9 Top Saudi Arabia Venture Capital Firms for Early-Stage Startups [2024]

Are you looking for Saudi Arabia Venture Capital firms for your early-stage startup? Check out the 9 promising options we’ve generated.

Venture capital companies in Saudi Arabia are becoming more and more important for promoting new ideas and growing the economy of the Kingdom. For startups to grow and succeed, Saudi Arabia is a great place to be because it has a great location, strong government backing, and a growing entrepreneurial ecosystem.

As part of its ambitious Vision 2030 plan, the Kingdom has promised to diversify its economy and become less reliant on oil revenues by putting a lot of money into areas like entertainment, technology, and green energy. This forward-thinking approach has caught the eye of venture capital firms from around the world and the United States looking for good places to invest.

Here is our list of top Saudi Arabia venture capitals for your early startup.

15 Early-Stage Saudi Arabia Venture Capital Firms

1. Raed Ventures

Raed Ventures is an early-stage Saudi Arabia venture capital firm. They create partnerships with exceptional founders who are building transformative companies in the MENA region. Also, they help startups in building and executing their visions through collaborations. Besides that, they open doors for MENA startups and allow them to work in the Saudi & GCC markets.

Details of Raed Ventures

Foundation Year: 2015

Countries of Operation:

- Saudi Arabia

Number of Investments: 63

Lead Investments: 26

Number of Exits: 3

Funds raised: $12.6M

Focus of Raed Ventures

Stage

- Early Stage Startup

- Seed

Industries

- Fintech

- E-Commerce

- Supply Chain & Logistics

- Education

- Healthcare

- Enterprise

- Consumer

- AI & ML

- SaaS

- Marketplace

- InsurTech

- Automative

- Entertainment

Notable Investments

1. Sylndr

URL: sylndr.com

Funding Rounds: 2

Total Funding: $12.6M

2. Sary

URL: sary.com

Funding Rounds: 5

Total Funding: $112.1M

3. Opontia

URL: opontia.com

Funding Rounds: 4

Total Funding: $62M

Contact

Website: https://raed.vc/

Email: info@raed.vc

2. Impact46

Impact 46 is a venture capital firm based in Riyadh, Saudi Arabia. They are an asset manager and advisor that specializes in alternative investment opportunities. They focus on alternative Saudi Arabian investment opportunities.

Additionally, they provide innovative investment products and services to local & international institutions, family groups, endowments, and high-net-worthorth investors. Besides that, they offer a skilled team and a highly valuable network to the startups as part of their investment decision-making process.

Details of Impact46

Foundation Year: 2019

Countries of Operation:

- Saudi Arabia

Number of Investments: 49

Lead Investments: 23

Number of Exits: 3

Funds raised: SR24,000,000

Minimum cheque size: SR500,000

Maximum Cheque Size: SR7,000,000

Focus of Impact46

Stage

- Early Stage Startup

- Late Stage Startup

- Seed

Industries

- Supply Chain & Logistics

- Fintech

- Marketplace

- Healthcare

- DTC

Notable Investments

1. Homzmart

URL: homzmart.com

Funding Rounds: 3

Total Funding: $39.3M

2. Dawul

URL: dawul.net

Funding Rounds: 1

Total Funding: $5M

3. Jahez International Company

URL: jahez.net

Funding Rounds: 1

Total Funding: $36.5M

Contact

Website: https://impact46.sa/

Email: info@impact46.sa

Phone: 011-2381660

3. Hala Ventures

Hala Ventures is a Saudi Arabia venture capital company. They target early to growth-stage companies, enhancing their economic infrastructure. They invest in technology-based companies that have achieved sustainable revenue. Also, try to empower them with investment and consultancy. Besides that, they provide investment advice and support specifically to meet the needs of each company.

Details of Hala Ventures

Foundation Year: 2018

Countries of Operation:

- United Arab Emirates

- Egypt

Number of Investments: 39

Lead Investments: 3

Number of Exits: 4

Funds raised: $24,000,000

Focus of Hala Ventures

Stage

- Early Stage Startup

- Seed

Industries

- InsurTech

- Marketplace

- Fintech

- Food & Beverage

- API

- Education

- Media

- Productivity

Notable Investments

1. Krave Mart

URL: kravemart.com

Funding Rounds: 4

Total Funding: $12.3M

2. Bevy

URL: bevy.com

Funding Rounds: 3

Total Funding: $61.4M

3. El-Dokan

URL: el-dokan.com

Funding Rounds: 4

Total Funding: $550K

Contact:

Website: https://www.hala.vc/

Email: info@halavc.com

4. DAAL Ventures

Daal Ventures is a Saudi Arabian venture capital firm. They invest in Middle-Eastern tech entrepreneurs. They prefer to connect with the most promising IT opportunities around the world. Also, they are led by investors and principles who are dedicated to bringing innovative companies to the GCC region.

Besides that, they aim to create excellent opportunities for investment by providing business development and mentorship. Also, they have an excellent team to guide and nurture portfolio companies into achieving business growth.

