13 Top Australia Venture Capital Firms for Early-Stage Tech Startups [2024]

We have created a list of top Australian venture capital businesses that are driving growth and innovation for your industries. Grab this cutting-edge opportunities for your growth.

Australia venture capital landscape has undergone a dramatic transformation in recent years. It’s anticipated that Australia will raise €969.0 million in total capital in the Venture Capital market by 2024, which means a lot of money is available for founders to secure funding.

If you are an early-stage founder seeking funding, this land of natural wonders has much to offer. Australia has a robust network of incubators and accelerators with approximately $68m FUM, collaborating closely with VCs to support high-potential ventures.

Also, it’s about more than just financial support. Australia has a competent and skilled workforce from top universities that can help build strong teams for startups.

We are here to help you find the right investment partner. This article lists 13 VCs in Australia for your early-stage startup.

13 Early-Stage Australia Venture Capital Firms

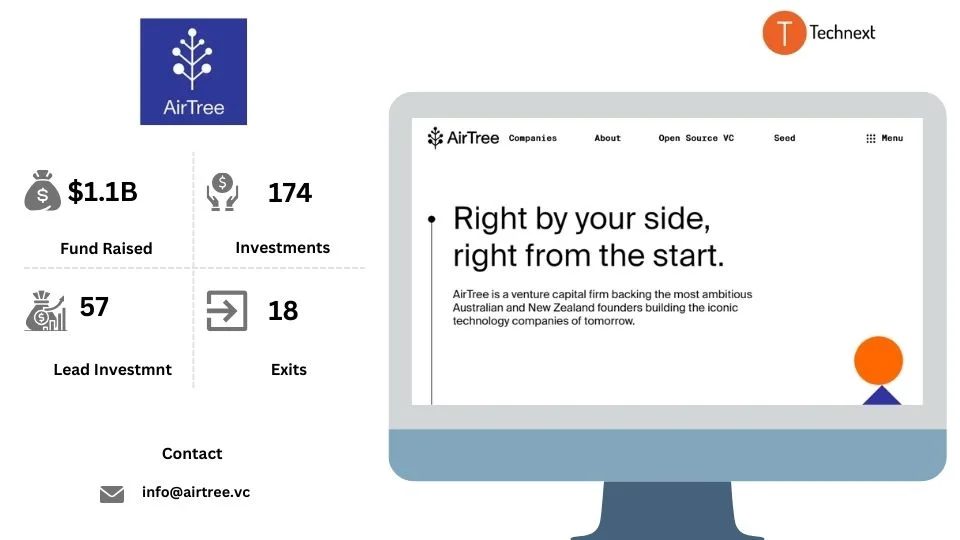

1. AirTree

AirTree Ventures is undoubtedly one of Australia’s top venture capital firms. They invest in the most ambitious startup founders within the technology sector. They are known for their collaborative approach and working closely with founders to help them build successful businesses.

Also, they help founders recruit key roles, introduce them to a community, connect with tech leaders, and provide a playbook of tactics to guide and smoothen their startup journey. If you’re looking for a VC firm that can provide both funding and strategic support, AirTree Ventures is definitely worth considering

.

Details of AirTree

Foundation Year: 2014

Countries of Operation:

- Australia

Number of Investments: 174

Lead Investments: 57

Number of Exits: 18

Focus of AirTree

Stage

- Early Stage Startup

- Seed

Industries

- SaaS

- Marketplace

- Fintech

- AI

- Industrial

- Health & Wellness

- Hardware

- Enterprise

- Education

- E-Commerce

- Consumer

- Infrastructure

- Energy

- Crypto & Blockchain

Notable Investments

1. Prospa

URL: prospa.com

Funding Rounds: 6

Total Funding: $96.7M

2. A Cloud Guru

URL: acloudguru.com

Funding Rounds: 3

Total Funding: $40M

3. Xplor

URL: ourxplor.com

Funding Rounds: 2

Total Funding: $9M

Contact

Website: https://www.airtree.vc/

Email: info@airtree.vc

Phone: +61 280353459

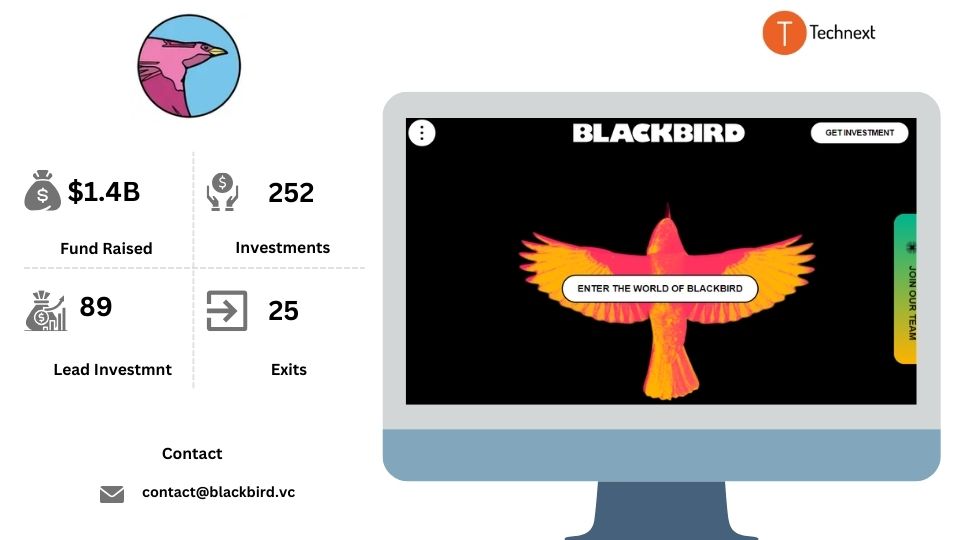

2. Blackbird

Blackbird Ventures is Australia’s largest and most active venture capital fund. They have a strong track record of supporting founders and helping them grow their businesses. They focus on Australian companies with big ideas that are aiming to be the best in the world. They also desire to invest right at the beginning of a company’s life before producing a product or revenue.

Besides that, they’re not only investing their money but also their time to help founders to acieve success. And their investment strategy is long-term, seeking to build companies to disrupt and scale.

Details of Blackbird

Foundation Year: 2012

Countries of Operation:

- Australia

- New Zealand

Number of Investments: 252

Lead Investments: 89

Number of Exits: 25

Funds raised: $1.4B

Focus of Blackbird

Stage

- Early Stage Startup

- Seed

Industries

- Enterprise

- Deep Tech & Hard Science

- Healthcare

- Hardware

- Education

- Consumer

Notable Investments

1. Zoox

URL: zoox.com

Funding Rounds: 5

Total Funding: $1B

2. LIFX

URL: lifx.com

Funding Rounds: 4

Total Funding: $16.3M

3. Redbubble

URL: redbubble.com

Funding Rounds: 3

Total Funding: $55.8M

Contact

Website: https://www.blackbird.vc/

Email: contact@blackbird.vc

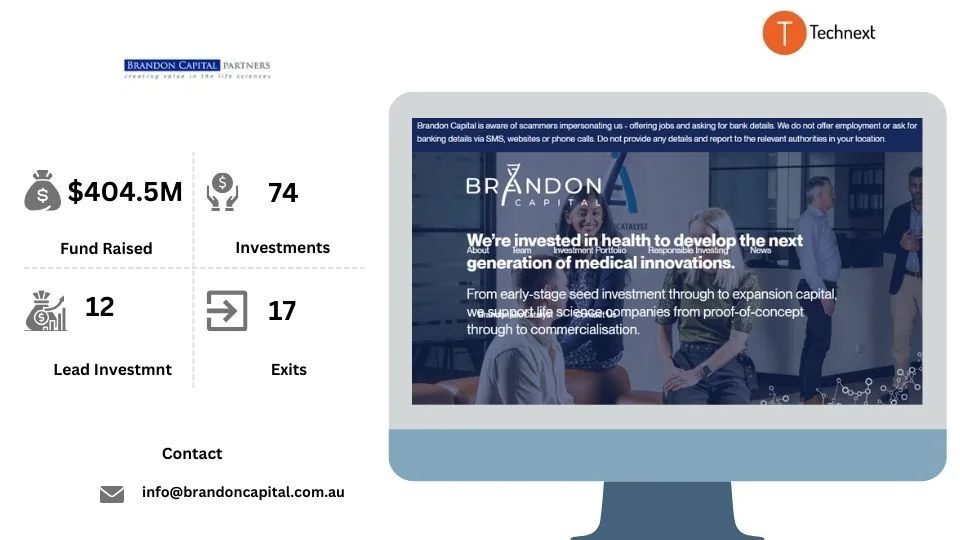

3. Brandon Capital

Brandon Capital is Australasia’s leading life science venture capital firm. From the beginning, they have focused on developing the next generation of medical innovations. They work with founders from the proof-of-concept stage through to commercialization.

Their team comprises professionals with technical, business, and operational experience. They collaborate with startup founders and establish successful long-term relationships with their management teams.

