15 Houston Venture Capital Firms for Early-Stage Startups[2024]

If you’re looking for Houston venture capital firms to help fund your early-stage startup, we’ve created a list of 15 alternatives worth considering.

Finding the right venture capital company is essential for startups that want to grow. For founders seeking to develop a startup within a supportive community and connect with excellent VCs, Huston can be an ideal destination.

In this recent decade, the city of energy has also gained popularity in innovation and growth. This helped to channel investment capital into startups like never before.

With an extraordinary 47.4 percent annual growth rate, venture capital investment in Huston has skyrocketed from 2017’s $423 million to 2021’s $2.02 billion, a nearly five times increase.

We have created a list of the best Houston venture capital firms to help you navigate this dynamic landscape of VCS. These VCs are dedicated to encouraging new ideas and giving startups the resources they need to succeed.

15 Early-Stage Houston Venture Capital Firms

1. The Artemis Fund

The Artemis Fund is a renowned venture capital firm operating in Houston. They invest in female-founded, tech-enabled companies. They support startups working in Fintech and Ecommerce. They have made 24 diversity investments.

Their mission is to diversify and modernize wealth. Also, they enable people to build wealth and allow people to take care of their families and communities in a more sustainable way. Apart from funding, this Huston venture capital firm provides network and skills support that the startups require to accelerate and become sustainable companies.

.

Details of The Artemis Fund

Foundation Year: 2019

Countries of Operation:

- USA

Number of Investments: 30

Lead Investments: 7

Number of Exits: 2

Funds raised: $15M

Focus of The Artemis Fund

Stage

- Seed

Industries

- Fintech

- E-Commerce

- Infrastructure

- Health & Wellness

Notable Investments

- DRESSX

URL: dressx.com

Funding Rounds:5

Total Funding: $19.2M

2. Naborforce

URL: www.naborforce.com

Funding Rounds: 5

Total Funding: $12.3M

3. Fundid

URL: www.getfundid.com

Funding Rounds:2

Total Funding: $5.3M

Contact

Website: https://www.theartemisfund.com/

Email:team@theartemisfund.com

2. Amnis Ventures

Amnis Ventures is an investment firm that invests in technologies that produce sustainable results. They focus on innovative technologies in many fields of use that deliver sustainable results, making them one of the best venture capital firms in Huston.

Their investments have included energy-related specialty chemicals, innovative hardware technologies in renewable energy, novel democratized blockchain-based financial services platforms, and sustainable real estate development.

Apart from providing funds, they work closely with the portfolio companies and offer mentorship and industry expertise, helping them grow faster.

Details of Amnis Ventures

Foundation Year: 2013

Countries of Operation:

- USA

Number of Investments: 6

Lead Investments: 3

Number of Exits: 1

Focus of Amnis Ventures

Stage

- Seed

Industries

- Financial Services

- Oil & Gas

- Renewable Energy

- Real Estate

- Industrial Services

- Technology

Notable Investments

1. Qredo

URL: qredo.com

Funding Rounds: 3

Total Funding: $188.3M

2. Archax

URL: www.archax.com

Funding Rounds:6

Total Funding: $41.6

3. CloseCross

URL: closecross.com

Funding Rounds: 1

Total Funding: 3M

Contact

Website: https://www.amnis-venturEm

Email: info@amnis-ventures.com

Phone: +1.713.370.6544

3. Climate Impact Capital

Climate Impact Capital (CIC) is an early-stage focused Huston venture capital. They focus on the mitigation and adaptation to climate change. By using smart ideas, they make energy, food, and water better and sustainable. They are interested in investing in technology-driven early-stage firms that fix the climate change issues. They not only bring a new system-level investment approach but also a new category of target companies for long-term impact investors. They are now seeking partners and companies with a long-term view of impact investing and growth

Details of Climate Impact Capital

Foundation Year: 2016

Countries of Operation:

