7 Top Startup Revenue Models in 2023 and How to Choose One

Learn about different startup revenue models and discover the best ways to maximize your startup profit using the same resources.

What do you think the main motivation behind funding a startup is? Yes, you guessed it right: for most investors, it’s the high return on investment.

So, whatever your product, service, target audience, or value proposition is, you need to generate revenue for your investors. And to successfully generate revenue, you need to have a solid revenue model for your startup.

There are many startup revenue models in existence, but we will only talk about the 7 most common revenue models in the tech startup industry, their advantages, and disadvantages, and provide examples of companies who are using them so that you have a clear understanding.

Before the description of each review model, let’s have a quick look at them:

| Name | Description | Example |

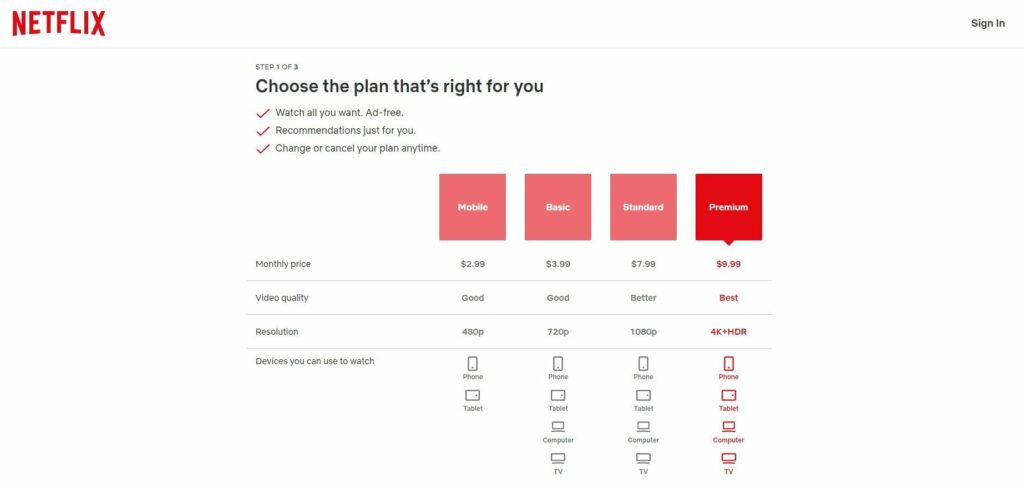

| Subscription-Based Revenue Model | Charge customers a recurring fee for access to a product or service, generating steady income. | Netflix, Amazon Prime |

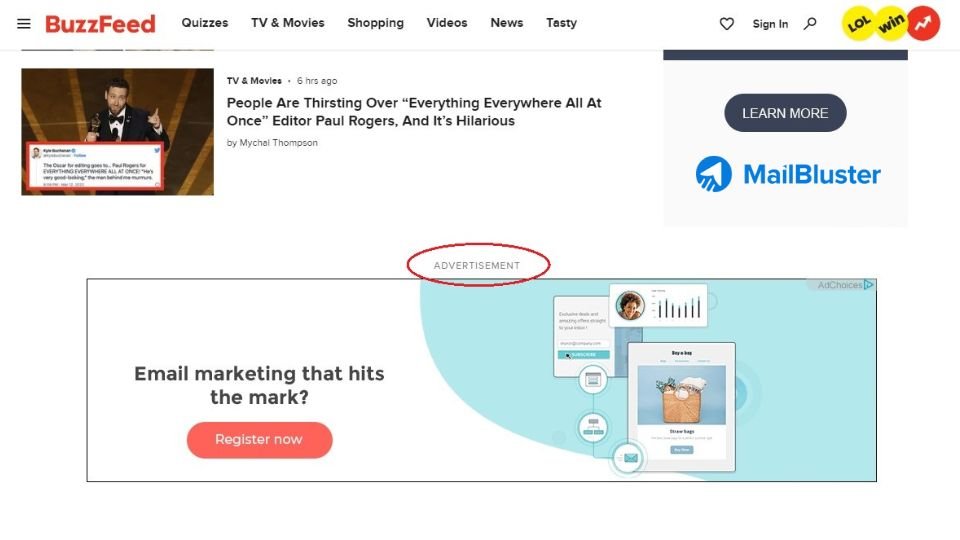

| Advertising-Based Revenue Model | Generate revenue by selling ad spaces on a platform or within content, earning from clicks or views. | Google, BuzzFeed |

