17 New York Venture Capital Firms for Early-Stage Startups[2024]

Are you seeking New York venture capital for your early-stage startup? Check out these 17 promising options we’ve created.

New York City is often seen as the beating heart of the global business world. It has also become a growing center for innovation and entrepreneurship. The city’s robust ecosystem has recently attracted some of the most forward-thinking venture capitalists (VCs) who help potential enterprises succeed.

The number of venture capital deals and the amounts invested have climbed 256 percent and 439 percent in recent years. New York City’s global share rose to 6.01 percent in 2017 from 4.58 percent in 2008.

These VCs have a great sense of ideas and can transform new ideas into successful businesses. With the right New York venture capitalist (VC), your startups can find many opportunities and reach new heights in their growth.

We have created a list of New York venture capital firms to help you find your desired VC.

17 Early-Stage New York Venture Capital Firms

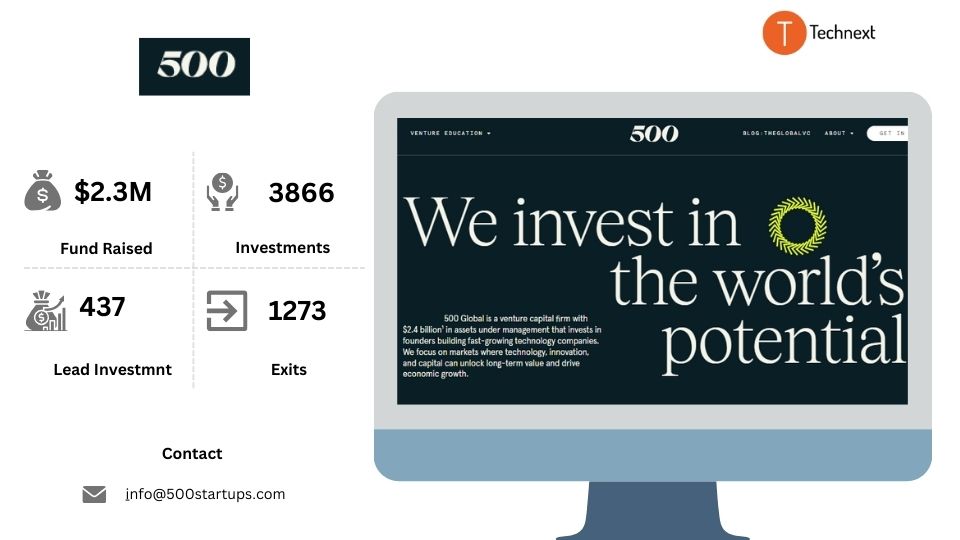

1. 500 Startups

500 Global is a multi-stage New York venture capital firm that invests in founders building fast-growing technology companies. They are one of the most active venture capital firms in the world. They are on a mission to discover the most talented entrepreneurs. If you are one of the aspiring talented founders, they will help you build a successful company. Further, they contribute to developing innovation ecosystems by supporting startups and investors through educational programs, events, conferences, and partnerships.

.

Details of 500 Startups

Foundation Year: 2010

Countries of Operation:

- USA

- India

- United Kingdom

- Hong Kong

- Singapore

- China

Number of Investments: 3866

Lead Investments: 437

Number of Exits: 1273

Funds raised: $2.3M

Minimum cheque size: $50,000

Maximum cheque size: $250,000

Focus of 500 Startupsis Fund

Stage

- Early Stage Startup

- Seed

Industries

- SaaS

- Media

- E-Commerce

- Consumer

- Healthcare

- Fintech

- Crypto

- Blockchain

- Computer Hardware

Notable Investments

- Canva

URL: canva.com

Funding Rounds:17

Total Funding: $581M

2. Reddit

URL: reddit.com

Funding Rounds: 7

Total Funding: $1.62B

3. Solana

URL: solana.com

Funding Rounds: 4

Total Funding: $374M

Contact

Contact

Website: 500. co/

Email: info@500startups.com

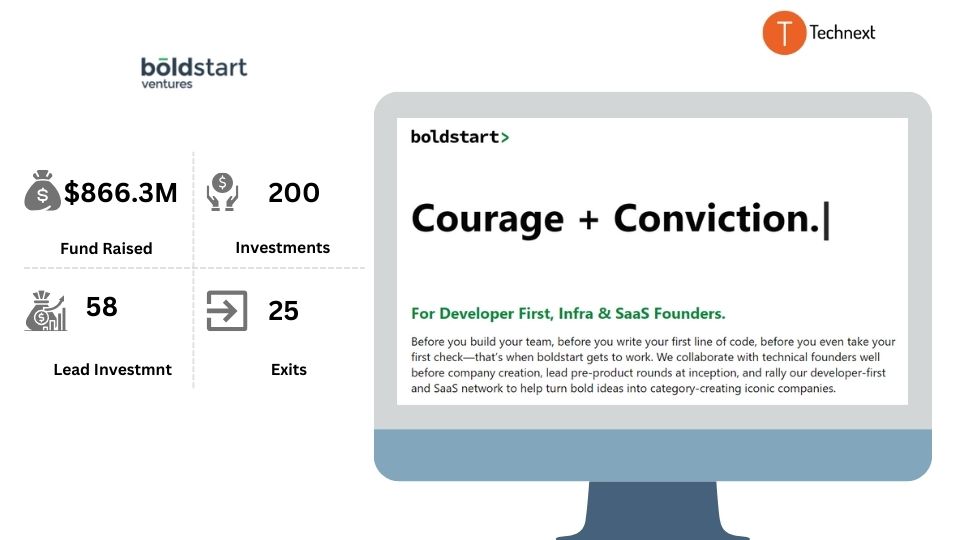

2. BoldStart Ventures

BoldStart Venture is one of the venture capital firms in New York investing in software and blockchain technology. They love to build partnerships with tech founders who are passionate about solving problems. They help founders from the beginning to shape their vision and help get them moving in the right direction from the very beginning. Also, they work closely with technical founders even before a company is formally established.