- United States

Number of Investments: 7

Lead Investments: 1

Focus of Climate Impact Capital

Stage

- Early Stage Startup

- Late Stage Startup

Industries

- Energy Tech

- Environment Tech

- Food and Agriculture Tech

- Enterprise Applications

Notable Investments

- Hazel Technologies

URL: www.hazeltechnologies.com

Funding Rounds: 7

Total Funding: $87.8M

2. 60Hertz Energy

URL: www.60hertzenergy.com

Funding Rounds: 6

Total Funding: $3.2M

3. OpConnect

URL: www.opconnect.com

Funding Rounds: 4

Total Funding: $3.1M

Contact:

Website: https://climateimpactcapital.com/

Email: paul@climateimpactcapital.com

Phone: +1 5129616033

4. Fitz Gate Ventures

Fitz Gate Ventures is an early-stage, network-driven venture capital firm in Houston. Their returns are top quartile among all VC funds according to industry benchmarks. They provide seed funding to firms in the technology sector but with a special emphasis on the Princeton University ecosystem. Apart from offering funds, they also offer help in various forms, such as networking, mentorship, etc. Also, their portfolio companies have been profiled in the New York Times, CNN, The Wall Street Journal, The Financial Times, Forbes, Vogue, Bloomberg, and elsewhere.

Details of Fitz Gate Ventures

Foundation Year: 2015

Countries of Operation:

- USA

Number of Investments: 37

Lead Investments: 11

Number of Exits: 2

Funds raised: $25M

Investment size:

Minimum cheque size: $500,000

Focus of Fitz Gate Ventures

Stage

- Early-Stage Venture

- Seed

Industries

- SaaS

- E-Commerce

- AI & ML

- Media

- Travel & Hospitality

Notable Investments

1. Cartful Solutions

URL: www.cartfulsolutions.com

Funding Rounds: 3

Total Funding: $1.3M

2. BlockApps

URL: blockapps.net

Funding Rounds: 8

Total Funding: $50.3M

3. Realworld

URL: www.realworld.co

Funding Rounds: 3

Total Funding: $7.7M

Contact

Website: https://www.fitzgate.com/

Email: mark@fitzgate.com

5. Texas Atlantic Capital

Texas Atlantic Capital is known as an unconventional, caring, driven, and very fast company among all the Huston venture capital firms. They like opportunities in financial technology companies, digital banks, e-commerce, media, and software domains.

They love to partner with a team that can share their values. They provide entrepreneurs with the capital required to grow their companies. Also, they prefer to invest in all stages of companies with outstanding teams and scalable business models.

Details of Texas Atlantic Capital:

Foundation Year: 2009

Countries of Operation:

- USA

- Germany

Number of Investments: 50

Lead Investments: 16

Number of Exits: 16

Funds raised: $170M

Focus of Texas Atlantic Capital:

Stage

- Early Stage Startup

- Growth Stage Startup

- Late Stage Startup

Industries

- Cloud

- Big Data & Analytics

- SaaS

- E-Commerce

- Media

Notable Investments

1. Talixo

URL: talixo.com

Funding Rounds: 5

Total Funding: €6.6M

2. Zyncd

URL: www.zyncd.com

Funding Rounds: 4

Total Funding: $946.7K

3. B2X

URL: www.b2x.com

Funding Rounds: 6

Total Funding: $35.4M

Contact

Website: https://www.ta.capital/

Email: contact@ta.capital

Phone: +1 713 341 5326

6. Golden Section

Golden Section is a famous Huston venture capital fund and studio for founders. Their mission is to invest in early-stage B2B SaaS entrepreneurs and assist them in achieving a meaningful exit. They look for potential businesses that have the ability to achieve greatness with the right support and architecture. They have the right solutions to help you grow your business, whether you are interested in increased efficiency or avoiding equity dilution. Partnering with them can help you feel confident and make your company move forward.