| Freemium Revenue Model | Offer a basic product/service for free and charge for premium features, attracting and upselling users. | LinkedIn, Dropbox |

| Licensing Revenue Model | Grant the right to use intellectual property in exchange for a fee, typically one-time or royalty-based. | Microsoft (Windows licensing) |

| Transaction-Based Revenue Model | Earn revenue by charging a fee or commission for each use or transaction of a service. | PayPal, Amazon (third-party seller fees) |

| SaaS Revenue Model | Collect periodic subscription fees for cloud-hosted products/services. Monitored with metrics like MRR and churn. | Salesforce, Zoom |

| Affiliate Revenue Model | Earn by promoting others’ products, gaining a percentage of profits. Common in e-commerce and web marketing. | WPBeginner |

We will also discuss how you can choose the right revenue model for your startup and the mistakes you need to avoid while creating your revenue model. Let’s get started.

What Is the Startup Revenue Model?

It’s easy to get mixed up between the business model and revenue models. Let’s start with the business model before moving on to the revenue model.

A business model defines the structure of a business and how it creates and delivers value to its customers. It outlines the key components of your business, such as the product or service offered, value proposition, customer segments & relationships, key partners, cost structure, etc.

On the other hand, the revenue model is a part of the business model that focuses specifically on the sources of revenue and how they will be managed to ensure the sustainability and success of the business.

Having a revenue model helps you prioritize your revenue streams and price your products effectively.

Why Your Startup Needs A Reliable Revenue Model

As you know, revenue is essential to the survival of your company so as a revenue model. Here is why your startup needs a reliable revenue model:

- It helps your business determine which revenue sources to prioritize. By prioritizing revenue streams, you can focus efforts on the most promising sources of revenue and allocate resources accordingly, increasing your business’s overall profitability.

- Gives your business a roadmap for ensuring sustainable growth and success by forecasting and tracking revenue over time. That can help you monitor progress and provide a historical perspective for future predictions to ensure your business can grow and succeed over the long term.

- Allows your business to price products effectively so that you can cover your costs and reach your financial goals by understanding target customers, their needs, and their value. You can also attract more customers and increase sales by effectively pricing your product.

- Shows potential investors that the business has a clear plan for generating revenue and maximizing profit. This gives potential investors confidence that the business has thought through its financial strategy, which is crucial for attracting investment capital.

- Permits your business to change or pivot if the original revenue-generating strategy is not working effectively to help your business stay competitive, meet changing customer needs, and generate revenue in changing circumstances.

7 Most Common Revenue Models for Startup In 2023

Now that you understand the fundamentals of the revenue model, you might want to design a revenue model that maximizes your revenue. Here, let’s look at the various forms of Common Revenue Models so that you can come up with your own revenue model.

1. Subscription-Based Revenue Model

One of the most popular and widely used revenue models in the startup world. In a subscription-based revenue model, you charge customers a recurring fee, typically on a monthly or annual basis, for access to a product or service. The more subscribers there are, the more money you make.

Your startup can use the recurring income from subscriptions to cover costs and generate profit. If your business includes online streaming services, software as a service (SaaS) providers, or print or digital media publications, you can use the subscription revenue model.

Highlight

Customers pay a recurring fee for continued access to a product or service. Netflix or Amazon Prime would be the best example.

Although this model seems fairly easy to implement, the complete subscription revenue cycle involves acquiring new customers and delivering high-quality service to them, which is not quite an easy task to accomplish.

Once you have customers on board, you can look for opportunities to upsell or cross-sell by offering additional products or services that enhance the value they receive. To maintain a steady stream of recurring revenue, it’s crucial to work on retaining customers. By following these steps consistently, you can ensure the success of your subscription revenue model and generate a profitable and sustainable income stream over time.

Examples of Subscription Revenue Model

A real-life example of a subscription-based revenue model is Netflix. Netflix allows customers to access a wide range of video content for a fixed monthly or annual fee, providing a predictable, recurring revenue stream for the company.