Details of DAAL Ventures

Foundation Year: 2018

Countries of Operation:

- Saudi Arabia

Number of Investments: 20

Lead Investments: 2

Number of Exits: 3

Focus of DAAL Ventures

Stage

- Early Stage Startup

Industries

- Marketplace

- Fintech

- SaaS

- AI & ML

- DTC

- Big Data & Analytics

- IoT

Notable Investments

1. Datlo

URL: datlo.com

Funding Rounds: 2

Total Funding: $125K

2. Eventtus

URL: eventtus.com

Funding Rounds: 6

Total Funding: $2.6M

3. Wuilt

URL: wuilt.com

Funding Rounds: 2

Total Funding: $535K

Contact

Website: https://daal.ventures/

Email: info@daal.io

Phone: +966138878874

5. 500 Startups

500 Startup is a well-known venture capital organization that invests in early-stage technology firms. They continually improve people and the economy worldwide via their excellent entrepreneurship. They also concentrate on markets where technology, innovation, and capital can produce long-term value and support economic progress.

In addition, through their 5 global funds and 15 thematic funds, they have invested in approximately 2,300 companies. Furthermore, their 100+ team members are spread across 20 countries to serve the 500 Startups’ global portfolio of investments spanning more than 75 nations

.

Details of 500 Startups

Foundation Year: 2010

Countries of Operation:

- Saudi Arabia

- United Arab Emirates

- Azerbaijan

- Egypt

- Bahrain

- USA

- India

- United Kingdom

- Brazil

- France

- Hong Kong

- Singapore

- Thailand

- China

- Malaysia

- Cambodia

- South Korea

- Taiwan

Number of Investments: 3974

Lead Investments: 446

Number of Exits: 370

Funds raised: $2.3M

Minimum cheque size: $50,000

Maximum cheque size: $250,000

Focus of 500 Startups

Stage

- Early Stage Startup

- Seed

Industries

- SaaS

- Media

- E-Commerce

- Consumer

- Healthcare

- Fintech

- Crypto

- Blockchain

Notable Investments

1. Canva

URL: canva.com

Rounds: 17

Total Funding: $581M

2. Reddit

URL: reddit.com

Rounds: 7

Total Funding: $1.62B

3. Dimension

URL: eyewa.com

Funding Rounds: 8

Total Funding: $29.8M

Contact

Website: http://500.co/

Email: info@500startups.com

Phone: (415) 974-6343

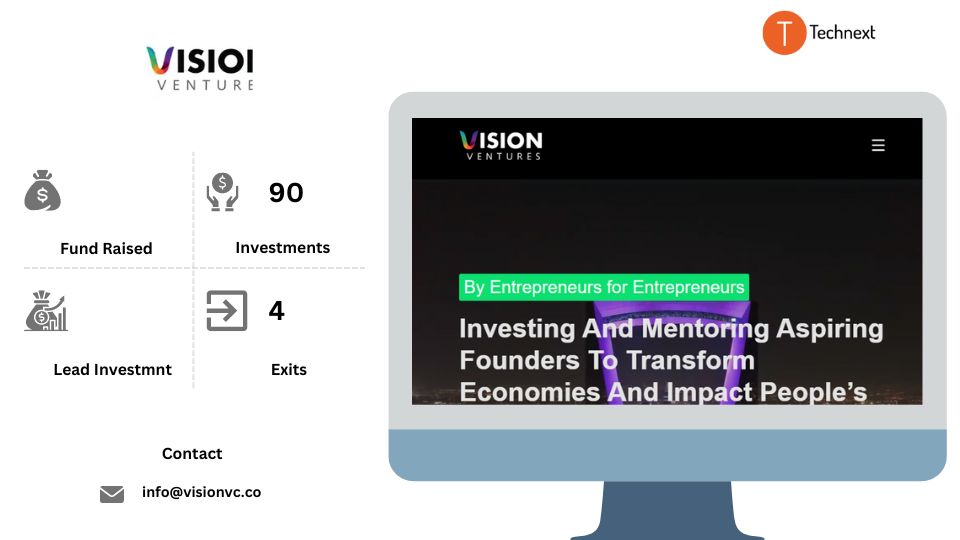

6. Vision Ventures

Vision Ventures is an early-stage venture capital firm founded by experienced entrepreneurs. They have been investing in early-stage tech startups in MENA since 2016. They are an energetic team with extensive experience in launching businesses and guiding them to success and hyper-growth.

