-based enterprises with strong growth potential and the ability to become dominant players in their respective marketplaces. Their equity investment approach, expert advice, and vast network help Canadian technology innovators build world-class companies.

They are active at every stage of the company’s development cycle, from seed through expansion. They also help to create and develop strong Canadian businesses through financing, consulting services, and securitization.

Details of BDC Venture Capital

Foundation Year: 1975

Number of Investments: 1024

Lead Investments: 127

Number of Exits: 124

Funds raised: $1.1B

Focus of BDC Venture Capital

Stage

- Early Stage Startup

- Seed

Industries

- AgTech

- Angel Investment

- CleanTech

- Financial Services

- Venture Capital

- Waste Management

- Water

Notable Investments

1. Arteria AI

URL: arteria.ai

Funding Rounds: $40.9M

Total Funding: 3

2. Cognota

URL: cognota.com

Funding Rounds: 8

Total Funding: $12.6M

3. Miovision

URL: miovision.com

Funding Rounds: 10

Total Funding: $358M

Contact

Website: https://www.bdc.ca/en/bdc-capital/venture-capital

Email: socialmedia@bdc.ca

Phone: 877-232-2269

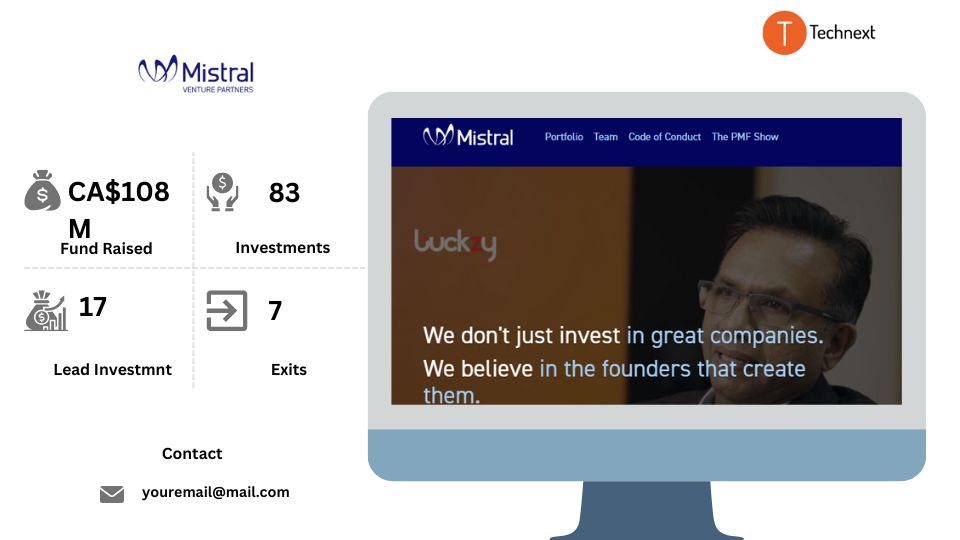

8. Mistral Venture Partners

Mistral Venture Partners is one of the few established seed-stage firms in Canada. Everyone on their team has been a founder of at least two startups and has a great network. They prefer to invest in startups that can tackle critical business problems regardless of the business model– B2B SaaS, enterprise software marketplaces, etc. They also like to partner with founders who value commitment and the highest standards of integrity and respect..

Details of Mistral Venture Partners

Foundation Year: 2013

Countries of Operation:

- Canada

- United States

Number of Investments: 83

Lead Investments: 17

Number of Exits: 7

Funds raised: CA$108M

Focus of Mistral Venture Partners

Stage

- Early Stage Startup

- Seed

Industries

- Software

- SaaS

- Internet

Notable Investments:

1. Expeto

URL: expeto.io

Funding Rounds: 6

Total Funding: $25.9M

2. Cookin

URL: cookin.com

Funding Rounds: 2

Total Funding: $17.6M

3. Buckzy Payments

URL: buckzy.net

Funding Rounds: 4

Total Funding: $23.5M

Contact

Website: https://mistral.vc/

Email: youremail@mail.com

9. E-Fund

The E-Fund was established in 2011. They were founded with the goal of achieving higher returns and more exits from angel investments. They invest in British Columbia-based ventures with unique technology, a validated product-market fit, a scalable business model, and a strong team. They offer a great way for accredited investors to get familiar with the unique opportunities, risks, and rewards of angel investing. They also involve specific investors in the investment due diligence process depending on their industry experience, knowledge, and particular technical expertise.