Another example is Spotify – a music streaming platform that offers users access to millions of songs and podcasts for a monthly subscription fee. The company offers both free and paid versions.

Amazon Prime is also a subscription service offered by Amazon that provides users with a range of benefits, including free two-day shipping, access to Prime Video, Prime Music, and other services. The monthly subscription fee also includes exclusive deals and discounts on Amazon products.

Pros and Cons of the Subscription Revenue Model

Every revenue model comes with its own pros and cons. Let’s have a look at the advantages and disadvantages of the subscription-based revenue model.

| Advantages of the Subscription Revenue Model | Dis-advantages of the Subscription Revenue Model |

|---|---|

| Subscriptions increase customer loyalty through long-term commitment and lower turnover. | Losing subscribers can have a substantial influence on a company’s income and success. |

| Providing additional goods and services can boost the value, leading to a rise in income. | Offering continued access and additional products/services may result in increased expenses and lower profit margins. |

| Offers a steady, predictable revenue source, hence enhancing customer lifetime value (LTV). | If clients are uncertain about the value and quality of the products/services, they may be hesitant to subscribe. |

| Continuous access fosters stronger relationships, resulting in greater customer satisfaction and a more positive brand image. | The cost of acquiring customers initially may be higher compared to other revenue models. |

| Adding additional subscribers results in a rise in revenue, allowing for long-term growth. | Customers may feel locked in to a subscription, resulting in a negative experience and churn. |

| Consistent recurring revenue enhances cash flow and decreases the danger of running out of money. |

2. Advertising-Based Revenue Model

The advertising revenue model is a business model where your company can generate revenue by selling ad spaces on your platform or within your content. The advertisements can be banner ads, video ads, display ads, or sponsored content.

You earn revenue each time a viewer clicks on or views one of the advertisements. There are three types of payment you can receive – cost-per-click (CPC), cost-per-action (CPA), or cost-per-thousand-impressions (CPM).

Highlight

Startup offer free access to their platforms while generating revenue through targeted advertising. Google and Facebook dominate this space.

Before implementing an advertising revenue model, you need to consider key factors such as understanding different types of ads, target audience, ad performance tracking and optimization, content strategy, laws and regulations for online advertising, and pricing. You should also be aware of ads’ impact on user experiences, such as relevance and website loading speed.

Examples of Ad based revenue model

Google’s search engine and many of its other products, including YouTube and other digital properties, are free to use, but the company generates the majority of its revenue from advertising.

Advertisers pay to display their ads alongside search results or on other Google products, and Google earns money from clicks or impressions on those ads.

Another example is BuzzFeed – a media company that produces articles, videos, and other content. Advertisers can create sponsored content that is integrated into BuzzFeed’s articles or videos, and BuzzFeed earns money from clicks or impressions on those ads.

The most popular social media platform Facebook also generates revenue through advertising. Advertisers can create targeted ads based on user data and pay to have them displayed on the site.

Advantages and Disadvantages Of The Advertising Revenue Model

The advertising-based revenue model is also associated with several strengths and challenges. Let’s have a quick look at them.

| Advantages of the Advertising Revenue Model | Disadvantages of the Advertising Revenue Model |

|---|---|

| Poorly designed or intrusive ads can negatively impact the user experience. | Poorly designed or intrusive ads can negatively impact the user experience of your website. |

| Flexibility to experiment with different types | Poorly designed or intrusive ads can negatively impact the user experience for your website. |

| Highly scalable allows you to increase the number of advertisements you display and the revenue you generate | The increasing usage of ad-blockers may decrease the number of ads users see on a platform. |

| You may find it challenging to attract high-quality advertisers if you are a startup. | Having an advertising revenue model can provide you with an additional source of income. |

| Can generate profit by providing advertisers with performance-tracking data, allowing for targeted marketing campaigns | You may face challenges with ad fraud and clickbait, which can lower the credibility of your advertising platform and harm your reputation. |

3. Freemium Revenue Model

Freemium is a revenue model that offers a basic version of a product or service for free while charging for premium features or additional functionality. This model is popular in many industries, especially in software and mobile app development.

If you want to implement a freemium revenue model, you need to decide which features to offer for free and which to pay for. If you keep your value proposition to users in mind, it becomes easy to decide.