Details of Golden Section

Foundation Year: 2012

Countries of Operation:

- United States

- Canada

- United Kingdom

Number of Investments: 50

Lead Investments: 18

Number of Exits: 1

Funds raised: $20M

Focus of Golden Section

Stage

- Debt

- Early Stage Startup

- Seed

Industries

- FinTech

- Media & Entertainment

- Real Estate and Construction Tech

- Transportation and Logistics Tech

- Business Services

- Enterprise Applications

- Consumer

Notable Investments

1. Snappy

URL: gosnappy.io

Funding Rounds: 3

Total Funding: $12M

2. VanHack

URL: www.vanhack.com

Funding Rounds: 2

Total Funding: $2.4M

3. Sinecure.ai

URL: www.sinecure.ai

Funding Rounds: 2

Total Funding: $5.5M

Contact:

Website: https://www.goldensection.com/

Email: info@goldensection.com

7. Houston Ventures

Houston Ventures is another renowned Huston venture capital firms. They focus on technology opportunities that solve operational problems in the energy and power industries. These technologies are often used in different industries to make more money or cut costs, but they haven’t been used much in the energy and power sectors yet.

Interestingly, they consider their portfolio companies as clients and work hard to make sure they do well. In fact, they have a history of selling many of its portfolio companies to other big companies like Siemens, IHS AT&T, and IBM.

.

Details of Houston Ventures

Foundation Year: 2004

Countries of Operation:

- United States

Number of Investments: 19

Lead Investments: 3

Number of Exits: 3

Funds raised: $11.1M

Focus of Houston Ventures

Stage

- Series A

- Seed

Industries

- Business products and services

- Information technology sectors

- Energy

- Enterprise application

- Retail

Notable Investments

1. Osprey Data

URL: www.ospreydata.com

Funding Rounds: 5

Total Funding: $12.9M

2. LiquidFrameworks

URL: liquidframeworks.com

Funding Rounds: 2

Total Funding: $5M

3. Geoforce

URL: www.geoforce.com

Funding Rounds: 3

Total Funding: $3M

Contact

Website: https://www.houven.com/

Email: info@houven.com

Phone: 832.529.2829

8. The Sterling Group

The Sterling Group is a private equity firm that focuses on manufacturing, distribution, and industrial services. They are one of the oldest venture capital firms in Huston. It targets controlling interests in basic manufacturing, industrial services, and distribution companies.

Sterling builds partnerships with management teams to help industrial businesses grow and become successful. It excels as a partner where it can bring its operational focus and expertise to a situation. Nearly 80% of Sterling’s past partnerships have been with family businesses and corporate carve-outs.

Details of Sterling Group

Foundation Year: 1982

Countries of Operation:

- United States

- Canada

- India

Number of Investments: 2

Lead Investments: 2

Number of Exits: 1

Fund raised: $225.2M

Focus of Sterling Group

Stage

- Early Stage Startup

- Private Equity

Industries

- Real Estate and Construction

- Energy

Notable Investments:

1. Ergotron

URL: www.ergotron.com

Funding Rounds: 1

Total Funding: $287

2. Frontline Road Safety

URL: www.frontlineroadsafety.com

Funding Rounds: 1

Total Funding: $189.9M

3. L&S Mechanical

URL: http://lsmech.com/

Funding Rounds: 1

Total Funding: $140.8M

Contact

Website: https://sterling-group.com/

Email: inquiries@sterling-group.com

Phone: 7133415704

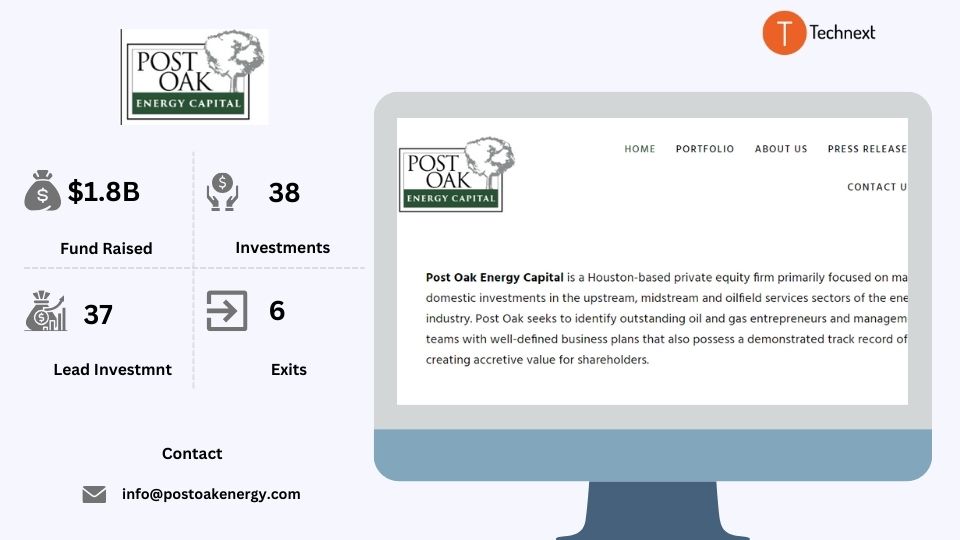

9. Post Oak Energy Capital

Post Oak Energy Capital is a private venture capital firms in Houston. They primarily focused on making domestic investments, especially in the upstream, midstream, and oilfield services of the energy industry. Their goal is to identify the top-notch management teams with great plans and provide them with growth capital and strategic support to create successful oil & gas businesses.

The strength of Post Oak’s investment approach is to work closely with its management teams to deliver strategic planning. Also, they look for exceptional oil and gas entrepreneurs and teams with clear plans and a proven history of adding value for shareholders.

.

Details of Post Oak Energy Capital

Foundation Year: 2006

Countries of Operation:

- United States

Number of Investments: 38

Lead Investments: 37

Number of Exits: 6

Fund raised: $1.8B

Focus of Post Oak Energy Capital

Stage

- Private Equity

Industries

- Energy

- Environment

Notable Investments

1. Oryx Midstream Services

URL: oryxmidstream.com

Funding Rounds: 2

Total Funding: $300M

2. Layne Water Midstream

URL: www.laynewatermidstream.com

Funding Rounds: 2

Total Funding: $200M

3. Saxet III Minerals

URL: riplpsaxet.com

Funding Rounds: 1

Total Funding: $100M

Contact

Website: http://www.postoakenergy.com/

Email:info@postoakenergy.com

Tel: (713) 571-9393

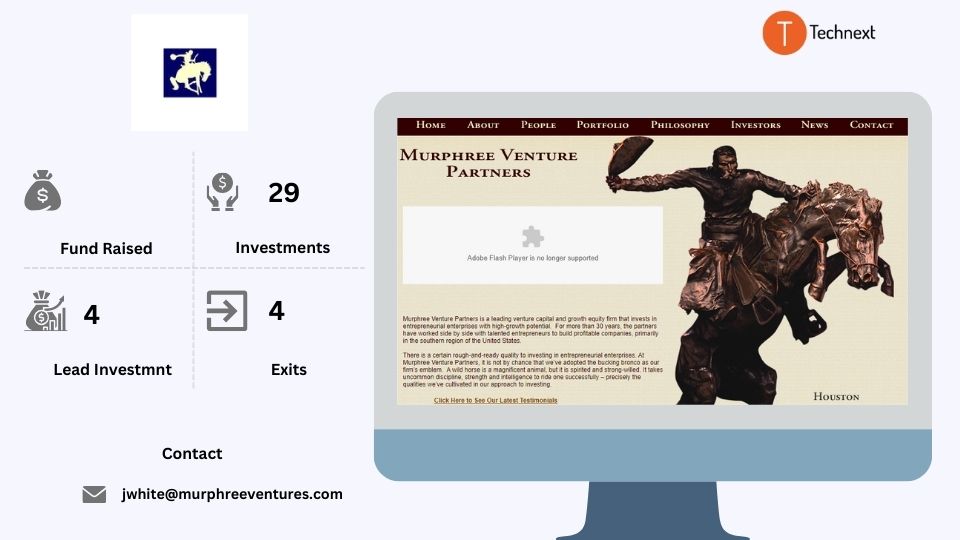

10. Murphree Venture Partners

Murphree Venture Partners is a prominent vc in Houston and growth equity firm. They invest in entrepreneurial enterprises with high-growth potential. They offer funding to companies working in energy, tech-enabled services, critical infrastructure, and waste management industries. They seek to create long-term value for their investors and the companies they invest in. For over 30 years, the partners have teamed up with talented entrepreneurs to build successful companies, mainly in the southern region of the United States