Details of E-Fund

Foundation Year: 2011

Countries of Operation:

- Canada

Number of Investments: 45

Lead Investments: 3

Number of Exits: 6

Focus of E-Fund

Stage

- Seed

- Pre-Seed

- Funding Round

Industries

- Health Care

- Medical Device

- Software

Notable Investments

1. Frontly

URL: frontly.ai

Funding Rounds: 1

Total Funding: CA$350K

2. Care2Talk

URL: care2talkhealth.com

Funding Rounds: 2

Total Funding: $1.3M

3. VoxCell BioInnovation

URL: voxcellbio.com

Funding Rounds: 5

Total Funding: $1.7M

Contact

Website: https://www.e-fund.ca/

Email: info@e-fund.ca

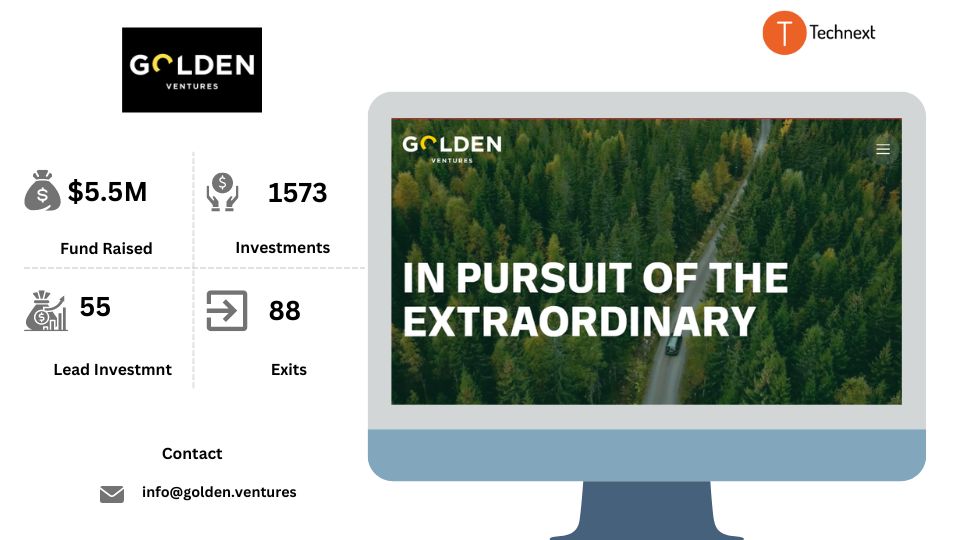

10. Golden Ventures

Golden Ventures made a name for itself as one of Canada’s most competitive VC firms. They are known for both its angel investments and seed funding all across North America, although they are headquartered out of Toronto.

They are very particular about choosing their partners. Also, they prefer to fund both startup companies and companies that need rescue, but their mission has to align with their beliefs. They provide funding to different types of companies and help them start, grow, sell, and everything in between. For those companies that want both investment and funding, Golden Ventures is the perfect VC firm to pitch.

Details of Golden Ventures

Foundation Year: 2011

Countries of Operation:

- Canada

- United States

- Japan

Number of Investments: 181

Lead Investments: 26

Number of Exits: 20

Funds raised: $247M

Focus of Golden Ventures

Stage

- Early Stage Startup

- Seed

Industries

- Software

- Artificial Intelligence

- Information Technology

Notable Investments

1. Ideogram

URL: ideogram.ai

Funding Rounds: 1

Total Funding: CA$22.3M

2. Shakudo

URL: shakudo.io

Funding Rounds: 2

Total Funding: CA$13.7M

3. Basil Systems

URL: basilsystems.com

Funding Rounds: 3

Total Funding: $1.5M

Contact

Website: https://www.golden.ventures/

Email: info@golden.ventures

Phone: 763-691-9699

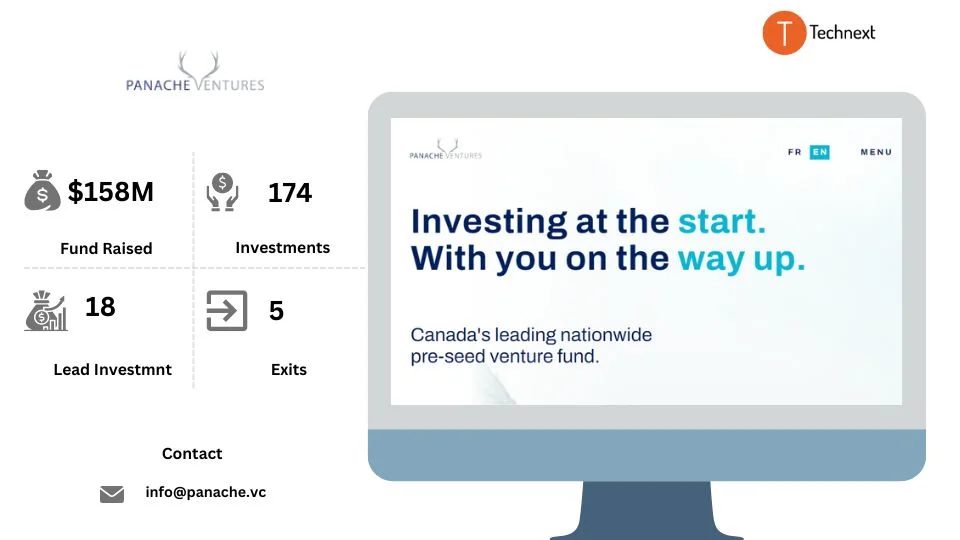

11. Panache Ventures

Panache Ventures is known as Canada’s top pre-seed venture fund. They prefer seed-stage companies that are currently working to decentralize, automate, and expand human capabilities. Their sector-agnostic view makes them so desirable and unique. They do not specialize in a single industry but rather have a diverse portfolio of businesses.

Some of their most successful businesses include the company Eli Health, which is working on innovating women’s health technology for hormone monitoring, and the B2B software company Lancey.

Details of Panache Ventures

Foundation Year: 2017

Countries of Operation:

- Canada

- United States

- Israel

Number of Investments: 174

Lead Investments: 18

Number of Exits: 5

Funds raised: $158M

Focus of Forum Ventures

Stage

- Early Stage Startup

- Seed

Industries

- Angel Investment

- Artificial Intelligence

- Consumer Lending

- Financial Services

- FinTech

- Impact Investing

- Venture Capital

Notable Investments

1. Eli

URL: eli.health

Funding Rounds: 4

Total Funding: $6.7M

2. ODAIA

URL: odaia.ai

Funding Rounds: 4

Total Funding: $43.4M

3. Reworkd

URL: reworkd.ai

Funding Rounds: 1

Total Funding: CA$1.7M

Contact

Website: https://www.panache.vc/

Email: info@panache.vc

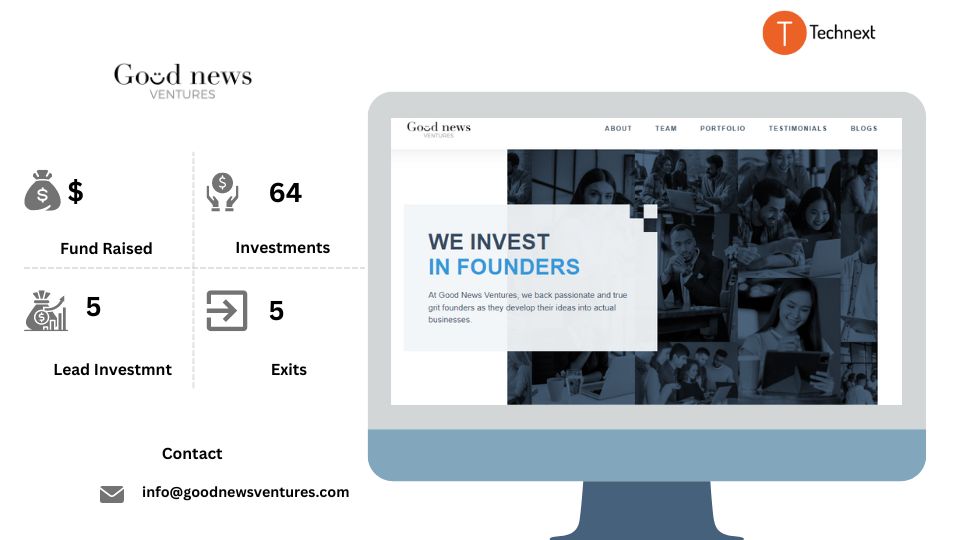

12. Good News Ventures

Good News Ventures is a venture capital firm based in Markham, Canada. They prefer to invest in early-stage technology companies founded by true grit entrepreneurs. They admire those who embrace the risk and uncertainty and aren’t afraid to break with convention.

At Good News Ventures, they support their portfolio companies through their next-level program. Also, they help their founders through their network to achieve their different goals and solve operational problems.