In the freemium review model, you need to ensure that the free features are compelling enough to encourage users to sign up and use your product.

Now, what features should you offer for free? You can make any features free but not so extensive that they don’t see the need to upgrade to the paid version.

You need to find the sweet spot between providing enough value to attract users and keeping some features to encourage them to upgrade.

Highlight

Startup offers a basic version of the product or service for free, inviting users to upgrade for additional features. Spotify or LinkedIn implemented this model very well.

You need to know one more fact about how the conversion rate works for the freemium model. It depends on various factors, such as your business model and target market.

If your target market is small, a higher conversion rate may be more appropriate for your business and vice versa.

Examples of the Freemium revenue model

The professional networking site LinkedIn offers a free version with limited features where Users can create a profile, connect with other professionals, view job postings in their industry, etc.

LinkedIn charges users for a premium version with additional features and benefits, such as LinkedIn Learning courses or the ability to send messages to people outside of your network.

Another great example is Dropbox. Almost everyone has heard of Dropbox – a cloud storage provider. Did you know that Dropbox was among the first businesses to use the freemium model?

They follow the traditional model. Their free users always have access to 2GB of storage space; if they need more room, they can pay to upgrade.

Advantages and disadvantages of the freemium revenue model

| Advantages of the Freemium Revenue Model | Disadvantages of the Freemium Revenue Model |

|---|---|

| A freemium model can be a smart strategy for building a large user base for your product | Can result in high acquisition costs per user, which can be a challenge for your startup. |

| You only need to provide developer support to premium customers, so low cost on developer support. | The low barrier to entry can attract budget-conscious or cautious users to your product. |

| The revenue potential is limited to the number of users who convert to a paid plan for your product. | Can lead to a fast cash burn rate that exceeds your revenue. |

| The revenue potential is limited to the number of users who convert to a paid plan of your product. | Once you have a large user base, this becomes effective strategy for upselling to premium versions and other products/services to increase revenue. |

| You can use the massive free product user base for market research and beta testing before release to paid users. | Offering a freemium model can result in a higher churn rate as it attracts customers who may not be committed to your product or service for the long term. |

4. Licensing Revenue Model

The licensing revenue model involves a company granting the right to use its intellectual property, such as patents, trademarks, or copyrights, to another company in exchange for a fee, which can either be a one-time payment or a recurring royalty based on product sales.

Let’s assume you have a software company; you license your software to another company for their products and receive a portion of the profits from those sales. From the example, as you can see, this model benefits you and your licensee.

Highlight

Startups license their software to other companies for a fee. It’s not a popular model for startups, as relying solely on licenses can limit scalability.

To ensure success, you must be careful of implementing license agreements, ensuring licensee compliance with regulations like copyright law, protecting your intellectual property from misuse or abuse, etc. If you want to know better about the tech licensing revenue model, you may read the research article by Bowman Heiden and Thomas on Licensing-Based Business Models.

Example of licensing revenue model

A common example of a licensing revenue model is how Microsoft licenses its Windows operating system to computer manufacturers, including Dell, HP, and Lenovo. Through this arrangement, these companies are able to pre-install Windows on their computers and sell them to end-users.

In this model, Microsoft grants manufacturers the right to use its software in exchange for a licensing fee. The fee is usually determined by the number of units sold or a set royalty per device. As a result, Microsoft is able to generate revenue from every computer sold with its operating system.

Advantages and disadvantages of licensing revenue model

| Advantages of the Licensing Revenue Model | Disadvantages of the Licensing Revenue Model |

|---|---|

| By licensing, you can build brand awareness and increase your market visibility | You may have limited control over your product’s quality, design, and marketing |

| You can generate a steady stream of income for your startup by monetizing your IP | If the licensee fails to generate any profit from your IP, you will not receive any profit |

| Licensing IP minimizes the need for your to invest in product commercialization, as the licensee takes responsibility for associated costs. | Enforcing contracts and protecting your intellectual property can be difficult and expensive |

| Licensing your product or service can be a significant way to break into new markets | Granting a license to use your trademark, name, or technology can damage your brand if the licensee uses these assets unlawfully or ethically. |

| Allowing you to participate in markets without overextending your capacity | Licensing your IP to a competitor or even a partner company can cause cannibalization of your product or service, harming your revenue stream. |

5. The Transaction-Based Revenue Model

The transaction-based revenue model is a classic way to generate revenue by charging customers for each use or transaction of a service.