Details of BoldStart Ventures

Foundation Year: 2010

Countries of Operation:

- United States

- Canada

- United Kingdom

- Austria

- Belgium

- Germany

- Sweden

Number of Investments: 200

Lead Investments: 58

Number of Exits: 25

Funds raised: $866.3M

Minimum check size: $500,000

Maximum check size: $5,000,000

Focus of BoldStart Ventures

Stage

- Seed

- Early Stage Startup

- Late Stage Startup

Industries

- SaaS

- Cybersecurity

- Crypto

- Blockchain

- API

- Developer Tools

Notable Investments

1. Spectro Cloud

URL: www.spectrocloud.com

Funding Rounds: 4

Total Funding: $67.5M

2. Robin

URL: robinpowered.com

Funding Rounds: 1

Total Funding: $59.1M

3. Blockdaemon

URL: www.blockdaemon.com

Funding Rounds: 10

Total Funding: $431.3M

Contact

Website: https://boldstart.vc/

Phone Number: 877-342-7222

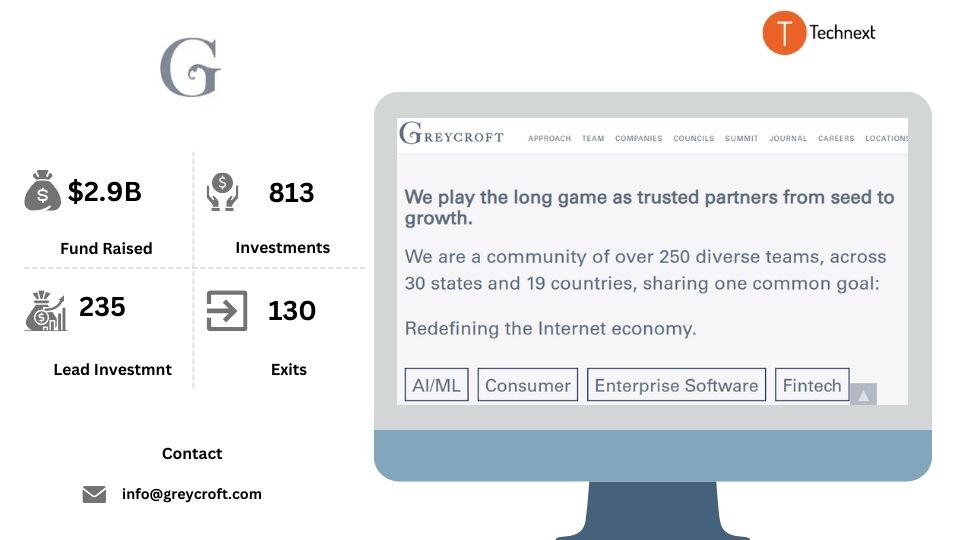

3. Greycroft Partners

Greycroft New York venture capital firm seeks to partner with exceptional entrepreneurs. They focus on technology start-ups and investments in the Internet and mobile markets. Their team is great at solving problems. And they enjoy partnering with entrepreneurs to turn company dreams into reality. As a team, they support and advise entrepreneurs to achieve their vision. They use their media and tech connections to help entrepreneurs gain visibility, build relationships, bring their products to market, and build successful businesses.

Details of Greycroft Partners

Foundation Year: 2006

Countries of Operation:

- United States

- United Kingdom

Number of Investments: 813

Lead Investments: 235

Number of Exits: 130

Funds raised: $2.9B

Minimum cheque size: $1,000,000

Maximum Cheque Size: $10,000,000

Focus of Greycroft Partners

Stage

- Early Stage Startup

- Late Stage Startup

- Private Equity

- Seed

Industries

- Consumer

- Enterprise

- Fintech

- SaaS

- Internet & Mobile

- Healthcare

- AI & ML

- Automation

- Cloud

Notable Investments

- Shipt

URL: www.shipt.com

Funding Rounds: 3

Total Funding: $65.2M

2. Rocket.Chat

URL: rocket.chat

Funding Rounds: 4

Total Funding: $36.9M

3. Octave

URL: www.findoctave.com

Funding Rounds: 5

Total Funding: $86M

Contact:

Website: https://www.greycroft.com/

Email: info@greycroft.com

Phone: 212-756-3508

4. Google Ventures

Google Ventures (GV) is a unique VC firm New York that aims to back innovative founders. They not only provide founders with capital but also help them build the right team. Also, to select the right co-founders to develop the best product. If you are aiming to build a product that would bring equitable change, GV would be the right fit for you.

Details of Google Ventures

Foundation Year: 2009

Countries of Operation:

- USA

- United Kingdom

Number of Investments: 1022

Lead Investments: 292

Number of Exits: 231

Funds raised: $100M

Investment size:

Minimum check size: $2,000,000.