Besides that, they have a robust global presence and remain at the forefront of contributing to the growth of a high-value and sustainable biotechnology industry

Details of Brandon Capital

Foundation Year: 2007

Countries of Operation:

- Australia

- New Zealand

- USA

- United Kingdom

Number of Investments: 74

Lead Investments: 12

Number of Exits: 17

Funds raised: $404.5M

Focus of Brandon Capital

Stage

- Early Stage Startup

- Late Stage Startup

- Seed

Industries

- Pharmaceuticals

- Health & Wellness

- Healthcare devices and supplies

- Biotech

- Life sciences

- Digital health

- Manufacturing

Notable Investments

1. Elastagen

URL: elastagen.com

Funding Rounds: 3

Total Funding: $15.1M

2. Fibrotech Therapeutics

URL: fibrotech.com.au

Funding Rounds: 1

Total Funding: A$7.3M

3. Allay Therapeutics

URL: allaytx.com

Funding Rounds: 4

Total Funding: $118.9M

Contact:

Website: https://brandoncapital.vc/

Email: info@brandoncapital.com.au

Phone: +61 3 9657 0700

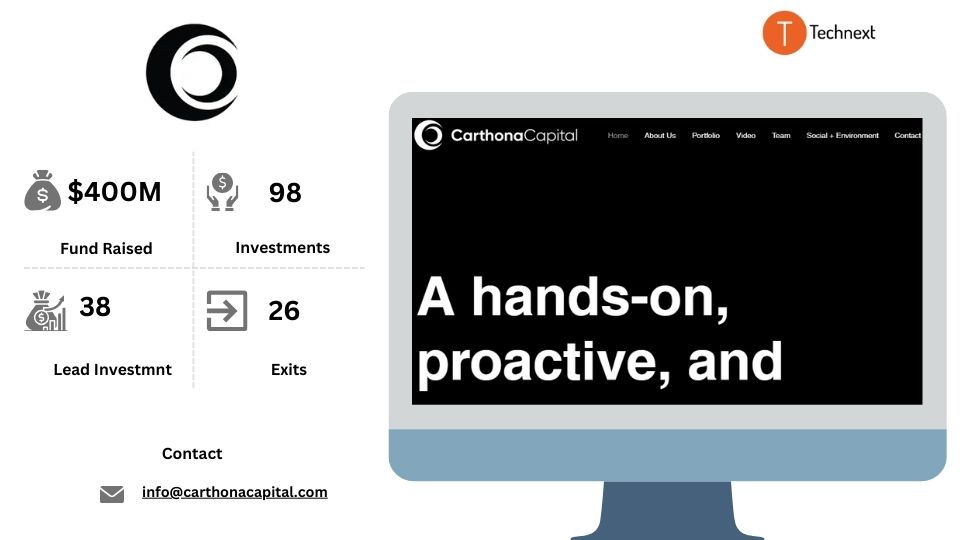

4. Carthona Capital

Carthona Capital labels itself as a hands-on and proactive venture capital investment company. They invest in early-stage businesses, usually at pre-seed, seed-stage, and Series A stages.

While Carthona Capital prefers investing early, they also make follow-on investments and support the portfolio companies by deploying larger financial support as the company matures. Also, they maintain an extremely hands-on approach with their portfolio companies and are active in helping startup founders reach managerial decisions.

Details of Carthona Capital

Foundation Year: 2014

Countries of Operation:

- Australia

Number of Investments: 98

Lead Investments: 38

Number of Exits: 26

Funds raised: $400M

Focus of Carthona Capital

Stage

- Pre-Seed

- Seed

- Series A stages

Industries

- SaaS

- Fintech

- Proptech & Real Estate

- Crypto & Blockchain

- Enterprise

Notable Investments

1. Life360

URL: life360.com

Funding Rounds: 15

Total Funding: $140.2M

2. Abra

URL: abra.com

Funding Rounds: 6

Total Funding: $106.6M

3. Cherre

URL: credible.com

Funding Rounds: 3

Total Funding: $75M

Contact

Website: https://www.carthonacapital.com/

Email: info@carthonacapital.com

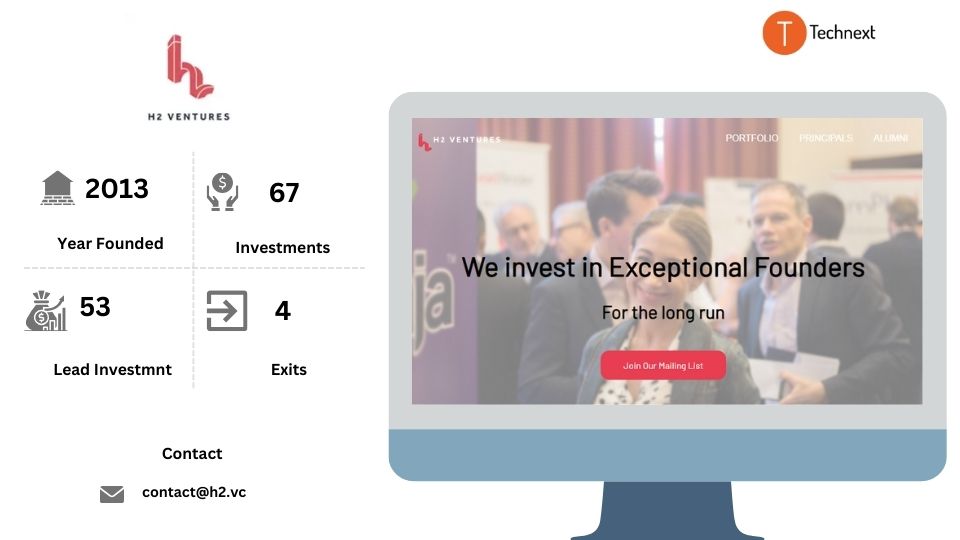

5. H2 Ventures

H2 Venture is another of Australia’s best VC firms. They provide equity capital, mentoring, and knowledge to support high-caliber founders. Also, they look for companies whose management teams have potential and unique industry insight.

Since 2013, they have reinvented financial services by bringing together talented investors, entrepreneurs, forward-thinking established financial services organizations, and other thought leaders. By fostering the startup ecosystem and supporting founders, they strive to contribute significantly to innovation in the Australian economy.

Details of H2 Ventures

Foundation Year: 2013

Countries of Operation:

- Australia

Number of Investments: 67

Lead Investments: 53

Number of Exits: 30

Focus of H2 Ventures

Stage

- Early Stage Startup

Industries

- AI & ML

- Fintech

- Big Data & Analytics

Notable Investments

1. Stockspot

URL: stockspot.com.au

Funding Rounds: 3

Total Funding: $4.2M

2. Nod

URL: noddocs.com

Funding Rounds: 3

Total Funding: A$2.1M

3. Edstart

URL: edstart.com.au

Funding Rounds: 6

Total Funding: $17.4M

Contact

Website: https://h2.vc/

Email: contact@h2.vc

Phone: (830) 443-4744

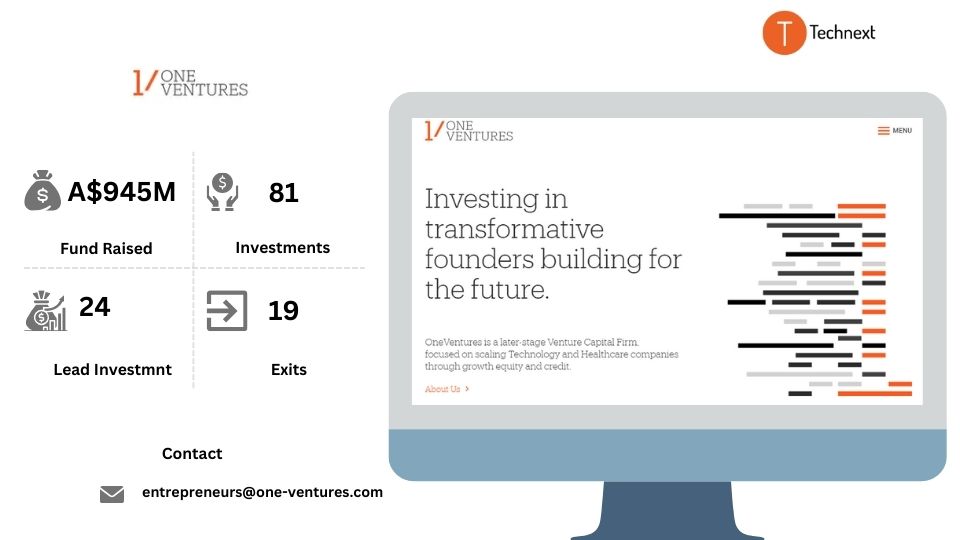

6. One Ventures

One Ventures is a leading VC firm in Australia. They work with company founders through different stages of business growth.

They prefer to invest in the healthcare and technology sectors. Also, they look for unique founders who tackle products that will solve global issues.

Before investing in healthcare companies, they focus on those companies at or near the clinical stage. In the case of technology, they analyze present and projected revenue. Also, they review the use of funds to drive marketing and sales.