They also provide hands-on experience to help founders in their journey and enable them to accelerate their companies’ growth. Additionally, they provide startups with hands-on assistance and guidance on marketing, sales, product/service development, financial planning and management, expansion & growth strategy, and more

Details of Vision Ventures

Foundation Year: 2016

Countries of Operation:

- Saudi Arabia

- United Arab Emirates

Number of Investments: 90

Number of Exits: 4

Focus of Vision Ventures

Stage

- Convertible Note

- Debt

- Early Stage Startup

- Seed

Industries

- Financial Services

Notable Investments

1. Sibly

URL: sibly.com

2. Bayzat

URL: bayzat.com

Funding Rounds: 7

Total Funding: $53.6M

3. POSRocket

URL: posrocket.com

Funding Rounds: 6

Total Funding: $11.6M

Contact:

Website: https://visionvc.co/

Email: info@visionvc.co

7. Saudi Venture Capital Company

Saudi Venture Capital Company (SVC) is a well-known government investment company. They aim to develop the venture capital and private equity ecosystem in Saudi Arabia. Also, they are uniquely positioned to stimulate the development of the private capital industry in the same region.

Besides that, they help to minimize current equity funding gaps for startups. Also, their board of directors comprises key government stakeholders and experienced members of the private sector.

Details of Saudi Venture Capital Compan

Foundation Year: 2018

Countries of Operation:

- Saudi Arabia

- Lebanon

Number of Investments: 19

Focus of Saudi Venture Capital Compan

Stage

- Pre-Seed

- Late Stage

Industries

- Financial Services

- Venture Capital

Notable Investments

1. VentureSouq

URL: venturesouq.com

Funding Rounds: 1

Total Funding: $50M

2. Global Ventures

URL: global.vc

Funding Rounds: 1

Total Funding: $1.5M

3. Surface Logix

URL: barqapp.com

Funding Rounds: 3

Total Funding: $9.9M

Contact

Website: https://svc.com.sa/en/

8. MSA Capital

MSA Capital is a renowned global venture capital and private equity firm. They back the world’s leading entrepreneurs. They invest in technology-enabled companies from the seed to the growth stage. Also, they actively partner with outstanding entrepreneurs in China and other technology markets. Besides that, they manage capital from the world’s top sovereign wealth funds, international asset managers, pension funds, university endowments, funds of funds, and family offices

Details of MSA Capitals

Foundation Year: 2014

Countries of Operation:

- Saudi Arabia

- United Arab Emirates

- Bahrain

- China

- Singapore

Number of Investments: 151

Lead Investments: 23

Number of Exits: 10

Funds raised: $837M

Focus on MSA Capital

Stage

- Seed

- Early Stage Startup

- Late Stage Startup

Industries

- Health & Wellness

- Consumer

- Enterprise

Notable Investments:

1. Uber

URL: uber.com

Funding Rounds: 32

Total Funding: $25.2B

2. NIO

URL: nio.com

Funding Rounds: 12

Total Funding: $7.2B

3. Meituan

URL: meituan.com

Funding Rounds: 9

Total Funding: $17.3B

Contact

Website: https://500.co/

Email: info@500startups.com

9. Shorooq Partners

Shorooq Partners is the leading technology investor in the Middle East. They invest in early-stage technology startups focusing on the (MENAP) region. In 2021, they also launched the region’s first venture debt fund. Today, their portfolio companies have generated over $2.5 billion in equity value. Which makes them one of the best Saudi Arabia venture capital.

Their mission is to propel the technology startup innovation landscape in the region. Also, they have received the Investor of the Year Award three consecutive times and were recognized as the fastest-growing VC in the region.

Details of Shorooq Partners

Foundation Year: 2017

Countries of Operation:

- Saudi Arabia

- United Arab Emirates

- Bahrain

Number of Investments: 116

Lead Investments: 49

Number of Exits: 5

Funds raised: $200,000,000

Focus of Shorooq Partners

Stage

- Early Stage Startup

- Pre-Seed

- Seed

- Series A

Industries

- Healthcare

- InsurTech

- Marketplace

- Big Data & Analytics

- Supply Chain & Logistics

- Fintech

- Future of Work, AI & ML

Notable Investments:

1. Tamara

URL: tamara.com

Funding Rounds: 7

Total Funding: $615.6M

2. ZenLedger

URL: zenledger.io

Funding Rounds: 4

Total Funding: $25.9M

3. Colabs

URL: colabs.pk

Funding Rounds: 4

Total Funding: $4M

Contact

Website: https://www.shorooq.com/

Email: deals@shorooq.com

Phone: +971 02 671 1127

Saudi Arabia’s SaaS market has a lot of room for growth, and these venture capital firms can help you a lot as you start your own business. This group of VCs can help your SaaS business grow with their knowledge, contacts, and money. If you need more advice, you can consult our expert.

![15 United States Saas Venture Capital Firms for Startups[2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/04/Saas-Venture-Capital-Firms-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)

![Top 17 Toronto Venture Capital Firms for Tech Startups [2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/03/Toronto-Venture-Capital-Firms-for-Tech-Startups-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)

![17 New York Venture Capital Firms for Early-Stage Startups[2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/04/New-York-Venture-Capital-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)

![13 Top Amsterdam Venture Capital Firms for Early-Stage Startups [2024]](https://e6tgusu7445.exactdn.com/wp-content/uploads/2024/05/Amsterdam-venture-capital-768x432.jpg?strip=all&lossy=0&sharp=1&ssl=1)