This model ensures a consistent and scalable revenue stream by imposing a fixed amount or a percentage of the transaction value. Revenue is only earned when a transaction takes place, providing a reliable way to plan and forecast revenue based on anticipated transactions.

Highlight

Startups earn revenue by charging a fee or commission for each transaction facilitated on their platform. PayPal and Wise are excellent examples of this model.

To excel with this model, it is crucial to offer value-added services that foster customer loyalty. Additionally, staying adaptable and innovative is critical to ensuring success in a dynamic market environment.

Examples of Transaction-Based Revenue model:

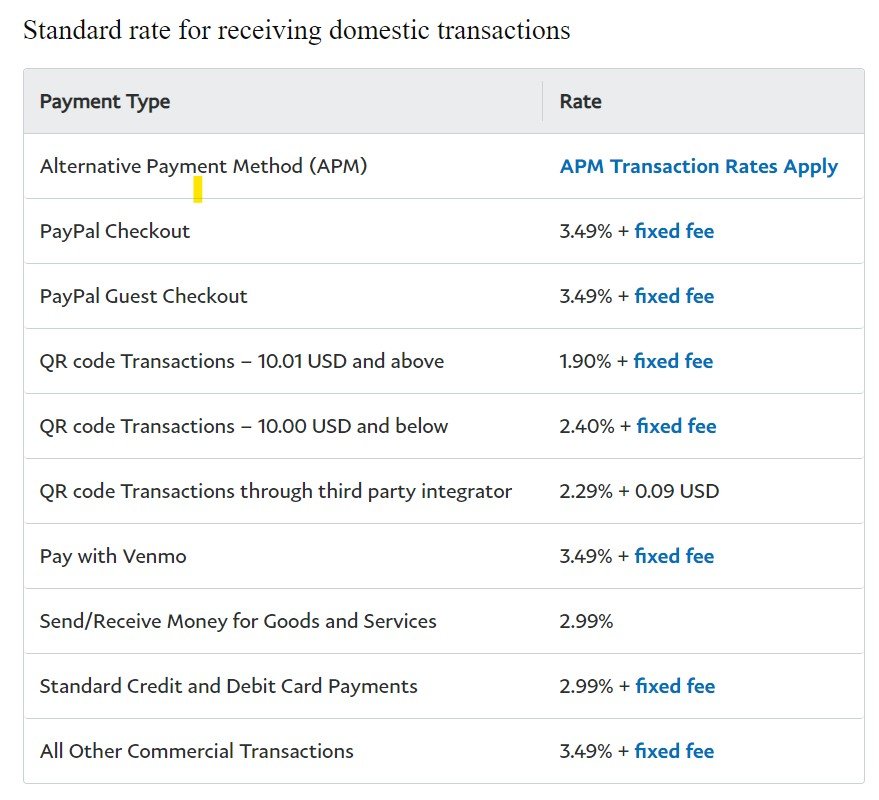

Most Banking systems follow the transaction bank revinew model. For instance, PayPal – the most popular online payment service charges a fee for each transaction on its platform. Which is usually a a percentage of the total transaction amount and a flat fee per transaction.

Amazon is a great example of a company that uses a transaction-based revenue model. Amazon charges fees to third-party sellers for each product sold through their platform, as well as for certain other services such as warehousing and fulfillment. These fees are typically a percentage of the sale price or a fixed amount per transaction.