Besides that, they also apply their years of international experience and operational and execution expertise to accelerate the growth of portfolio companies

Details of One Ventures

Foundation Year: 2006

Countries of Operation:

- Australia

Number of Investments: 81

Lead Investments: 24

Number of Exits: 19

Funds raised: A$945M

Focus of One Ventures

Stage

- Debt

- Early Stage Startup

- Late Stage Startup

- Seed

Industries

- Healthcare

- Enterprise

- SaaS

- Life Sciences

- Fintech

- Marketplace

Notable Investments

1. Vaxxas

URL: vaxxas.com

Funding Rounds: 8

Total Funding: $102.5M

2. 6clicks

URL: 6clicks.com

Funding Rounds: 6

Total Funding: A$23M

3. ImmVirX

URL: immvirx.com

Funding Rounds: 3

Total Funding: $50M

Contact:

Website: https://one-ventures.com.au/

Email: entrepreneurs@one-ventures.com

Phone: +61 2 8205 7379

7. Reinventure

Reinventure is an independent Venture Capital firm. They have a strong corporate partnership with Westpac. They consider founders with proven entrepreneurial skills and proven traction. They also look for companies with a strong network effect and disruptive business models.

They prefer to invest for the long term and put their ventures first. Once they invest, their job is to unlock maximum synergy value between their ventures and their largest investor, Westpac. Apart from financial investments, they seek to add value to their ventures in the best way possible

Details of Reinventure

Foundation Year: 2014

Countries of Operation:

- Australia

Number of Investments: 72

Lead Investments: 19

Number of Exits: 15

Funds raised: $137.3M

Focus of Reinventure

Stage

- Early Stage Venture

- Late Stage Venture

- Seed

Industries

- AI & ML

- Proptech & Real Estate

- Crypto & Blockchain

- Education

- Gaming

- Enterprise

- Travel & Hospitality

- Social

- Cybersecurity

- Big Data & Analytics

Notable Investments

1. Moneyme

URL: moneyme.com

Funding Rounds: 4

Total Funding: $335M

2. OpenAgent

URL: openagent.com.au

Funding Rounds: 3

Total Funding: $16.2M

3. CodeLingo

URL: codelingo.io

Funding Rounds: 2

Total Funding: $450.9K

Contact

Website: https://reinventure.com.au/

Email: info@reinventure.com.au

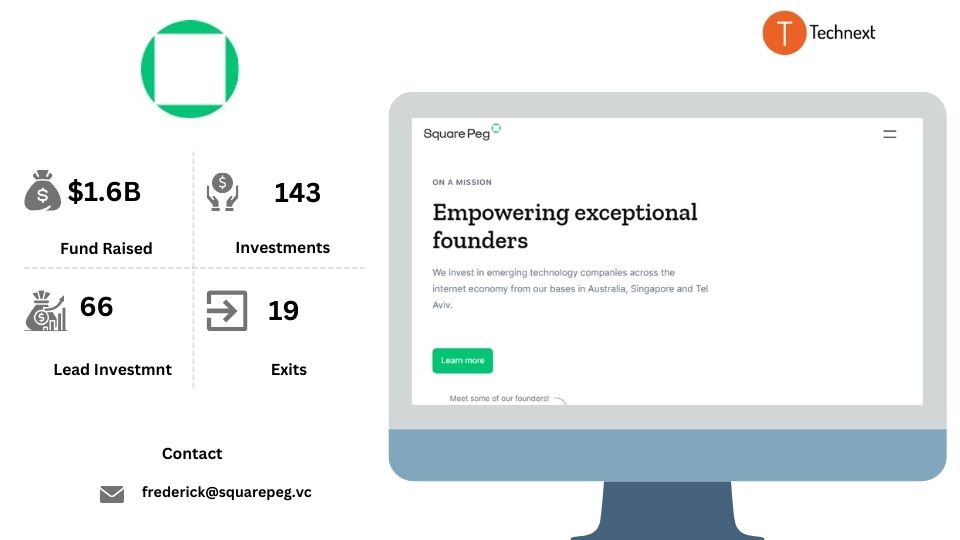

8. Square Peg Capital

Square Peg is one of the renowned venture capital firms in Australia. They were founded on the belief that technology would transform every industry in the world. They are a dedicated team of founders, investors, advisors, and operators.

Their mission is to empower exceptional founders who are solving e big problems in a unique and different way. At the same time, they ensure a rapid, disciplined, and transparent investment process. Since 2012, they have invested in over 144 companies, including Fiverr, Canva, Rokt, Kredivo, Tomorrow, and Airwallex.