Details of Murphree Venture Partners

Foundation Year: 1987

Countries of Operation:

- United States

Number of Investments: 29

Lead Investments: 4

Number of Exits: 4

Focus of Murphree Venture Partners

Stage

- Early Stage Startup

- Late Stage Startup

Industries

- High Tech

- HealthTech

- Retail

- Transportation and Logistics Tech

- Industrial Goods and Manufacturing

- Environment

- Enterprise Applications

- Consumer

Notable Investments

1. MedServe

URL: www.medserve.com

Funding Rounds: 3

Total Funding: $36.8M

2. Dowley Security Systems

URL: dowley.com

Funding Rounds: 8

Total Funding: $26.4M

3. Accellos

URL: www.accellos.com

Funding Rounds: 2

Total Funding: $28.5M

Contact

Website: https://www.murphreeventures.com/HOME.aspx.html

Email: jwhite@murphreeventures.com

Phone: (713) 655.8500

11. Cathexis Ventures

Cathexis Ventures is a corporate venture capital arm of Cathexis Holdings. They look for the most talented teams that are building high-quality products quickly and efficiently. They also love to invest in talented people solving challenging problems. They primarily focus on seed-stage companies. However, they will occasionally invest in a company’s pre-seed or series A round. So far, they have made 5 diversity investments..

Details of Cathexis Ventures

Foundation Year: 2018

Countries of Operation:

- United States

Number of Investments: 173

Lead Investments: 2

Number of Exits: 1

Focus of Cathexis Ventures

Stage

- Early Stage Startup

- Seed

- Series A

Industries

- Financial Services

- Healthcare

- Semiconductors

- Gig Economy

- Blockchain Technology

- Consumer Goods

- Business Services

- Energy Tech

- Environment Tech

- Aerospace, Maritime and Defense Tech

- Transportation and Logistics Tech

Notable Investments

1. Biofire

URL: smartgun.com

Funding Rounds: 4

Total Funding: $28.8M

2. Chamberlain Coffee

URL: www.dynamofl.com

Funding Rounds: 3

Total Funding: $19.3M

3. Creative Intell

URL: remedial.health

Funding Rounds: 5

Total Funding: $17.4M

Contact

Website: https://cathexis.ventures/

Email: Info@Cathexis.com

Phone: 7134003334

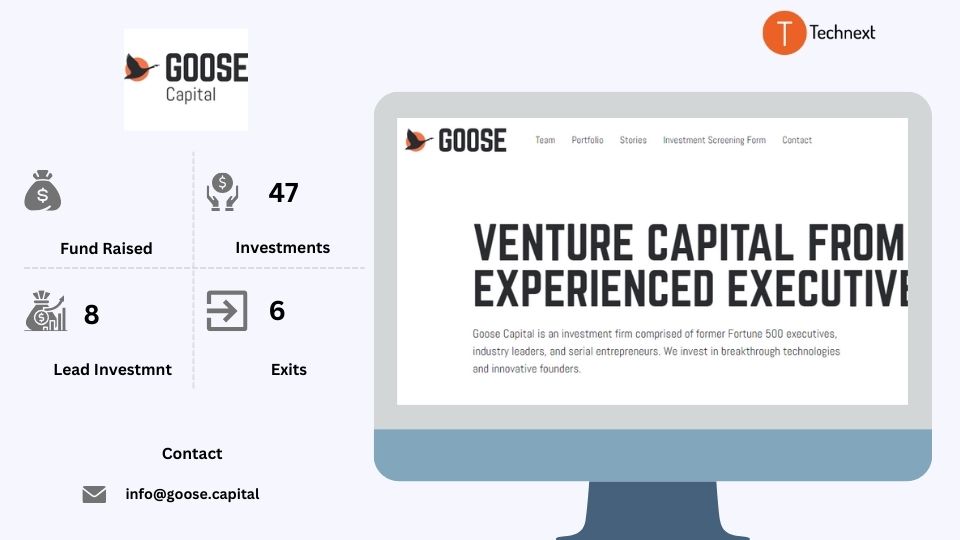

12. GOOSE Capital

GOOSE Capital is a Houston-based investment group comprised of highly successful operators and investors. Thay are one of the biggest vc firms Huston.They invest in breakthrough technologies and innovative founders. They have invested over $55 million in early-stage venture deals and have had many successful exits. Also, they invest around $10 million annually in various industries, prioritizing breakthrough, defendable technologies.