Details of Good News Ventures

Foundation Year: 2017

Countries of Operation:

- Canada

- United States

- Portugal

Number of Investments: 64

Lead Investments: 5

Number of Exits: 5

Focus of Good News Ventures

Stage

- Early Stage Startup

- Seed

Industries

- Software

- Information Technology

- Machine Learning

Notable Investments

1. Voltpost

URL: voltpost.com

Funding Rounds: 4

Total Funding: $4.9M

2. Quandri

URL: quandri.io

Funding Rounds: 2

Total Funding: $10.1M

3. Spellbook

URL: spellbook.legal

Funding Rounds: 7

Total Funding: $12.4M

Contact

Website: https://www.goodnewsventures.com/

Email: info@goodnewsventures.com

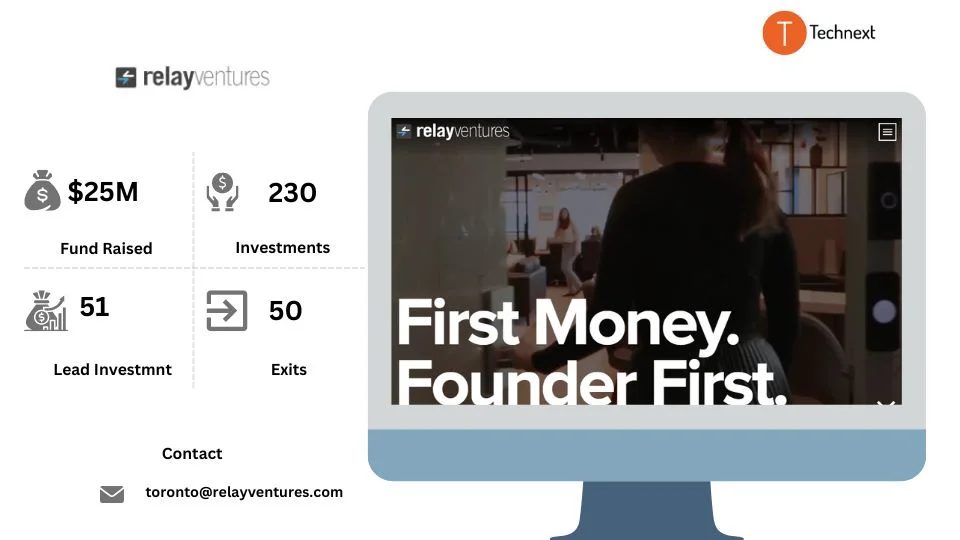

13. Relay Ventures

Relay Ventures is a renowned early-stage venture capital firm. They invest in passionate entrepreneurs disrupting and creating new markets through mobile technologies. They also invest in ideas that go beyond conventional wisdom and solve major pain points within large markets.

They saw founders as their partners. They support their founders across growth stages throughout the financing life of their companies. They believe that together, they can build transformational businesses based on teamwork, trust, and aspiration.

Details of Relay Ventures

Foundation Year: 2008

Countries of Operation:

- United States

- Canada

- United Kingdom

Number of Investments: 230

Lead Investments: 51

Number of Exits: 50

Funds raised: $25M

Focus of Relay Ventures

Stage

- Early Stage Startup

- Seed

Industries

- Angel Investment

- Finance

- Financial Services

- Impact Investing

- Venture Capital

Notable Investments

1. Cookin

URL: cookin.com

Funding Rounds: 2

Total Funding: $17.6M

2. Train Fitness

URL: trainfitness.ai

Funding Rounds: 3

Total Funding: $3.5M

3. FCTRY LAb

URL: fctry.la

Funding Rounds: 1

Total Funding: $6M

Contact

Website: https://relay.vc/

Email: toronto@relayventures.com

Phone: +1-416-367-2440

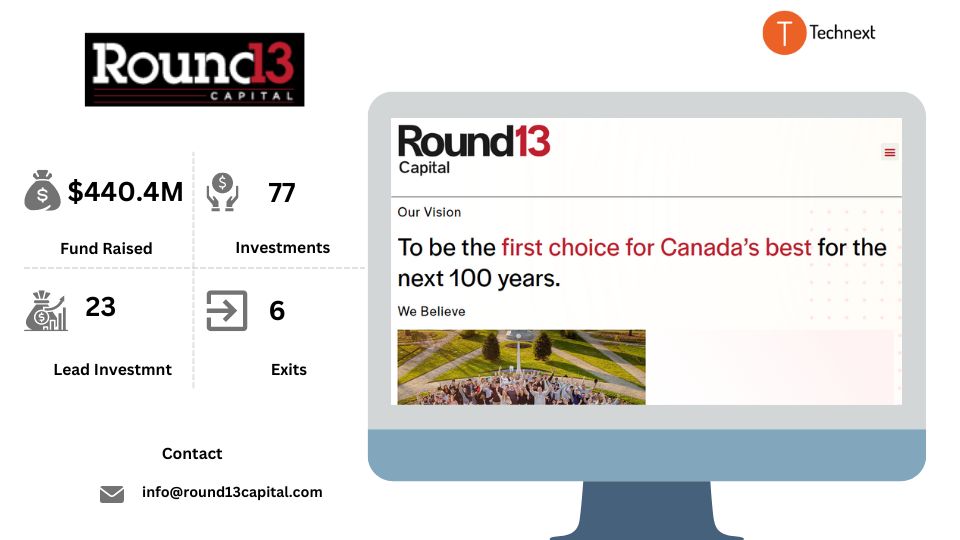

14. Round13 Capital

Round13 Capital is a leading venture and growth equity investment platform based in Toronto, Canada. They are different from a typical venture capital fund. They invest in promising companies from different sectors with a focus on supporting their growth and development over the long term.

Their team of experienced investors and operators brings a wealth of expertise and insight to every investment. Also, they help portfolio companies to realize their full potential. They are also dedicated to creating long-term value for its investors and the companies it supports.

Details of Round13 Capital

Foundation Year: 2011

Countries of Operation:

- Canada

- United States

Number of Investments: 77

Lead Investments: 23

Number of Exits: 6

Funds raised: $440.4M

Focus of Round13 Capital

Stage

- Early Stage Startup

- Late Stage Startup

Industries

- Software

- SaaS

- Information Technology

Notable Investments

1. Lane

URL: joinlane.com

Funding Rounds: 5

Total Funding: $13.9M

2. Sourced Group

URL: sourcedgroup.com

Funding Rounds: 2

Total Funding: CA$22.5M

3. Affinio

URL: affinio.com

Funding Rounds: 5

Total Funding: $13.5M

Contact

Website: https://round13.com/

Email: info@round13capital.com

Phone: (416) 362-0844

15. Capital Angel Network

The Capital Angel Network (CAN) is a network of angel investors in the Ottawa-Gatineau region. The firm seeks to invest in startups in the National Capital Region. Their goal is to build the region’s entrepreneurial community and make the region the best place to start a business. They are a member of the National Angel Capital Organization (NACO) and Angel Investors Ontario (AIO). They are also collaborating with angel groups and ecosystems across the country for deal sharing.

Details of Capital Angel Network

Foundation Year: 2010

Countries of Operation:

- Canada

- United States

Number of Investments: 54

Lead Investments: 12

Number of Exits: 14

Focus of Capital Angel Network

Stage

- Seed

- Angel

- Funding Round

Industries

- Software

- Information Technology

- Health Care

Notable Investments

1. Bodily

URL: privacyanalytics.com

Funding Rounds: 3

Total Funding: $4.9M

2. FileFacets

URL: filefacets.com

Funding Rounds: 5

Total Funding: $4M

3. 360pi Corp.

URL: 360pi.com

Funding Rounds: 2

Total Funding: $6.6M

Contact

Website: https://www.capitalangels.ca/

Email: info@capitalangels.ca

There is a lot of opportunity in the Canadian SaaS market, and the VC companies on this list can help you a lot as you start your own business. With their knowledge, connections, and ability to provide money, these investors can help your SaaS company grow.

Remember, the right VC firm for you is out there waiting to be discovered. Take control of your startup’s destiny by thoroughly researching each firm’s investment focus, portfolio companies, and team philosophy. This way, you can find the perfect match that aligns with your vision and goals.

Once you find that match, ensure you are well-prepared with an acceptable MVP and pitch deck. Also, Put together your startup team, figure out your equity, and do your market research. You could also talk to a professional.

![13 Top Amsterdam Venture Capital Firms for Early-Stage Startups [2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/05/Amsterdam-venture-capital-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)

![15 United States Saas Venture Capital Firms for Startups[2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/04/Saas-Venture-Capital-Firms-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)

![9 Top Saudi Arabia Venture Capital Firms for Early-Stage Startups [2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/05/Saudi-Arabia-Venture-Capital-Firms-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)

![Top 17 Toronto Venture Capital Firms for Tech Startups [2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/03/Toronto-Venture-Capital-Firms-for-Tech-Startups-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)

![17 New York Venture Capital Firms for Early-Stage Startups[2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/04/New-York-Venture-Capital-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)