Details of Square Peg Capital

Foundation Year: 2012

Countries of Operation:

- Australia

- Singapore

- Israel

Number of Investments: 143

Lead Investments: 66

Number of Exits: 19

Funds raised: $1.6B

Focus of Square Peg Capital

Stage

- Early Stage Startup

- Late Stage Startup

- Seed

Industries

- Healthcare

- Fintech

- Consumer

- Climate & Sustainability

- SaaS

- Cybersecurity

- Marketplace

- E-Commerce

- Cloud

- Enterprise

- DTC

- Education

- Agriculture

- Marketing

Notable Investments:

1. AgriDigital

URL: agridigital.io

Funding Rounds: 3

Total Funding: $23.3M

2. Fiverr

URL: fiverr.com

Funding Rounds: 9

Total Funding: $111M

3. Blinq

URL: blinq.me

Funding Rounds: 1

Total Funding: $5M

Contact

Website: https://www.squarepeg.vc/

Email: frederick@squarepeg.vc

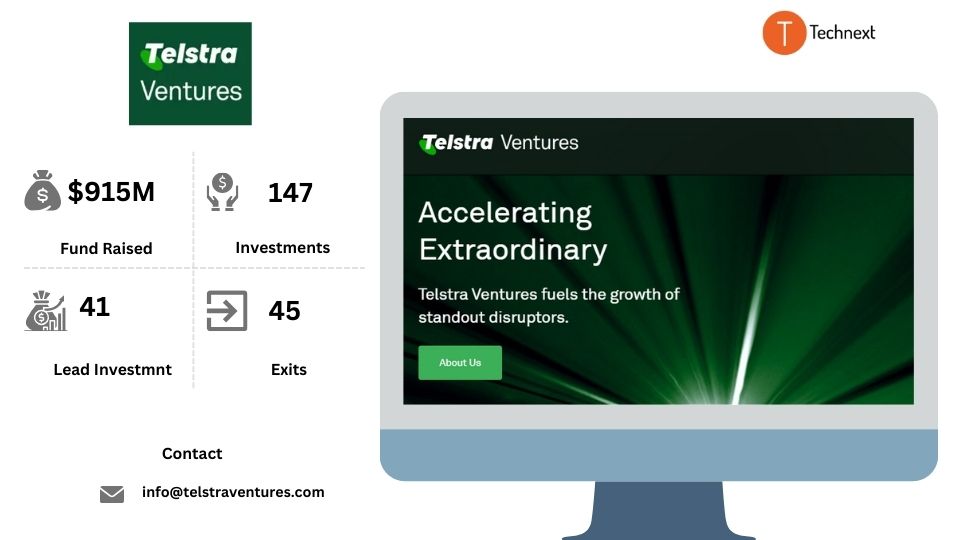

9. Telstra Ventures

Telstra Ventures is a corporate venture capital arm of Telstra. They are backed by the telecom giant Telstra and one of the largest private equity firms, Harbor West. Their mission is to invest in market-leading, high-growth companies that are strategically aligned with Telstra. Also, they seek to build partnerships with extraordinary founders and combine their knowledge with data to create futuristic solutions.

Besides that, they also assist their portfolio companies in raising funds and scaling up to successfully overcome obstacles. Also, help them by sharing their learnings and insights what they have achieved from portfolio companies and investment partners.

.

Details of Telstra Ventures

Foundation Year: 2011

Countries of Operation:

- Australia

- USA

- United Kingdom

Number of Investments: 147

Lead Investments: 41

Number of Exits: 45

Funds raised: $915M

Focus of Telstra Ventures

Stage

- Early Stage Startup

- Late Stage Startup

Industries

- Cloud

- Consumer

- Media

- Internet & Mobile

- SaaS

- Fintech

- Big Data & Analytics

- IoT

- Cybersecurity

- Network

Notable Investments

1. DocuSign

URL: docusign.com

Funding Rounds: 20

Total Funding: $536.2M

2. CrowdStrike

URL: crowdstrike.com

Funding Rounds: 9

Total Funding: $1.2B

3. Snap

URL: snap.com

Funding Rounds: 16

Total Funding: $4.9B

Contact

Website: https://telstraventures.com/

Email: info@telstraventures.com

10. Artesian

Artesian is a mission-driven investment firm. They seek for startups that can solve the biggest challenges facing humanity and the world today. They are providing early to growth stage capital to technology companies. They are specialize in public and private debt, venture capital, and impact investment strategies.

Since 2004, they have managed specialized funds focused on credit arbitrage and relative-value strategies across global financial markets. They plan to partner with best-of-breed accelerators, incubators, angel groups, and university programs. In 2017, they launched their China VC Fund with a USD 50m cornerstone investment industry super fund Hostplus. And soon, they will launch a Southeast Asia VC Fund

Details of Artesian

Foundation Year: 2004

Countries of Operation:

- Australia

- Singapore

- China

- Indonesia

- United Kingdom

- USA

Number of Investments: 734

Lead Investments: 108

Number of Exits: 200

Funds raised: $65.5M

Focus of Artesian

Stage

- Early Stage Startup

- Late Stage Startup

- Seed

Industries

- Agriculture

- AI & ML

- Climate & Sustainability

- IoT, Robotics

- E-Commerce

- Healthcare

- Crypto & Blockchain

- Hardware

- Supply Chain & Logistics

- Education

- Fintech

- Food & Beverage

- Gaming

- Entertainment

- Human Resources

- Marketing

- Advertising

- Social

Notable Investments

1. Instaclustr

URL: instaclustr.com

Funding Rounds: 4

Total Funding: $22.2M

2. PouchNATION

URL: pouchnation.com

Funding Rounds: 6

Total Funding: $4.5M

3. Jayride

URL: jayride.com

Funding Rounds: 7

Total Funding: $15.8M

Contact

Website: http://www.artesianinvest.com/

Email: admin@artesianinvest.com

Phone: 646 495 6018

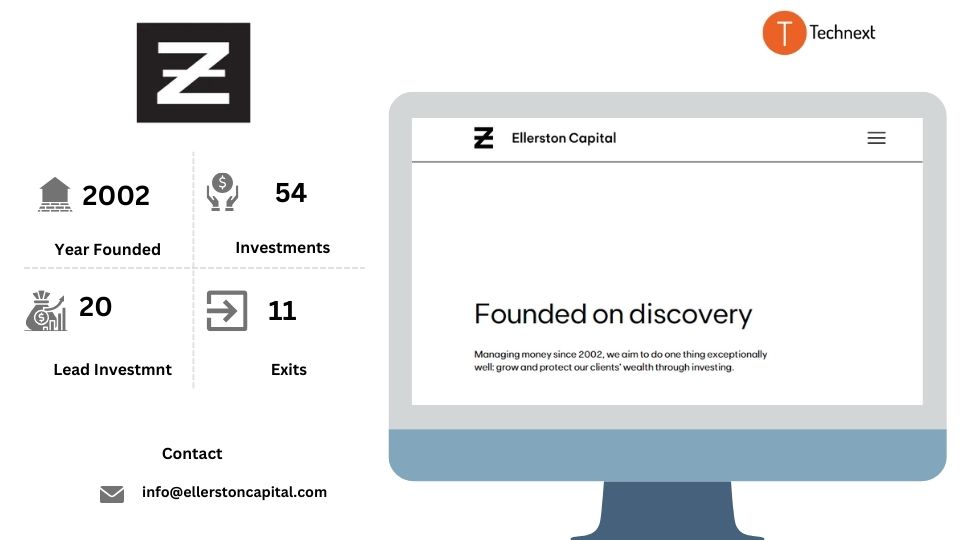

11. Ellerston Capital

Ellerston Capital is a well-known asset management firm with multiple investment strategies. They have offices in Melbourne and Sydney. They mainly prioritize startups with top-tier management teams and strong business models. They invest anywhere from Series A to later-stage deals.

Also, they are a specialized investment manager with a unique approach to portfolio management and investment selection. Each month, they investigate 30 companies and focus on leads with strong management teams

Details of Ellerston Capital

Foundation Year: 2002

Countries of Operation:

- Australia

Number of Investments: 54

Lead Investments: 20

Number of Exits: 11

Focus of Ellerston Capital

Stage

- Early Stage Startup

- Late Stage Startup

- Private Equity

Industries

- Finance

- Financial Exchanges

- Financial Services

Notable Investments

1. Aerologix

URL: aerologix.com

Funding Rounds: 3

Total Funding: A$7.7M

2. BiomeBank

URL: biomebank.com

Funding Rounds: 1

Total Funding: A$10.7M

3. Internet 2.0

URL: internet2-0.com

Funding Rounds: 1

Total Funding: $5M

Contact

Website: https://ellerstoncapital.com/

Email: info@ellerstoncapital.com

12. Antler

Antler is one of the well-known ventuer capital firms. They were founded on the belief that people with innovative ideas are the key to building a better future. They love to help enthusiastic founders right from the beginning until they achieve success. Also, they offer global residency programs to help entrepreneurs from all over the world.

Since 2018, they have proudly invested in over 600 companies. Besides that, they are interested in teaming up with people globally to grow and scale up their businesses.