Advantages and disadvantages of the transaction-based revenue model

| Advantages of the Transaction-Based Revenue mode | Disadvantages of the Transaction-Based Revenue model |

|---|---|

| The model’s predictability lets you estimate monthly transactions, which can help in budgeting, resource allocation, and growth strategies through revenue planning and forecasting | The transaction-based revenue model can lead to inconsistent revenue for your company due to monthly transaction variations |

| Charging transaction fees based on transaction size and complexity can increase your revenue | Tracking individual customers’ spending habits is difficult. Which makes tracking your consumer purchasing trends and pricing and availability decisions harder. |

| The simple fee structure of the model makes it easy to implement, which can save you time and resources in the setup phase. | This revenue model may have growth limits. Market demand, competition, and customer behavior limit transactions. |

| Your business only earns revenue when a transaction occurs, so there is no upfront cost. This reduces financial risk. | Transaction fees may dissatisfy your customers, especially if they feel overcharged. |

| This payment structure’s flexibility and freedom can boost your customer satisfaction and loyalty. | Customers have more options in a competitive industry, which leads you to lower transaction fees and revenue potential. |

6. Saas Revenue Model

If your product is easily provided online, your development staff is both technical and analytical, and you are willing to wait for a long sales funnel, the SaaS revenue model is for you. Your customers will pay a subscription fee periodically to access your cloud-hosted product/service.

You can determine the success of your SaaS business with key metrics like customer churn, customer acquisition cost (CAC), monthly & annual recurring revenue (MRR & ARR), average revenue per account (ARPA), customer lifetime value (CLV), LTV-to-CAC ratio, etc.

Monitoring these metrics enables informed decision-making and strategy adjustments for long-term success.

Examples of Saas Revenue model:

Launched in 1999, Salesforce is a cloud-based CRM software provider. It was an early adopter of the software-as-a-service model and is now one of the largest SaaS providers in the world. The yearly revenue of Salesforce in 2022 was $26.492B, up 24.66% from 2021.

Another good example of the SaaS review model is Zoom. It is a cloud-based video conferencing platform that has gained immense popularity during the COVID-19 pandemic.

The company has achieved significant growth since its founding in 2011 and recently went public in 2019. With a 54.63% rise from the previous year, Zoom Video Communications’ annual revenue in 2022 was $4.1B, which is a great accomplishment.

| Advantages of Saas Revenue mode | Disadvantages of Saas Revenue mode |

| Saas model allows your business to scale your software offering up and down quickly depending on the needs of your clients. | Saas model has a longer conversion funnel; you have to wait many months to convert free users into paying subscribers. |

| You can earn predictable revenue once the service/ product becomes stable, making your budgeting and planning easier. | Because of the popularity, you might face high competition as many companies are adopting the SAAS revenue model. |

| Distribution is simple because any web browser can access your product so you don’t need to create different versions for different operating systems and devices. | You will find marketing and business analytics for the SaaS business model more complicated, as data often comes in from multiple sources. |

| The Sass model allows you to provide your customers with flexible subscription options per their needs and budgets. | Storing sensitive business data in the cloud can be a concern for you as there are chances of data loss or security violation |

| With easy user feedback, your developers know which new feature to add or which one to update. | Your competitors can easily duplicate a successful SaaS marketing, sales, price, or email campaign by searching online. |

7. Affiliate Revenue Model

The affiliate model is widely used in the fields of e-commerce and web advertising. In the affiliate marketing model, other companies will sell or promote their items or services on your platform in exchange for a percentage or a fixed amount of their profits or vice versa.

Also, affiliate marketing income grows year after year. Since 2015, incomes have increased by 10% year, and this trend appears to continue beyond 2023.

You need to find goods and services that your users will like. Then, it joins an affiliate program. After joining the program, you will get a unique affiliate link to advertise goods.

Any sale made through the link will earn you a percentage of the profit. You can use advertisements depending on the platform’s goals. Always remember to sign a deal with the supplier.

To maximize the profit, select an appropriate program for your industry, budget, target audience, and promotional activities to optimize revenue. It is important to compare each program’s return on investment (ROI) by analyzing its payment terms, commission rates, and other aspects.