Maximum check size: $30,000,000

Focus of Google Ventures

Stage

- Early Stage Startup

- Late Stage Startup

- Private Equity

- Seed

Industries

- Consumer

- Engineering

- Enterprise

- Design

- Life Sciences

- Marketplace

- Diversity & Inclusion

- Transportation

- Talent Productivity

Notable Investments

1. Uber

URL: www.uber.com

Funding Rounds: 32

Total Funding: $25.2B

2. Slack

URL: www.slack.com

Funding Rounds: 13

Total Funding: $1.4B

3. Censys

URL: censys.io

Funding Rounds: 5

Total Funding: $128.1M

Contact

Website: https://www.gv.com/

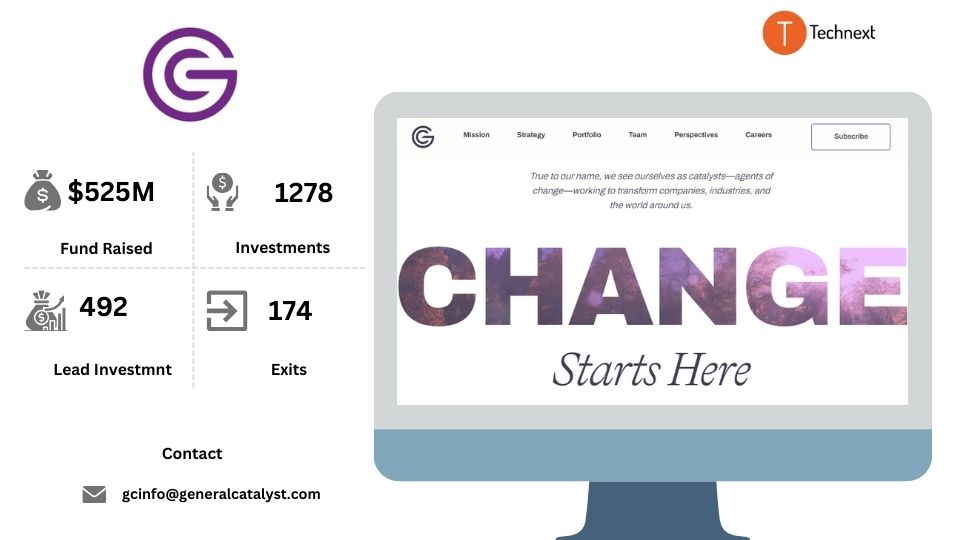

5. General Catalyst

General Catalyst is working to transform companies, industries, and the world around us. The important side of General Catalyst is that they work with companies through their entire lifecycle—from the earliest stages through growth and beyond. This makes them one of the best New York venture capital. They are exceptional entrepreneurs who are building innovative technology companies and market-leading businesses. Their mission is to invest in robust, positive changes that endure. Also, team members of General Catalyst always use their extensive knowledge to assist founders in building outstanding companies

Details of General Catalyst:

Foundation Year: 2000

Countries of Operation:

- USA

- United Kingdom

Number of Investments: 1278

Lead Investments: 492

Number of Exits: 174

Funds raised: $8B

Focus of General Catalyst:

Stage

- Early Stage Startup

- Late Stage Startup

- Seed

Industries

- Consumer

- Enterprise

- AI & ML

- Cloud

- Marketplace

- SaaS

- Developer Tools

Notable Investments

1. HubSpot

URL: www.hubspot.com

Funding Rounds: 6

Total Funding: $100.5M

2. Airbnb

URL: www.airbnb.com

Funding Rounds: 30

Total Funding: $6.4B

3. Nova Credit

URL: novacredit.com

Funding Rounds: 9

Total Funding: $124.4M

Contact

Website: https://www.generalcatalyst.com/

Email: gcinfo@generalcatalyst.com

Phone Number: 212-775-4000

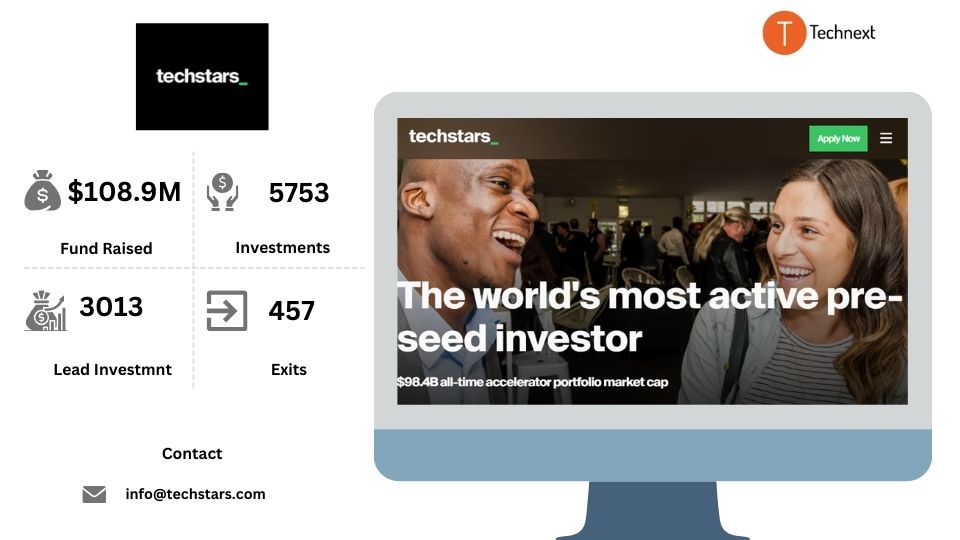

6. Techstars

Techstars is a global platform that provides innovation and investment. Their goal is to provide a worldwide network that helps entrepreneurs succeed. They also provide access to mentorship, talent, and infrastructure. By connecting entrepreneurs with organizations and corporations around the globe, they can drive innovation and solve the world’s largest problems.

Whether you’re looking to build a local startup community, connect with the world’s top startups, or invest in startups that are making an impact in your industry, Techstars can be your best find as New York venture capital. They offer a variety of ways to engage with your startup ecosystem that align with your business goals

Details of Techstars

Foundation Year: 2006

Countries of Operation:

- United States

- United Kingdom

- India

- China

- Africa

- Oceania

Number of Investments: 5753

Lead Investment: 3013

Number of Exits: 457

Funds raised: $108.9M

Minimum cheque size: $20,000

Maximum Cheque Size: $100,000

Focus of Techstars

Stage

- Debt

- Early Stage Startup

- Seed

Industries

- Advertising

- Aerospace & Space

- Agriculture

- AI & ML

- Biotech

- Crypto & Blockchain

- Climate & Sustainability

- Cloud

- Consumer

- Cybersecurity

- SaaS

- Big Data & Analytics

- Developer Tools

- E-Commerce

- Education

- Energy

- Enterprise

- Entertainment

- Fintech

- Sports

- Food & Beverage

- Future of Work

- Gaming

- Life Sciences

- Manufacturing

- Marketplace

- Media

- Mobilit

Notable Investments

1. Leucine

URL: www.leucinetech.com

Funding Rounds: 4

Total Funding: $8.1M

2. Dollarize

URL: dollarize.me

Funding Rounds: 3

Total Funding: $2.6M

3. Upgrade Boutique

URL: upgradeboutique.com

Funding Rounds: 3

Total Funding: $2.7M

Contact:

Website: https://www.techstars.com/

Email: info@techstars.com

Phone: +1 303-720-6559

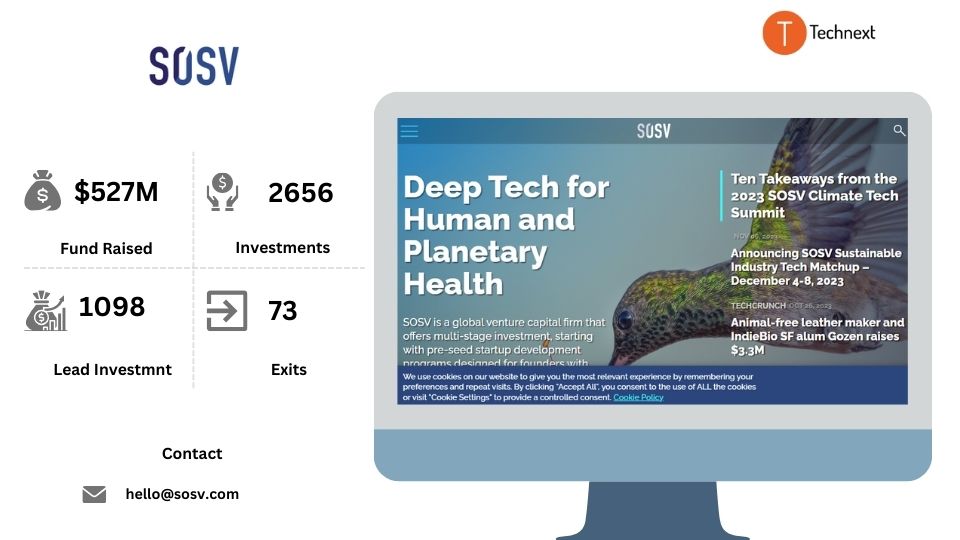

7. SOSV

SOSV is one of the global venture capital firms that operates early-stage startup development programs. As a VC firm in New York, its programs are focused mainly on two broad areas. The first is revolutionary deep tech that promises the betterment of humanity and the planet. The second is startups in emerging markets that are ripe for explosive growth.

Their strategy is to invest in a small number of high-potential startups and use its deeply resourced programs to accelerate product development, customer acquisition, and overall scalability. Also, SOSV companies consistently raise funding rounds led by top-tier investors.

.

Details of SOSV

Countries of Operation:

- USA

- China

- Taiwan

- Ireland

Number of Investments: 2656

Lead Investments: 1098

Number of Exits: 73

Funds raised: $527M

Minimum cheque size: $100,000

Maximum Cheque Size: $250,000

Focus of SOSV

Stage

- Early Stage Startup

- Seed

Industries

- Health & Wellness

- Deep Tech & Hard Science

- E-Commerce

- Consumer

- IoT

- SaaS

- Robotics

- AI & ML

- Fintech

- Healthcare

- Media

- Crypto & Blockchain

- Climate & Sustainability

- Advertising

Notable Investments

1. Leap Motion

URL: www.leapmotion.com

Funding Rounds: 7

Total Funding: $94.1M

2. Roadie

URL: www.roadie.com

Funding Rounds: 4

Total Funding: $62M

3. Motiv

URL: mymotiv.com

Funding Rounds: 8

Total Funding: $25.7M

Contact

Website: https://sosv.com/

Email: hello@sosv.com

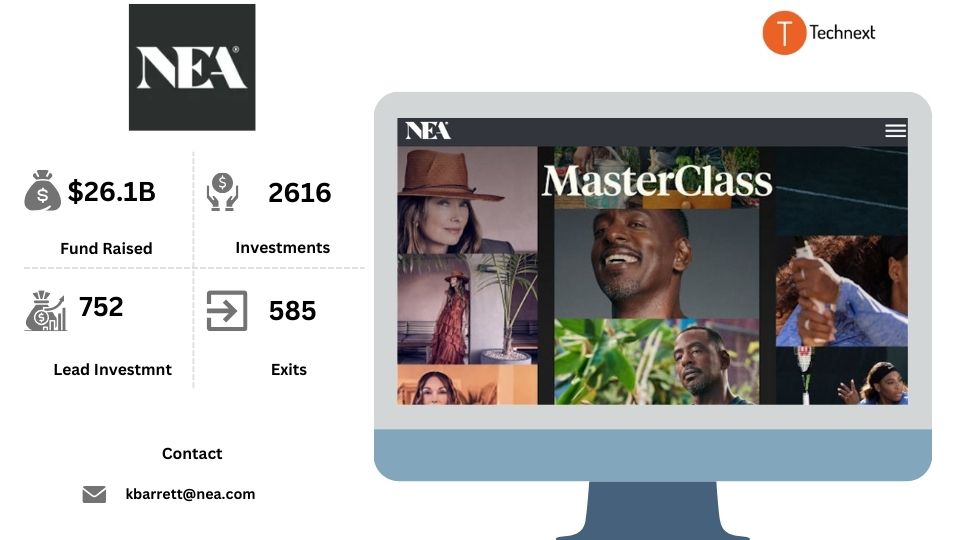

8. New Enterprise Associates

New Enterprise Associates (NEA) is a renowned New York venture capital firm. They invest in technology and healthcare. They are making the world better by helping founders. They collaborate with forward-thinking founders to turn big ideas and bold aspirations into the services, products, and solutions that shape the future. They are investors, but they are also inventors, technologists, operators, physicians, researchers, marketers, and, yes, even entrepreneurs

Details of New Enterprise Associates

Foundation Year: 1997

Countries of Operation:

- United States

- India

Number of Investments: 2616

Lead Investments: 752

Number of Exits: 585

Funds raised: $26.1B

Minimum cheque size: $1,000,000

Maximum Cheque Size: $10,000,000

Focus of New Enterprise Associates

Stage

- Early Stage Startup

- Late Stage Startup

Industries

- Enterprise

- Consumer

- Life Sciences

- AI & ML

- Education

- Fintech

Notable Investments:

1. Uber

URL: www.uber.com

Funding Rounds: 32

Total Funding: $25.2B

2. Juniper Networks

URL: www.juniper.net

Funding Rounds: 5

Total Funding: $38.7M

3. Cloudflare

URL: www.cloudflare.com

Funding Rounds: 8

Total Funding: $332.2M

Contact

Website: https://www.nea.com/

Email: kbarrett@nea.com

Phone: 650-854-9499

9. IDG Capital

IDG Capital is a global venture capital firm. Their mission is to make the world better by helping founders build great companies. Which makes them one of the best venture capital firms New York. At IDG Capital, they value scientific research technology. For years, they’ve been dedicated to long-term investments and maintaining close relationships with diversified partners from all over the world. They invest in companies at different stages and work with top-notch entrepreneurs to build lasting legacies.