Details of Antler

Foundation Year: 2018

Countries of Operation

- Australia

- Canada

- India

- Indonesia

- Japan

- Korea

- Malaysia

- Singapore

- Vietnam

- Denmark

- Finland

- France

- Germany

- Iberia

- Netherlands

- Norway

- Sweden

- UK

- Brazil

- US

- Kenya

- Middle East

Number of Investments: 1240

Lead investments: 637

Number of Exits: 106

Funds raised: $82.2M

Focus of Antler

Stage

- Early Stage

- Seed

Industries

- AI & ML

- Consumer

- Crypto & Blockchain

- Cybersecurity

- E-Commerce

- Fintech

- SaaS

- Gaming

- Proptech

- Real Estate

- Internet & Mobile

- Food & Beverage

- Supply Chai & Logistics

- Healthcare

- Media

Notable Investments

1. Treyd

URL: treyd.io

Funding Rounds: 2

Total Funding: $25M

2. Volopay

URL: volopay.com

Funding Rounds: 5

Total Funding: $31.2M

3. Airalo

URL: airalo.com

Funding Rounds: 5

Total Funding: $67.3M

Contact

Website: https://www.antler.co/

Email: hello@antler.co

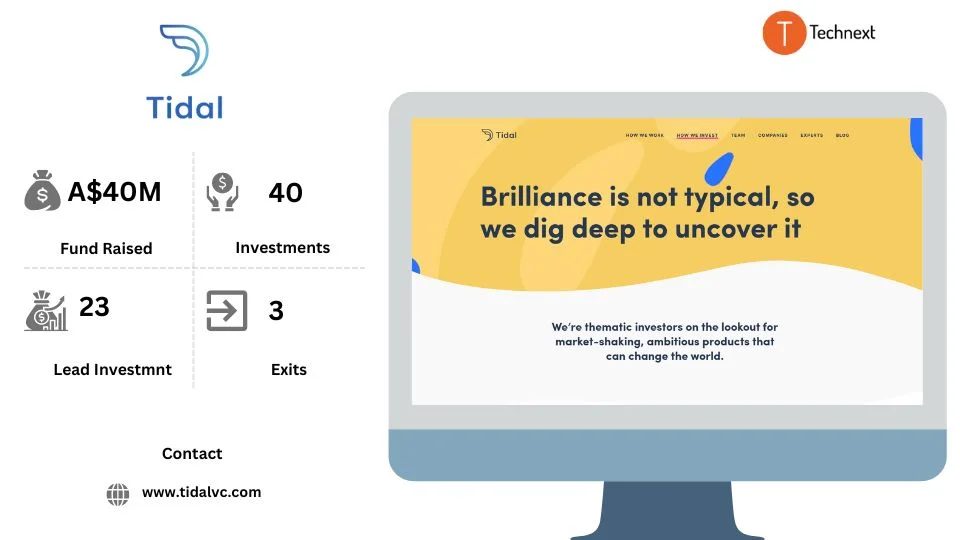

13. Tidal

Tidal Ventures is Australia’s leading seed-stage venture capital firm. They focus on product-driven Australian startups looking to expand internationally. They also provide valuable capital and support early in the startup lifecycle to help them grow.

As operators and technologists at heart, they will advise founders on strategy, product, resourcing, hiring, and more. Besides that, founders can also leverage Tidal’s expert network of technology leaders, founders, and executives, who will share their years of learned operational and business expertise with them.

Details of Tidal Ventures

Foundation Year: 2016

Countries of Operation:

- Australia

- USA

Number of Investments: 40

Lead Investments: 23

Number of Exits: 3

Funds raised: A$40M

Focus of Tidal Ventures

Stage

- Early Stage Startup

- Seed

Industries

- Enterprise

- SaaS

- API

- Cybersecurity

Notable Investments

1. Shippit

URL: shippit.com

Funding Rounds: 8

Total Funding: $77.8M

2. TheLoops

URL: theloops.io

Funding Rounds: 3

Total Funding: $8.8M

3. Search.io

URL: search.io

Funding Rounds: 1

Total Funding: A$3M

Contact

Website: https://www.tidalvc.com/

Phone: (650) 483-1622

This is our list of 13 VCs in Australia. As you can see, the Australian VC landscape offers a diverse range for your startup. From established firms to exciting newcomers, there’s a VC out there with the potential to be the perfect fit for your early-stage startup goals and industry.

Also, consider researching their investment preferences, team expertise, and track record to identify the VCs that best align with your vision. If you need advice, discuss it with an expert.

![15 Houston Venture Capital Firms for Early-Stage Startups[2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/03/Best-Venture-Capital-Firms-in-Miami-for-Early-Stage-Startups-1-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)

![13 Top Dubai Venture Capital Firms for Early-Stage Startups [2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/05/Dubai-Venture-Capital-Firms-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)

![15 United States Saas Venture Capital Firms for Startups[2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/04/Saas-Venture-Capital-Firms-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)

![15 Best Miami Venture Capital Firms for Early-Stage Startups [2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/03/Best-Venture-Capital-Firms-in-Miami-for-Early-Stage-Startups-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)

![13 Top Amsterdam Venture Capital Firms for Early-Stage Startups [2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/05/Amsterdam-venture-capital-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)

![13 Top Japan Venture Capital Firms for Early-Stage Startups [2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/05/Japan-Venture-Capital-Firms-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)