Details of GOOSE Capital

Foundation Year: 2005

Countries of Operation:

- United States

Number of Investments: 47

Lead Investments: 8

Number of Exits: 6

Focus of GOOSE Capital

Stage

- Convertible Note

- Early Stage Startup

- Seed

- Venture

Industries

- High Tech

- HealthTech

- Consumer

- Chemicals and Materials Tech

- Environment Tech

- Retail

- Blockchain Technology

- Auto Tech

- FinTech

- Media & Entertainment

- Education

- Life Sciences

- Enterprise Applications

Notable Investments

- Outrider

URL: www.outrider.ai

Funding Rounds: 4

Total Funding: $191M

2. Zynga

URL: plasmonics.tech

Funding Rounds: 8

Total Funding: $106M

3. H2PRO

URL: www.nanograf.com

Funding Rounds: 9

Total Funding: $89.5M

Contact

Website: https://www.goose.capital/

Email: info@goose.capital

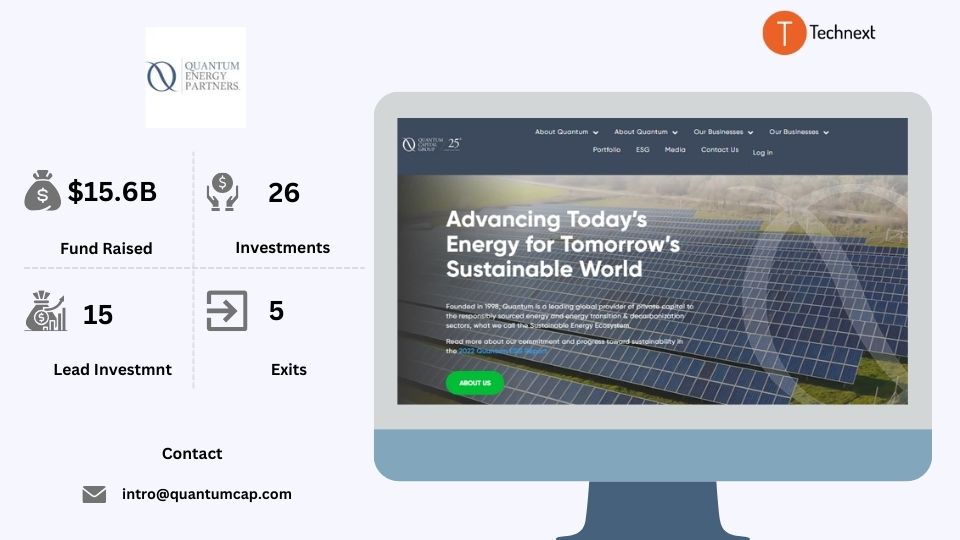

13. Quantum Energy Partners

Quantum Energy Partners is a renowned private equity firm based in Houston, Texas. They are the leading provider of private equity, credit, and venture capital in the global energy and energy transition industry. They invest in clean and sustainable energy, as well as sectors working on energy transition and decarbonization. They enjoy partnering with entrepreneurs to build companies that deliver the sustainable energy the modern world needs. Also, they boost their partner’s operational performance and speed up progress so that they can succeed in the fast-evolving Sustainable Energy Ecosystem.