Also, they have a competent and consistent investment team with a global perspective. And these team member uses their educational and professional experience to help their portfolio companies succeed.

.

Details of IDG Capita

Foundation Year: 1992

Countries of Operation:

- USA

- United Kingdom

- South Korea

- Vietnam

- China

Number of Investments: 1458

Lead Investments: 517

Number of Exits: 152

Funds raised: $2.9B

Minimum cheque size: $1,000,000

Maximum Cheque Size: $100,000,000

Focus of IDG Capita

Stage

- Early Stage Startup

- Late Stage Startup

- Private Equity

- Seed

Industries

- Media

- Healthcare

- Consumer

- Entertainment

- Climate & Sustainability

- Energy

Notable Investments

1. Animoca Brands

URL: www.animocabrands.com

Funding Rounds: 26

Total Funding: $806.7M

2. Razer

URL: www.razer.com

Funding Rounds: 4

Total Funding: $200M

3. Tencent

URL: www.tencent.com

Funding Rounds: 6

Total Funding: $12.6B

Contact

Website: https://en.idgcapital.com/team

Email: cooperation@idgcapital.com

Phone: +86 10 8590 1800

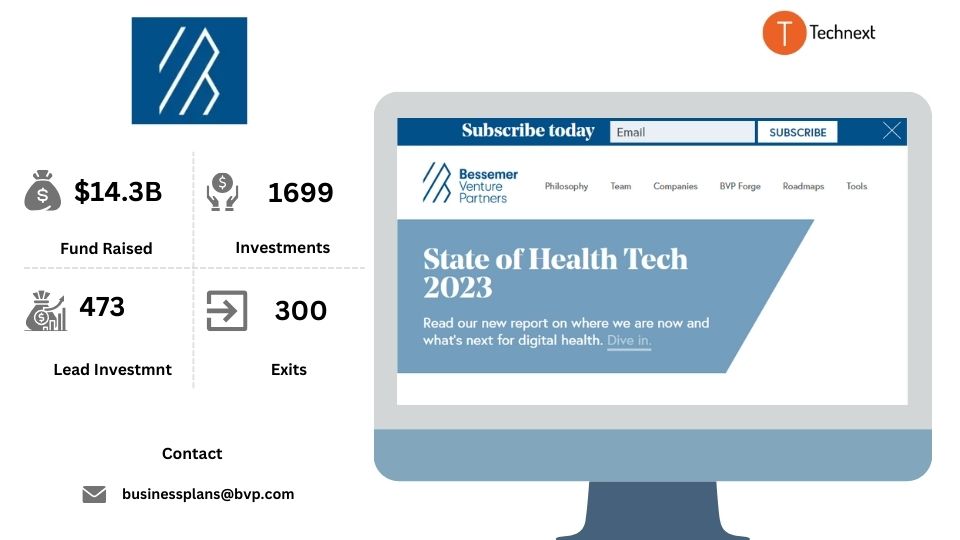

10. Bessemer Venture Partners

Bessemer Venture Partners is a renowned New York venture capital firm. They have good partnerships with founders all around the world. They love to team up with innovative companies that have big ideas to change the way we live, work, and do business.

They always appreciate founders with new ideas, new thinking, and different perspectives. Also, they always try to find out hidden problems and try to understand things that others might miss. Their partners and operating advisors collaborate to help entrepreneurs in key areas for growing their businesses.

Details of Bessemer Venture Partners

Foundation Year: 1911

Countries of Operation:

- USA

- India

- Israel

- United Kingdom

Number of Investments: 1699

Lead Investments: 473

Number of Exits: 300

Funds raised: $14.3B

Minimum cheque size: $2,000,000

Maximum Cheque Size: $8,000,000

Focus of Bessemer Venture Partners

Stage

- Early Stage Startup

- Late Stage Startup

Industries

- Consumer

- Enterprise

- Healthcare

- Cloud

Notable Investments

1. Shopify

URL: www.shopify.com

Funding Rounds: 4

Total Funding: $122.3M

2. Pinterest

URL: pinterest.com

Funding Rounds: 26

Total Funding: $1.5B

3. Twitch

URL: www.twitch.tv

Funding Rounds: 3

Total Funding: $35M

Contact

Website: https://www.bvp.com/

Email: businessplans@bvp.com

Phone: +1 415 800 8982

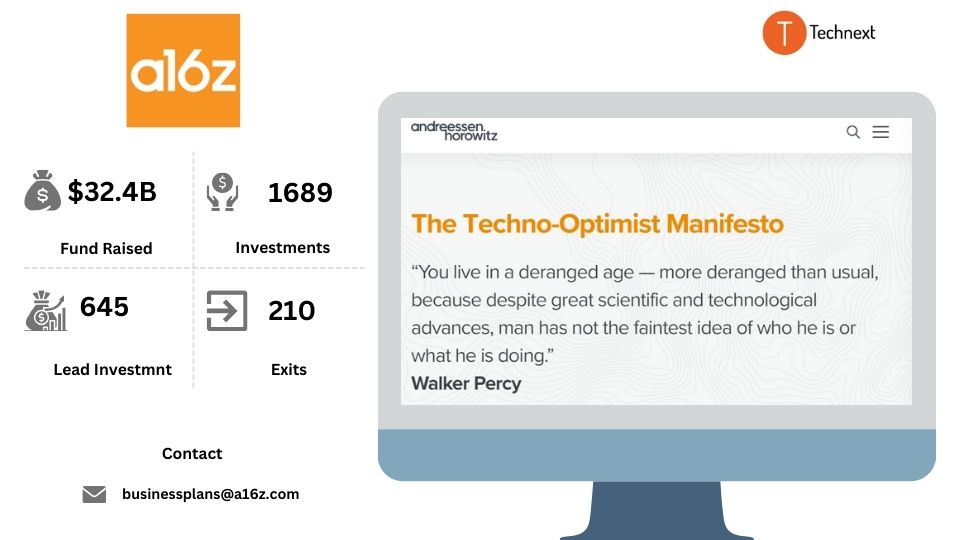

11. Andreessen Horowitz

Andreessen Horowitz venture capital firm is known as (“a16z”). Based on their operation as New York venture capital, they are one of the best. They back bold entrepreneurs who are using technology to build the future. They aim to connect with entrepreneurs, engineers, investors, academics, executives, industry experts, and others in the technology ecosystem.