Examples of Affiliate Revenue Model:

Almost all the popular media and publication businesses utilize the affiliate revenue model. WPBeginner, a WordPress learning platform, utilizes the affiliate revenue model.

| Advantages of the Affiliate Revenue Model | Disadvantages of the Affiliate Revenue Model |

| The Affiliate revenue model ensures long-term revenue stability through passive sales. | It is unpredictable whether revenue will be generated during the early stages. |

| It can also be used in combination with advertising, which can be more profitable than ads alone. | Your startup’s affiliate revenue is limited by industry size, product type, and audience. |

| Affiliates are a great way to boost both website traffic and brand recognition. | Since it’s based on commission, there is no upfront cost, so it is a risk. |

| In the affiliate revenue model, you need to share a portion of your revenue. | Seeing significant revenue and traction from the affiliate revenue mode can take some time and sometimes be a little challenging. |

| Since it’s based on commission, there is no upfront cost, so it is a risk. | Multi-campaign management is another issue. Multiple campaigns require coordination and tracking to avoid mistakes. |

How To Choose The Right Revenue Model For Your Startup

Choosing the right revenue model is crucial for the success of your startup as it enables your business to gain traction in the market and scale up efficiently. Here are some steps that will help you to choose the right revenue model:

- Determine what your product or service is, what makes it unique, who your target customers are, and what pain point you are solving. Don’t forget revenue models that are consistent with your business idea and solve a problem for your target market are always the most successful.

- Look at what revenue models are being used by other companies in your industry and analyze their success. Combining several revenue streams not only allows you to increase your overall earnings but also allows you to provide your clients with more cutting-edge options.

- Analyze your target customer’s behavior, preferences, and willingness to pay for your product or service. Because it’s important to remember that consumers’ expectations of value must be greater than the amount they pay

- It’s important to consider the cost structure associated with your product or service. This includes the costs of prototyping, producing, marketing, and selling your product or service. Understanding these costs will help you determine how to price your product or service

- For risk management, identify and understand your key risk factors so you can address them. Once you have identified the risks, you can develop strategies to mitigate them and increase the likelihood of success for your chosen revenue model.

- Startup is the perfect ground for experimentation. You can test and experiment with different revenue models and adjust as necessary based on customer feedback, market response, and a lot of other variables until you find your unique revenue model.

The idea is to identify a revenue model that coincides with your business goals and allows you to earn long-term revenue while giving value to your consumers. Remember that there is no such thing as a one-size-fits-all revenue strategy. Even with careful consideration, there are several factors that can lead to the failure of a revenue model.

Pitfalls In Your Startup Revenue Model that Could Lead To Failure

As we mentioned earlier, choosing the revenue model is no easy task, and the road to choosing the right one is full of pitfalls. Here are some of those you should actively avoid.

- Even if you have the best revenue model, it can fail if it’s not executed properly. This may be due to poor implementation, lack of resources, or ineffective marketing. It’s important to ensure that you have the necessary resources and expertise to execute your revenue model effectively and to monitor and evaluate its performance continuously.

- If a new competition enters the market with a better product or service, your revenue model may fail as customers may switch to the new offering. It’s important to stay aware of new entrants to the market and continue to innovate and improve your own product or service to stay competitive.

- You should keep in mind that economic conditions can change rapidly and unexpectedly, making it difficult to sustain your revenue model. Factors such as inflation, recession, or changes in the consumer behavior can impact your revenue streams and threaten the viability of your startup. It’s important to regularly assess economic trends and adjust your revenue model accordingly to stay competitive and profitable.

- If your revenue model is inflexible and unable to adapt to changing market conditions or customer needs, it may become obsolete. It’s essential to regularly review and update your revenue model to ensure it remains relevant and effective.

- Sometimes your customers can change their behavior, such as moving to a new platform or channel, and your revenue model may no longer be effective. It is important to stay up-to-date with changes in customer behavior and adapt your revenue model as necessary to ensure its continued success.

- If external factors, such as changes in regulations, occur, they can have a significant impact on the viability of your revenue model. For instance, new regulations or changes in tax laws can affect your pricing structure or cost structure, making it difficult to sustain your business model. Therefore, it is important to monitor the regulatory landscape and adapt your revenue model accordingly to minimize any negative impact.

If you are starting a startup or have already been working on one, then you need to finalize your review model as soon as possible. Not only that, but you may also figure out things like developer hiring, team structure, capital division, etc. The following articles would help you in that case.

How to do Market Research for Startups

How to Split Equity in a Startup

How to Hire Developers for a Startup

In-house Development vs Outsourcing

In case you are thinking of reducing costs in development, outsourcing software development might be an option. And here at Technext we provide quality startup services to help founders get rid of development headaches and achieve more with less.

Best of Luck!