Details of Quantum Energy Partners

Foundation Year: 1998

Countries of Operation:

- United States

- Canada

- United Kingdom

Number of Investments: 26

Lead Investments: 15

Number of Exits: 5

Funds raised: $15.6B

Focus of Quantum Energy Partners

Stage

- Private Equity

Industries

- Energy

- Environment Tech

- Auto Tech

- Financial Service

- Transportation and Logistic

Notable Investments

1. Project Canary

URL: www.projectcanary.com

Funding Rounds: 5

Total Funding: $121.1M

2. HEQ Deepwater

URL: www.heqdeepwater.com

Funding Rounds: 1

Total Funding: $400M

3. Trace Midstream

URL: tracemidstream.com

Funding Rounds: 2

Total Funding: $600M

Contact

Website: https://www.quantumcap.com/

Email: intro@quantumcap.com

Phone: 713-452-2000

14. QED Investors

QED is the leading Huston venture capital firm in the fintech area. It was founded on the principles of bringing transparency, fairness, and access to financial services.

They are focused on investing in disruptive financial services. They are also dedicated to building great businesses and use a unique, hands-on approach that leverages their partners’ expertise. Overall, they are known for their knowledge, engagement, and empathy

Details of QED Investors

Foundation Year: 2007

Countries of Operation:

- United Kingdom

- USA

- Austria

- Canada

- Sweden

- China

Number of Investments: 353

Lead Investment: 121

Number of Exits: 39

Funds raised: $2.3B

Focus of QED Investors

Stage

- Early Stage Startup

- Seed Stage Startup

Industries

- Creator Economy

- Crypto & Blockchain

- Fintech, Education, Healthcare

- InsurTech

- Marketplace

- E-Commerce

Notable Investments

1. Klarna

URL: klarna.com/us/

Rounds: 23

Total Funding: $4.09B

2. Remitly

URL: remitly.com

Rounds: 13

Total Funding: $436M

3. SoFi

URL: sofi.com

Rounds: 15

Total Funding: $2.67B

Contact

Website: qedinvestors.com/

Email:

15. Mercury Fund

Mercury has a set of values that will guide your investment choices. These values include embracing entrepreneurial passion, fostering intellectual curiosity, upholding intentional integrity, fostering an innovative mindset, and being intrinsically inclusive.

Mercury’s primary goal is to support entrepreneurs, especially those who may not yet be well-known in the industry. They have been a remarkable Huston venture capital since 2017. They believe in their ability to assist a new generation of entrepreneurs and make a meaningful impact by building ecosystems and communities, having a clear purpose, welcoming everyone, and providing valuable advice

Details of Mercury Fund

Foundation Year: 2017

Countries of Operation:

- America

Number of Investments: 105

Lead Investments: 39

Number of Exits: 14

Funds raised: $525M

Minimum cheque size: $250,000

Maximum cheque size: $4,000,000

Focus of Mercury Fund

Stage

- Early Stage Startup

- Seed

- Series A

Industries

- SaaS

- Enterprise

- Marketplace

- Supply Chain

- LogisticsFintech

- Crypto

- Blockchain

- Manufacturing

- Energy

Notable Investments

1. Polco

URL: info.polco

Rounds: 4

Total Funding: $24.3M

2. Captain

URL: goamify.com

Rounds: 2

Total Funding: $15.8M

3. Embrace Software

URL: blumira.com

Rounds: 3

Total Funding: $28M

Contact

Website: mercuryfund.com/

Email: info@mercuryfund.com

This was our list for Huston venture capital firms interested in investing in your early-stage startup. Bur you have to remember this process requires careful consideration and strategic planning.

You can start by doing market research, then figure out your equity and team structure. Last but not least find out if you want to concider any outsoursing.

Consider all of those aspects and consult an expert if necessary. Funding may be challenging to secure, but with thorough planning, you may convince others to support your goal.

![15 Top Berlin Venture Capital Firms for Early-Stage Startups [2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/04/Berlin-Venture-Capital-Firms-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)

![15 United States Saas Venture Capital Firms for Startups[2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/04/Saas-Venture-Capital-Firms-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)

![17 New York Venture Capital Firms for Early-Stage Startups[2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/04/New-York-Venture-Capital-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)

![Top 17 Toronto Venture Capital Firms for Tech Startups [2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/03/Toronto-Venture-Capital-Firms-for-Tech-Startups-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)