The leaders of this firm are former CEOs or tech experts with experience in various fields like biology, crypto, and finance. So far, they have built a network with tech and executive talent, media, and key tech influencers. And they use this network as part of their commitment to help their portfolio companies grow their business.

Details of Andreessen Horowitz

Foundation Year: 2009

Countries of Operation:

- USA

- China

Number of Investments: 1689

Lead Investments: 645

Number of Exits: 210

Funds raised: $32.4B

Minimum cheque size: $500,000

Maximum Cheque Size: $1,000,000

Focus of Cathexis Ventures

Stage

- Early Stage Startup

- Late Stage Startup

Industries

- Biotech

- Healthcare

- Crypto & Blockchain

- Consumer

- Enterprise

- Fintech

- Gaming

Notable Investments

1. Slack

URL: www.slack.com

Funding Rounds: 11

Total Funding: $1.22B

2. GitHub

URL: github.com

Funding Rounds: 5

Total Funding: $350M

3. Instacart

URL: www.instacart.com

Funding Rounds: 19

Total Funding: $2.9M

Contact

Website: https://a16z.com/

Email: businessplans@a16z.com

Phone: (650) 798-5800

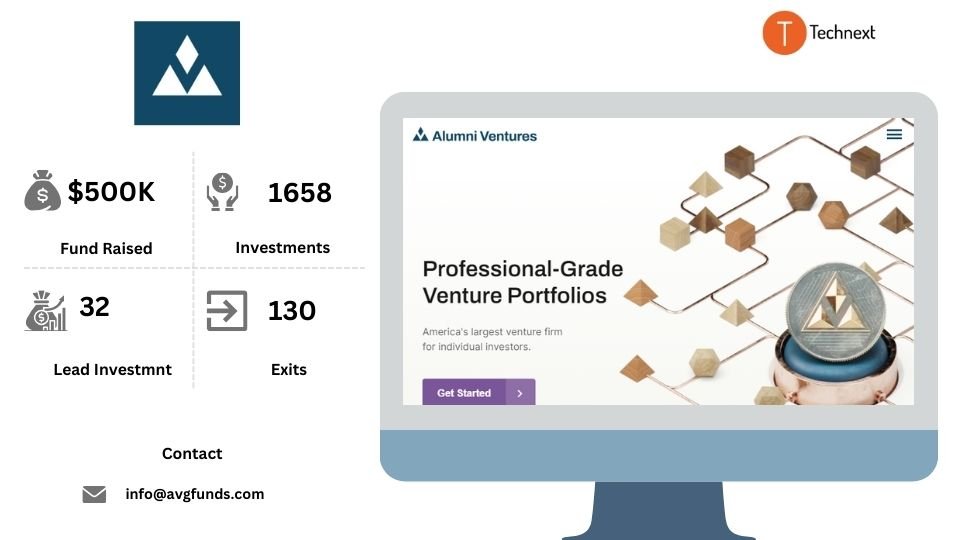

12. Alumni Ventures Group

Alumni Ventures is a New York Venture Capital Firm as well as America’s Largest for Individual Investors. They have one of the largest and most rapidly growing venture portfolios in the world. Also, they have a large group of venture investors all over, representing all the venture communities.

They believe in diversification. They love to invest in established lead investors and run a disciplined and rigorous process. If you connect with Alumni Ventures, their network will help you to get access to potential partners and customers.

.

Details of Alumni Ventures Group

Foundation Year: 2014

Countries of Operation:

- United States

- United Kingdom

Number of Investments: 1658

Lead Investments: 32

Number of Exits: 130

Funds raised: $500K

Focus of Alumni Ventures Group

Stage

- Early Stage Startup

- Late Stage Startup

- Seed

Industries

- AI & ML

- AR & VR

- Consumer

- Cybersecurity

- Fintech

- Food & Beverage

- Healthcare

- Industrial

- IoT

- Life Sciences

- Proptech & Real Estate

- SaaS

- Climate & Sustainability

- Transportation

- Media

- Manufacturing

Notable Investments

- GitHub

URL: github.com

Funding Rounds: 5

Total Funding: $350M

2. Shift

URL: shift.com

Funding Rounds: 11

Total Funding: $504M

3. Payzer

URL: payzerware.com

Funding Rounds: 6

Total Funding: $42.2M

Contact

Website: https://www.av.vc/

Email: info@avgfunds.com

Phone: 603-518-8112

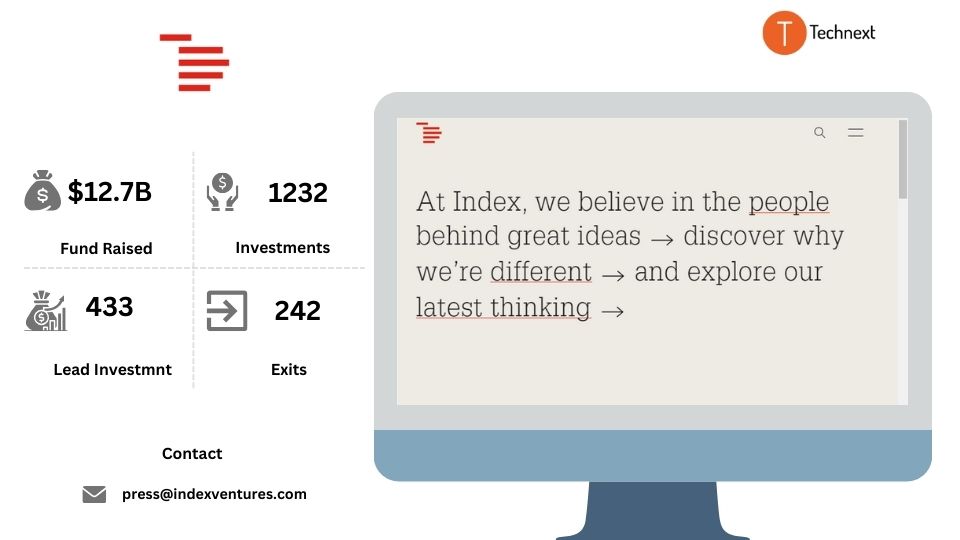

13. Index Ventures

Index Ventures helps the most ambitious entrepreneurs turn bold ideas into global businesses. They are an international team with a global mindset and ready to help founders wherever they come from. Other firms may invest in deals, but Index Venture invests in people making them the best V in New York.

They build partnerships with outstanding entrepreneurs with great ideas and a strong determination to turn their ideas into reality. Also, they work closely with founders and their teams throughout the scaling-up process and build strong relationships

Details of Index Ventures

Foundation Year: 1996

Countries of Operation:

- USA

- United Kingdom

Number of Investments: 1232

Lead Investments: 433

Number of Exits: 242

Funds raised: $12.7B

Minimum cheque size: $1,000,000

Maximum Cheque Size: $1,000,000

Focus of Index Ventures

Stage

- Early Stage Startup

- Late Stage Startup

- Seed

Industries

- AI & ML

- Entertainment

- Fintech

- Healthcare

- Media

- SaaS

Notable Investments

1. Funding Circle

URL: www.fundingcircle.com

Funding Rounds: 10

Total Funding: $746.4M

2. Datadog

URL: www.datadoghq.com

Funding Rounds: 8

Total Funding: $147.9M

3. Zendesk

URL: zendesk.com

Funding Rounds: 8

Total Funding: $85.5M

Contact

Website: https://www.indexventures.com/

Email: press@indexventures.com

Phone: 415-471-1700

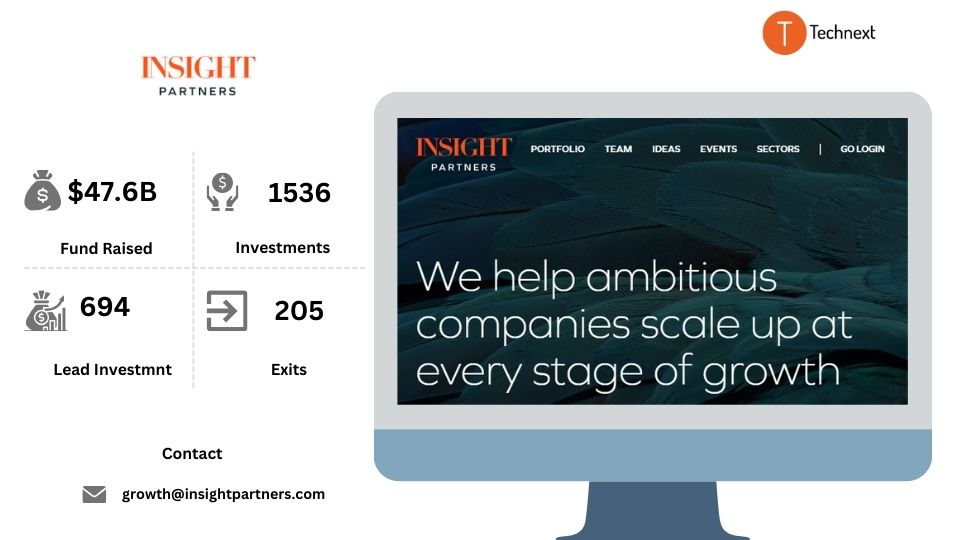

15. Insight Partners

Insight Partners is a private venture capital firm based in New York. They are a global software investor. They partner with high-growth technology, software, and Internet startup companies. They help ambitious companies scale up at every stage of growth. For over 25 years, Insight Partners has helped leaders turn their vision into reality. However, as a trusted partner for more than 600+ companies, they offer experienced software operators and flexible funding at every stage for leaders to fly faster and farther

Details of Insight Partners

Foundation Year: 1995

Countries of Operation:

- USA

Number of Investments: 1536

Lead Investments: 694

Number of Exits: 205

Funds raised: $47.6B

Minimum cheque size: $15,000,000

Maximum Cheque Size: $20,000,000

Focus of Insight Partners

Stage

- Debt

- Early Stage Startup

- Late Stage Startup

- Private Equity

- Seed

Industries

- Crypto & Blockchain

- Cybersecurity

- DevOps

- E-Commerce

- Education

- Fintech

- Government Technology

- Healthcare

- Supply Chain & Logistics

- Proptech & Real Estate

- Future of Work

- AI & ML

- API

- Food & Beverage

- Marketplace

- Legal

- Infrastructure

Notable Investments

1. DocuSign

URL: www.docusign.com

Rounds: 20

Total Funding: $536.2M

2. Shopify

URL: www.shopify.com

Rounds: 4

Total Funding: $122.3M

3. HqO

URL: www.hqo.com

Rounds: 7

Total Funding: $156.9M

Contact

Website: https://www.insightpartners.com/

Email: growth@insightpartners.com

Phone: 212-230-9200

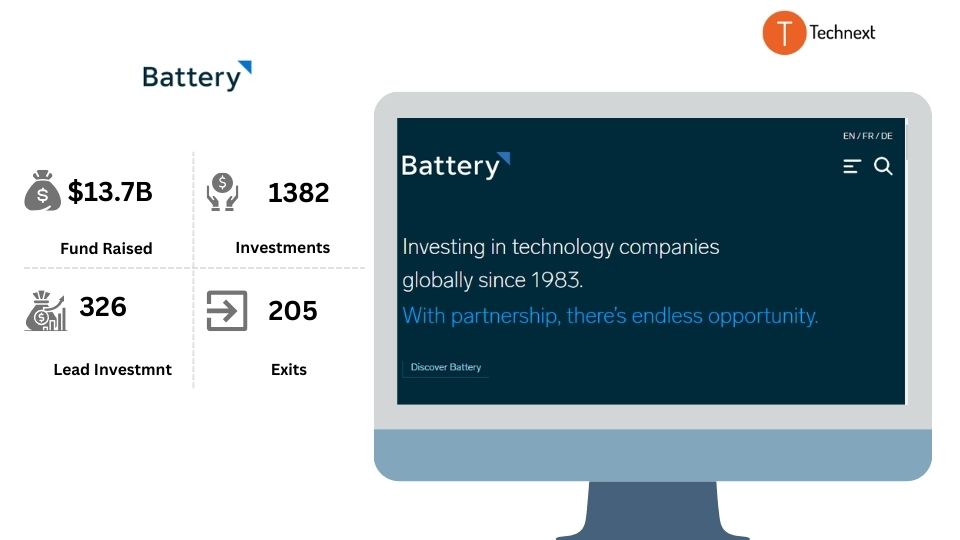

16. Battery Ventures

Battery Ventures is one of the global investment firms that focuses on technology. They are hard-working and focused investors with a clear strategy. They always look forward to extraordinary business leaders. Also, they support exceptionally skilled teams, from startups to becoming market leaders as a VC in New York. To help companies, they specialize in areas like recruiting, branding, business development, IT infrastructure scaling, and growth leadership.

Details of Battery Ventures

Foundation Year: 1983

Countries of Operation:

- USA

- United Kingdom

- Israel

Number of Investments: 1382

Lead Investments: 326

Number of Exits: 205

Funds raised: $13.7B

Minimum cheque size: $15,000,000

Maximum Cheque Size: $20,000,000

Focus of Battery Ventures

Stage

- Debt

- Early Stage Startup

- Late Stage Startup

- Private Equity

- Seed

Industries

- Life Sciences

- Industrial

- Consumer

- Cybersecurity

- Cloud

- DevOps

- AI & ML

- Fintech

- Healthcare

- Infrastructure

Notable Investments

1. Wayfair

URL: www.wayfair.com

Rounds: 5

Total Funding: $2.3B

2. Coinbase

URL: www.coinbase.com

Rounds: 19

Total Funding: $678.7M

3. Glassdoor

URL: glassdoor.com

Rounds: 10

Total Funding: $204.5M

Contact

Website: https://www.battery.com/

Phone: (415) 426-5900

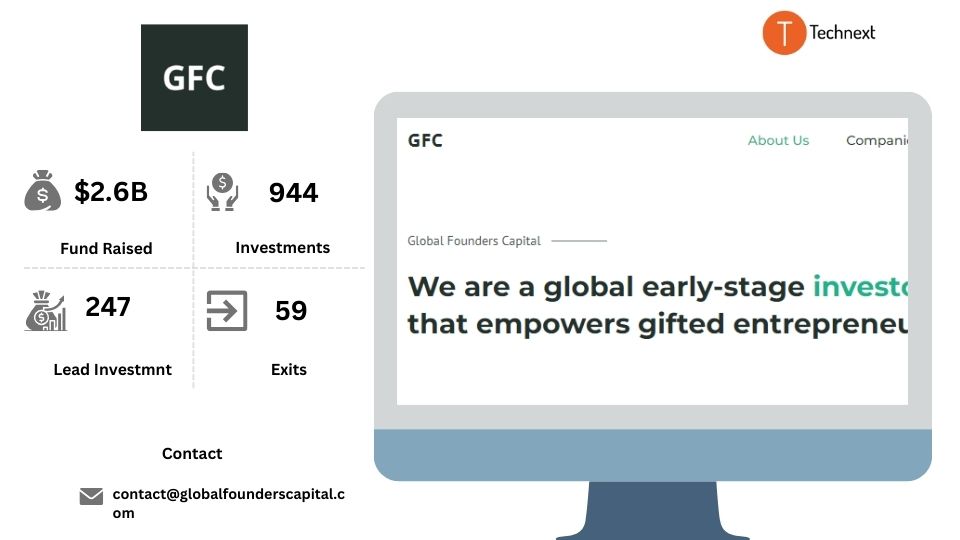

17. Global Founders Capital

Global Founders Capital is a globally oriented-venture capital firm headquartered in Berlin, Germany. They help founders from day 0 to IPO. Besides that, they also offer founders all the support for scaling up their journey. Their operations in New York make them one of the best New York venture capital.

Details of Global Founders Capital

Foundation Year: 2013

Countries of Operation:

- USA

- Canada

- United Kingdom

- Germany

- France

- Sweden

- Italy

- Turkey

- Singapore

- China

- Israel

- United Arab Emirates

- Indonesia

- Brazil

- Mexico

Number of Investments: 944

Lead Investments: 247

Number of Exits: 59

Funds raised: $2.6B

Focus of Global Founders Capital

Stage

- Early Stage Startup

- Late Stage Startup

- Seed

Industries

- Consumer

- SaaS

- Enterprise

- Internet & Mobile

- E-Commerce

- Productivity

- Supply Chain

- Logistics

- InsurTech

Notable Investments

1. Slack

URL: www.slack.com

Rounds: 11

Total Funding: $1.22B

2. Canva

URL: www.canva.com

Rounds: 17

Total Funding: $581M

3. Revolut

URL: www.revolut.com

Rounds: 12

Total Funding: $2.14B

Contact

Website: https://www.globalfounderscapital.com/

Email:contact@globalfounderscapital.com

This was our list of New York venture capital firms that are willing to invest in your startup. However, obtaining early funding is difficult. Preperar yourself with solid MVP and pitch deck.

Venture capital firms invest in people, not just ideas. So ensure you assemble your startup team, calculate equity, undertake market research, and assess potential. You can also consult an expert.

Remember, venture capital firms invest in people, not just ideas. If investors see you’re ready, your chances of funding grow. You can also consult an expert.

Finally, remember that funding can be difficult, but with preparation and vision, you can get it.

![9 Top Saudi Arabia Venture Capital Firms for Early-Stage Startups [2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/05/Saudi-Arabia-Venture-Capital-Firms-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)

![15 United States Saas Venture Capital Firms for Startups[2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/04/Saas-Venture-Capital-Firms-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)

![13 Top Japan Venture Capital Firms for Early-Stage Startups [2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/05/Japan-Venture-Capital-Firms-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)

![15 Top Berlin Venture Capital Firms for Early-Stage Startups [2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/04/Berlin-Venture-Capital-Firms-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)

![Top 17 Toronto Venture Capital Firms for Tech Startups [2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/03/Toronto-Venture-Capital-Firms-for-Tech-Startups-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)